The Top 5 Amazon Data Insights from 2024

Our research in 2024 quantified several key drivers of Amazon marketplace performance. The data revealed that achieving a #1 Best Seller Rank (BSR) subsequently drives 41.5% higher weekly sales, while adding coupons increases search visibility by 17.2%. We also tracked meaningful changes in Prime Day purchasing patterns and Amazon’s approach to review displays.

Here are the five most significant findings from our 2024 research, along with the implications for brands planning their 2025 Amazon strategy:

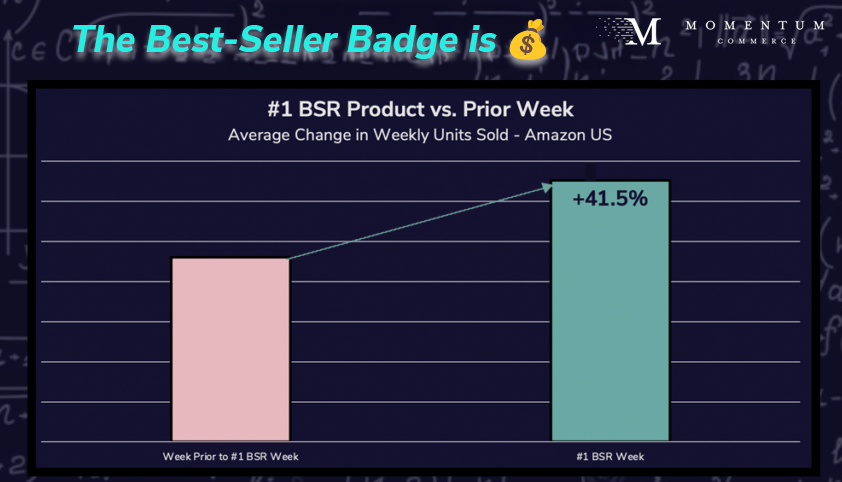

#1 Best Seller Rank Drives a 41.5% Weekly Sales Increase

Our six-month analysis tracked ASINs before and after achieving #1 BSR on Amazon US. Products maintaining the #1 BSR for a full week averaged 41.5% more units sold compared to their performance before achieving the #1 spot. This quantifies, for the first time, the specific sales advantage of reaching this milestone, making a clear business case for strategies that target BSR improvement.

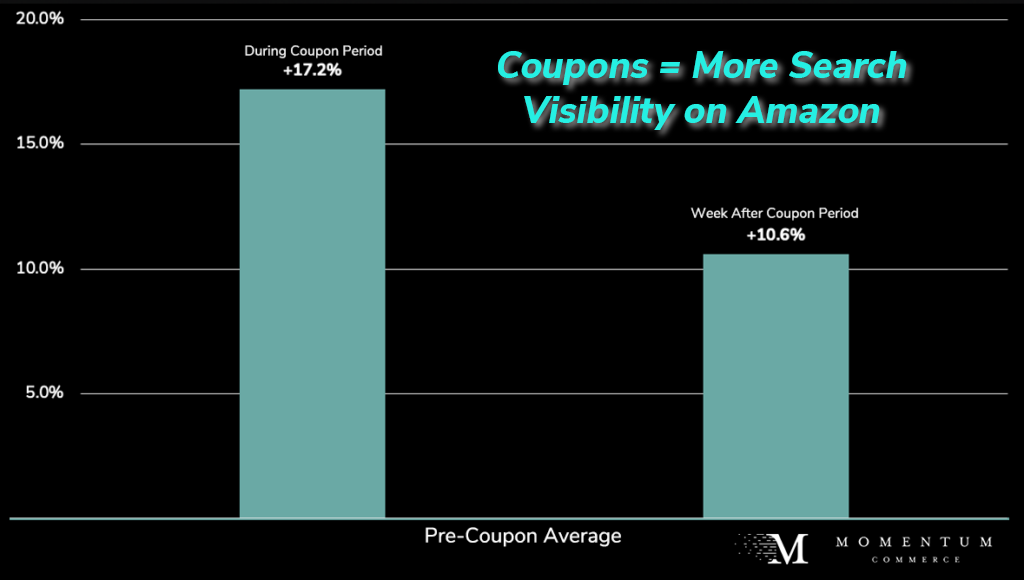

Coupons Increase Search Visibility by 17.2% – With Lasting Effects

An analysis across two product cohorts revealed that adding a coupon increased organic page-one search appearances by 17.2% versus pre-promotion levels. Another notable finding — this visibility boost persisted after promotions ended, with search appearances remaining 10.6% above baseline the following week. This supports the idea that coupons provide both immediate and residual benefits to product discoverability.

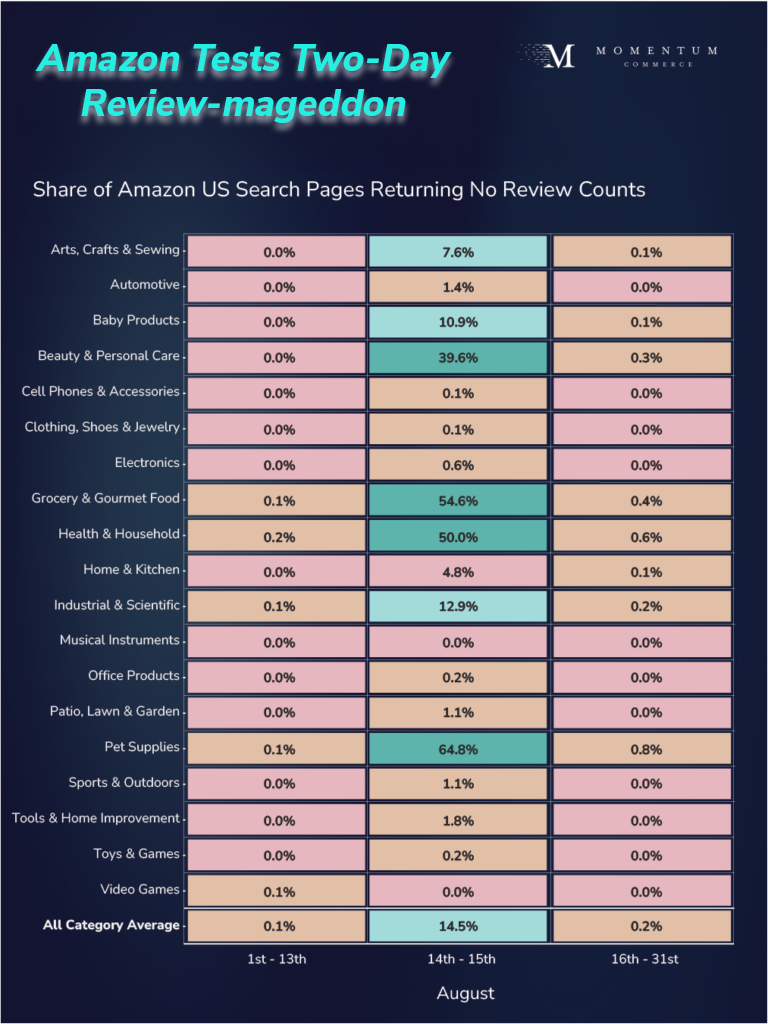

Amazon Tests Hidden Review Counts, Particularly in CPG Categories

From August 14 through 15, 2024, Amazon removed review counts from search results across 15.6% of the top million US search terms. CPG categories saw the highest rate of review removal. While the test was brief, it indicates Amazon’s willingness to experiment with reducing the influence of review counts on purchase decisions, particularly in specific product categories.

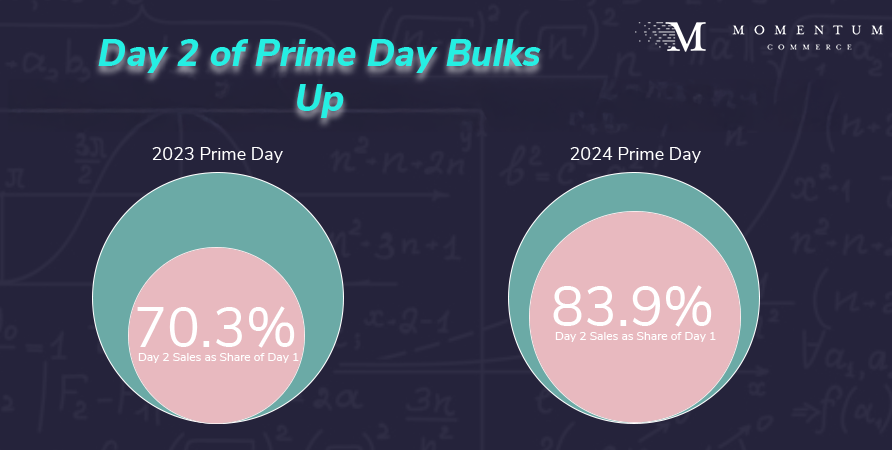

Prime Day: Day 2 Sales Gap Narrows Significantly

While overall Prime Day sales grew 14% year-over-year, the most notable shift was in daily sales distribution. Day 2 sales reached 83.9% of Day 1 volumes in 2024, up from 70.3% in 2023. This data points to evolving consumer behavior and suggests brands should reconsider traditional front-loaded Prime Day strategies.

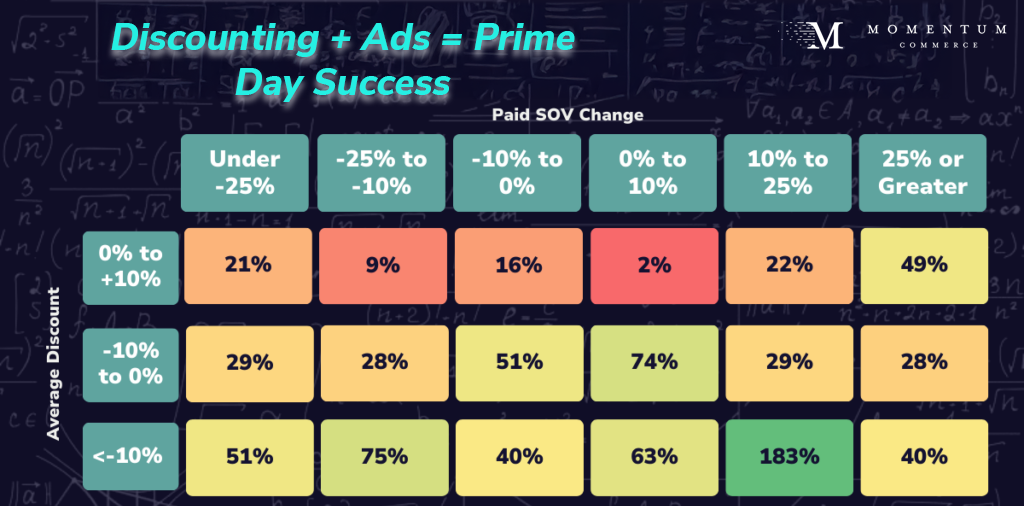

Combined Discount-Advertising Strategy Shows Highest Prime Day Returns

Studying the activity across thousands of brands revealed that combining >10% discounts with increased paid visibility (+10%) consistently outperformed single-tactic approaches during Prime Day. This finding held true across product categories and price points, providing clear direction for 2025 Prime Day planning.