Amazon Private Labels Double Share of Amazon’s Choice Badges During Cyber Week

The Amazon ‘Best Seller’ and ‘Amazon’s Choice’ badges are clear indicators to consumers that a product is trustworthy and most likely a good choice based on what they are shopping for. For this reason, they are highly sought after by brands and sellers – it visually helps a product stand out on a search page for all the right reasons. When these badges show up for high-volume searches, the impact is magnified, doubly so during high-traffic periods like Cyber Week. And during this past Cyber Week, a Momentum Commerce analysis shows that Amazon’s roster of private label brands captured a growing share of both Best Seller and Amazon’s Choice badges across the most popular search terms on the retail site.

Key Observations

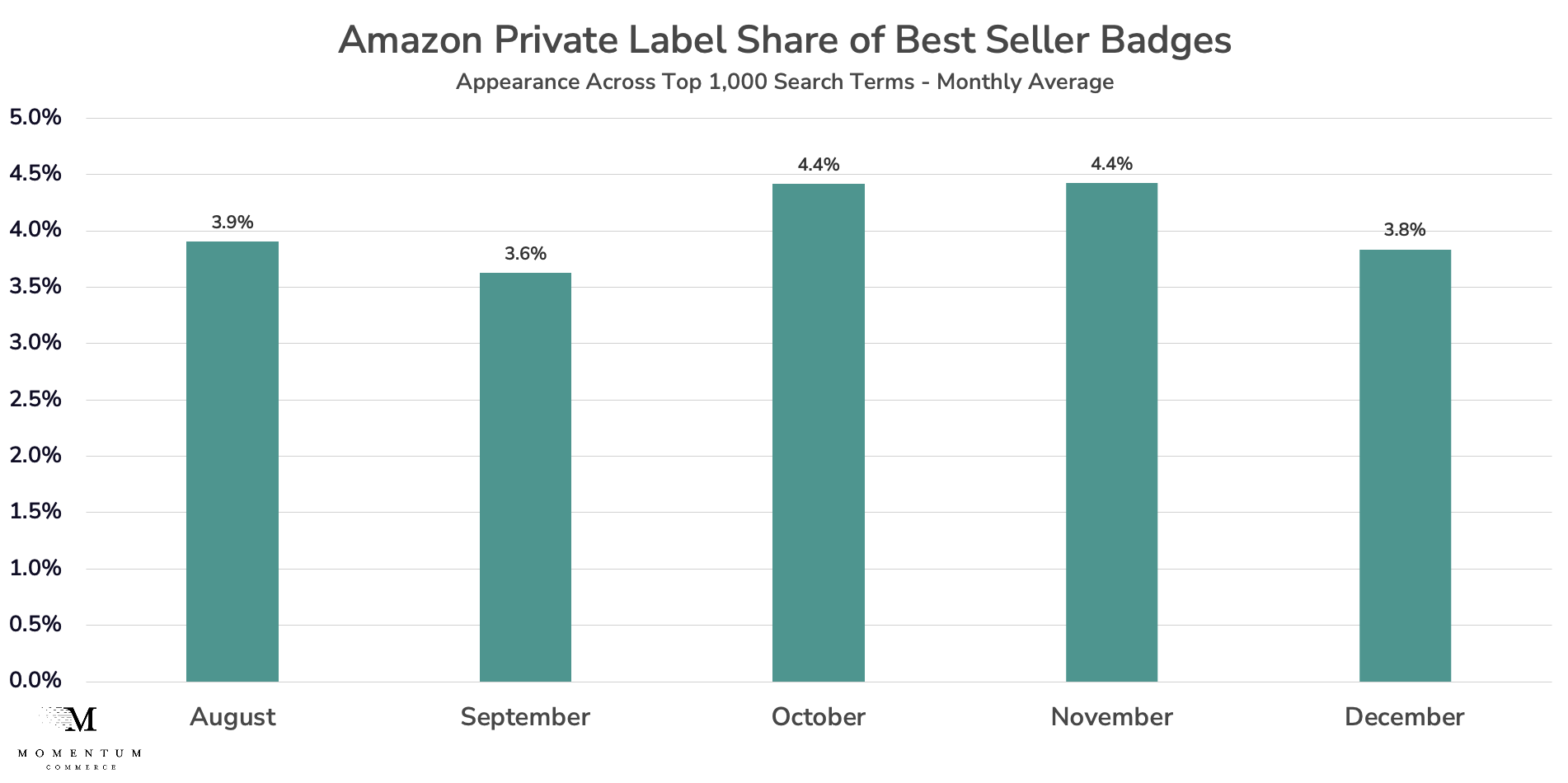

- Amazon private label brands collectively captured a rising share of Best Seller badges leading into Cyber Week 2021

- On a monthly basis, Amazon private label’s share of best seller badges seen across the top 1,000 terms on Amazon rose 22% between September and November 2021

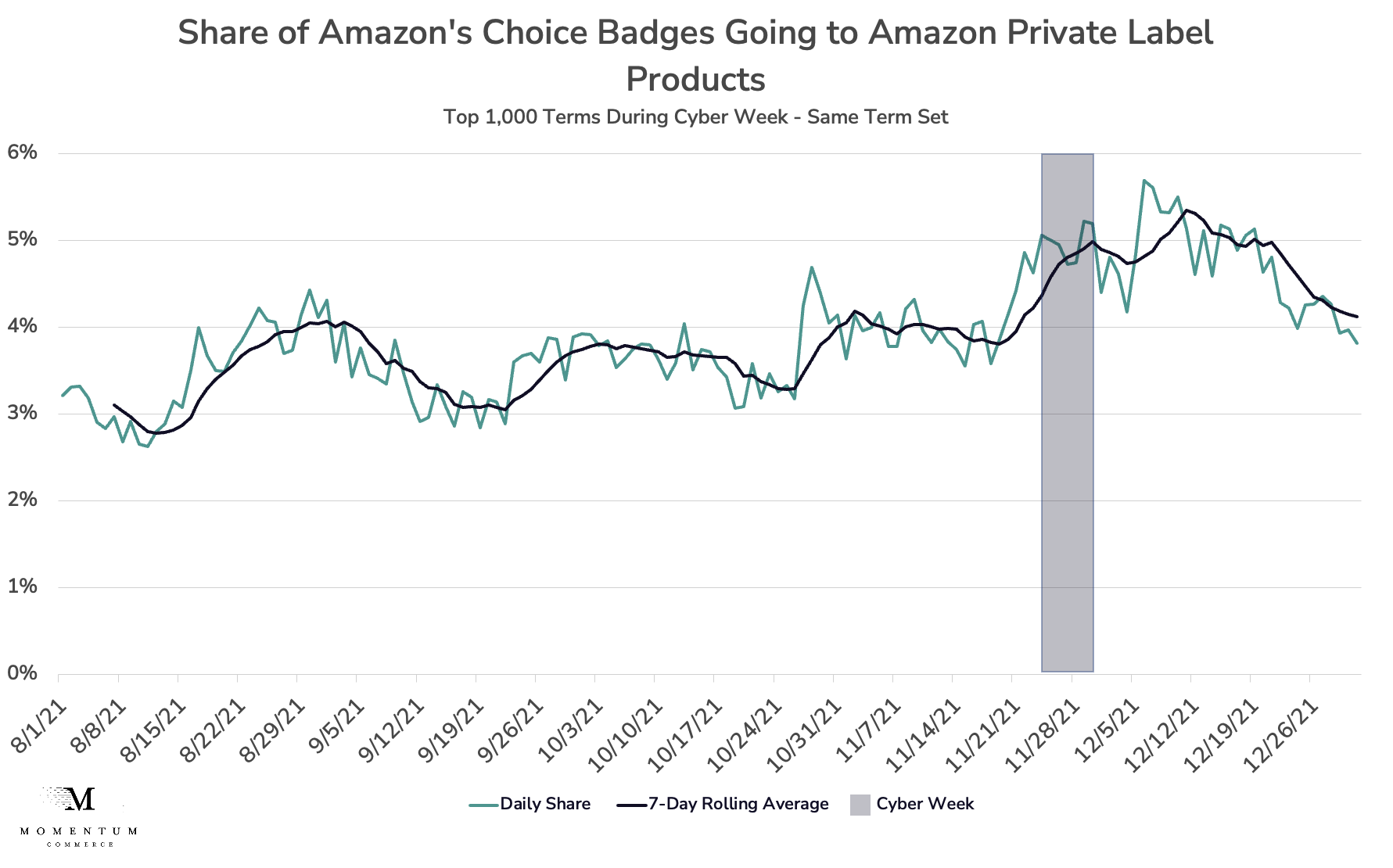

- Meanwhile, those same brands captured a even larger share of Amazon’s Choice badges – even when this is measured against a same set of the top 1,000 terms during Cyber Week

- From August through October, Amazon private label brands captured between 3-4% of Amazon’s Choice badges across those terms – by late November and early December that figure was between 5-6%

- This underscores how Amazon is very adept at implementing tactical and strategic lessons that maximize conversions, and brands should track what Amazon’s private labels are doing in their space

Best Seller Badges

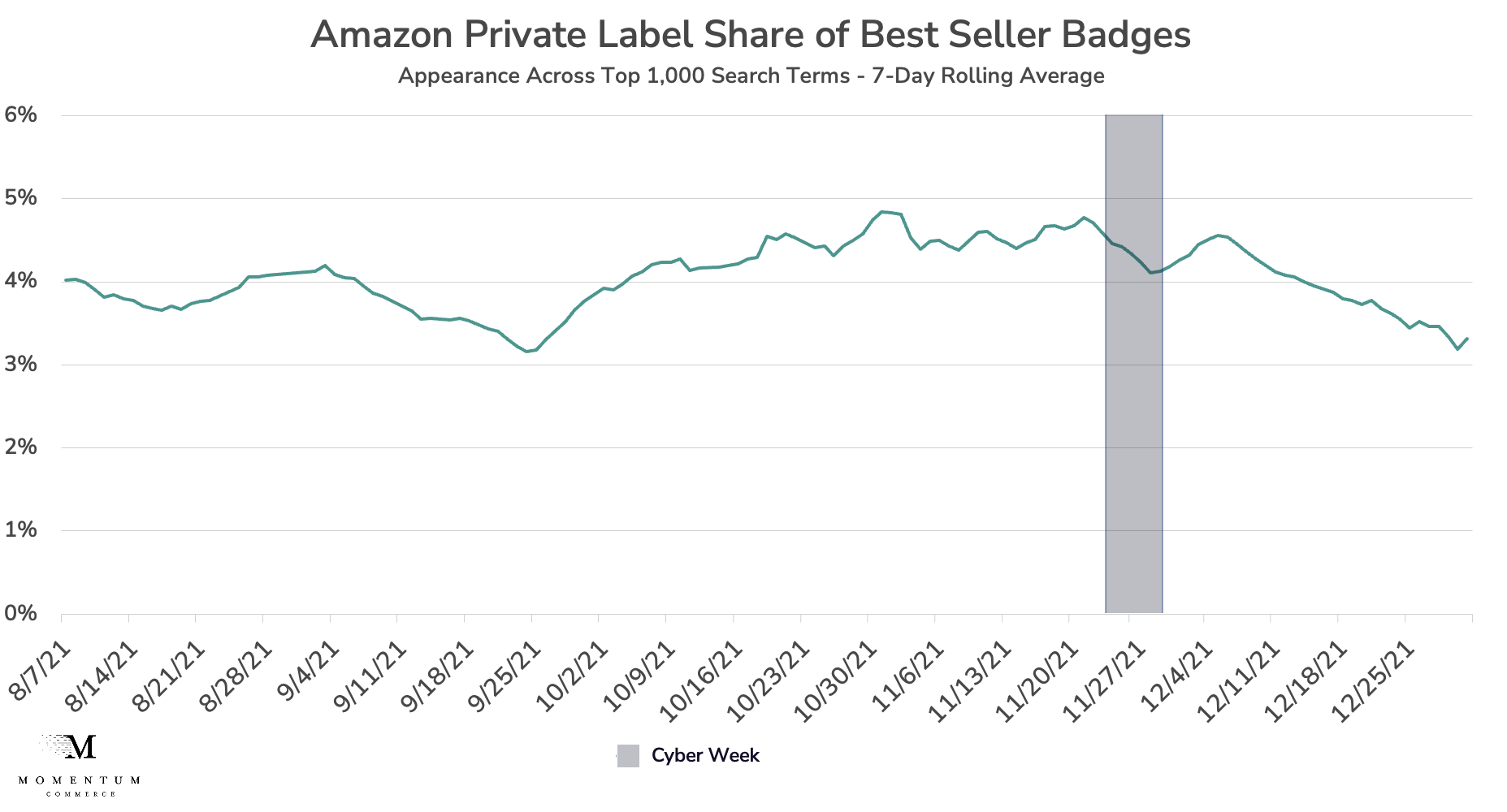

On Amazon, Best Seller badges are awarded to the top-selling products within a given category or sub-category. These badges show up on every search where that product appears. By definition, the top best-selling products will fluctuate over time. What the below analysis shows is that Amazon private label brands captured a slowly escalating number of these badges during October and November, with the November share reaching close to 4.5% of all badges shown within the top 1,000 searches on Amazon – a jump of more than 22% from September totals.

A graph showing figures on a seven-day rolling average demonstrates that Amazon’s share remained high in the lead up to the critical Cyber Week period, before dropping in early to mid December. This indicates that in aggregate, Amazon’s private label brands were able to successfully capture more conversions than competitors before the key holiday shopping season, giving them Best Seller badges at higher rates as the market entered its busiest period.

Amazon’s Choice Badges

One critical aspect of the Best Seller badge is that because it is tied to a product, on a given search page a consumer may see multiple products with that designation. However, the Amazon’s Choice badge is search-specific and will only appear once on a given results page. This makes it an especially powerful signal to consumers, but one that is less transparent to sellers and brands compared to the Best Seller badge. What goes into identifying a particular product as Amazon’s Choice encompasses a variety of factors like ratings and reviews, Prime eligibility, competitive pricing and more. The opaque and more complex nature of how a product achieves the Amazon Choice badge for a given search also means the owner of that badge can change relatively frequently. But in the case of last holiday season, it was Amazon’s private label brands that significantly grew their share of Amazon’s Choice badges across the most popular terms on the site.

To provide a standardized view of what occurred, Momentum Commerce identified the top 1,000 search terms on Amazon during Cyber Week 2021, and looked at which brands held the Amazon’s Choice badge for those same terms from August 1 through December 31, 2021.

The result is that the percentage of Amazon’s Choice badges going to Amazon private label products across this same set of search terms peaked during Cyber Week and the immediate aftermath – at a rate more than double what was observed in early August.

Over the next month, we’ll be diving deeper into exactly how Amazon achieved these results. For example, whether the products exhibited significant price changes and/or greater advertising exposure on certain search pages. In the meantime, a major takeaway for brands and sellers should be that Amazon is very good at playing its own game. Outside of these more tactical changes, one constant is that across Amazon’s roster of brands, product pages are rich with imagery, and have clear product titles and rich, benefit-laden descriptions. Brands operating in categories with Amazon private label competitors are well served by looking at what those brands are doing and learning from those practices.

Methodology:

Data in the Best Seller badge analyses is reflective of products appearing on page one across the top one thousand Amazon US search terms for each day during the study period (August 1 – December 31, 2021). Data in the Amazon’s Choice analysis is reflective of products appearing on page one across the top one thousand Amazon US search terms between November 25 and November 29, 2021, with that same consistent set of search terms being analyzed between August 1 and December 31, 2021. Roughly 80 different Amazon private label brands were cataloged for the purposes of this analysis.