Amazon Cyber Week 2021: Consumer Interest in Electronics Soars, Home & Kitchen Sinks

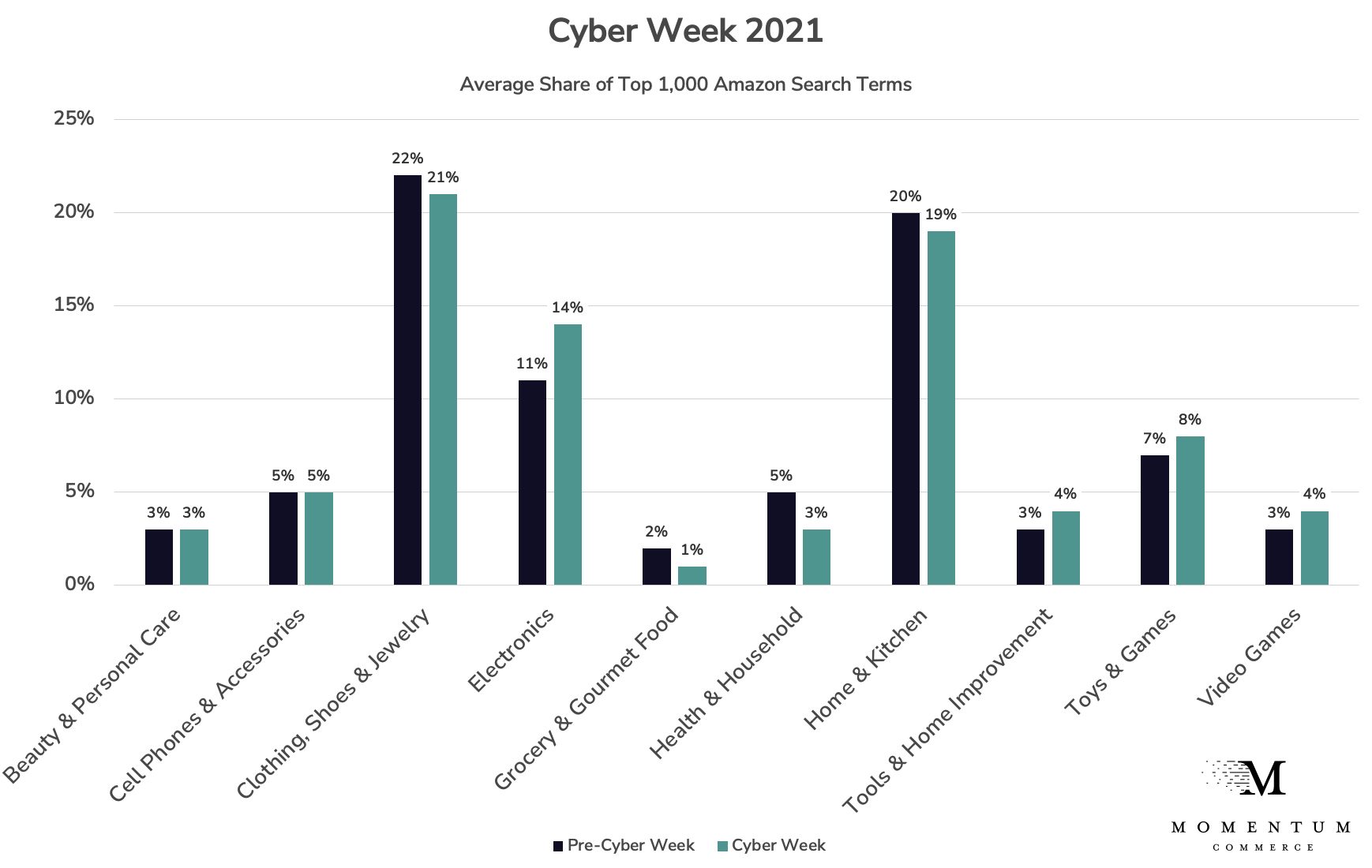

Despite the pandemic’s impact on consumer behavior patterns, Cyber Week remains a major retail event. Amazon was quick to label the post-Thanksgiving period in 2021 as “record breaking” on the site, although looking more granularly at the retail landscape, the signals were more mixed. Firms like Adobe Analytics actually observed a slight 1.4% year-over-year slowdown across the wider ecommerce ecosystem, and in Momentum Commerce’s own data analysis on Amazon specifically, different categories experienced varying fortunes.

Key Observations:

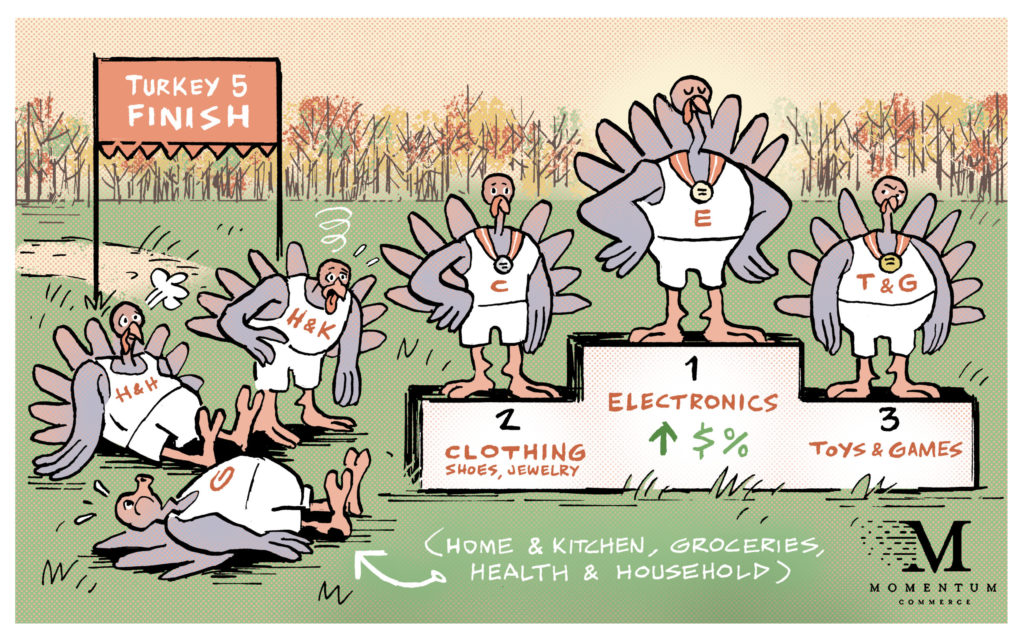

- Biggest Winners

- Electronics search terms grew to account for 14% of the top 1,000 search terms on Amazon during Cyber Week – after hovering close to 11%. The share topped out at 16% on Saturday of Cyber Weekend.

- Search terms in the Toys & Games category rose to account for more than 8% of the top 1,000 from a 7% figure before the high-traffic period

- Categories which saw notable drops in search term popularity during Cyber Week included Grocery & Gourmet Food, Health & Household, and Home & Kitchen

- Notably, the impact on Home & Kitchen popularity seems to be transient – as the share of category terms in the top 1,000 terms rebounded significantly after Cyber Monday

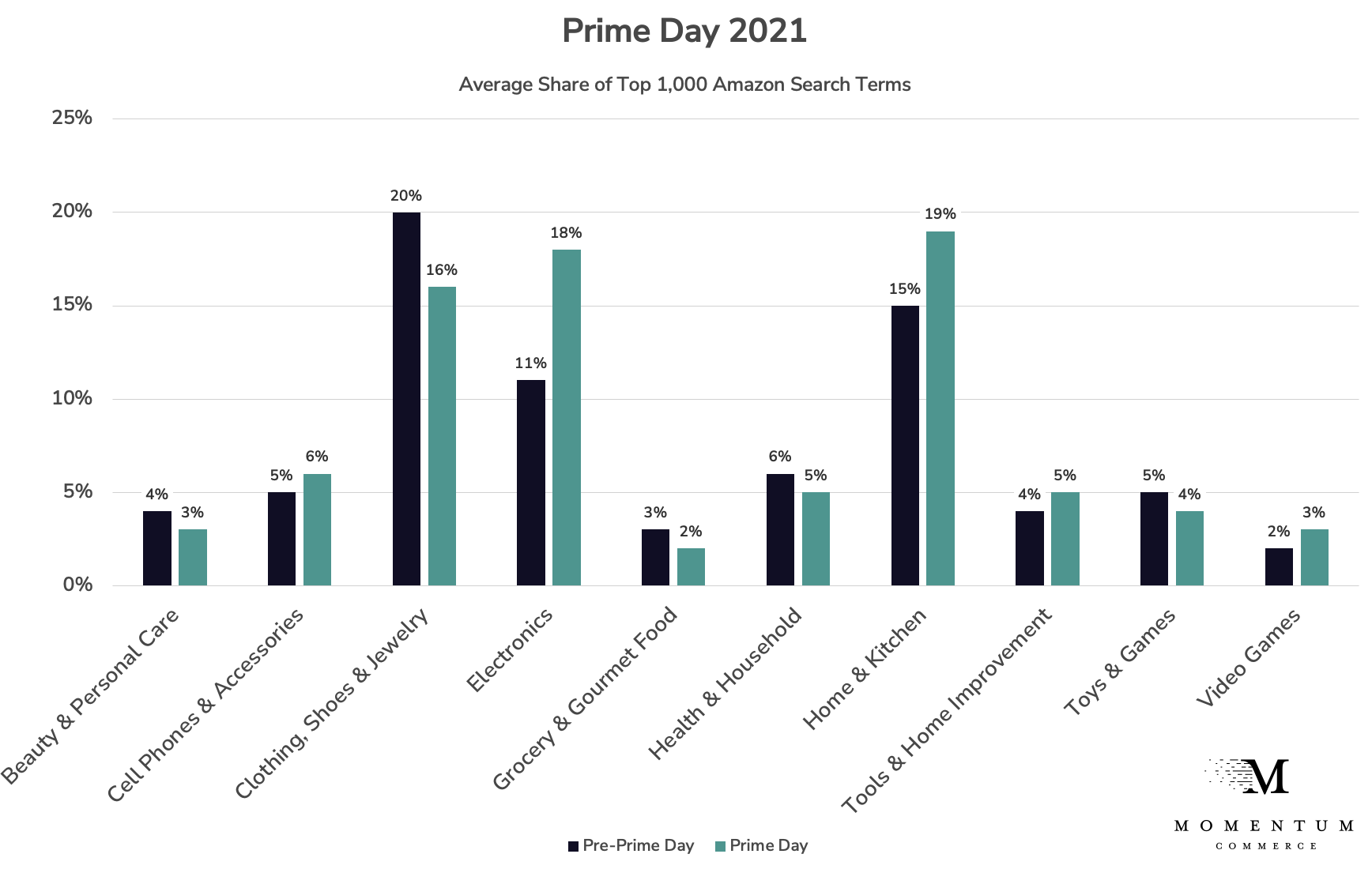

Many of these category-level shifts during Cyber Week 2021 were remarkably similar to what occurred during Prime Day 2021 – Electronics searches grew in popularity, while Clothing Shoes & Jewelry lost some share of the top 1,000 terms on Amazon. But critically, Home & Kitchen, rather than losing share as occurred during Cyber Week, actually gained during this past Prime Day. This emphasizes how high traffic periods do inject some volatility on Amazon that needs to be addressed based on real-world activity, as it develops.

Looking deeper at the Cyber Week data, within individual categories, the popularity of certain search terms rose dramatically both due to seasonal changes along with emerging pop culture trends. This includes tremendous jumps in popularity during Cyber Week for searches on Amazon relating to a hair accessory finding popularity on TikTok, and the new season of ‘Yellowstone’.

Top Rising Terms by Category:

| Category | Top Rising Search Term | Rank During Cyber Week | Rank Pre-Cyber Week |

| Arts Crafts & Sewing | Santa Bags for Gifts | 48,504 | 953,500 |

| Baby | Potty Safe | 38,221 | 998,820 |

| Beauty & Personal Care | Lazy Bird’s Nest Plate Hairpin | 26,557 | 948,277 |

| Cell Phones & Accessories | Halo Bolt with Air Compressor | 28,449 | 974,304 |

| Clothing Shoes & Jewelry | Yellowstone Shop | 12,582 | 988,051 |

| Electronics | Apple Air Pods Pros | 18,441 | 850,708 |

| Grocery & Gourmet Food | Brine Some Turkey | 13,777 | 954,437 |

| Health & Household | Trash, Compost & Lawn Bags | 51,507 | 979,414 |

| Home & Kitchen | Dyson v10 Animal Cordless Stick Vacuum | 40,914 | 992,864 |

| Tools & Home Improvement | Black Friday Tools | 18,166 | 942,351 |

| Toys & Games | Lux Blox | 26,730 | 990,882 |

| Video Games | Occulace Quest 2 | 8,606 | 971,520 |

With the usual ‘rising tide’ of activity during Cyber Week seemingly a bit more muted in 2021, it’s more critical than ever to take a data-centric approach to your entire Amazon presence. From pricing to promotions, the ability to capture market share is determined by placing your bets as intelligently as possible, based on real-world market conditions and trends. To elaborate on this, keep an eye out for our upcoming piece, where we’ll explore how discounting was not prevalent on Amazon during Cyber Week across nearly every major category, along with the implications for brands.

Methodology:

Share figures are calculated based on the percentage of the top 1,000 search terms on Amazon where a plurality of products within page one of results conform to a specific category. Pre-Cyber Week and Pre-Prime Day averages were calculated based on the three weeks of activity leading up to the high-traffic period.