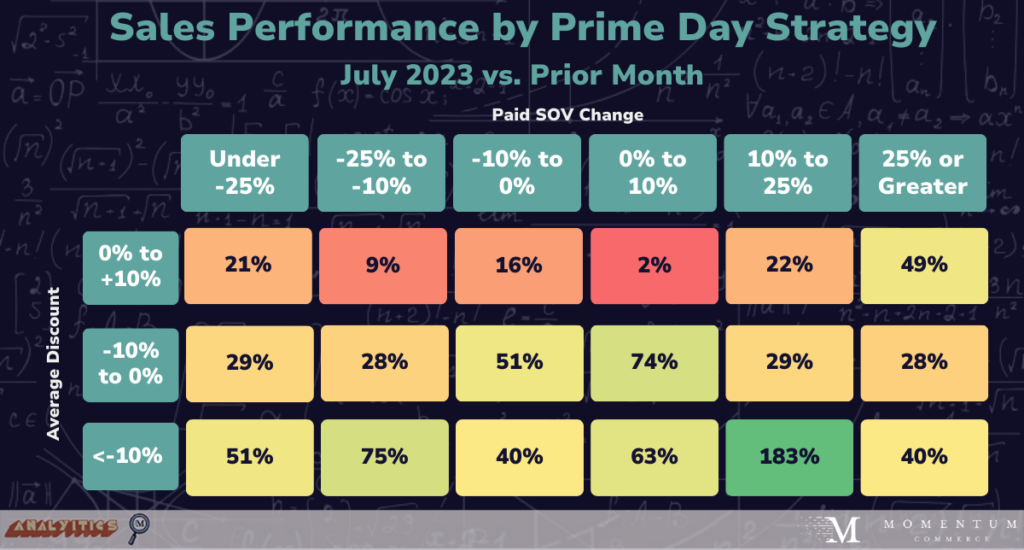

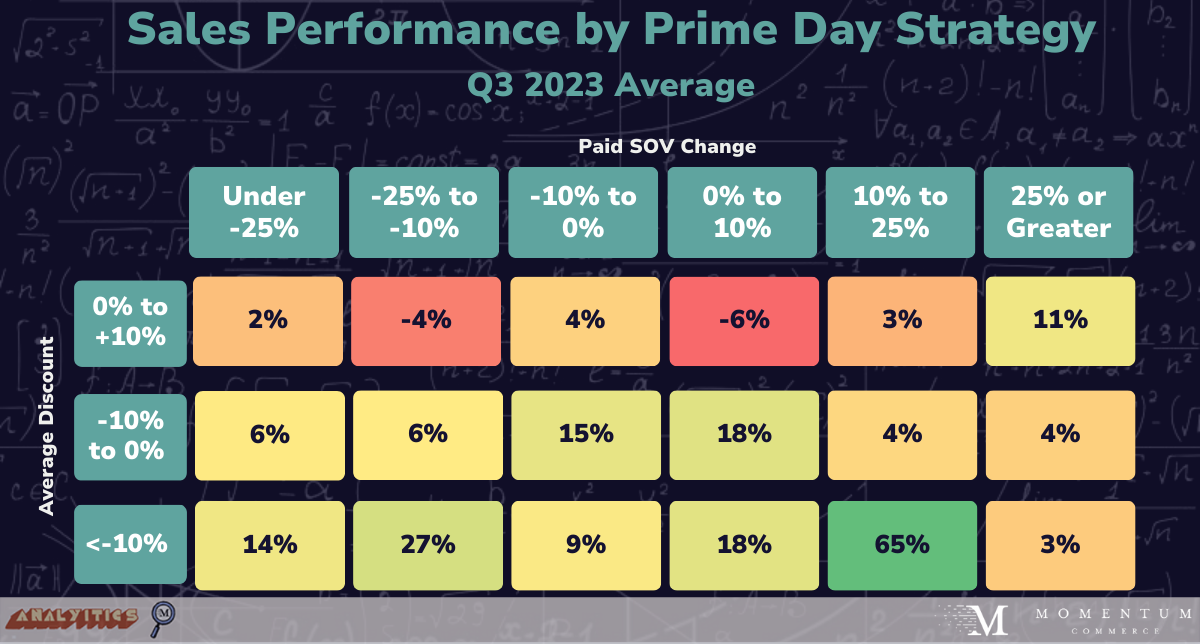

Win Prime Day by Blending a >10% Discount with 10% More Paid Visibility

An analysis of thousands of brands shows that a mix of discounting and advertising during Prime Day is clearly the strategy associated with better outcomes during the month of the sale event.

As seen above, for brands that may need to choose between advertising or discounting over Prime Day due to margin constraints, discounting alone generated more of a revenue impact compared to brands that only drove a greater advertising presence. Similar dynamics are present when looking at the three months following Prime Day. Brands that both discounted prices and increased advertising activity relatively heavily over Prime Day also saw longer-term success through Q3 2023.

Biggest Takeaways for Brands

- There is a point of diminishing returns on search advertising during Prime Day

- Across both the short- and long-term analyses, brands that drove a 25% or more increase in their paid appearances on Amazon during Prime Day saw relatively muted returns

- Brands are likely better off aiming for a slightly more modest increase in paid visibility while devoting any additional promotional budget to discounts

- Have a clear view into price elasticity of demand for your products prior to Prime Day

- While these overall stats can help narrow the strategic discussion, the exact discount to employ should reflect unit economics and observed trends for your brand and category

- Examine historical data around product price and sales – particularly during high traffic periods – to develop a clear understanding of discounts that will most closely thread the needle of maximizing profit and sales velocity

- When in doubt, advertise and discount during Prime Day

- This analysis makes it pretty clear that the biggest winners from Prime Day 2023 were brands that employed some discounting on top of increases in advertising investment

- Brands can, at a rudimentary level, weigh which approach they want to lean more heavily on by studying recent and past Prime Day competitor trends

- For example, advertising may want to command a higher portion of overall budget within categories showcasing historically high ad saturation rates in search

- Conversely, discounts may be more important in categories with a track record of higher discount rates across top competitors

Amplify Results with Amazon Marketing Cloud

Brands can further optimize their Prime Day performance by leveraging Amazon Marketing Cloud (AMC) data to enhance advertising effectiveness. AMC enables precise audience targeting by identifying high-intent shoppers who have recently engaged with products through wishlists, registries, or cart additions. This capability, combined with personalized creative elements, allows brands to build qualified lead pools before Prime Day and execute more targeted campaigns during the event. The result is improved ROAS through better audience segmentation and more relevant ad experiences throughout the consumer journey.

Customer Retention Strategies to Maximize Prime Day Impact

Beyond pricing and advertising optimization, brands can amplify Prime Day performance through strategic customer retention tactics. Data shows that combining retargeting ads with loyalty incentives creates multiple touchpoints for engagement. Effective approaches include implementing targeted email campaigns to past purchasers, offering exclusive early access to Prime Day deals for loyalty program members, and leveraging retargeting capabilities across platforms to re-engage recent site visitors. These retention strategies complement advertising and pricing tactics while building longer-term customer value beyond the Prime Day event itself.

Amazon Prime Day Statistics and Research Methodology

Momentum Commerce analyzed monthly Amazon US sales estimates, daily paid search appearances, and daily average pricing figures from June through September 2023 across the top 4,000 brands by revenue over that same time period. Brands were then segmented into buckets based on the change in average price (i.e discount) and change in total brand paid appearances observed in weekly values during Prime Day 2023 (July 9-15) vs. the week prior to the sale event (July 2-8). Comparative metrics were then calculated based on June vs. July 2023, along with June vs. the combined monthly average of July, August, and September 2023.