Brand Equity Pays Dividends Launching Products on Amazon

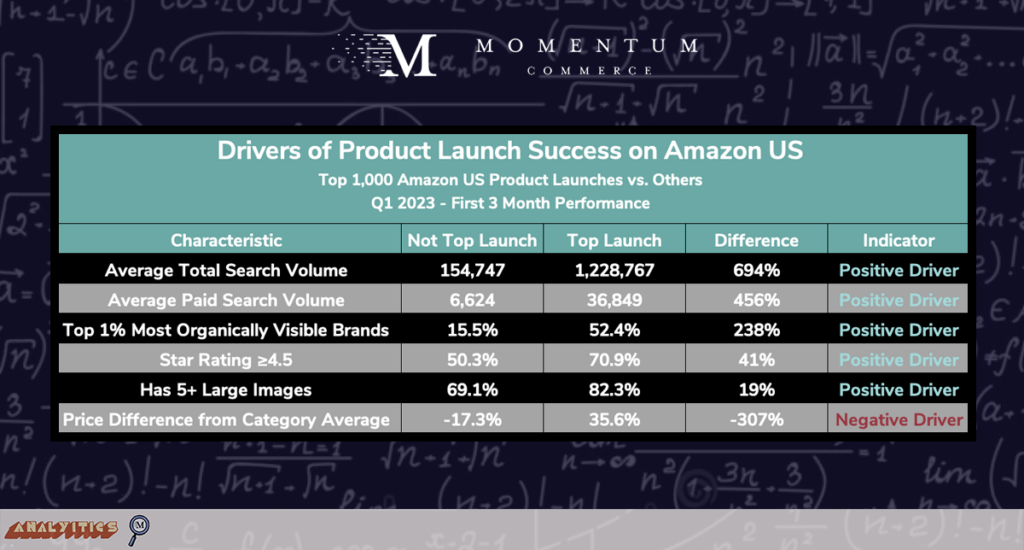

The most successful product launches on Amazon over the first portion of 2023 were significantly more likely to have large total and paid search presence, higher star ratings, and come from brands with large, existing organic appearances on Amazon, compared to less successful product launches.

While the Amazon marketplace is generally thought of as a democratizing force in retail — any brand can compete and theoretically get in front of the same consumers — this analysis underscores the significant advantages larger, established brands have on the retail site as compared to newer or smaller brands.

Earlier, we outlined the top product launches of Q1 2023 on Amazon in terms of average weekly revenue driven over their first three months on the retail site. In this analysis, we take a wider view, analyzing the top 1,000 product launches over that same period and outlining what factors separated those products compared to less successful launches.

Specifically, Momentum Commerce analyzed thousands of products that debuted on Amazon between January and March 2023, examining the average weekly sales for the first three months following launch date. To ensure a more standardized sample, products that are no longer available on Amazon as of 2024 (e.g. due to limited availability, limited release, or delisting by Amazon) were excluded. Additionally, new child ASINs under existing parent ASINs were excluded from the analysis to ensure more meaningful comparisons. The specific date range was selected to remove the impact of Prime Day on performance data.

The Story

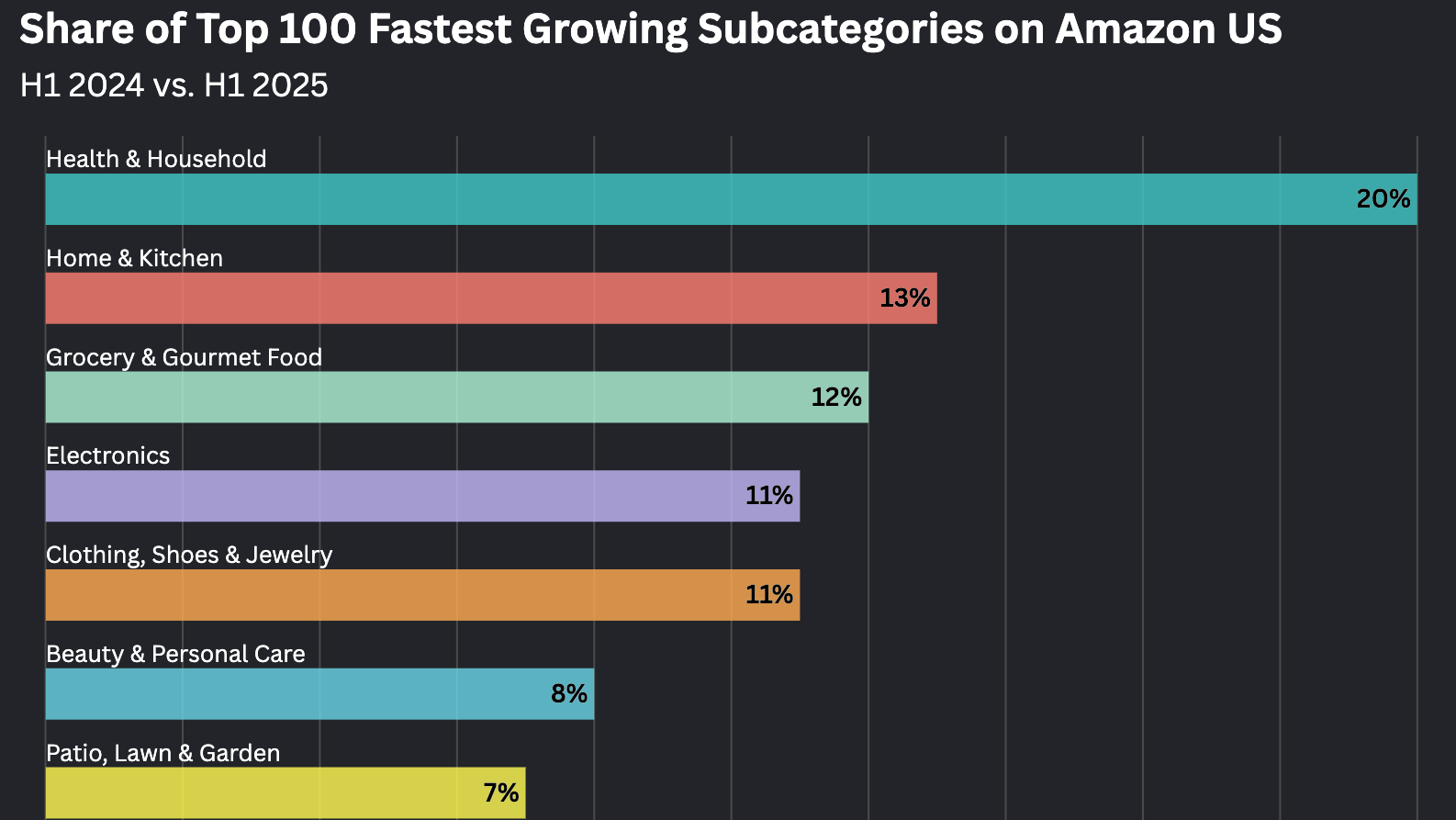

Compared to average non-top 1,000 product launches, average top-performing product launches:

- Were significantly more likely to be associated with the top 1% of brands by organic search appearances across Amazon in aggregate

- Appeared in page 1 search results roughly 8X more often

- Appeared in page 1 paid results roughly 6X more often

- Were 40% more likely to hold a 4.5 or better star rating

- Were priced roughly 35% higher than their respective category average vs. roughly 17% lower than the category average

- Were 19% more likely to have at least 5 large images on the PDP

Biggest Takeaways for Brands

- Bigger brands are at a tremendous advantage on Amazon as compared to smaller brands – but hurdles to success are real

- The vast majority of the top 20 products by average weekly revenue in the first three months following their debut on Amazon US came from large, national brands

- 52.4% of the top 1,000 product launches were associated with the top 1% most organically visible brands on Amazon US – a group that encompasses less than 20% of products on Amazon overall

- If a new product isn’t effectively merchandised, particularly through product imagery and search visibility, it’s at a disadvantage despite the brand name associated with it

- Larger brands should strongly consider leveraging their relevant, popular branded search terms by advertising new products in Sponsored Brands placements in order to drive sales velocity

- Smaller brands need to focus on supporting their new product launches with aggressive paid, organic, and review strategies

- For brands without a great deal of visibility across Amazon search, product launches are naturally going to be more expensive

- Prior to launch, smaller brands should be highly cognizant of optimizing every aspect of the product detail page to improve visibility across relevant, popular terms

- Amazon Vine is likely going to be the best option for driving the requisite ratings and reviews necessary to compare favorably versus competitors

- Particularly during the initial period following launch, a decided focus for smaller brands should be on tracking paid visibility on top terms

- While organic SOV is important long term, increased organic visibility specifically wasn’t as highly differentiated between the top and non-top product launch groups in the first three months

- We’ll be breaking out the best product launches by smaller brands over the next month to better illustrate how those brands were able to separate themselves from the pack without the benefit of a strong, pre-launch Amazon presence

- Amazon consumers aren’t afraid to pay a premium for a new product provided the value is there

- Having a higher average price may also provide the margin necessary to maximize the visibility of the product via paid search advertising

- Brands should look beyond simply having a lower price than existing competitors as a key lever in their product launch strategy for Amazon

- Merchandising the product effectively to generate positive ratings and reviews through Amazon Vine and other purchasers is particularly important in cases where a product’s premium price naturally hints at high quality