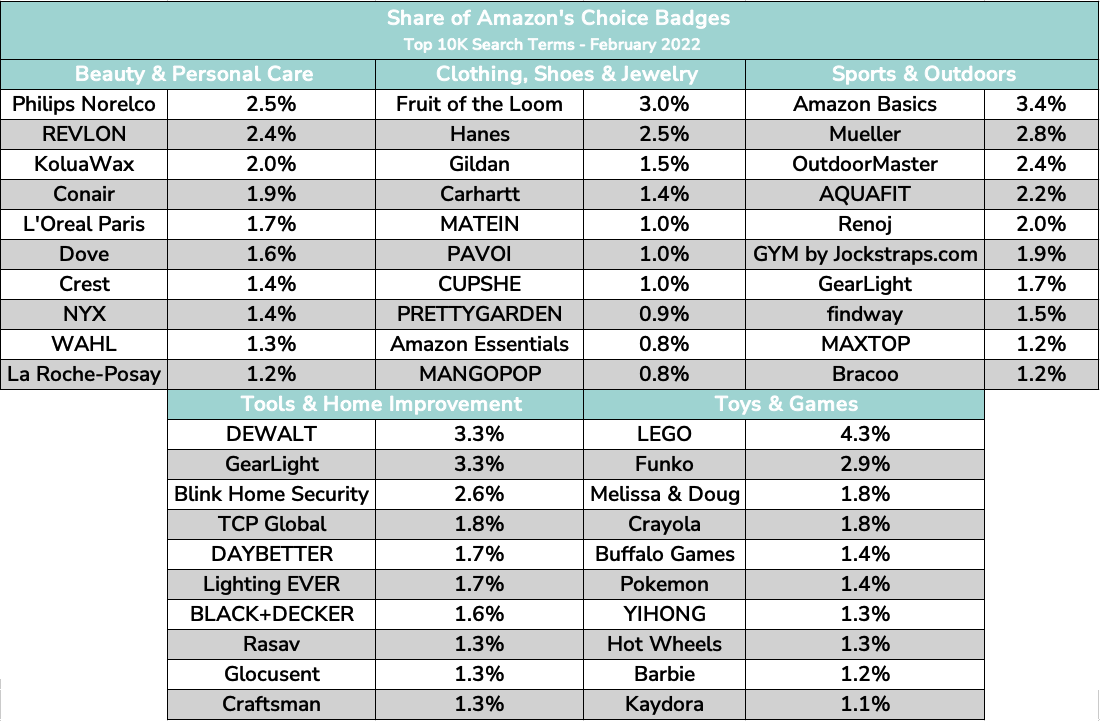

Amazon Private Label is Winning the Badge Race

Amazon’s Choice badges, which are awarded on a search term-by-search term basis, are a powerful indicator to consumers that a certain product is a good, reputable option to purchase. Unlike the ‘Best Seller’ badge, which relates solely to Best Seller Rank (BSR), Amazon’s method of determining which products get the Amazon’s Choice badge on a given search are more opaque, factoring in some combination of price, sales history, reviews, and relevance. After examining a month’s worth of data across the 10,000 most-searched terms on Amazon, there’s a wide range in how much a top brand dominates the capture of Amazon’s Choice badges for a given category. But a near constant are Amazon Private Label brands either leading the pack, or nearly doing so.

Key Observations

- Regardless of category and across the most popular searches on Amazon, Amazon Private Label products capture comparatively large shares of Amazon’s Choice badges

- In categories where a non-Amazon brand took the highest share of Amazon’s Choice badges, brand shares tended to be more closely grouped together

- Amazon Private Label brands are adept at executing on the metrics that play into achieving Amazon’s Choice badges on the most popular search terms

- Brands operating in these categories need to set aggressive advertising strategies while maintaining consistently competitive and compelling pricing and product content

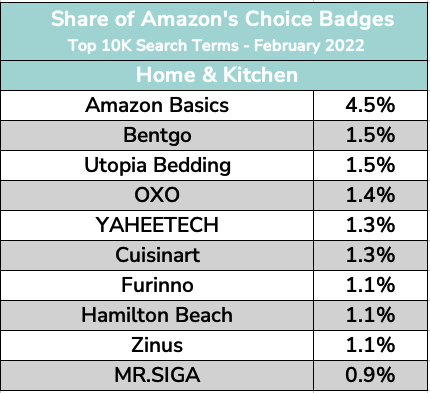

To this point, in February 2022 Amazon Basics captured 4.5% of all Amazon’s Choice badges across Home & Kitchen search terms in the top 10,000 most searched terms on Amazon. The next most frequently badged brand was Bentgo, earning a 1.5% share. That’s a tremendous difference when considering that this category generates a plurality of the most searched terms on Amazon (roughly 15%).

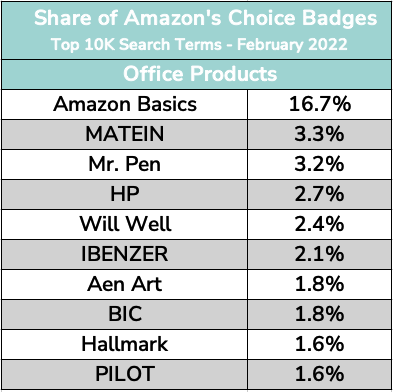

Perhaps most eye catching, Amazon Basics captured nearly 17% of Amazon’s Choice badges across the most popular Office Products search terms. The next closest competitor, Matein, only garnered 3.3%.

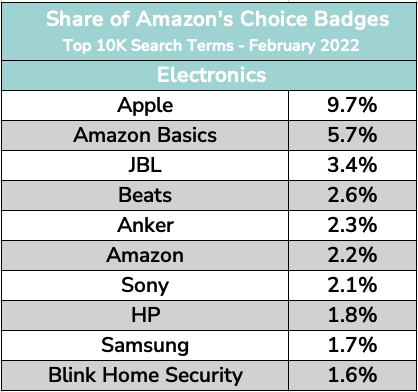

Apple is the only other brand that can boast a similarly large share of Amazon’s Choice badges in a given category, with nearly 10% of badges captured in the Electronics category. Even then (although perhaps not surprisingly) Amazon Basics is second at 5.7%, Amazon branded products (e.g. Echo) are sixth at 2.2%, and Amazon’s Blink Home Security is 10th at 1.6%.

Outside of Apple, in cases where a non-Amazon brand took the highest share of Amazon’s Choice badges, brand shares tended to be more closely grouped together.

The biggest takeaway from these findings is that, at a minimum, Amazon’s Private Label brands are doing a terrific job executing on the metrics that play into achieving Amazon’s Choice badges on the most popular search terms. For brands, even popular ones, this bolsters the imperative for setting an aggressive advertising strategy on key popular terms for individual products. This is on top of consistently keeping popular products competitively priced, and maintaining product detail pages updated with rich content that is optimized for conversions on terms rising in popularity as they develop over time.

Methodology

Data in this analysis is reflective of products appearing on page one across the top ten thousand Amazon US search terms between February 1 and February 28, 2022. Categorization of the terms is based on the top-level category attached to a majority of products appearing across a given search results page.