Profitability Levers on Amazon & Digital Retail

Understanding your profitability is necessary to operate any business. In the world of Amazon, it can be difficult to keep track of the variety of costs that you can incur before and after you sell a product. Making these calculations and having a firm grasp of them simplifies strategic decision-making.

Earlier in my career, my only responsibility was to effectively manage ad spend to drive product sales. Profitability was always the invisible constraint on how much budget we had. Now that I have the opportunity to work with Amazon brands on activities beyond ads, it’s obvious to me that a well-balanced P&L is fundamental to success in digital retail, and there are costs that you have to consider before you can think about what your marketing investment should be.

To that end, I’m going to try to simplify the world of Amazon P&Ls as much as possible – partly to help marketers understand what else their finance team or sales team is thinking about, but also to demystify it as much as possible as there are some different ways companies report on and name things in their P&L.

Let’s start with the basics: there are two types of things in a P&L:

1) Sales

2) Costs

From these two things you can basically calculate everything else you might care about – Gross Profit, Net Income, Margin %, and so on. More on that later.

Sales & Revenue

What we consider to be Revenue or the value of a Sale can vary. In the world of 3P Sellers, it makes sense to consider the full retail price of the products sold in the Revenue line.

For 1P Vendors, the retail value of a sale doesn’t matter. Only the Wholesale value of the goods that have been sold should be considered.

Further – there are two types of Wholesale Revenue that vendors need to worry about: what you sell to Amazon (we’ll call it Sell-In) and what Amazon sells from your inventory to its shoppers (we’ll call this Sell-Through).

Sell-In would be equivalent to the revenue value from accepted Purchase Orders. This is what Amazon is choosing to buy.

Sell-Through revenue would represent the consumer demand for the vendor’s products and is equivalent to the wholesale revenue value from units that consumers have purchased and Amazon has shipped. The Sell-Through metric is usually represented by Shipped COGS in Vendor Central and I think is a bit easier to use on a regular basis.

Your CFO is, rightfully, only going to care about the PO value, as that’s real cash hitting the bank account.

There are also some less notable parts of the revenue line that might be worth considering – things like Amazon’s gift wrap referral fee that 3Ps are eligible for, or any revenue from a shipping fee if the customer or product is not eligible for free shipping. We’re going to leave details like this for a different blog post.

Costs

We have arrived at an important concept in our P&L – Costs.

The most obvious cost is your Cost of Goods – or the costs a brand incurs to acquire either through purchasing or manufacturing the product that it then sells to Amazon.

Sometimes companies will distinguish additional costs as ‘Above the Line’ and ‘Below the Line’ – I’m going to also reserve this nuance for a future blog post.

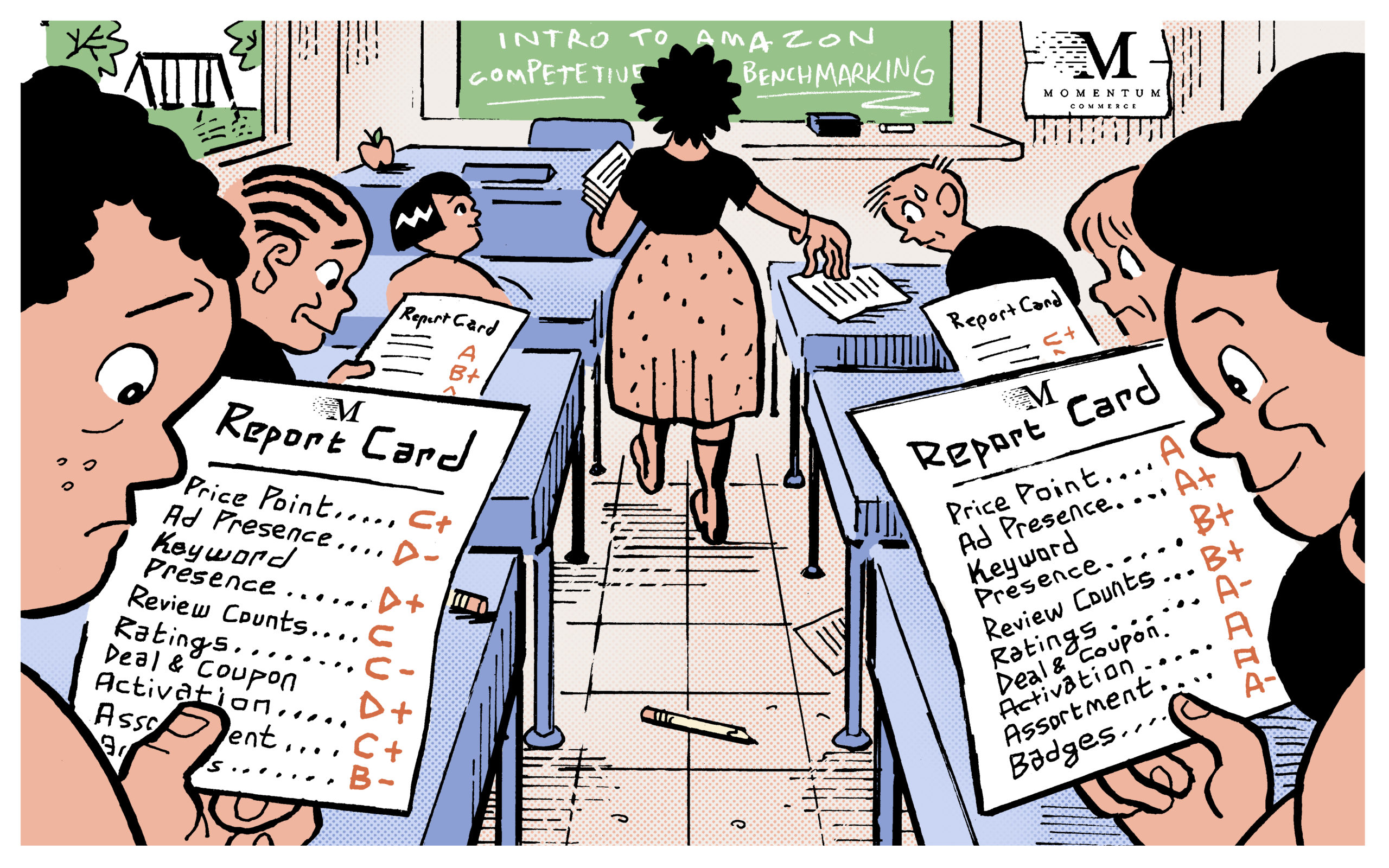

I do want to use the term ‘Direct Costs’ that I sometimes see used to categorize several cost types – this classification has been helpful for me to understand what it’s like to sell on Amazon as they are somewhat unavoidable. What your company chooses to include as a direct cost may vary from my list, but the below is a good starting point.

1P Direct Costs

For 1P vendors direct costs will generally include the following:

Market Development Fund (MDF) or Co-Op: The MDF is part of the terms that Amazon includes in their agreements with Brands that it purchases directly from. It is typically a % of the sum of the purchase price of the goods that it agrees to buy from the Brand. It is generally used to support Amazon’s marketing activities – for instance, when Amazon buys Google Shopping ads on behalf of a brand this investment is usually coming from the MDF.

Damage / Return Allowance: A % of the purchase price of goods to cover the cost that Amazon incurs from products that are damaged in transit, or are returned by a consumer and cannot be placed back in inventory.

Freight: Again this is a % of the purchase price of the goods that it has agreed to buy, but for the purposes of covering the cost to ship products to an Amazon distribution center.

Another type of discount or cost that we sometimes see is Volume Incentives or rebates that a Brand would provide to Amazon if Amazon orders sufficient quantities of products.

Sometimes there are also Early Pay discounts that Amazon will negotiate with its suppliers, where the amount owed is reduced by a small percentage if Amazon pays the invoice for the goods it has purchased within a fixed time frame before the payment is due.

All of these types of costs generally act as discounts on the amount of cash that Amazon must pay its Brand suppliers for the goods it has agreed to purchase.

3P Direct Costs & Marketplace Fees

For 3P sellers there are similar types of costs that they will incur before they get paid for any of the products that they sell on the platform. This includes:

Referral Fee – a percentage of the retail purchase price that Amazon keeps. This is the marketplace toll Sellers pay for the ability to sell a product to Amazon’s shoppers. Usually around 15% of the purchase price of the product, but can vary by category.

FBA Fee – this is the fee the Seller pays for Amazon to handle storage and shipping the product to a consumer. This is generally determined by the product category and its product dimensions – size and weight specifically. There’s a pretty crazy system to figure out what class of FBA fee you need to pay for your product. Again, another blog post for another day. Sellers can avoid this fee by fulfilling the products themselves – but good luck getting accepted into the Seller Fulfilled Prime program or selling anything if you offer slow shipping through your own fulfillment.

Storage Fees – if you are using Amazon’s fulfillment option, Sellers must also pay Amazon a monthly storage fee based on the volume of storage their products are taking up in Amazon’s fulfillment centers. If your products stick around in Amazon’s FCs for too long (more than 365 days) you may also see a Long Term Storage Fee.

Gross Profit

With your revenue and direct costs in mind, it’s time to calculate Gross Profit – you can do this either at the account level or the product level. Product level is very useful as it gives you the ability to make decisions on product price and promotional activities.

Here’s an example of what a product level P&L to calculate Gross Profit might look like for a 1P vendor:

40% is a pretty healthy gross profit. It gives you some room to navigate in terms of Marketing costs.

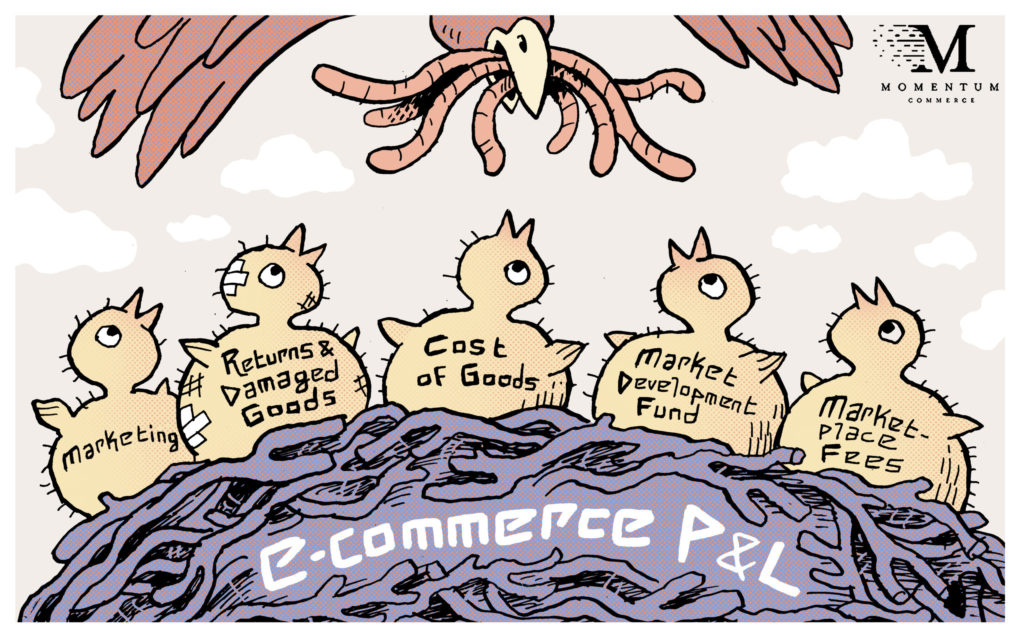

Additional Costs

On Amazon your Marketing Costs will consist of Coupons, Deals, sometimes Subscribe & Save discounts, and most importantly Advertising. Quick benchmark – plan on 10% of your revenue to be distributed across these costs.

If you can’t allocate at least 10% of your revenue to fund all promotional activities it may be a good signal that you should increase your price.

I want to call special attention to Returns & Damaged Goods as they are especially important. For 3P sellers this is a cost that you might incur AFTER you’ve promoted and sold the product and allocated your standard costs. For 3Ps there is a flat fee for every unit that a customer returns to Amazon starting at around $2. The net impact here on your profitability depends on the frequency of returns – for Apparel where return rates are very high it can be quite meaningful, and something to watch carefully.

If the purchase price of the product is refunded to the customer then there are a bunch of different reimbursements that Amazon may provide to the Seller. There are also some open questions as to whether or not the product should go back into Inventory to be sold again. To keep this post simple – we’re going to skip these details.

Other Costs – things like Salaries, Facilities and Rent, Merchant Shipping Costs, and Packaging Supplies are quite common and may apply to both 3P and 1P businesses. Be sure to consider any other costs – even if indirectly related to the sale of a particular product – that support your operations on Amazon.

The Bottom Line

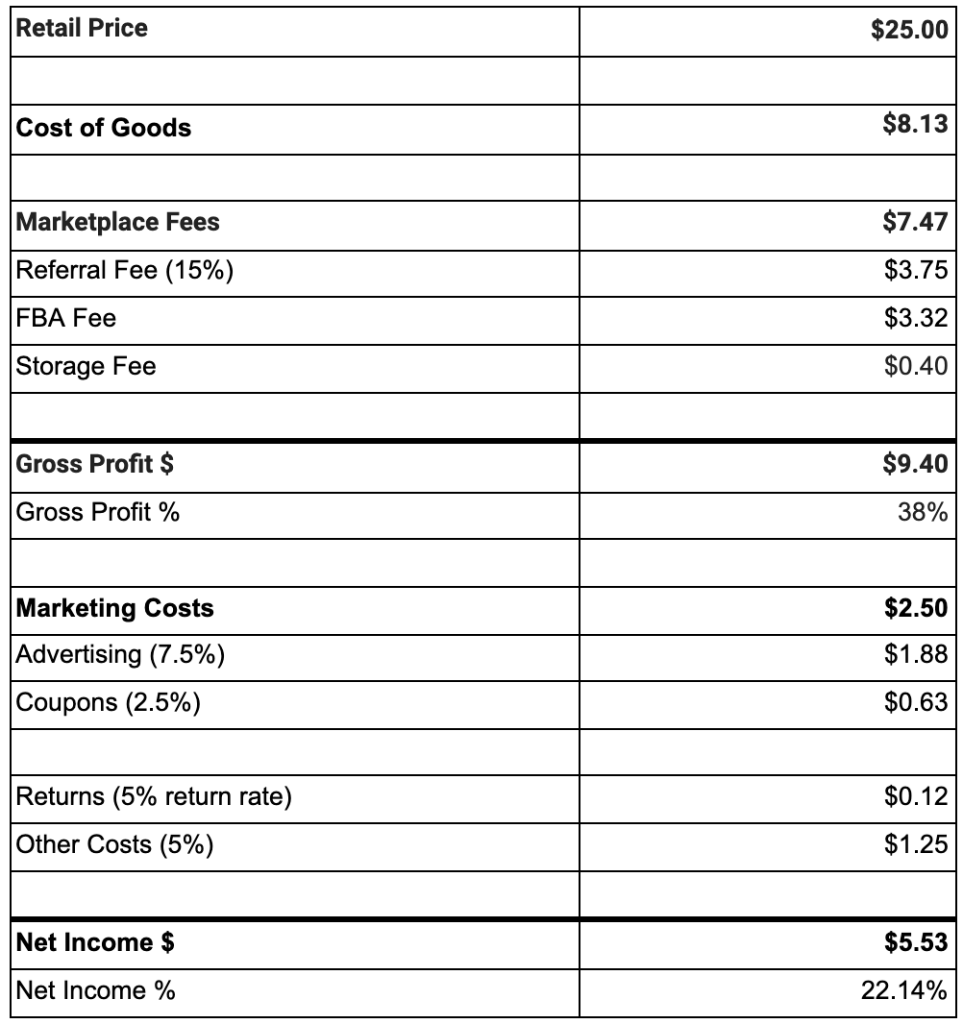

Net Income – is usually the final line of any P&L and represents profitability inclusive of all revenue sources and cost allocations. Here’s a simplified example of what this might look like on a unit basis (single product) for a 3P:

An Additional Note on Returns

The most important thing I want to emphasize about returns on Amazon is your ability to try to understand what’s driving the product to be returned. You can’t do anything to negotiate the FBA fee for your products, and it’s not easy to negotiate a lower MDF contribution in your Vendor terms with Amazon. But you do have some control over returns.

It’s fairly common for consumers to leave a review for your product, especially if they have a bad experience and choose to return it. The reason will usually be included in the review. This information can be key to understanding flaws in your product that, if addressed, can help avoid additional returns. If you fix the problem – you should see fewer returns. This in turn likely means you’re protecting your product and brand from further negative reviews in the future.

For new products this is especially true, and becomes an overall business health metric rather than just a profitability input. I would strongly recommend you regularly monitor product reviews for recently launched items that might explain why a customer would choose to return your product. Then make sure to act on it.