How Big CPG Can Make the Performance Marketing Leap

Jordan Witmer manages Retail Media and Performance Marketing at Johnson & Johnson.

Particularly over the last 10 years, in the face of exploding competition from independents, legacy CPG brands have wrestled with what constitutes success when it comes to eCommerce and online marketing channels. For decades, national brands could rely on brand marketing driving awareness, and collaborating with retailers on shopper marketing to help drive sales. Only recently has performance marketing entered the equation – with its eye towards measurement and ROI. But while legacy CPG players are learning how this is the primary way to compete with digital native brands given consumer behavior shifts, the organizational shifts that need to take place in order to drive sustained growth are proving to be difficult hurdles. In this piece we’ll outline those specific, common issues, along with methods forward-thinking CPG brands are employing to measure and drive marketing success.

Performance Marketing for Legacy CPG Brands

2021 was a tipping point for retail in general. Excluding the Chinese market, Amazon officially became the top retailer in the world, surpassing Walmart. This underscores how Amazon and similar online retailers are the true growth engines of retail, with third-party sales on those platforms helping lead the way.

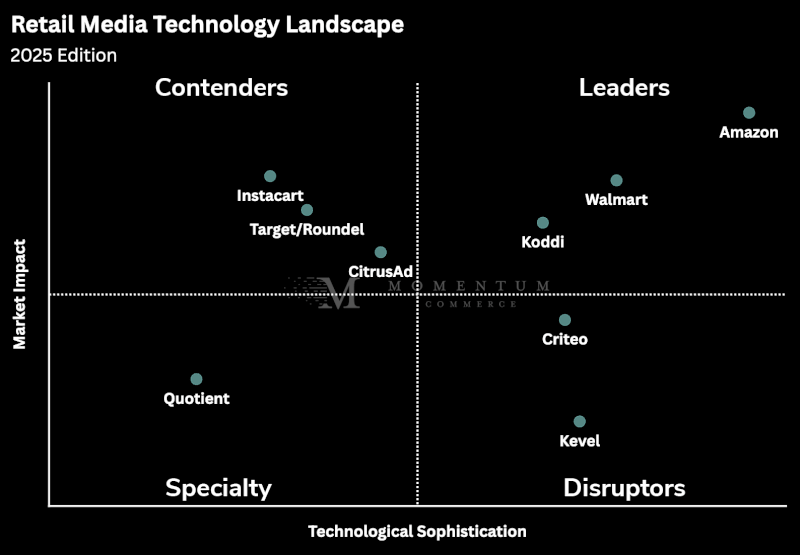

Meanwhile, ad inventory offered by Amazon and other retailers has grown tremendously. There are more ad slots than ever before on page one of a search results page, and the retailer’s Sponsored Display and DSP offerings expand inventory beyond Amazon’s own site, while still utilizing Amazon’s own targeting data and reporting capabilities. Beyond Amazon, CitrusAd now acts as the search and display ad infrastructure across Instacart, Target and others. This richer, large-scale retail media landscape creates a real opportunity for legacy CPG brands, but that promise is wasted if these channels are looked at or managed like another brand marketing channel.

Performance marketing in the context of retail media channels like Amazon is based around the idea that all spend and associated campaigns must be measurable, accountable to performance, and focused on direct revenue contributions. In this same vein, good performance marketing is nimble and unafraid – changing tactics and tweaking strategy when results, monitored constantly, dictate they need to change. This kind of thinking is largely the antithesis of how large CPG marketing organizations have traditionally operated, with campaigns being planned months in advance, and performance measured across much softer or indirect metrics, with longer lead times.

CPG marketing organizations can easily be stretched thin by these kinds of soft initiatives. Retail partners, or narrowly-incentivized internal stakeholders, may constantly question why their new initiative is not being supported. The result is a marketing organization supporting hundreds or thousands of initiatives (which could include products), with staff and resources stretched thinner than a startup.

It’s time for performance metrics and true data-driven decision making to pull back the veil on what projects are worth the investment of time and money. The digital shelf is fundamentally different from brick-and-mortar, and it needs to be managed that way in order to compete. Traditionally a large CPG brand would support a couple dozen items in a category knowing that there were 50-100 shelf slots in the store to win. Now, prime digital real estate (e.g top-of-search on important Amazon terms) may be concentrated in five placements. That scarcity makes it critical to be discerning on which products will receive marketing dollars and support in order to support wider growth goals.

The past decade alone is littered with CPG brands’ failed efforts that are creative and ‘buzz-worthy’ (e.g. Second Life storefronts, “modern” logo redesigns) but ultimately never added value. Removing the emphasis on soft metrics, which can naturally reinforce some of these tactics that have no measurable top- or bottom-line impact, can create a feeling of exposure to some marketers. However, by being among the first to embrace tactics and strategies that rely on performance metrics, marketers can put themselves in the driver’s seat as those structures are built internally.

Having a smaller product catalog and laser focus on eCommerce channels are what’s given small, upstart competitors an edge here, but legacy CPG brands can use scale to their advantage. They just need to take an approach similar to how their brands innovated on sophisticated systems of production and distribution, all oriented around performance.

Think about times CPGs have faced supply constraints, there are quick pivots to push inventory into the channels that the company’s data – POS rates, in-stock rates, margins, etc. – indicate will generate the most short- and long-term profit. Marketing, with dollars being a constrained resource, is simply the next domino that needs to fall and should be treated in the same manner.

Already, you’re seeing certain subsections of the CPG space take this to heart. Large legacy hair care brands – which were under pressure from independent digital native brands comparatively early – are now among the top advertisers on Amazon. So how did those brands successfully make the leap? By weaning themselves off of the enduring allure of brand marketing.

Digital Transformation at Large CPG Brands

CPG brands founded multiple decades (or even centuries) ago likely have, over time, built up a marketing ecosystem oriented around brand marketing. This includes job functions, how marketing budgets are allocated, and agency relationships. Many marketers have built their careers operating in this paradigm – driving top level strategic guidance down towards an array of agencies, where they manage execution. This understandably has created its own “gravitational pull,” where keeping key team members happy and legacy agency partners involved is a critical part of every decision. The result is marketing as a whole is naturally pushed towards more traditional brand marketing plays with only incremental changes around retail media, exacerbating the advantages more nimble competitors possess.

Quite simply, the math is changing in terms of how brands grow through marketing. Breaking the vicious cycle requires getting the larger marketing organization on the same page around what the goals are, the KPIs that roll up to those goals, and most importantly, data-driven measurement. That last point is where marketers can make an immediate impact and help spur change.

This kind of shift does not always require a restructuring of the marketing organization. Rather, it should be designed as building a support structure for the existing organization – inserting support resources around performance concepts, data analytics and similar functions to help influence decisions while marketers develop their skill sets. Whether these are some combination of external partners or technology tools, the goal is to construct a kind of ‘organizational scaffolding,’ which helps support the marketing team as it undergoes its digital transformation.

Making this leap requires not feeling ‘pot committed’ or falling into the sunk cost fallacy – the risk in not adapting to these larger scale changes is demonstrably greater than the short term pain associated with these necessary shifts. While more of an operational example, think about retailers that, during the dawning of ecommerce, believed the size of their operation insulated them from changes and remained complacent in “the way things are always done.” Either they went defunct (e.g. Sears, JCPenney) or after severe financial hardship are now playing catch-up with rivals farther ahead (e.g. Macy’s, GNC).

Methods for Success

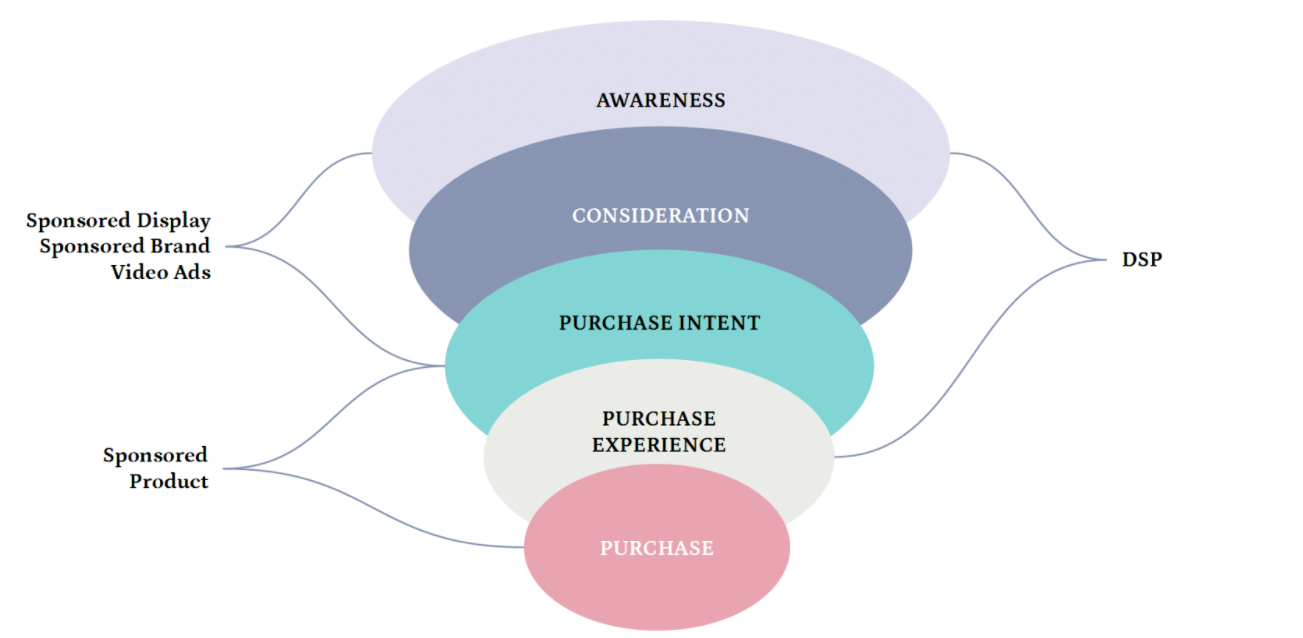

Marketers taking this step towards data-oriented decision making don’t have to abandon every top-of-funnel metric. Awareness still matters, and metrics like viewable impressions and product detail page views are goals that can be attached to DSP and Sponsored Display advertising on Amazon, for example. But in the context of retail media channels like Amazon, marketers can be exacting about committing resources to support the full customer journey, as seen below.

Even with these retail media tools, to keep up with those more nimble competitors it’s necessary to be more exacting about tactics and strategy to support each stage. To help, below are specific resources around major areas marketers should focus on:

- Executive Guide: How to Sell & Win on Amazon (Momentum Commerce)

- Utilizing Amazon Search Data to Inform Ad Campaign Strategy (Momentum Commerce)

- Profitability Levers on Amazon & Digital Retail Channels (Momentum Commerce)

- Measuring Brand Equity on Amazon (Momentum Commerce)

- CPG Marketing Models for Growth (McKinsey)

- Steps to CPG Digital Marketing Transformation (Think with Google)