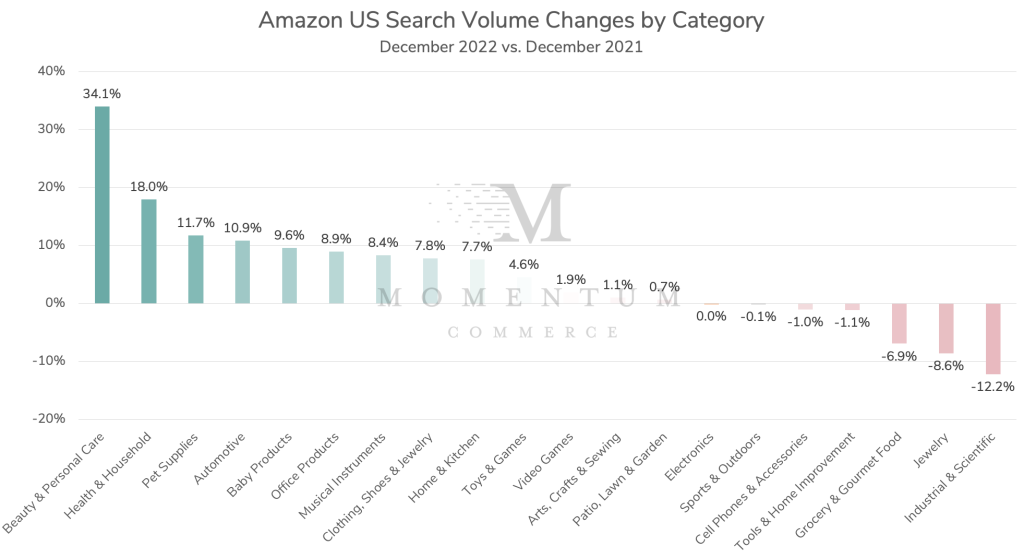

Amazon Search Volume Rises 6.3% Year Over Year in December 2022 – But Caveats Remain

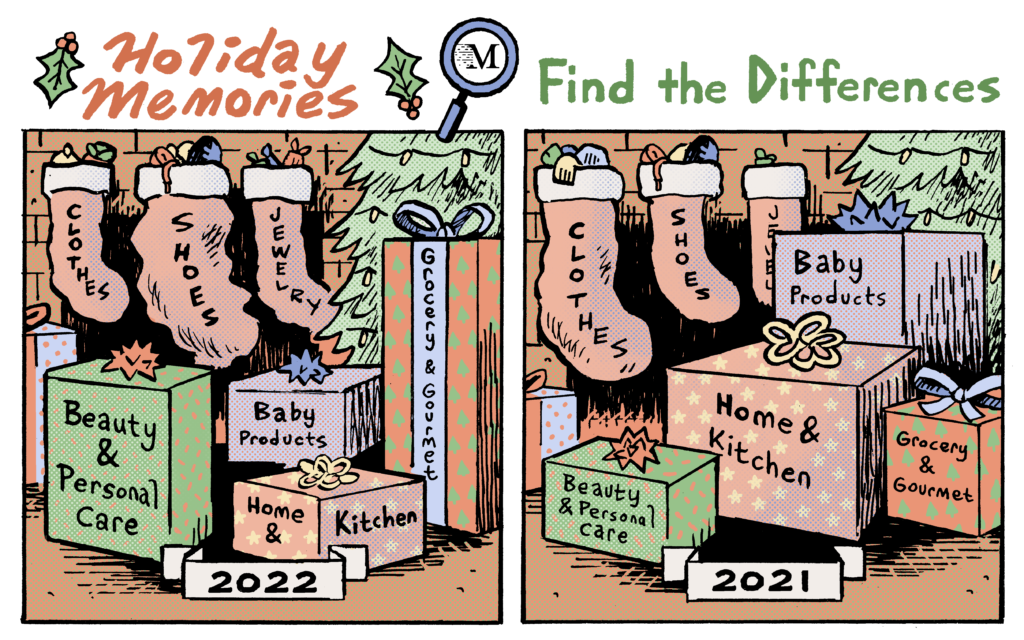

After multiple sources pointed to lower sales on Amazon.com this holiday season, the latest site-wide analysis by Momentum Commerce unveiled how this is manifesting when it comes to search activity. Year-over-year Amazon search volume rose slightly across the retail site, but this was not a uniform trend. Individual major product categories demonstrated year-over-year changes ranging from more than +34% to -12%.

The Research:

Momentum Commerce analyzed modeled search volume estimates across the top 500,000 search terms on Amazon during both December 2021 and December 2022. Search terms were categorized based on the top-level category associated with the majority of products appearing on the corresponding search results pages.

The Story:

- The analysis showed a +6.3% increase in search traffic across the top 20 categories by keyword frequency on Amazon between December 2021 and December 2022

- Out of all categories studied, Beauty & Personal Care demonstrated the largest a year-over-year increase in search volume.

- A number of other categories over-performed the larger marketplace with year-over-year volume increases beyond +6.3%

- On the other end of the spectrum, Grocery & Gourmet Food, Jewelry, and Industrial & Scientific, all exhibited the steepest year-over-year search traffic declines

Biggest Takeaways for Brands:

- This search traffic data is a clear window into demand shifts on Amazon, as opposed to dollar value revenues, which at a minimum need to be adjusted for inflation on a year-over-year basis

- For brands in categories demonstrating year-over-year volume increases, it’s imperative to understand which relevant search terms are driving those increases. Terms that may be relatively less popular can still be delivering higher growth rates and justify marketing investment (P.S you can use Momentum Commerce’s Search Trends Tool to investigate these trends)

- For brands in categories with dropping search traffic, the overall “pie” of potential customers on Amazon shrinks. Expect higher ad prices, which naturally increases the importance of optimizations around pricing, advertising, and product discoverability in search so brands capture the most revenue possible

- Year-over-year Amazon search traffic flattening or declining needs to be taken seriously. If they aren’t already, brands need to focus on share of voice, and above all market share, while setting strategies that are geared towards improving those metrics. This may come at the expense of some efficiency.

- In every category, certain brands will be improving their trajectory. Becoming one of those brands means understanding what products are winning, what’s behind their strength (e.g. better price, more discoverability on key terms etc.), and creating a plan of action for addressing those gaps. This is a concept known as Durable Dominance on Amazon, and will be the topic of an upcoming Momentum Commerce webinar with Stratably.

- Beauty & Personal Care is the only category that demonstrated year-over-year Amazon search volume increases during both December and October 2022. For brands in the space, they are in the enviable position of being able to take advantage of that natural growth, with well-optimized strategies opening up the potential to drive efficiencies at the same time.