The Diminishing Marginal Utility of Brand Awareness on Amazon

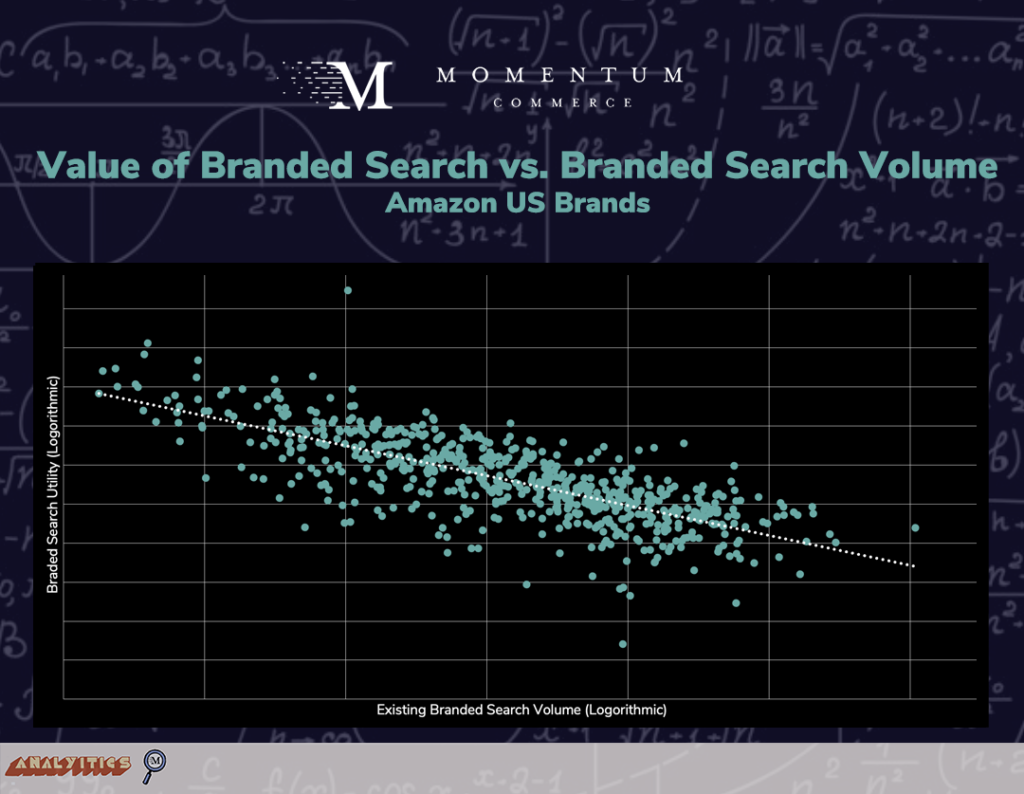

In our last piece, we noted the surprisingly low page CTRs broadly on Amazon SERPs. But we wanted to dig deeper into the reasons why branded term CTRs are especially low, and ways brands may need to adjust. After studying branded search and sales activity across nearly 1,000 top-selling brands over a five-month period, it’s clear that the expected value associated with each additional branded search – what we call Branded Search Utility – flexes considerably based on existing branded search volume.

Brands that already attract a large amount of branded search volume see less incremental value from each additional branded search, and brands with small amounts of branded search volume will see higher expected values from each additional branded search. This relationship needs to be factored into forward-looking media and sales planning so brands can set realistic targets and associated strategies that will help them reach sales goals.

So why does this phenomenon mean brands should treat branded search like a budget on Amazon? In a sense, if you have a solid handle on both your branded search volume and weekly sales over time, this evolving utility of branded search allows you to more effectively calculate the answers to key questions like:

- How much more revenue would we bring in if we increased branded searches by 5%?

- To drive an extra $100K in sales solely from branded search traffic, how much more volume do we need to capture?

It’s worth noting that brand characteristics like average product price, weekly sales, and catalog size did not have a clear relationship to Branded Search Utility. A major driver behind the stark association between existing branded search volume and Branded Search Utility is likely that brands generating higher and higher branded search volumes are naturally going to be seeing traffic coming increasingly from users who aren’t “loyal purchasers,” and may be more prone to doing subsequent filtering or refinement searches or bouncing entirely. For example, viral social content featuring the brand may cause branded search volume to pop, but so can terms around branded ‘dupes’, which are unlikely to help the actual brand’s bottom line.

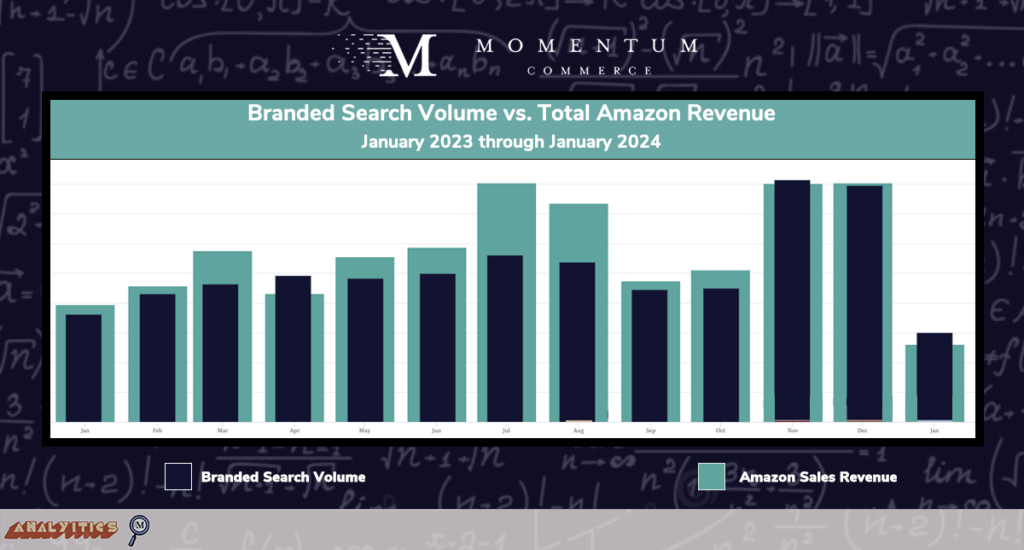

This nuance can be easy to overlook, because generally as a brand sees increasing branded search traffic it often also experiences an increase in overall revenue, as seen in the example below from a top apparel brand on Amazon. For larger brands particularly, a 5% increase in branded search traffic may represent a massive raw number and could drive substantial revenue gains despite the lower utility for each respective branded search. But for brands to more accurately forecast and plan, the shifting nature of branded search utility should be calculated and factored into decision-making when allocating advertising spending in particular.

Biggest Takeaways for Brands

- If you want to set realistic growth targets as an established brand on Amazon, you should get a handle on the present and historical value of your branded search traffic

- A basic, directional way of doing this is to map weekly revenue against total weekly branded search volume via Amazon’s Search Query Performance tool over at least the past three months, but longer periods will likely yield clearer results

- Convert each of these weekly figures into single values (e.g. Revenue / Branded Search Volume), then graph and add a trendline

- You can then use the basic forecasting tooling in Excel to extend the trendline and view what the expected dollar value would be following a given increase in branded search volume

- Keep in mind that this is directional for planning purposes, and won’t take into account sale events like Prime Day or large seasonal variations

- The expected value of increased branded search for smaller or fast-growing brands is high and needs to be prioritized

- Outside of fueling growth by focusing search advertising on top relevant generic search terms, challenger-type brands should not neglect top-of-funnel efforts

- This means employing and budgeting for tactics and strategies designed to increase branded search levels in aggregate (e.g. DSP campaigns, Streaming TV, etc.)

- For bigger brands, branded search still matters, but plan for the shifting value of that traffic

- When conducting revenue forecasting, it’s important to factor in a lower rate of return on branded search traffic as it increases in volume

- If advertising budgets are constant year-over-year and branded search is starting at a high level and expected to increase, it’s worth considering allocating a larger portion of the total budget to middle- and lower-funnel advertising (e.g. Sponsored Brands, Sponsored Products on top generic terms, PAT campaigns against competitor products, Sponsored Display campaigns targeting lapsed shoppers)

- As mentioned in our prior piece, AMC can be a valuable tool for optimizing particularly valuable slices of branded search activity

- For example, path-to-purchase tracking can identify which ad units were viewed prior to subsequent searches that did result in a purchase

- This level of granularity is helpful for more tactical decision-making around budget distribution across campaigns

Methodology

To quantify the marginal utility of a brand’s branded search activity, Momentum Commerce examined weekly sales data along with modeled weekly search volume metrics from April through August 2023. A statistical analysis provided estimated expected sales figures based on changes in branded search volume. These results were further enriched with pricing, catalog, and other retail data to better isolate commonalities between brands sharing similar brand search utility levels.