Amazon Cyber Week 2021: Disappearing Discounts & What That Means for 2022

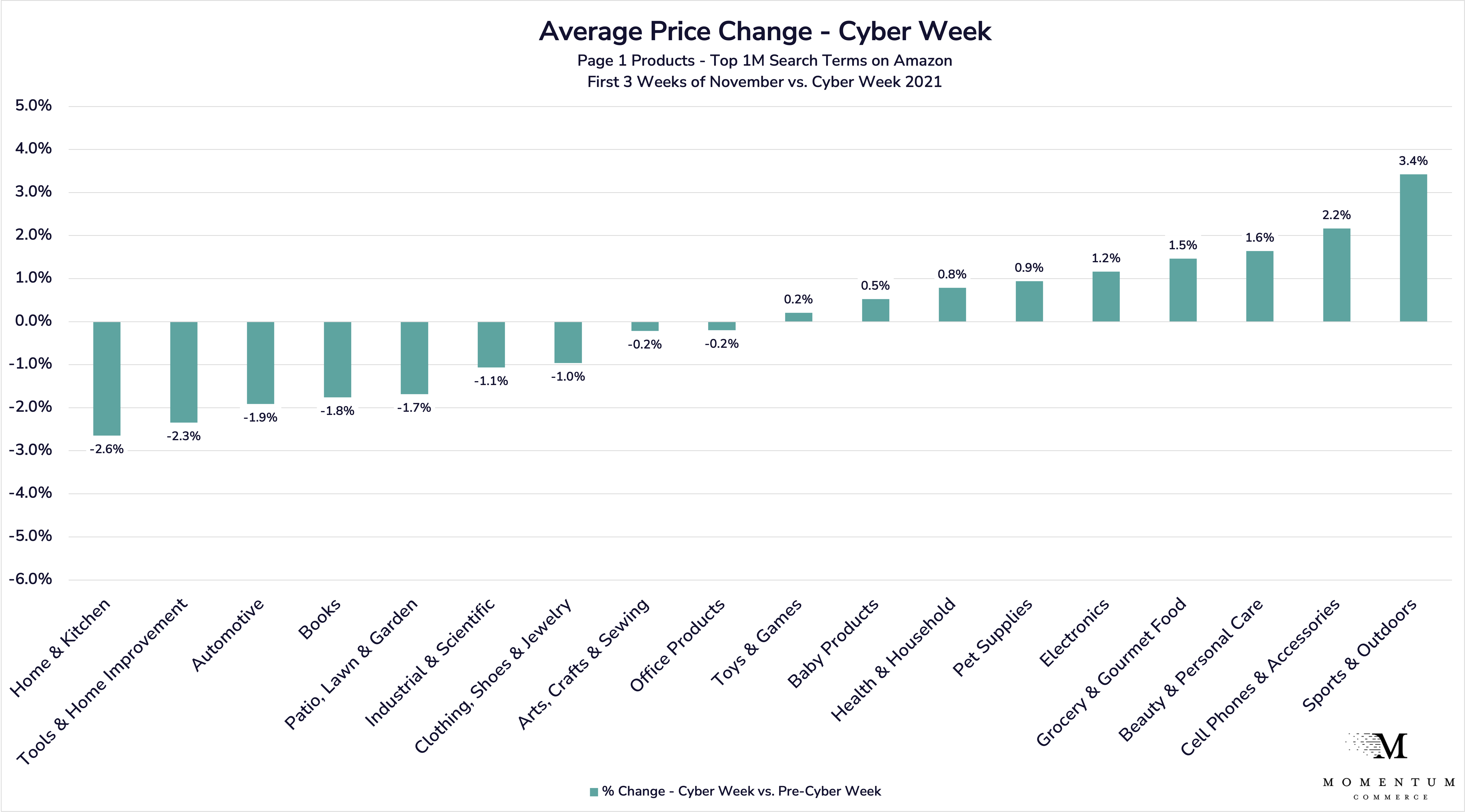

In our last post, we analyzed how different categories fared from a consumer activity perspective during Cyber Week 2021. The upshot was that search activity around certain categories like Electronics and Toys & Games outpaced Home & Kitchen and others. But when consumers made those searches on Amazon during Cyber Week, a new analysis from Momentum Commerce shows something surprising – discounting and low prices – a hallmark of Black Friday and Cyber Monday – was, in aggregate, absent or decidedly minimal across nearly every category in 2021.

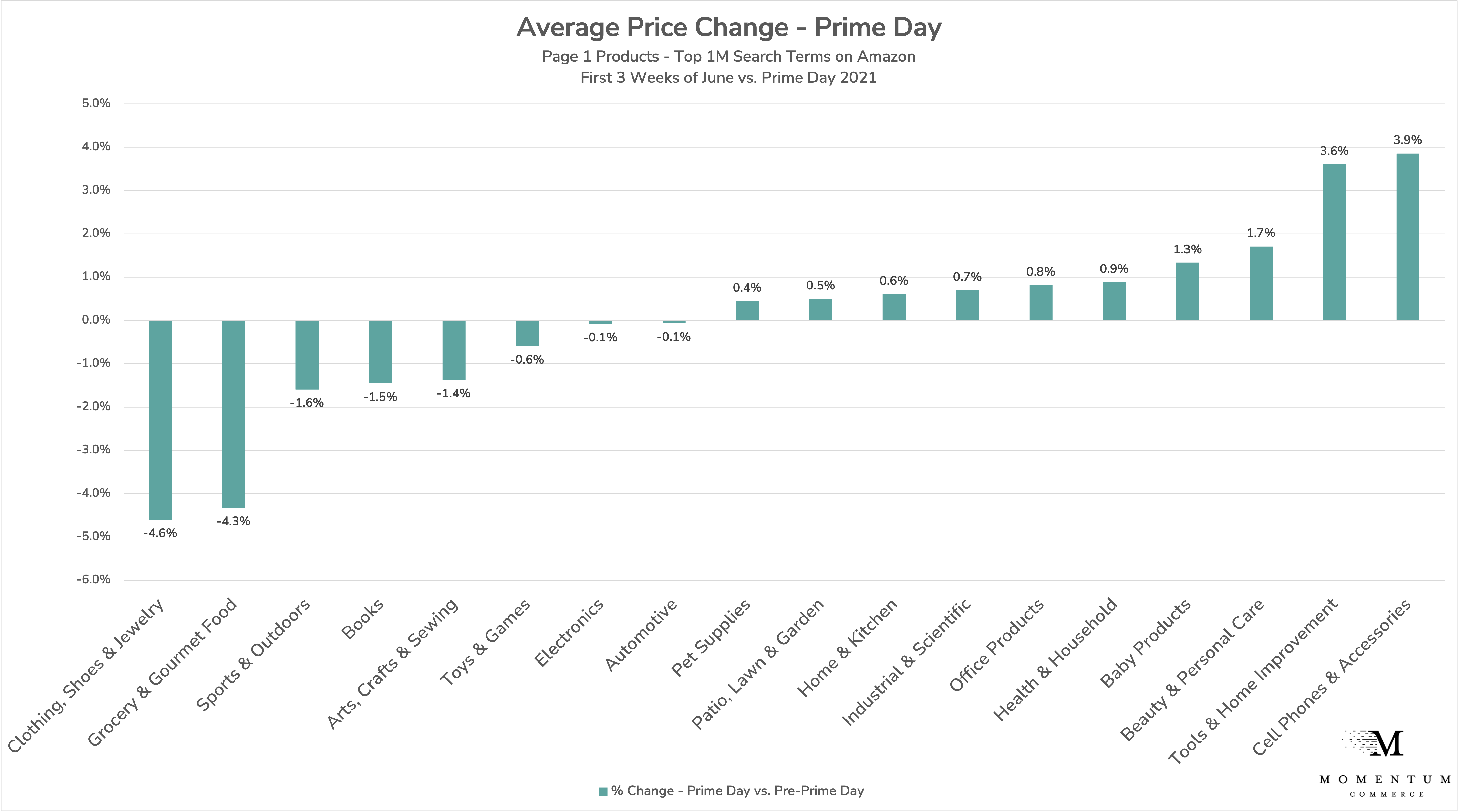

This muted discounting activity may be yet another reflection of 2021 market realities. Supply chain shortages may have disincentivized brands to more significantly discount in order to maximize total revenue and minimize the danger of stock outs. Additionally, during the 2021 Prime Day event, discounts were similarly scarce in aggregate across categories. However, during Prime Day, both Clothing Shoes & Jewelry and Grocery & Gourmet Food posted average price drops much larger than any major category during Cyber Week.

Key Observations

- Home & Kitchen posted the largest average discount during Cyber Week, with the average price of relevant products on Amazon falling 2.6% from the prior three weeks

- For context, Clothing Shoes & Jewelry took the title during Prime Day 2021, but exhibited a 4.6% average discount during that period

- A number of categories actually demonstrated price increases in aggregate during Cyber Week

- Notably, Electronics prices increased by an average of 1.2%, at the same time the category captured an increasing share of the top 1,000 searches across all of Amazon

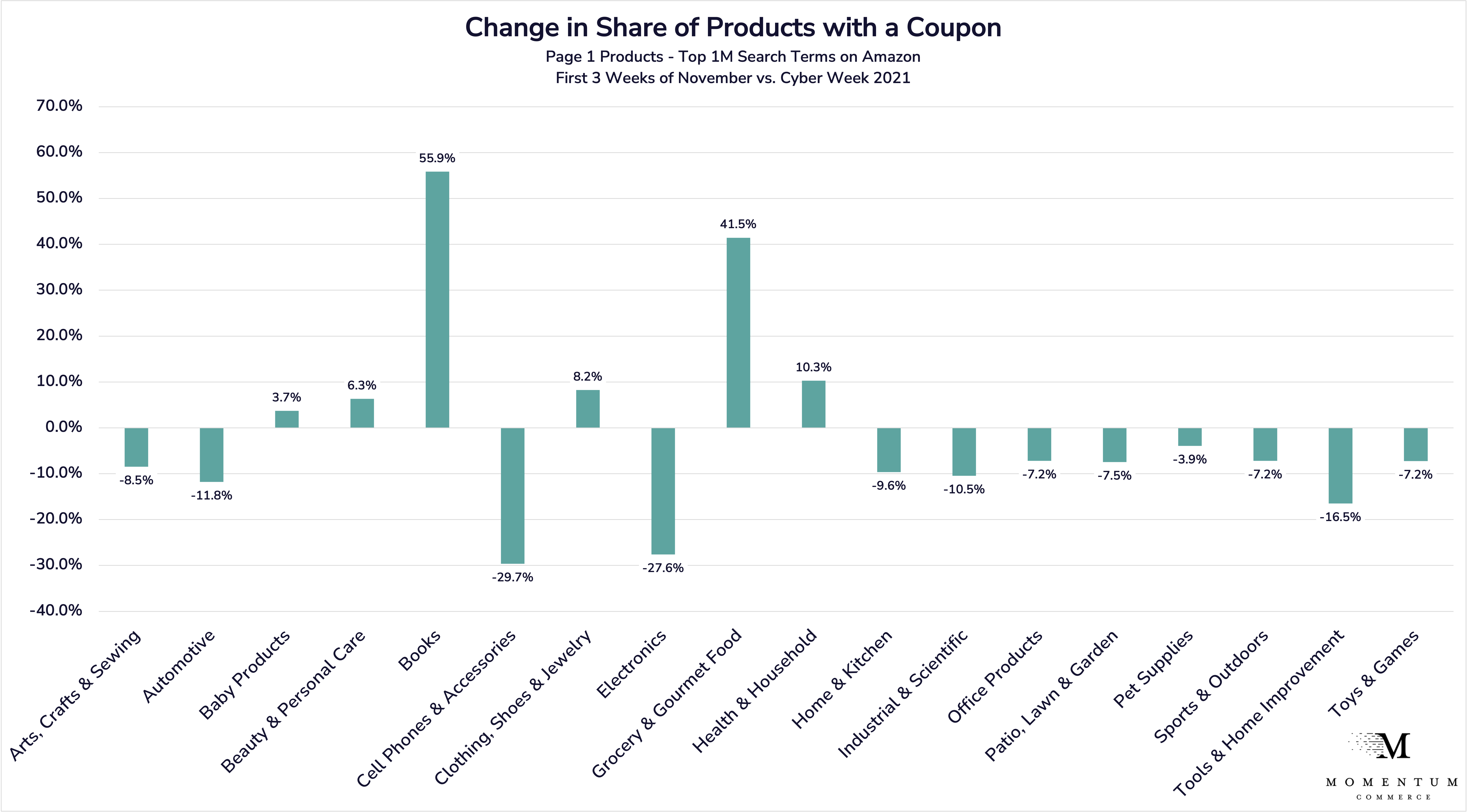

- Couponing activity was also muted during Cyber Week, with the share of products offering a coupon dropping across a majority of popular categories

- These trends, along with variances seen at a search term level, emphasize the importance of ‘relative price’ on a given Amazon search page

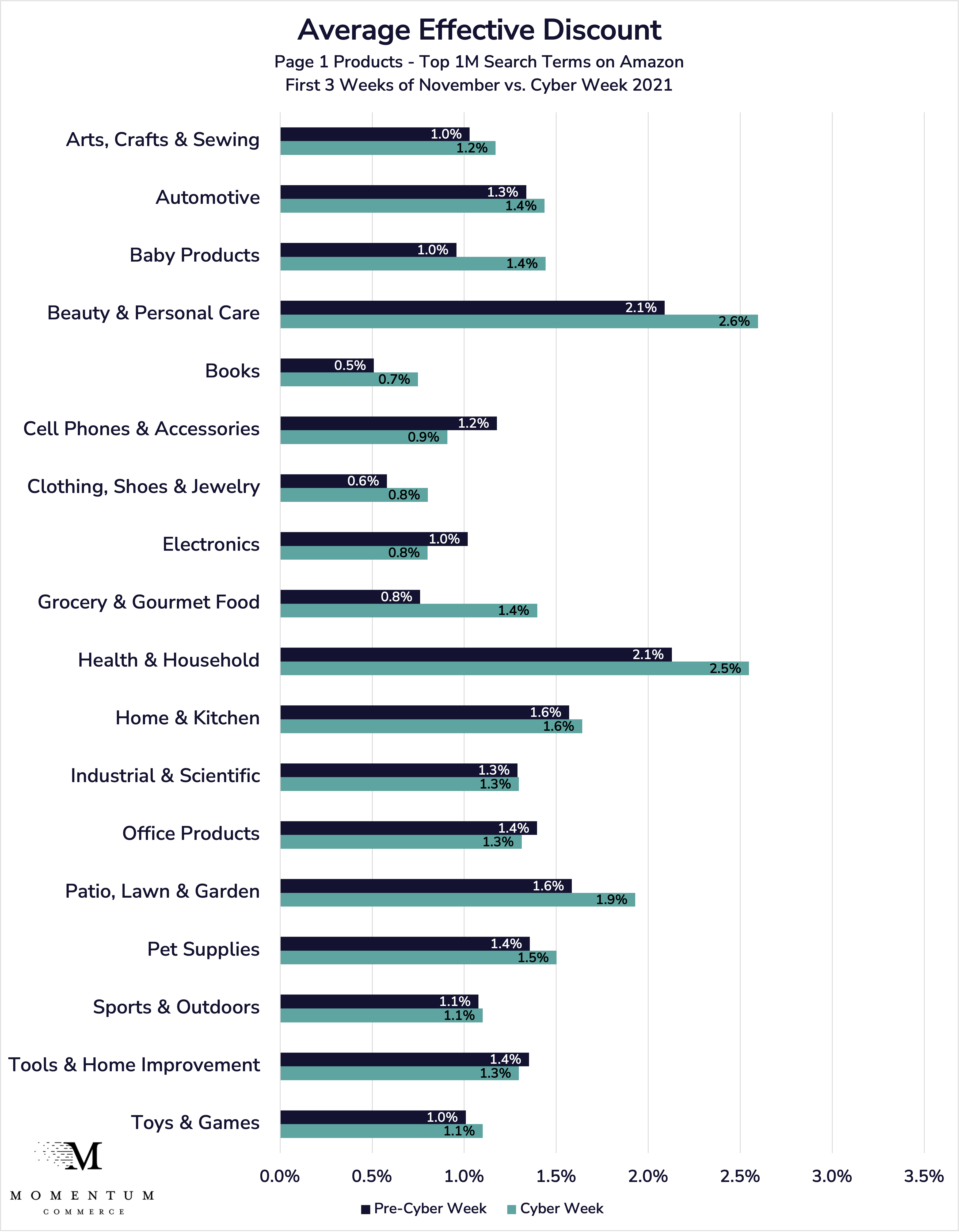

Even when factoring in couponing activity, discounts were decidedly light during Cyber Week across a number of categories in aggregate. Additionally, the percentage of products on page one where a coupon was present actually dropped for many popular categories.

Looking Towards 2022

The analysis above shows high-level trends, but when it comes to how brands, operationally, should consider whether or not to discount their products on Amazon (and by how much), more nuance is necessary. What makes a product attractive to consumers on Amazon, and what Amazon values in terms of how it ranks products on the search page, are both driven by context. How does your product compare to others that are most similar to yours?

According to Momentum Commerce research, it’s clear that ‘relative price’ often matters more than ‘absolute price.’ You can see this illuminated in a sampling of some of the most popular terms within the ‘Home & Kitchen’ category before, during, and following Cyber Week. Looking at the median price in each period, you can see how even for closely related terms, this median price point varies.

| Search Term | Median Pre-Cyber Week Price | Median Cyber Week Price | Median Post-Cyber Week Price |

| Advent Calendar 2021 | $28.99 | $24.99 | $23.49 |

| Air Fryer | $107.98 | $99.99 | $99.99 |

| Christmas Decorations | $28.99 | $22.49 | $21.99 |

| Christmas Ornaments | $20.49 | $19.99 | $18.99 |

| Christmas Stockings | $21.99 | $19.99 | $23.49 |

| Christmas Tree | $162.74 | $139.99 | $149.99 |

| Desk | $106.24 | $119.99 | $89.99 |

| Gaming Chair | $149.99 | $199.00 | $159.99 |

| LED Lights for Bedroom | $23.99 | $21.99 | $21.99 |

| Outdoor Christmas Decorations | $42.44 | $37.99 | $35.49 |

When it comes to positioning your product effectively against your competition, this matters. A decorative Christmas wreath costing $28 during Cyber Week will seem notably pricey when searching for “Christmas decorations.” However, the median price point on the term “Outdoor Christmas decorations” is $37.99, making that same product feel more affordable by comparison.

The absolute price of that wreath may be relatively high, but not when seen relative to the other results in that specific search.

It’s also worth noting the relative rates of change in median price across those different terms. Even just across this basket of the some of the most popular terms, in some cases prices returned to pre-Cyber Week levels following the sale event, in others prices remained stable or sank further, while in some instances prices actually rose higher than the early November figures.

This emphasizes how keying in on relative price, and adjusting based on your competition across the most important search pages for each product you sell should be an important part of your Amazon sales strategy.

Answering these kinds of nuanced questions for our clients through rigorous data analysis and experimentation is at the heart of what we do at Momentum Commerce. If you’re interested in a custom analysis of your pricing strategy relative to the market segments you operate in, please shoot us a note here.

Methodology:

Data is reflective of product prices listed on the first 20 results on page one across the top one million Amazon US search terms over the two study periods (November 5-29, 2021 and June 1-22, 2021). These prices are exclusive of any couponing or list price discounts. The Cyber Week period is defined as November 25-29, 2021, and the Prime Day period is defined as June 21-22, 2021. The post Cyber Week period in the final table is defined as November 30-December 7, 2021.