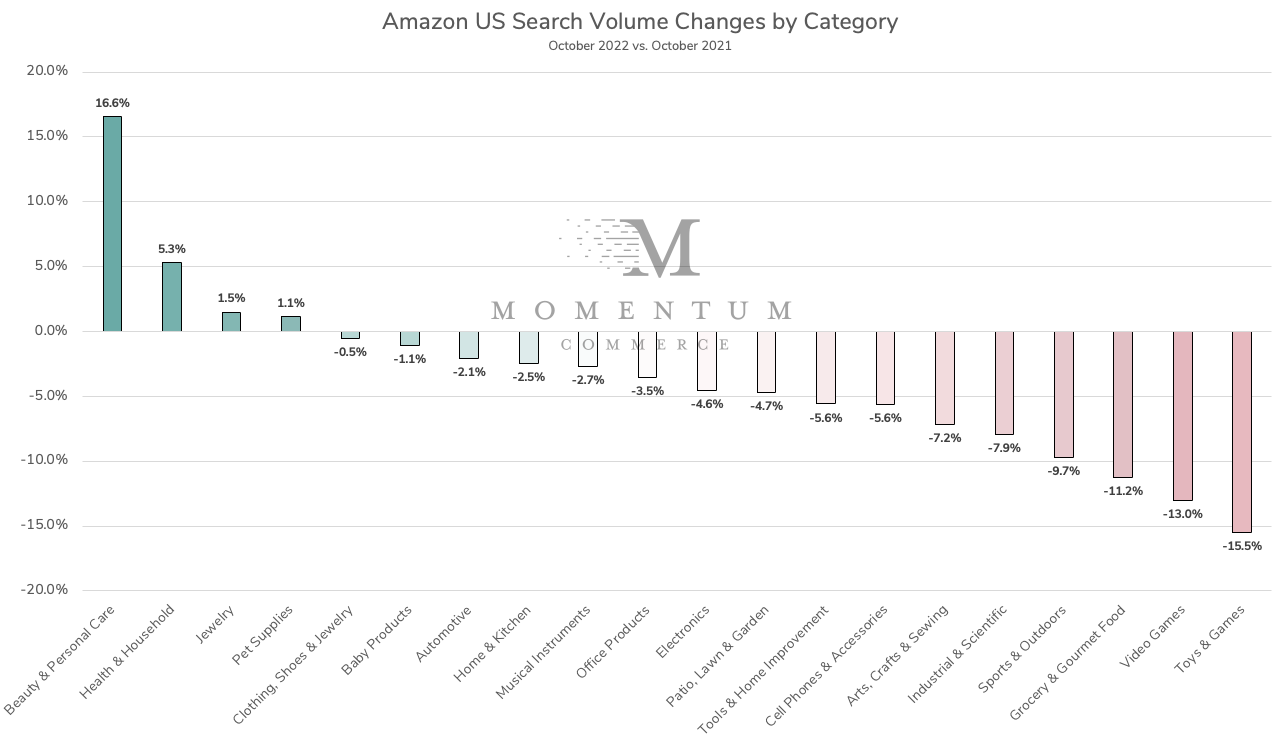

Amazon Search Volume Falls 3% Year Over Year in October 2022

Following anecdotal examples of softer than expected demand around the Prime Early Access Sale (PEAS), a site-wide analysis by Momentum Commerce found year-over-year search traffic decreases across most major product categories on Amazon during the month of October 2022.

The analysis showed a -3% decline in search traffic across the top 20 categories by keyword frequency on Amazon between October 2021 and October 2022. However, individual rates of change varied significantly, a small number of categories actually demonstrated year-over-year gains in search volume.

Beauty & Personal Care is the biggest exception to the overall trend on Amazon, with search volume rising by more than 16% year-over-year in October.

On the other end of the spectrum, search traffic within the Toys & Games and Video Games categories on Amazon dropped precipitously year-over-year. However, it’s worth noting that both of these categories typically see very strong gains in the lead-up to the holiday season, potentially brunting some continued impact of this softer demand.

While search volume does not always track with revenue – due to inflation, for example – search volume does represent a kind of ‘ceiling’ on Amazon. Dropping volumes naturally put pressure on brands to better optimize their advertising so they can cost-effectively capture more in-market consumers as their numbers shrink.

Overall, we see the trends above signaling several important themes for brands when it comes to setting a strategy for the holiday season:

- It’s imperative to have the capabilities to identify search trends as they happen on Amazon. Declining search volumes underscore how utilizing ‘last year’s playbook’ isn’t a viable strategy. Optimizing campaigns in the face of muted demand rests on being keenly aware of how consumers are searching, and adjusting budgets and targeting accordingly.

- Develop a realistic plan and expectations based on market realities. If your category is seeing declining volume, and your own sales figures are showing year-over-year declines in terms of units ordered, expect some of that to carry over through the holiday shopping season. Sales will still rise during the holiday season, but likely not as much as previous years.

- Beauty & Personal Care brands should strongly consider strategically increasing Amazon search advertising investment. Increased consumer search activity now is a major opportunity to grow revenues leading into the holiday season, and gain important knowledge about what will work best during Cyber Week and beyond.

Methodology: Data included in this analysis is based off of search volume estimates across the top 500,000 search terms on Amazon during both October 2021 and October 2022. Search terms were categorized based on the top-level category associated with the majority of products appearing on the corresponding search results pages.