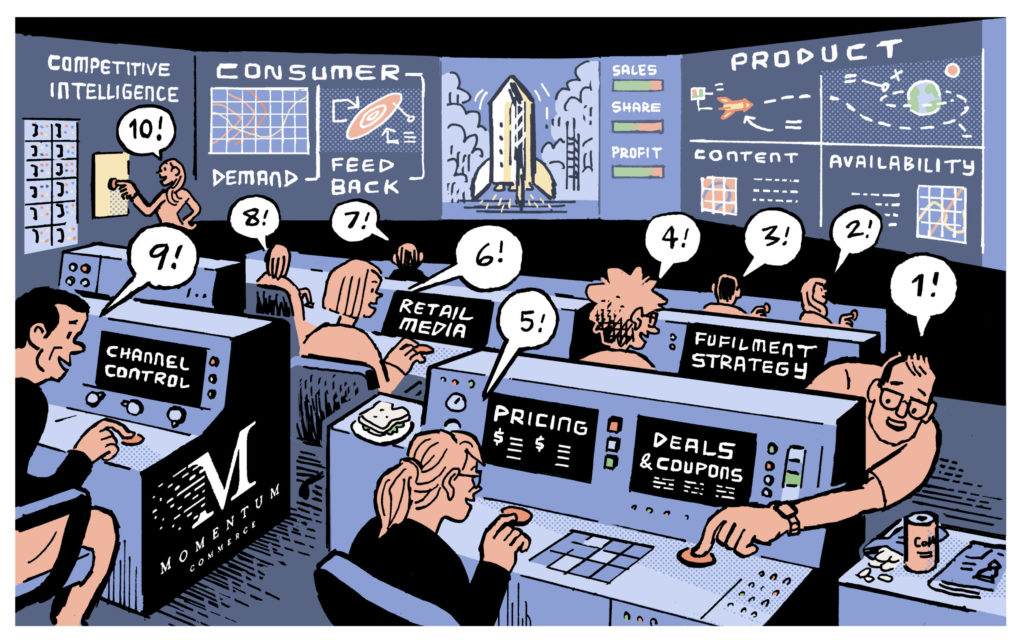

Building the Amazon Command Center: The 10 Drivers of Brand Success on Amazon

Managing a successful business across Amazon and other digital retail channels requires keeping a lot of balls in the air at once. Dropping even one can make it difficult or impossible to allow your business to reach its greatest potential. I find many brands focusing on trying to win the customer before they have effectively laid the groundwork to be able to do so with a repeatable process. Below you can find a summary of the major things you’ll need command of in order to win on the digital retail channels that matter most. It’s important to understand each of these individually but also how they all work together to allow your brand to stand out in an increasingly crowded digital retail landscape.

#1. Consumer Demand

Consumer demand is one aspect that is largely out of the control of individual brands selling on Amazon or other digital retail channels. What brands can do is use it as context when determining relative success or failure over any given measurement period. Brands should be aware of the growth or decline of their category as a whole when measuring their individual growth. Brands that are growing slower than their category as a whole are shedding market share to competitors, while brands that have seen declines year on year may actually be achieving success if their business is contracting at a slower rate than that of their entire category. New Consumer recently released a report that outlines US e-commerce penetration over three periods; pre-pandemic, peak lockdown and reopening. On slide 12, you can see that a category like online grocery has exploded during the pandemic and maintained much of it’s gains even post-reopening. Meanwhile, a category like apparel skyrocketed during the pandemic but has returned to pre-pandemic e-commerce penetration. There’s a lot tied up in the shopper experience online vs in-store but it’s important for brands to tie their success or failure to their category as a whole as opposed to purely looking at their individual period over period growth or decline.

#2. Competitive Intelligence

Competitive Intelligence and an accurate understanding of the digital shelf, both for your own brand and your competitors, are table stakes to developing an effective retail media business strategy. Competition is stronger than ever and new challengers are entering the market every day. Brands should understand the key drivers of their business from a keyword standpoint and identify the competitive brands and ASINs where there is the most overlap. As we mentioned earlier your discoverability is directly tied to how high you show up in a search result so it’s important to understand who you’re bidding against and make sure you’re picking the right spots to focus your advertising investment. Advertising is an important part of putting your brand and product in the best spot to succeed. That said, other considerations include promotional strategies, best in class product content, pricing and proactive management of reviews. Concentrate on your products with high margins and revenue where inventory can be replenished quickly.

#3. Product Availability

COVID-19 has had a seismic effect on both supply chains and consumer shopping behavior. To that end, the last 18 months have caused problems for brands and sellers on both sides of their business – sourcing inventory and the inventory levels that Amazon is willing to stock. The Amazon product ranking algorithm is a bit of a black box but brands can be sure that being able to fill orders (whether from Amazon directly or to meet consumer demand) plays a massive role in how and where Amazon will surface your product within search results. According to Johnathan Gold (VP of Supply Chain and Customs Policy for the NRF), of their 16,000+ members, two-thirds said they’ve been forced to add two to three weeks to their supply chains. There is undoubtedly a lot that is beyond the control of sellers and brands. Focusing on sourcing products that drive the majority of your revenue and understanding the effect of healthy inventory levels on corresponding Amazon product rank is necessary to weather the storm that brands have endured recently

#4. Channel Control

The more widely distributed your products are, the more likely you are to have unauthorized sellers of your product(s) across Amazon and other retail channels. The best way to protect your brand and the products you sell on Amazon is to sign up for Amazon Brand Registry. Being brand registered allows greater protections around monitoring and enforcement if outside parties are selling your products without your permission. You can also apply to be a restricted brand on Amazon which means that outside parties can’t sell your product on Amazon without your approval. The sheer size of Amazon makes it difficult to have complete channel control but brands need to be proactive in this area or risk losses to revenue and damage to your brand and reputation.

#5. Product Content

One of the most important aspects of a successful Amazon business is product content. The best advertising strategy won’t help if your potential customer isn’t met with a representative example of your product when they find it on Amazon and similar retail platforms. Here’s a quick rundown of the most important aspects of product content and why they matter….

- Product Title – This should include your brand name, color and variant (size for example), quantity (if there are multiple units in the package) as well as keywords. Keywords added to the title of your product are perhaps the least straightforward and the element that the most brands miss. Keeping track of the keywords that drive the most revenue for a given product is the best way to make sure that your product is properly categorized by Amazon and that it appears for the most relevant searches.

- Product Images – Images are easier (compared to words) for a consumer to recall, especially as they cross-shop your product with others that could potentially meet their need or want. Product images are a proxy for the in-store shopping experience where consumers can understand the size, shape and quality of a product. Brands will generally want to use 5-7 images and should make use of video whenever possible. It’s also important to make sure your images and videos are optimized for desktop as well as mobile (browser and app).

- Bullet Points – This is straightforward and should highlight key features and differentiators of your product. It also offers an opportunity to include secondary keywords that won’t fit in the product title.

- Product Description – This section gives brands an outlet for a more detailed description of their product in longer form format. Brands should be utilizing the product description as well as A+ content to set themselves apart from competitors and maximize the information available to consumers, especially for higher price point and longer consideration period products.

#6. Fulfillment Strategy

Brands selling on Amazon have different fulfillment strategies to choose from. Whether you operate in a 3P or 1P sales model, a successful Amazon will want to maximize flexibility, profitability and Prime eligibility.

- In most cases this means using Fulfillment by Amazon (FBA). Any brand utilizing FBA relies on Amazon to handle all shipping (both to the customer and receiving returns) as well as warehousing (including picking and packing). In a 3P model, brands are responsible for understanding what products consumers are purchasing and making sure that Amazon has sufficient stock levels to meet consumer demand for your products. You have a similar dynamic on the 1P side, however, it’s not as simple as sending more product when Amazon stock levels deplete for a given ASIN

Additional models that brands can use on the 3P side are Seller Fulfilled Prime (SFP) or Fulfillment by Merchant.

- Seller Fulfilled Prime (SFP) is a program that allows brands to deliver to Prime subscribers while using their own shipping operation. Here brands need to commit to being able to get their products to consumers within two days of a consumer purchase. There’s usually a trial period where Amazon will monitor whether you’re able to deliver products on time and comply with Amazon’s return policy. This is likely only going to make sense for well established brands with massive warehousing and distribution capabilities. Remember that the consumer and satisfying their needs and expectations is all that really matters to Amazon. While they’ll be eager to relieve whatever congestion they can in their fulfillment centers, they’ll be paying close attention to your ability to meet all Prime requirements.

- Fulfillment by Merchant (FBM) is also a consideration for brands selling on Amazon. FBM is a fulfillment model where brands don’t have a Prime badge (meaning you can take longer than 2 days to get your product to the end consumer). With this fulfillment model the seller controls the entire shipping process. Brands should likely stay away from this model unless the product is so exclusive or niche that the need for it can’t be readily replaced by a competitive product with Prime eligibility.

#7. Pricing

Pricing strategy on Amazon is mainly a 3P consideration since Amazon usually controls the price when the brand acts as the wholesaler. There are several expenses to understand before beginning to consider the competitive pricing landscape for similar products. Brands should understand their costs of goods, Amazon selling fees/referral fees (8-15% of the retail price depending on product category), FBA fees (cost associated with storing your product in an Amazon fulfillment center) and advertising costs. Target a profit margin after these costs that makes sense for your business while also understanding that many of the inputs mentioned above (such as COGs and advertising costs) are highly variable. If you’re a brand selling commoditized products at a lower price point, you’ll likely see massive changes in sell through rate when adjusting your price up or down even a few percentage points. Higher price point products tend to be less competitive due the cost of inventory and should see less relative fluctuation in sell-through rate based on price.

#8. Deals and Coupons

Retail media marketers are constantly trying to understand the advantages and disadvantages of utilizing a deal and/or couponing strategy as opposed to using advertising to promote their products. The two ideas are not mutually exclusive but marketers should understand the differences between deals and coupons and when they should be utilized.

- Deals

- Amazon makes it easy to run a deal whether you are operating out of Seller Central or Vendor Central. Most brands will be familiar with deals that run around peak traffic periods like Prime Day(s), Black Friday, Cyber Monday, etc. There are also opportunities to run deals during “normal traffic” periods including Deal of the Day, Best Deal, Lightning Deals and many others. The majority of deals are promoted on the Amazon Deals Page, which is one of the most highly trafficked pages on Amazon. There are a variety of things to consider when setting up a deal, such as what discount to offer, how many units to offer (before the deal expires) and how long a particular deal should run.

- Coupons

- Similar to deals, coupons are a great way to increase visibility and revenue for your products. There are a variety of ways to utilize a couponing strategy on Amazon including percentage off promo codes, buy one/get one and one time use codes. Coupons usually appear as a CTA under a product listing. Compared to deals, you’re going to stand out more prominently on a SERP (Amazon also has a coupon page similar to their deals page).

Ultimately, deals and coupons should be used in conjunction with a buttoned up advertising strategy. Both tactics are great ways to drive up revenue and as importantly, product reviews. Discounting strategies are great to use for a product launch, to move through excess inventory or to promote seasonal products (either to kickoff or round out a seasonal push). One thing for brands to be aware of is the longer term effects of discount strategies vs advertising. While deals or coupons may offer a quick push and a halo effect for products not being promoted, advertising is likely going to be the better option to help train Amazon’s ranking algorithm to index your product prominently within a high value search related to your product.

#9. Retail Media

I previously outlined the different digital retail platforms and networks brands should be looking to sell their products on. The success or failure of any business on these platforms is largely dependent on their willingness to “pay to play” via aggressive advertising investment. Ad Exchanger recently published a great article highlighting the acceleration of revenue being driven by paid placements on retail media platforms like Amazon, Walmart, Target and Google Shopping. “In the past three years, Amazon Sponsored Products ads have gone from fewer than 20% of Amazon’s top inventory (the first 10 products shown following and given shopping search) to currently covering more than 40% of average searches.” In most categories click-share falls off a cliff beyond the top ten listings so advertising will continue to be the primary driver of revenue growth on these platforms. It’s no coincidence that as Amazon’s stock price has soared so has the cost of discovery for brands on the platform. While retail media platforms outside of Amazon are less ad driven today, brands should expect to see their percentage of revenue driven by advertising continue to increase in the coming years.

#10. Consumer Feedback

Reviews are one of the most important components of a successful product on any retail media channel. Amazon places reviews higher on a product detail page than even price because quality and quantity of consumer reviews for a given product are what sets similarly priced products apart. Brands should keep in mind that Amazon has very strict rules around review manipulation and will suspend those that don’t comply with their terms and conditions. The best way to generate reviews (assuming you have a quality product) is to price and advertise your product effectively. The more sales you produce, the more opportunities you have to meet new and happy customers. There are a variety of ways to solicit reviews from a consumer within the confines of Amazon’s terms and conditions. These include requesting a review within 30 days of customer purchase (utilizing Amazon’s back end platform), Amazon Vine or using an insert within the packaging of your product. It’s important to note that there are strict rules around inserts. You can ask for reviews but you can’t ask that negative reviews not be submitted on Amazon. Brands certainly shouldn’t hide from negative reviews. Amazon will be proactive about taking responsibility when the reason for negative feedback is related to the delivery of the product (if utilizing FBA). Recently, Amazon began allowing sellers enrolled in Brand Registry to reach out directly to customers who leave a sub 4-star review. This is a great way for brands to address any negative reviews head on and potentially have the review rating removed or improved.