Amazon Private Label Increases Advertising Coverage by 31% to Win Cyber Week

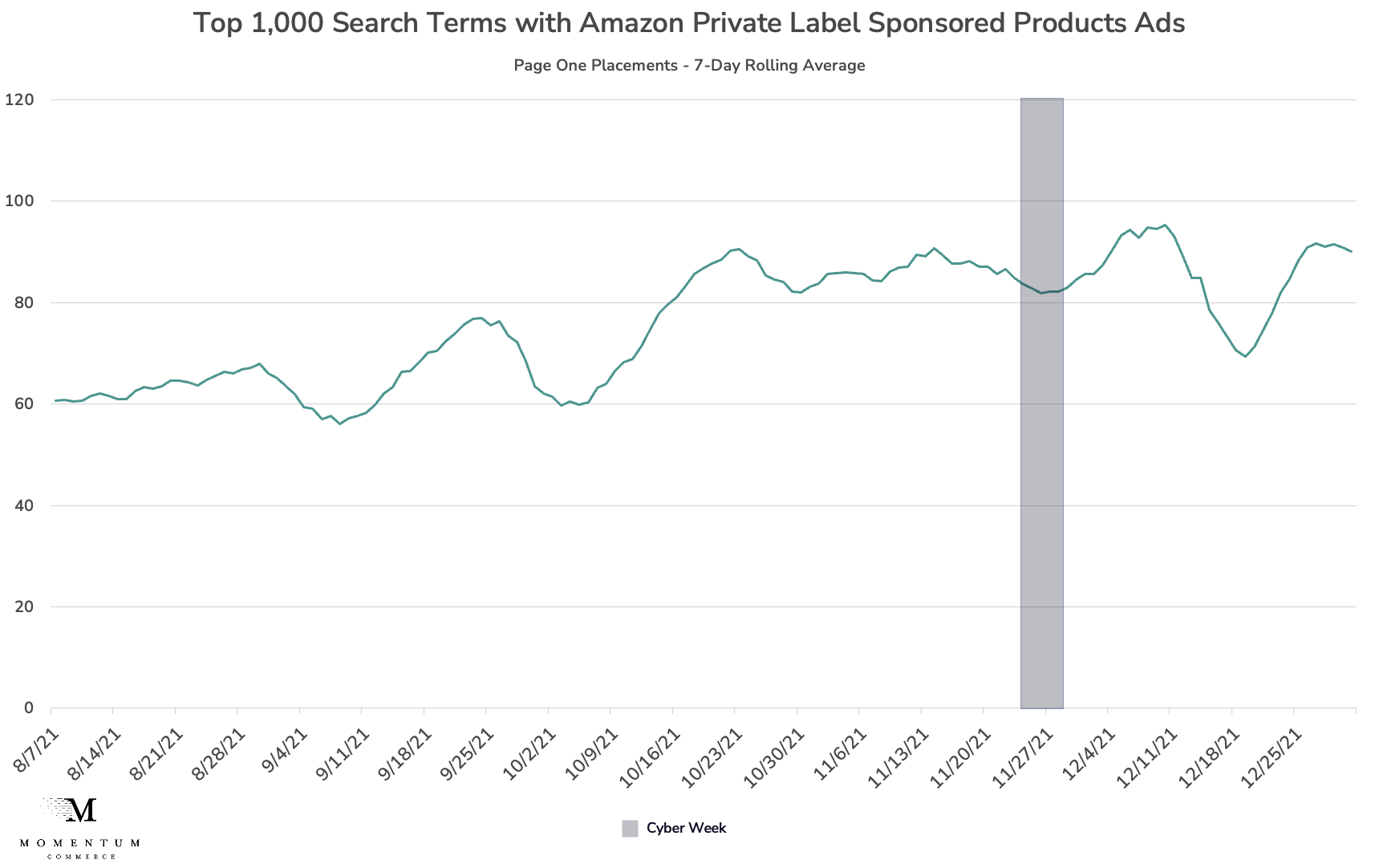

Our past studies touched on how Amazon’s Private Label brands captured significantly more Amazon’s Choice and Best Seller badges during the peak of the holiday shopping season, and how those brands cut prices to help support those efforts. In this follow-up piece, our analysis focused on Sponsored Products ads for Amazon’s Private Label products which either maintained or captured an Amazon’s Choice or Best Seller badge during Cyber Week. The results show those products appeared in ads roughly 30% more often on top searches starting more than a month before Cyber Week, lasting all the way through the majority of the holiday shopping period.

Key Observations

- There were ~170 individual Amazon Private Label ASINs that held Amazon’s Choice badges across the top 1,000 search terms on Amazon at some point during Cyber Week

- Those products appeared in Sponsored Products ads across an average of 64 different top-1,000 terms every day between August and September 2021

- During October through December 2021, the number of terms where Sponsored Products ads for those products appeared across that same-term set rose by more than 30%

- By advertising more in the weeks leading up to Cyber Week itself, Amazon helped boost sales to the point where products captured coveted Amazon’s Choice and Best Seller badges by the time shopper activity began increasing in earnest – this is something brands should emulate in the run up to future high-traffic periods.

Amazon Private Label Advertising During Cyber Week

There were roughly 170 individual Amazon Private Label ASINs that held Amazon’s Choice badges across the top 1,000 search terms on Amazon at some point during Cyber Week. On a given day during the months of August and September 2021, those same Amazon’s Private Label products appeared in Sponsored Products ads across an average of 64 different top 1,000 search terms. By October through December 2021, that term count had jumped to 84 – an increase of more than 31%.

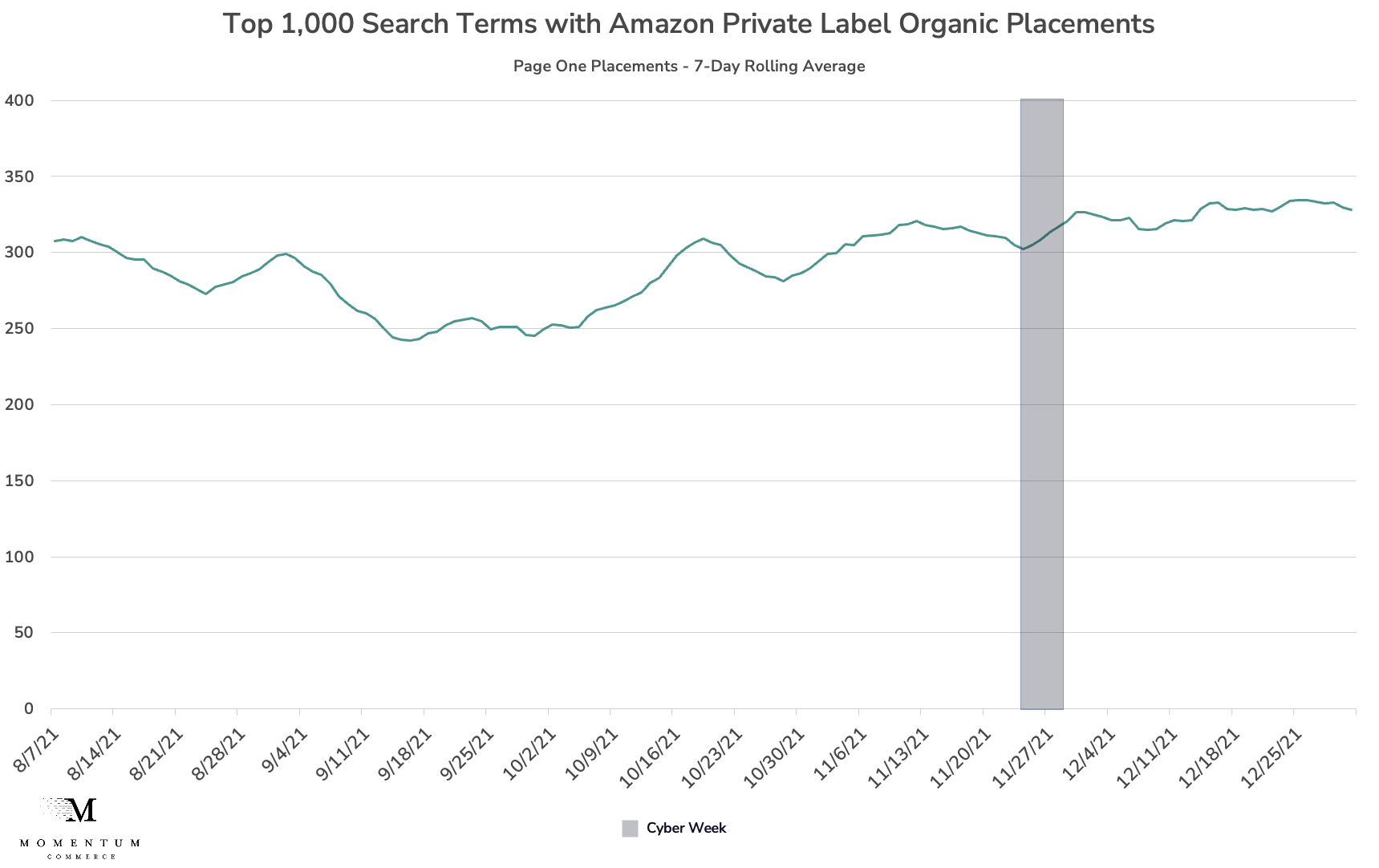

This advertising activity during October and November had the ancillary effect of helping maintain and strengthen those brands’ organic position across those top search terms.

Amazon’s playbook around how they timed their advertising, and where they placed their proverbial bets, is something brands should emulate in the run up to future high-traffic periods. By advertising more in the weeks leading up to the event itself, it helped boost sales to the point where products captured coveted Amazon’s Choice and Best Seller badges by the time shopper activity began increasing in earnest. Additionally, CPCs are generally lower outside of periods like Cyber Week, giving some comparative efficiency long term. What gives Amazon’s Private Label brands an advantage are the rigorous analytical tools at their disposal, on top of deep pockets. The challenge for brands in rolling out a similar strategy is gaining a detailed understanding, via data analysis, about where and how to deploy their budget in these ‘ramp up’ periods. Breaking this down, critical questions include:

- Which search terms hold the most comparative value for obtaining an Amazon’s Choice badge?

- What products hold the most comparative value for obtaining a Best Seller badge?

- What are the search terms with lower or higher defensibility?

- What is the competitive landscape across those terms?

- Besides advertising, what tests can demonstrate whether or not pricing needs to change in order to drive the desired result?

These types of questions are the kind we tackle as part of our ongoing analysis work with Thrasio and other clients. If you want to dive deeper into how we approach some of these issues, check out our 120+ page guide, How to Sell & Win on Amazon.