Beyond the $8M Ad Spot: How These Brands Turned Super Bowl Moments into Amazon Sales

With brands investing $8 million for just 30 seconds of Super Bowl LIX airtime, the stakes for converting that massive awareness play into actual sales have never been higher. Smart advertisers know that the TV spot is just the beginning. As consumers increasingly move between screens during major cultural moments, leading brands are creating sophisticated campaigns that connect their big game moments directly to purchase opportunities on Amazon. This year, we tracked which Super Bowl advertisers made the most of their multi-million dollar investments by leveraging Amazon’s retail media platform to drive conversion.

Three brands particularly stood out for their comprehensive approach to Super Bowl integration on Amazon:

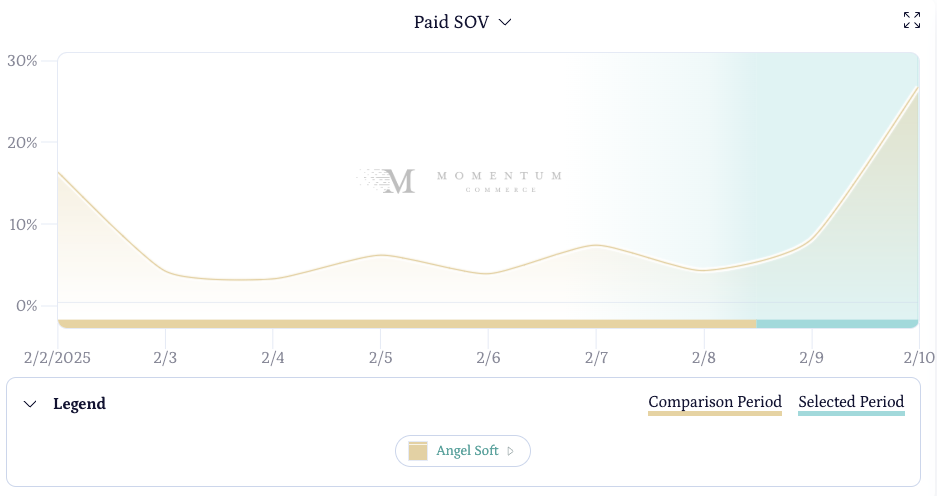

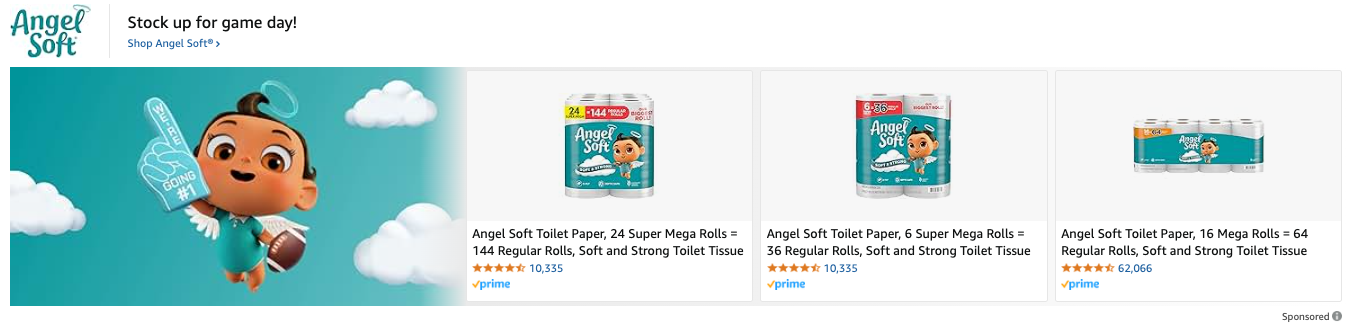

Angel Soft: Doubling Down on Digital Shelf Impact

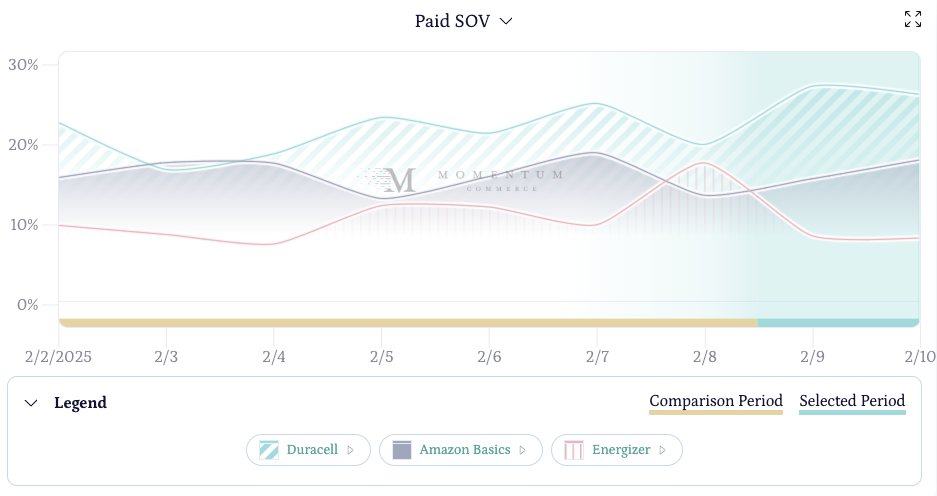

Angel Soft demonstrated one of the most comprehensive Super Bowl integrations we observed. The toilet paper brand more than doubled their paid Share of Voice (SOV) during the Super Bowl period compared to the previous week’s average – outpacing every other competitor in the toilet paper category.

Beyond advertising spend, Angel Soft executed a complete digital shelf transformation, updating their brand storefront, Sponsored Brands ads, and product detail pages to all feature their new mascot from the Super Bowl campaign.

Duracell: Winning Share in a Competitive Category

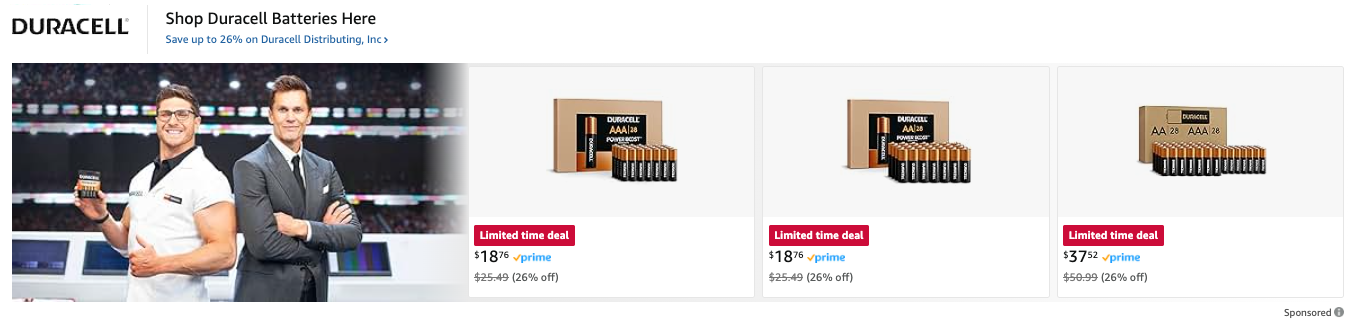

In a category dominated by Amazon Basics, with the private label brand commanding 27.1% of household battery revenue in January 2025, Duracell managed to increase their paid SOV by more than 6 percentage points during the Super Bowl period. No other competitor raised their paid SOV by even a single percentage point over the same time frame.

The battery brand leveraged Tom Brady’s star power across both their Super Bowl commercial and Amazon presence, featuring him prominently in Sponsored Brand placements and their brand store.

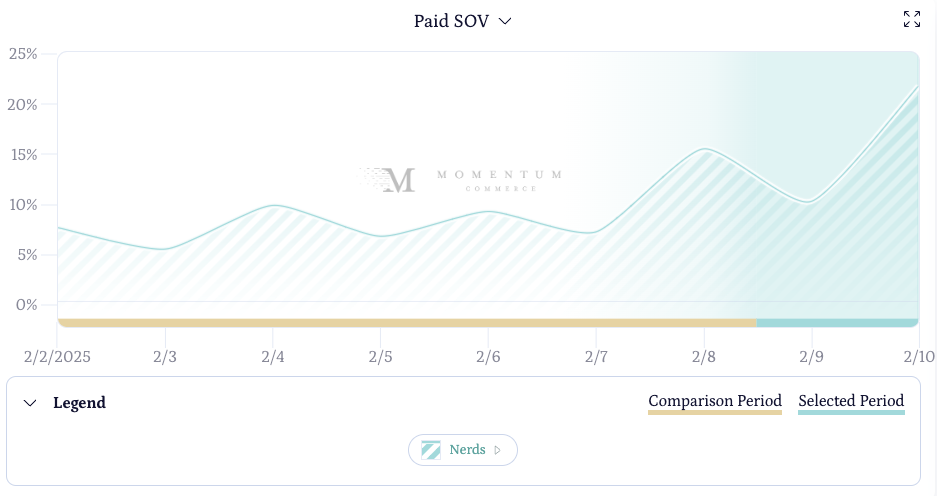

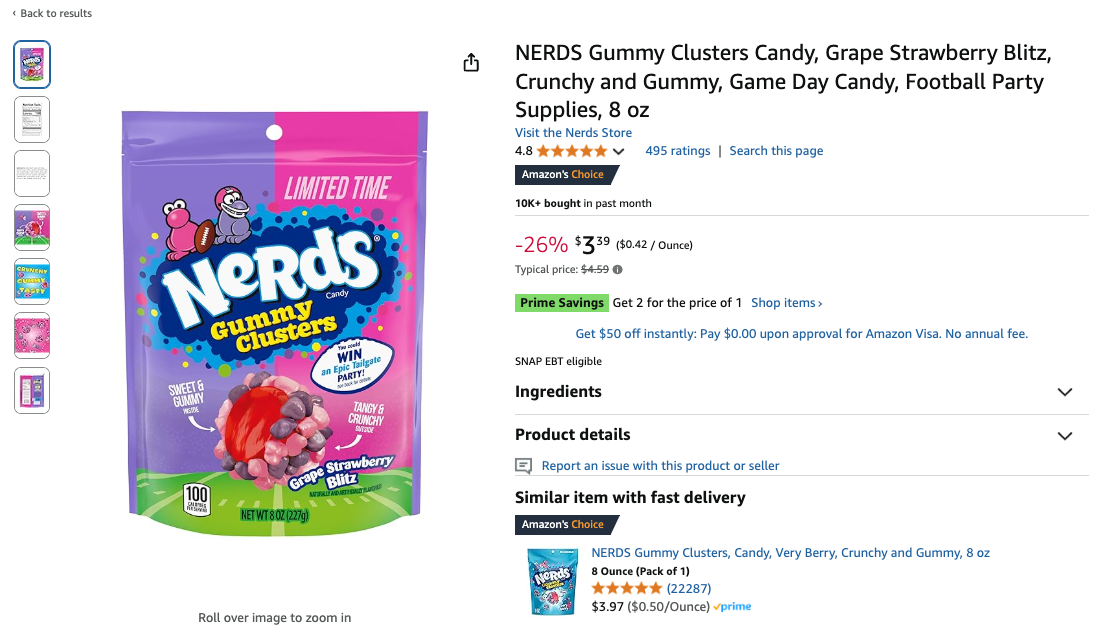

Nerds: Building on Past Super Bowl Success

Nerds showed how to evolve a Super Bowl strategy year-over-year. The brand nearly doubled their paid SOV in the gummy candy category – from 8.54% to 16.05%.

The brand also executed a comprehensive platform strategy that included:

- Football-themed brand store experience images

- Strategic timing of limited-time deals on Gummy Cluster products

- Building on their successful 2024 playbook, which included product title optimization and football-themed creative

- In the two-week period following that campaign, sales of the Nerds Gummy Cluster 8oz pack size hit more than $600K – more than 2X the entire product line sales across all of Amazon the prior two weeks

Key Takeaways for Brands

Integrated Campaign Planning is Critical

Amazon needs to be treated as a key shopper marketing channel for major TV advertising investments. Brands that coordinate their creative assets and increase their retail media presence around big moments can maximize their return on Super Bowl investments.

Early Activation Matters

Consumer engagement with Super Bowl advertising starts well before game day, with ads going live on YouTube a week or more before kickoff to ideally create viral moments. Just on Amazon itself, dozens of Super Bowl related queries shot up into the top 50K most searched terms on the site over the first week of February 2025. Your Amazon marketing support should reflect this extended timeline.

What’s Next

As sales roll in, we’ll analyze which of the dozens of consumer brands that ran a Super Bowl ad drove the biggest sales impact on Amazon. We’ll examine:

- Sales lift in the week following the game

- Category market share changes

- Larger impacts on brand performance in terms of search visibility