Valentine’s Day Search Activity Started Early on Amazon

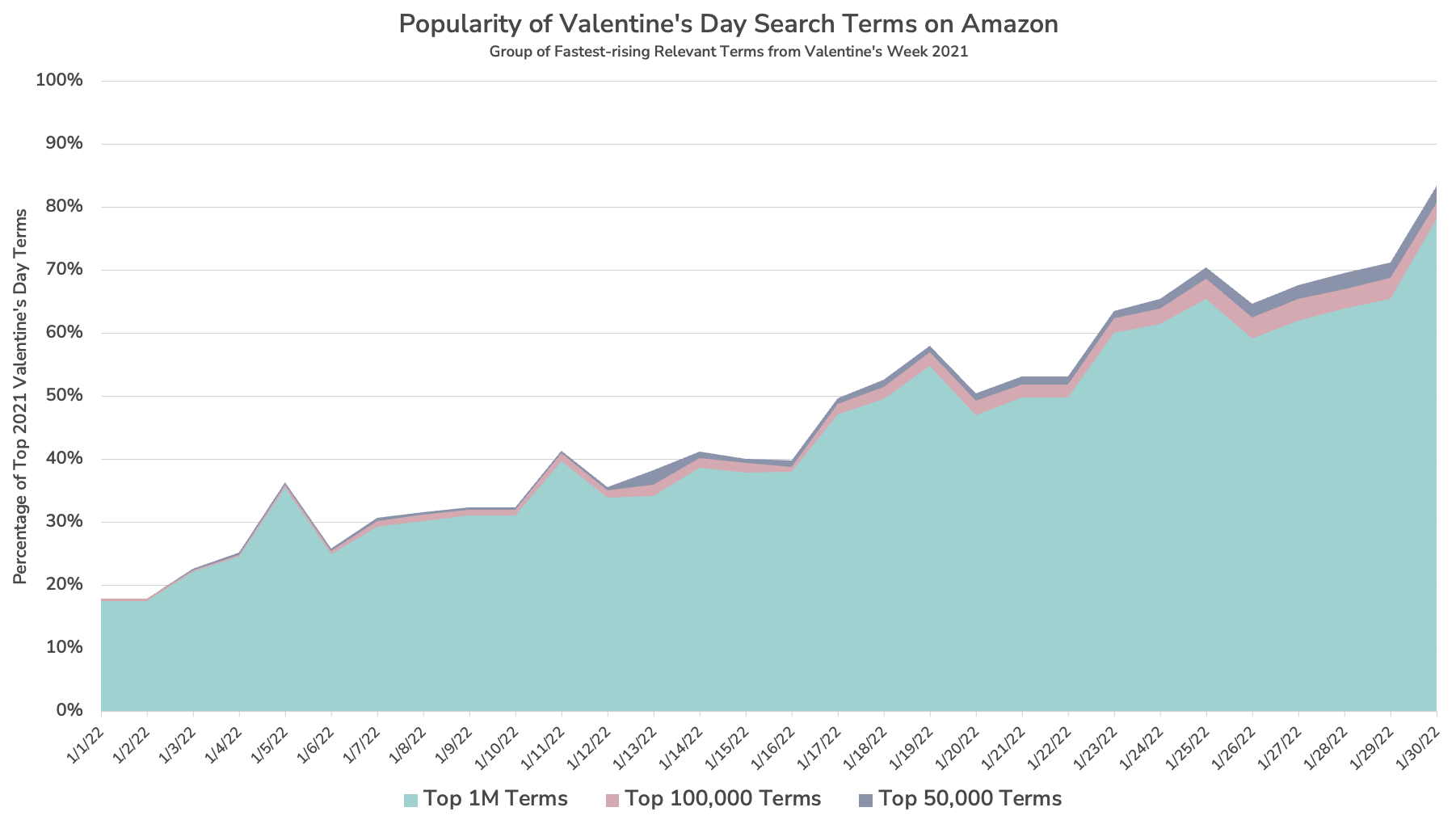

Something we explored in prior pieces was Amazon’s Private Label brands having a banner Cyber Week. This was thanks in no small part to those brands collectively ramping up Sponsored Products advertising activity on top terms more than a month before Black Friday. For brands expecting to drive additional revenue during seasonal events like Valentine’s Day, Amazon’s lesson is a prescient one. New data from Momentum Commerce shows how an ever increasing share of the fastest-rising Valentine’s Day search terms from 2021 have rapidly shot up in popularity throughout the month of January 2022.

Key Observations

- Out of the fastest-rising 1,127 Valentine’s Day search terms on Amazon from Valentine’s Week 2021, more than 80% were back in the top one million most searched terms by January 30, 2022

- More than 50% of the sampled terms were in the top one million in mid-January

- Roughly 3% of terms reached the top 100,000 most searched for terms and a further 3% were among the top 50,000 by January end

- For specific seasonal events, brands need to plan and budget for getting their products in front of early shoppers before activity begins to rise. This will help drive better cost efficiency, and potentially help capture Amazon’s Choice or Best Seller badges right as activity peaks

Valentine’s Day Shopping on Amazon

We examined roughly 39,000 search terms that exhibited the largest jumps in popularity on Amazon during the week directly preceding Valentine’s Day 2021. Of those terms, we identified 1,127 that were directly related to Valentine’s Day shopping (e.g. terms including the word ‘valentines’, ‘valentine’, ‘gift for husband’ etc.)

To visualize the ramp up to Valentine’s Day 2022, we mapped the relative popularity of these terms on Amazon during the month of January 2022. The results show that a majority of those terms were in the top one million most searched for terms by mid-January, and that figure rose to more than 80% by the end of the month.

Meanwhile, roughly 3% of terms reached the top 100,000 most searched for terms and a further 3% were among the top 50,000.

How this trend manifested itself at the individual term level emphasizes the dramatic nature of these popularity changes. Below are the terms in the sample exhibiting the best rank during January, and the change from their worst rank in the same month:How this trend manifested itself at the individual term level emphasizes the dramatic nature of these popularity changes. Below are the terms in the sample exhibiting the best rank during January, and the change from their worst rank in the same month:

| Search Term | Peak Rank in January | Change from Lowest January Rank |

| Valentines Earrings | 4,178 | -57,149 |

| Toddler Valentines Day Outfit | 9,025 | -249,417 |

| Pop Up Valentines Day Cards | 18,158 | -878,635 |

| Valentine Treat Bags | 18,189 | -172,727 |

| Valentine’s Gift for Her | 18,684 | -931,857 |

| Toddler Girl Valentines Day Outfit | 19,642 | -95,394 |

| Valentines Day Sweater | 20,079 | -205,939 |

| Valentine’s Candy | 23.745 | -317,133 |

| Valentines Day Shirts | 24,705 | -124,261 |

| Valentine Sweater | 26,757 | -416,605 |

| Valentines Shirts | 28,370 | -264,282 |

| Valentine’s Day Gifts Babies | 28,886 | -486,928 |

| Valentine Sweatshirts for Women | 35,000 | -426,922 |

| Valentines Press On Nails | 37,511 | -761,374 |

| Mens Valentines Underwear | 37,785 | -854,161 |

The takeaway for brands is that when it comes to specific, seasonal events, you need to plan and budget for consumer activity ramping up nearly a month early. Not only can you capitalize by getting in front of these early shoppers as their numbers begin to rise, but less intense competition means advertising cost efficiency overall is likely to be significantly better. Finally, if you drive enough sales early, you can capture Amazon’s Choice or Best Seller badges right as activity peaks. This is the strategy Amazon’s Private Label brands employed prior to Cyber Week 2021.

Of course, prerequisites for employing this kind of early advertising strategy on key search terms is understanding what terms saw the biggest jumps in prior years, what terms are most relevant for your products, and which terms place you in the best competitive position. The data analysis we do for clients at Momentum Commerce helps answer these questions, but more qualitative strategic guidance is a valuable supplement. If you want a deeper dive on our approach, check out our 120+ page guide, How to Sell & Win on Amazon.