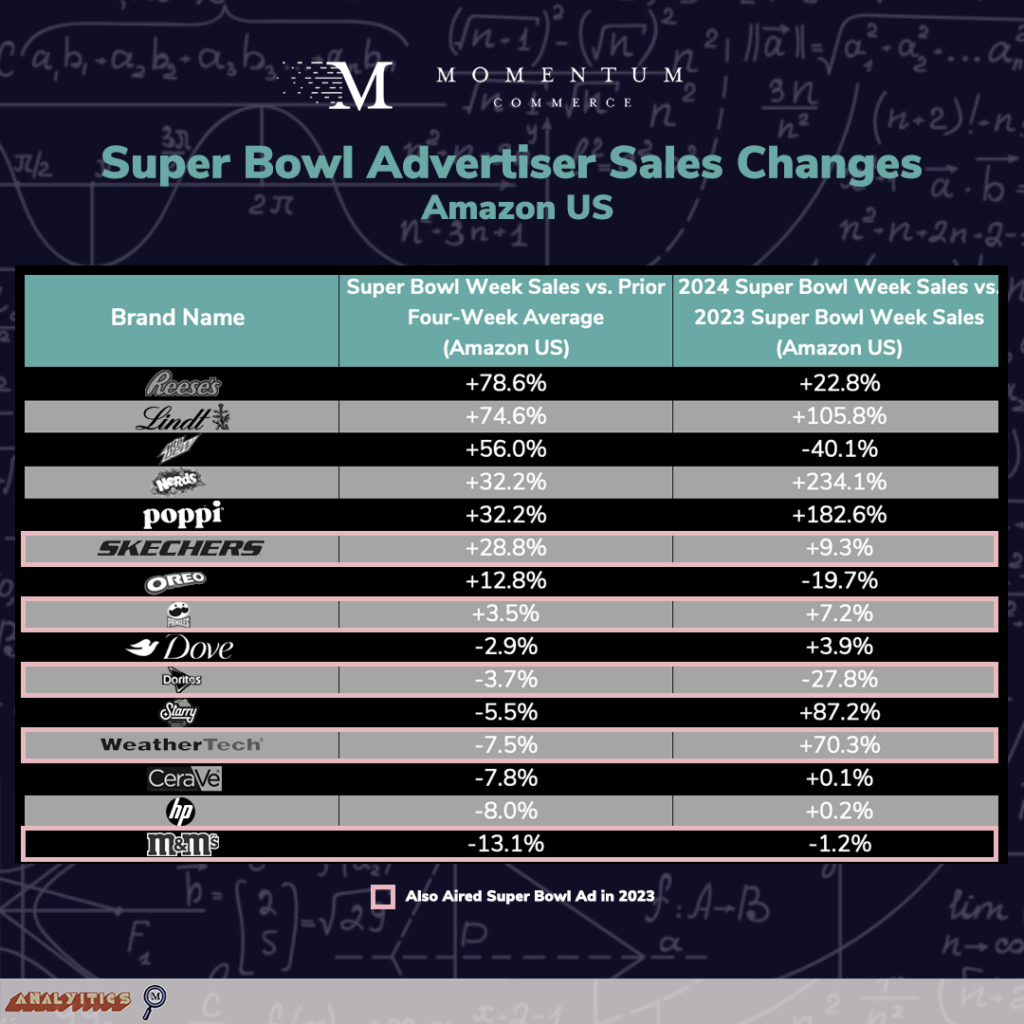

Reese’s, Lindt, and Mountain Dew Sales on Amazon Rise Following Super Bowl Ads

A variety of brands that advertised during Super Bowl 58 saw a marked increase in both sales and units sold on Amazon US the week following the event compared to the prior four-week average. While not every advertised brand that sells on Amazon saw an increase, the brands that did experience a sales lift were primarily consumables, with the largest units sold increases driven by Reese’s, Lindt, Oreo, and Mountain Dew.

Despite these increases, it’s worth noting the mixed fortunes across brands that both sell on Amazon and bought a Super Bowl ad. For example, Super Bowl advertisers CeraVe, Doritos, M&Ms, and Weathertech each had weekly sales figures below their pre-Super Bowl four-week average. This isn’t necessarily surprising in aggregate. Super Bowl ads are a clear ‘brand marketing’ play, and these naturally bigger brands sell across a variety of channels, while also having many proverbial irons in the fire promotion-wise.

Additionally, the biggest jumps tended to be from candy and sweets brands, which likely had the added benefit of the Super Bowl occurring the same week as Valentine’s Day.

However, it’s worth noting that the brands driving the largest sales increases year-over-year are brands which did not run a Super Bowl ad in 2023 (e.g. Poppi, Nerds, Lindt, Starry). One exception is WeatherTech, which despite a 7.5% drop in sales compared to the prior four weeks, saw a 70.3% year-over-year increase after also advertising during the 2023 Super Bowl – the fifth-largest increase of any brand studied. However, this likely is influenced by significantly slower new car sales due to supply chain issues in 2022.

Outside of consumables, the most notable sales increase by a Super Bowl advertiser on Amazon was driven by Skechers at +24%. Weekly sales of the brand’s ‘Slip Ins’ line, which was featured in their advertisement, rose 6% on Amazon US from the prior four-week average. At roughly $2.6M in additional sales, Skechers is the closest of any brand studied to achieving positive ROI on its >$7M Super Bowl advertising investment on Amazon US alone.

Biggest Takeaways for Brands

- Have Amazon-specific strategies associated with brand marketing pushes off-site

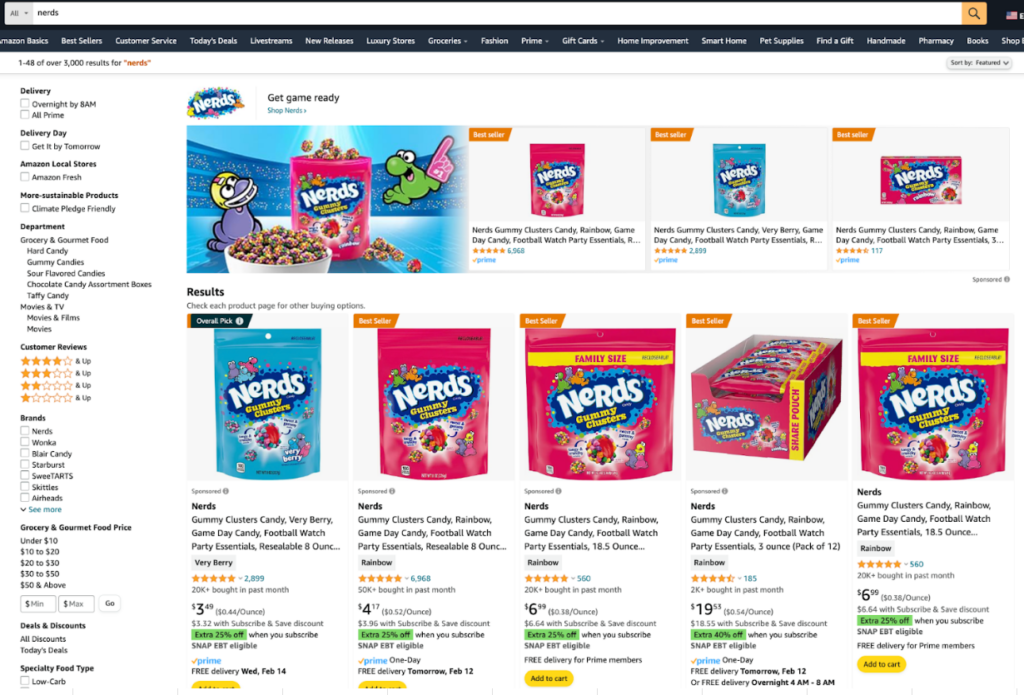

- Nerds changed the title of their 8oz gummy clusters product for the two weeks prior to the Super Bowl to include ‘Game Day Candy, Football Watch Party Essentials’

- The brand also updated its Sponsored Brands creative to feature football imagery and captured the Sponsored Brands slot on the search term ‘candy’ on Super Bowl Sunday itself

- Over that two-week period, sales of the 8oz pack size hit more than $600K – more than 2X all gummy cluster product line sales across all of Amazon the prior two weeks

- Nerds was not the only brand to employ these tactics – PepsiCo’s Frito Lay, for example, showcased football-themed Super Bowl creative on relevant products like Mountain Dew. But Nerds’ level of success emphasizes how temporary, event-oriented changes to the PDP and advertising are worth exploring

- When you telegraph your strategy, expect competitors to attempt to ‘steal your thunder’ on Amazon

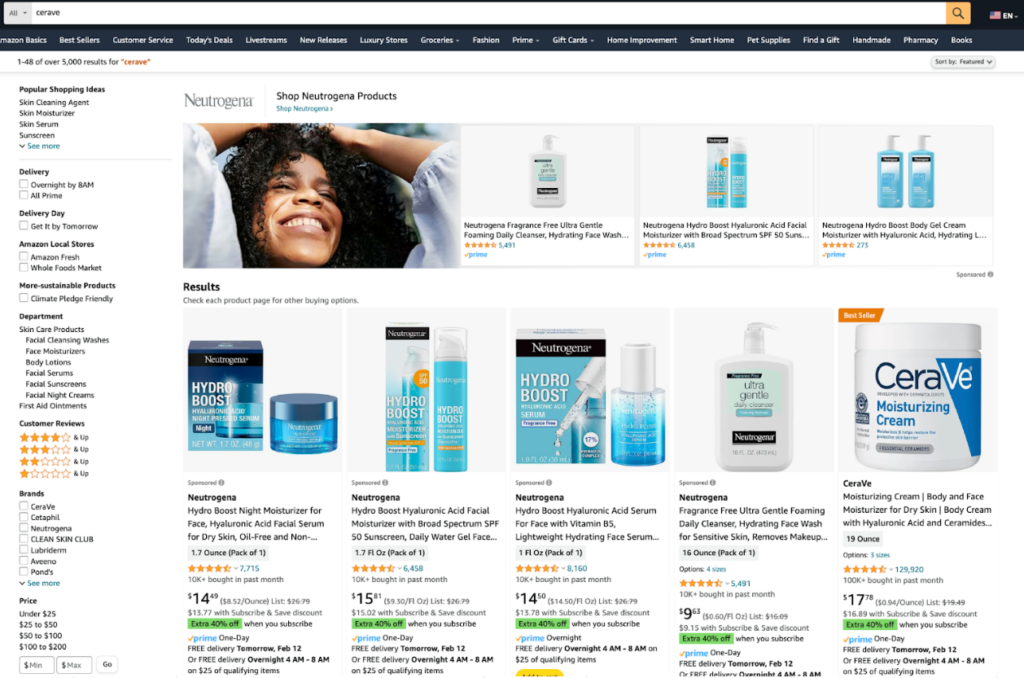

- Like many Super Bowl advertisers, CeraVe posted a teaser about a week prior to the Super Bowl itself

- But during the Super Bowl itself, consumers searching for ‘CeraVe’ on Amazon were greeted with a Neutrogena Sponsored Brands ad and a Neutrogena product in every top Sponsored Products slot

- This may be a contributing factor to CeraVe sales actually declining 8% during Super Bowl week compared to the prior four-week average

- For brands doing a strong brand push with something like a national TV ad, ensuring you maintain and defend these top slots on Amazon should be part of the overall strategy