The Meteoric Rise of Retail Media

Technology has empowered consumers and stripped their brand loyalty, often replacing it with relentless and unforgiving demands.

- Don’t have that product in my size until Thursday? You lose the sale.

- Won’t let me pick up my order curbside in 25 minutes from now? I’ll go somewhere else.

- Won’t refund my credit card immediately and let me drop off my return item at the grocery store whenever I feel like it? We’ll see if I ever shop from you again.

- etc..

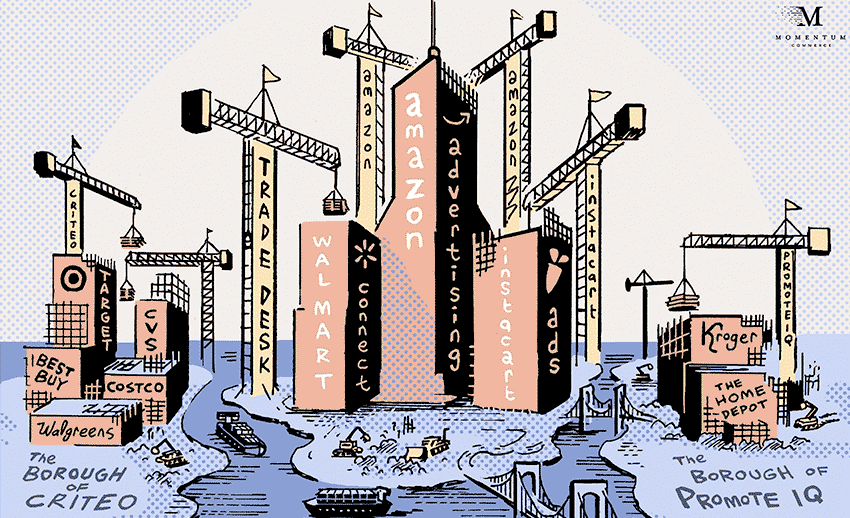

This insatiable thirst for retail convenience is fueling a massive – and hugely expensive – arms race in retail logistics. Amazon, Walmart, Instacart, UberEats, Google, Target, and many others are spending billions to offer consumers whatever they want (unlimited selection), whenever they want it (immediate gratification), however they want it (delivery, in-store, curbside, etc..). All while trying not to raise prices on the consumer. The only way they will be able to fund this war is if they can sell their access to these consumers to the brands that sell on these platforms in the form of advertising. This is is exactly what’s happening and why we are seeing a meteoric rise in what the industry calls “Retail Media” – the sale of advertising space on retailer websites and the sale of retailer.com data to target and measure consumers on programmatic media sources across the web and on connected television sets.

In the last year:

- Amazon’s advertising business surpassed $20B and now accounts for 10% of all digital ad buying.

- Walmart launched its own advertising business, rebranded it to Walmart Connect, and embarked on an ambitious partnership with the Trade Desk.

- Instacart launched a widely adopted self-service advertising product just in time for the massive surge in online grocery ordering resulting from the COVID-19 pandemic.

- We have seen retail media networks pop up at CVS, Walgreens, Target, Wayfair, Kroger, Home Depot, Costco, BJs, Ulta Beauty and just about every other major retailer there is.

- We have seen strong growth and funding from technology companies that are partnering with retailers to attack this opportunity like Criteo, PromoteIQ, Citrus Ad and Quotient.

It is the very early days in retail media, but eCommerce tailwinds are blowing and it’s fair to assume this will continue to accelerate throughout 2021.

To put it another way, consumers are whining, retailers are spending billions to acquiesce, and brands are expected to hold the tab. On its face, this doesn’t sound like a good deal for the brands. However, at Momentum Commerce, we argue that the opposite is true. Brands will need to plan for a heavy and increasing “advertising tax” in order to generate growth on retailer.com platforms, and if not done carefully and responsibly this will surely challenge profitability. However, the brands that pay these taxes and invest in the right “accountants” to ensure they pay the “right amount” will find critical benefits in three core areas:

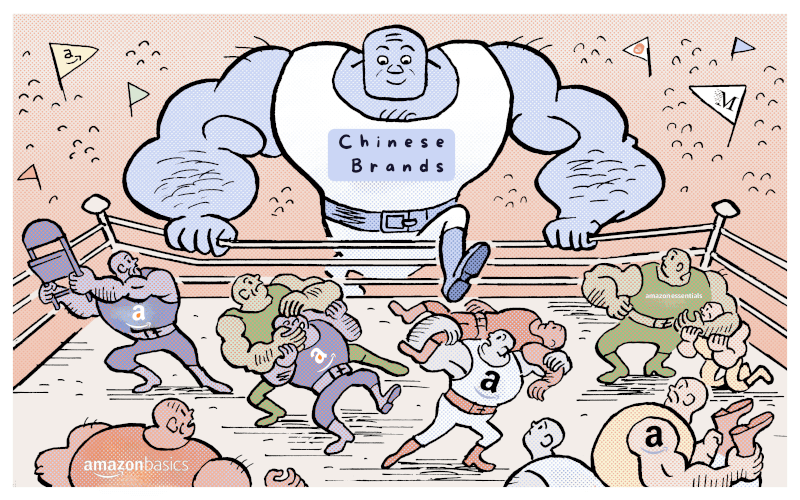

- Marketplace Clean Up: Brand competition on marketplace platforms is different than in physical retail due to the infinite nature of the digital shelf and the reduced barriers to access that shelf. As a result, brands face not only traditional competitors but are increasingly battling against overseas suppliers who provide similar products at much lower prices, resellers who provide grey-market inventory to consumers, and a smattering of upstart ankle-biter brands. Smart brands with good intellectual property should be able to command the widest margins and the rise of Retail Media allows them to wield that power to push these types of competitors down the search rankings and gain better control, performance, and share. Those of us that have been working in eCommerce for a long time will remember that this was the chief benefit brands saw as Google’s Froogle migrated to the entirely pay-for-play Google Shopping that we have today.

- Accelerated Learning: As trade marketing transitions to digital a whole new level of flexibility, speed and precision become possible. The planning cycles on shopper marketing are long and require heavy commitments to new product or promotional ideas without significant performance data to drive from. As a result, brands are shooting in the dark and often living in a world of opinions vs. facts. Retail Media, on the other hand, operates at the speed of digital – it is flexible, dynamic, and immediate. You can spin up a promotion or an ad blitz and within a day or two acquire statistically significant findings to fine-tune your strategy that you can turn into action immediately. Any brand that isn’t mining their retail media data sets for better more relevant consumer insights is leaving an opportunity on the table.

- A better more predictable next dollar spent: The rise of Retail Media is a new dawn for many categories that have traditionally never been able to draw a straight line between marketing investment and consumer transaction. For the very first time, marketers operating within grocery brands and big CPG companies have the opportunity to be true performance marketers and cut out a ton of waste. With this opportunity comes a much more predictable and controllable decision process around what is the next best dollar spent. Additionally, much of the promise of Retail Media’s efficacy is unaffected by the increasing privacy regulation and browser changes that will transform other avenues of performance digital advertising reinforcing the opportunity.

It’s the early days in Retail Media. At Momentum Commerce, our team has worked with brands through four major market disruptions over the last two decades: the rise of Google and the birth of search marketing, the rise of real-time ad exchanges and the birth of programmatic advertising, the rise of Facebook and the birth of social advertising, and the rise of the smartphone and the birth of business-to-consumer mobile communications. We have watched all four of these disruptions fundamentally change the way businesses reach consumers.

We believe what we are seeing in Retail Media today is the beginning of a fifth disruption. And just like with all of the other disruptions we have seen in the last two decades, we believe Retail Media will be a $100B+ business in short order, we believe new brands will be born entirely on the back of sophisticated Retail Media execution and we believe many incumbent brands will fail to adapt to this change and meet their expiration. Exciting times!