How Amazon Private Label Cut Prices During Cyber Week

In our last data study, Momentum Commerce showed that Amazon Private Label products captured a growing share of both Best Seller and Amazon’s Choice badges across the most popular search terms on the retail site during Cyber Week. Most remarkably across those same top 1,000 search terms, the share of Amazon’s Choice badges going to Amazon Private Label products doubled between August and the Cyber Week period. The open question was precisely how Amazon achieved this feat. In this first follow up, we examine how any change in price may have played a role.

Key Observations

- ~170 individual Amazon Private Label ASINs held Amazon’s Choice badges across the top 1,000 search terms on Amazon at some point during Cyber Week

- More than 50% of these products were discounted during the sale event, with a -11% average change from the prior 30-day average

- Across all Amazon Private Label products in the sample, the average change in price was -5%

- The most heavily discounted products were Amazon Echo and Fire devices, while products exhibiting price increases were in the Fashion, Small Appliances, and Office Products categories

- This wide range of discounting activity emphasizes the importance of having a deeper understanding about the competitive landscape and how similar products are being priced, in conjunction with your larger goals for a given product.

Price Changes

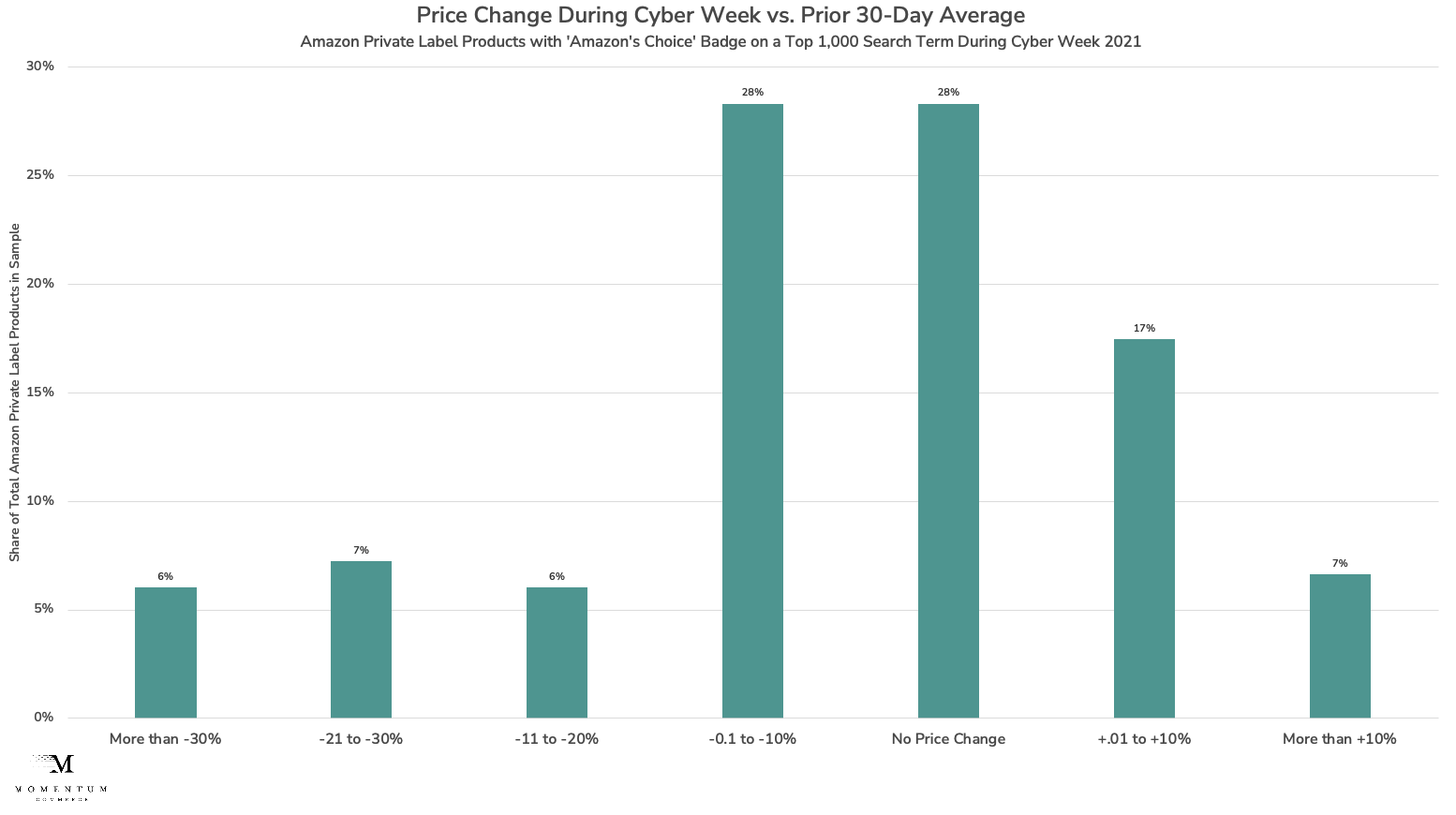

Roughly 170 individual Amazon Private Label ASINs held Amazon’s Choice badges across the top 1,000 search terms on Amazon at some point during Cyber Week. Amazon aggressively discounted more than 50% of those Amazon’s Choice products by an average of -11% during Cyber Week itself, compared to the 30 days leading up to the period. Across all products studied, the average price change was -5%.

The stratification of these price changes underscores how Amazon was strategic about what products it was most or least aggressive in discounting. Within this group, the top 12 heaviest discounted products during Cyber Week were either Amazon Echo or Amazon Fire devices, and the top 25 most discounted products are almost entirely in the Electronics category, including Ring devices and home security accessories. Not surprisingly, Amazon touted the sales growth of its Echo and Fire devices in its post Cyber Week roundup.

Meanwhile, the group of products where prices actually rose during Cyber Week are comprised of Amazon Basics fashion items, small appliances, and office products. The fact that these products, even with price increases, achieved or retained their Amazon’s Choice badge during Cyber Week could reflect larger supply chain issues that reduced both Amazon’s and their competitors’ likelihood to discount their products to reduce the risk of stock outs. Alternatively, it’s possible that Amazon has intelligence on consumers being less price sensitive for these classes of products during periods like Cyber Week, when Electronics and the Toys & Games categories tend to see the largest volume gains.

This wide range of price changes emphasizes the unique space Amazon occupies within its own marketplace, and how it leverages steep discounts to drive sales during key periods across products it sees as strategically valuable. For brands, one takeaway is that discounts aren’t a panacea to grow sales during events like Cyber Week. Instead, having a deeper understanding about the competitive landscape and how similar products are being priced can inform your strategy in conjunction with your larger goals for a given product.

Stay tuned for our next piece, which will go into advertising changes across this same product set, and whether that may have played a role in Amazon’s Private Label brands’ ascent during Cyber Week.

Methodology:

Data in this analysis is reflective of Amazon Private Label productsappearing on page one across the top one thousand Amazon US search terms with an Amazon’s Choice badge between November 25 and November 29, 2021. Prices of those products, inclusive of discounts, were then averaged across the 30 days prior to Cyber Week (October 25 through November 24, 2021) and then compared to the average price during Cyber Week.