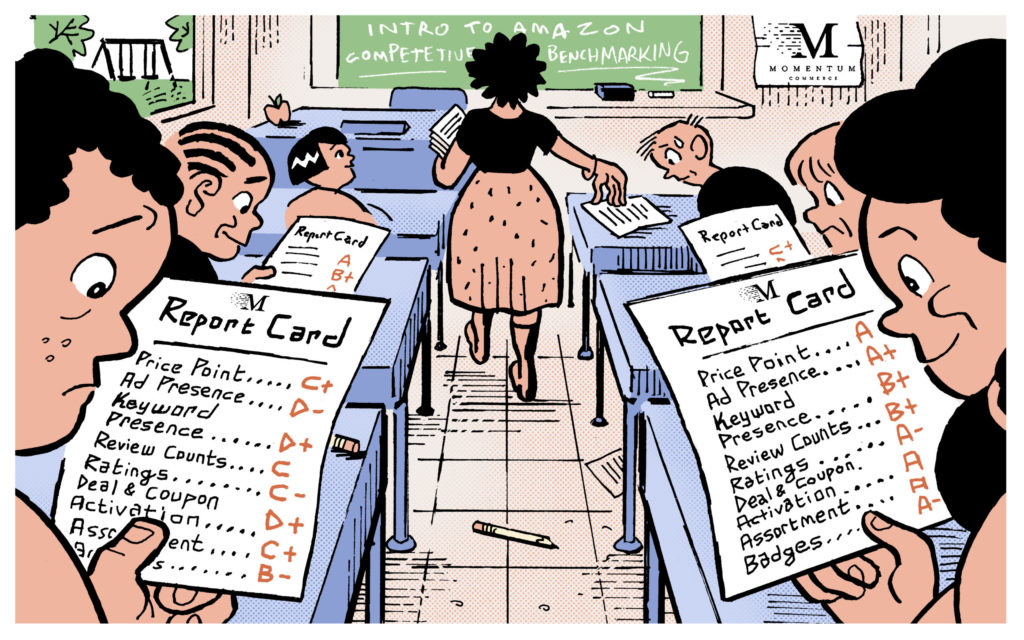

Introducing Momentum Commerce’s Amazon Competitive Benchmarking Tool

TLDR; We built a cool benchmarking tool to help brands understand their relative performance on Amazon.com across 17 different performance KPIs spanning Product Discoverability, Catalog Depth, Pricing, Promotion, Reviews and Ratings. If you’d like a free sample report or to learn more, email us at Hello@MomentumCommerce.com.

At Momentum Commerce, we are frequently hired by leading Private Equity firms to provide due-diligence on potential investments in the consumer sector that have significant exposure on Amazon.com (or other digital retail platforms). As part of our work on these projects, we assess business execution across the ten drivers of brand success on Amazon – things like pricing, in-stock rates, advertising execution, reviews and ratings, and product content. For many of these drivers, we find that a competitive analysis can help reveal areas of strength as well as opportunities for growth and expansion. However, we have found that the tools that are most commonly used in our industry to perform competitive analysis are often inflexible, restricting granularity and accuracy. For quick sniff-test projects, off-the-shelf analysis informed by the various low-cost SaaS tools can be super handy. However, for detailed analysis that will materially inform strategy or investment – flexibility is power! As a result, we decided to build our own tools for this purpose and our Principal Data Scientist, Joe Regan, created what we call, “The Momentum Commerce Amazon Competitive Scorecard”.

Application Overview: The Momentum Commerce Amazon Competitive Scorecard

The purpose of the tool is to produce a comparison of key Amazon Brand Performance metrics between a chosen Brand and a set of competitor brands.

As input, we specify a target Brand (to be compared against others) and we either enable the application to determine competitors automatically or we specify a hard-coded list we wish to study manually. Furthermore, the application will either define the market the brands are competing for automatically or allow us to specify a customized definition of the market. Because Amazon is inherently a search-driven platform, we use search terms as the basis for our market definitions. Finally, this analysis can be customized to a specific date range – helpful if we want to look back and see how the market may have been different during Prime Day.

Once the competitors and markets are defined, performance against a wide variety of designated KPIs is computed and displayed for all brands in a simple tabular format (see below for a sample output for the oral care brand Sensodyne).

The real power of the application is not just that it automates an otherwise painstaking piece of analysis. But instead, it is constructed in a way that can leverage the best of human and computer thinking.

On the computer thinking: There is an algorithm that is used to define markets by search terms based on a single brand input. There is then another algorithm that identifies the most prominent competitors on those search terms. There is a third algorithm that finds additional search terms that competitor products are discoverable on to more comprehensively “define the market”. There is then an optional algorithm to remove any search terms that contain a trademarked brand term to remove the bias we sometimes find in markets that are heavily influenced by brand search. Finally, the datasets are aggregated to the brand level first but it’s trivially easy to deconstruct the analysis down to the product level to reveal more directly actionable intelligence.

On Human thinking: All of the algorithms described above can be directed by a human analyst at Momentum Commerce to be more or less exploratory in how they define markets and competitors. And finally, because the output will always include the raw data files for the 1) the base search term set derived from the targeted brand 2) the surrounding competitor brands, and 3) the expanded search term set derived from all competing products humans can easily review the way the computer is thinking and quickly identify opportunities to make the analysis more accurate. For example, as we study Sensodyne products we may discover that many of their competitors market “organic” or “natural” toothpaste products which indicate these are relevant search terms to include in our market definition. However, if Sensodyne does not offer natural or organic toothpaste products and would not consider this to be their target market, we may wish to remove these terms from consideration and refactor the analysis.

Once the market and competition have been adequately defined, the competitive scorecard can help to drive really actionable insight. Here are just a few examples:

1) If you notice that your paid share of voice (SOV) is lower than your competitors, it could indicate an opportunity to boost your advertising investment and hone in on the relevant search terms identified in this analysis.

2) If you observe that your competitors are beating you on organic SOV and their prices are also lower, this could indicate an opportunity to revisit your pricing strategy as pricing impacts your ability to win the buy box which therefore impacts your organic ranking on Amazon.

3) If you notice that your average rating is lower than your key competitors it could indicate an opportunity to take a close look at your customer feedback to ensure that you are addressing it. High customer ratings are associated with higher conversion rates and organic rankings on Amazon.

Competitive Intelligence is an interesting field in business. On the one hand, excessive focus on competitor analysis can come at the expense of customer or execution focus and derail forward progress. On the other hand, inadequate focus on competitor analysis can prevent companies from tracking the most important economic indicator of all – when and how consumers vote with their feet or wallets. Competitive intelligence is particularly valuable in new markets or in periods of transformation where building organizational consensus on “what is good” is difficult – in our experience Amazon certainly qualifies as such a market. However, nothing derails business productivity quite like incorrect competitive benchmarking presented to executive teams and then passed down to operational teams as judgment. If we can help you study your field of play on Amazon and draw some actionable insights from it, please reach out at Hello@MomentumCommcerce.com.