Navigating the Maze of Retail Media Platforms

The retail media ecosystem has evolved into a complex landscape of platforms, networks, and technology providers, each vying for brands’ attention and investment. As the industry matures, marketers face increasingly sophisticated choices about where and how to invest their media dollars. This analysis provides both a comprehensive overview of the key players and a strategic framework for understanding their positions in the market. We’ll examine standalone retail platforms, evaluate the overall technology landscape, and dive deep into the networks and providers shaping the future of retail media.

Even if you’ve developed brand equity through marketing channels that point towards your .com site, we’re increasingly seeing spill-over and stand-alone demand for most products, categories, and brands on the platforms below. The right retail media mix is going to be a little different for every brand, so often the best path forward is partnering with an agency or consultancy that has the expertise and can understand your goals in order to help develop the best retail media strategy and advertising mix.

Stand-Alone Retail Media Platforms

Amazon

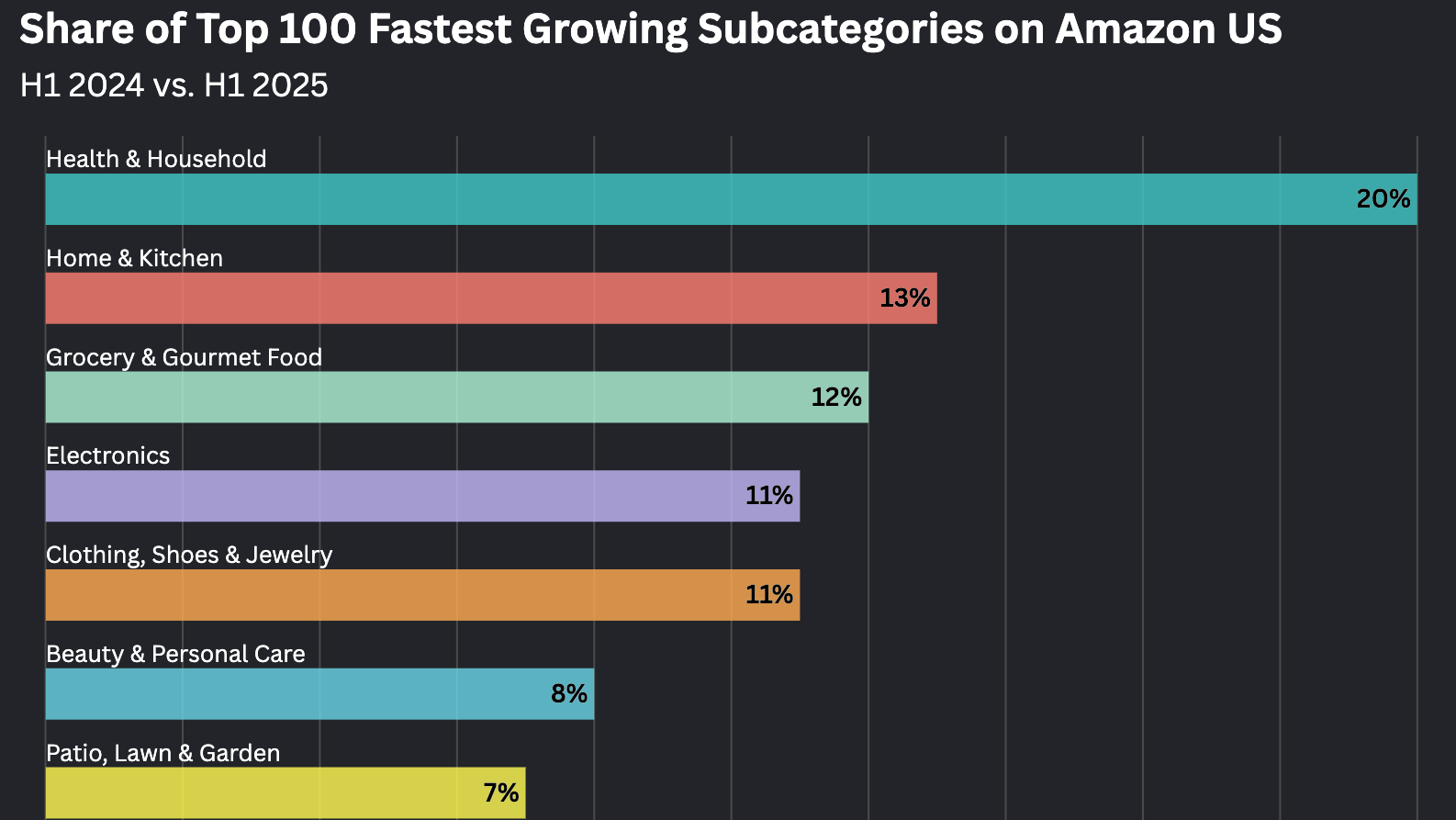

Before you spend too much time considering some of the other retail media opportunities below, you should be confident in your strategy on Amazon. Amazon represents over 40% of US e-commerce sales, more than 5.5x compared to the next closest competitor, Walmart (source: eMarketer). That said, I am seeing more and more brands that are diversifying their channel mix by tapping into the platforms and networks below. If you don’t feel poised to expand beyond Amazon just yet or are looking to read up on additional topics in the retail media space, you’ve come to the right place!

Walmart

As a percentage of overall YoY e-commerce growth, Walmart is growing faster than Amazon. eMarketer projects they will generate close to $65B during 2021, ~21% more revenue than in 2020. Depending on your category, this should be one of the first platforms you look to expand to (after Amazon). Earlier this year, Walmart rebranded their media management team to Walmart Connect (formerly Walmart Media Group). Walmart allows brands to manage their advertising through an in-house ads platform or by partnering with a SaaS vendor with Walmart API access. One obvious advantage that Walmart has is their massive brick and mortar presence. With over 5,300 physical retail stores in the US, Walmart is well positioned from an e-commerce fulfillment standpoint but also offers unique opportunities around omni-channel and curbside pickup. For brands, one thing to keep an eye on is Walmart’s partnership with The Trade Desk. Like Amazon, Walmart has a massive first-party data set that brands will undoubtedly be looking to tap into given Google’s move toward third-party cookie deprecation.

Target

There is a myriad of ways to promote your products on Target.com. Target’s internal retail media group, Roundel, offers both managed and self-service options for advertisers. You also have the opportunity to leverage Target.com as a part of a broader retail media network strategy with Criteo or CitrusAd (more on that below). Like Walmart, Target has created a refined curbside pickup offering, allowing them to leverage their brick and mortar presence (about 40% of Walmart’s). Target’s total projected e-commerce revenue in 2021 is expected to be around $20B, representing just over 2% of total e-commerce sales in the US (source: eMarketer).

Wayfair

Similar to Instacart in the case of online grocery, COVID-19 has accelerated the share of wallet customers are spending on home goods and furniture. Most retail platforms are eager to play in the lucrative high price point furniture category but look for Wayfair to hold their own as they are able to focus on logistics and services that handle the delivery of bulkier products. In a Q1 ‘21 earnings call, CEO Niraj Shah said, “Shoppers need inspiration through relevant content, discovery through a wide assortment and confidence that is built through strong merchandising, fair prices, reliable delivery, and effortless customer service.” Wayfair has built an in-house internal Sponsored Products platform allowing advertisers to promote products on their platform. Brands have the ability to utilize both display ads and sponsored products via keyword bidding. Over 4,000 brands utilize Wayfair’s Media Services, representing 4x growth YoY. Perhaps most inviting for brands looking to sell their products on Wayfair is their 18M square foot warehouse network across North America and Europe. This network lets Wayfair ship to 95% of the US population within 2 days and 60% within 1 day, allowing them to compete with some of the fulfillment giants mentioned previously.

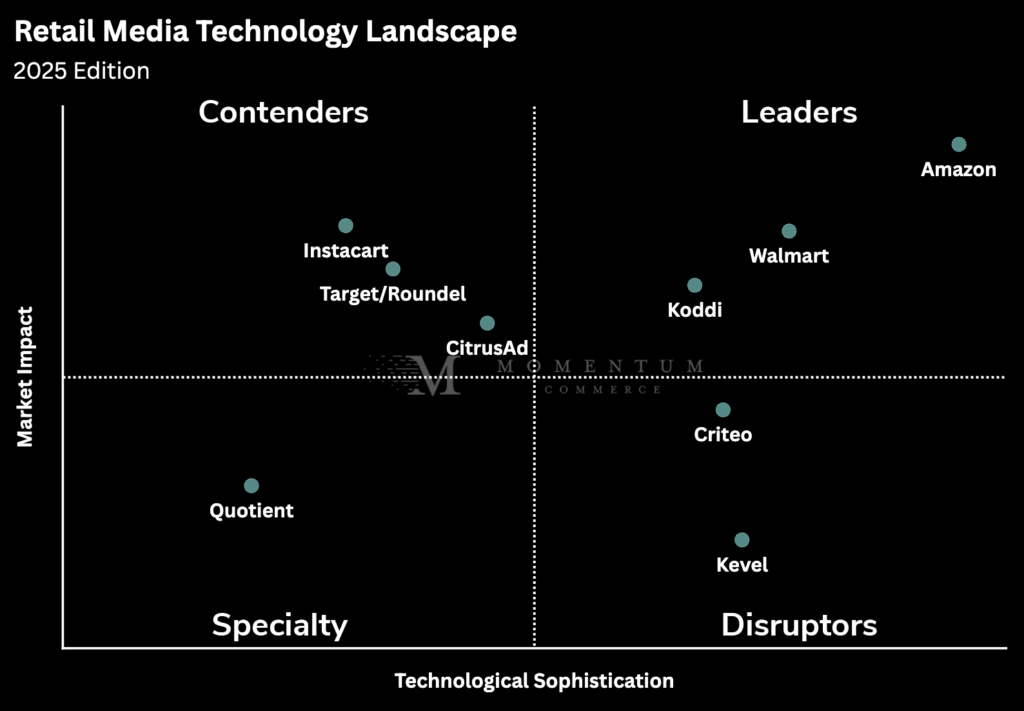

Understanding the Retail Media Technology Landscape

As the retail media ecosystem continues to evolve, it’s crucial to understand how different platforms and providers compare in terms of their technological capabilities and market impact. The following analysis provides a strategic framework for evaluating the current state of the retail media technology landscape.

Retail Media Technology Landscape

The retail media technology landscape can be evaluated across two critical dimensions: technological sophistication and market impact. Here’s how the major players stack up:

Leaders (High Technology & High Impact)

- Amazon: Dominant market position with advanced advertising capabilities

- Walmart Connect: Robust omnichannel presence with sophisticated targeting

- Koddi: Full-stack solution with advanced AI and broad integration capabilities

Challengers (High Impact, Developing Technology)

- Target/Roundel: Strong retail presence but developing ad tech

- Instacart: Growing rapidly with focused grocery capabilities

Visionaries (High Technology, Growing Impact)

- Criteo

- CitrusAd: Innovative technology but limited market penetration

- Kevel: Advanced API capabilities but smaller scale

Niche Players (Specialized Focus)

- Quotient: Digital promotion focus

- Other emerging platforms

This landscape continues to evolve rapidly, with technology capabilities and market impact shifting as platforms invest in new capabilities and forge new partnerships.

Deep Dive: Key Networks and Technology Providers

While the landscape analysis provides a high-level view of relative positioning, understanding the unique capabilities and offerings of each major player is crucial for making informed investment decisions. Let’s examine the leading networks and technology providers in detail.

Retail Media Networks & Technology Leaders

Koddi

Koddi offers a full-stack commerce media solution that goes beyond traditional retail media platforms, supporting on-site, off-site, and in-store campaigns through a white-labeled, retailer-owned platform. Its ad server and self-serve UI enable both direct and programmatic demand, with recent innovation focused on launching a commerce media SSP. With direct DSP integrations—including DV360, The Trade Desk, StackAdapt, and Yahoo—retailers can now offer programmatic access to on-site sponsored listings and in-store inventory while maintaining full control. Koddi’s AI sophistication, including outcome-based automation and proprietary quality scoring, help drive performance at scale. Partners like Grubhub have seen measurable results, including 6x incremental ROAS and 13% incremental sales growth. Koddi also enables off-site expansion through integrations with Meta, Google Shopping, Snapchat, and Fetch, and powers in-store media across 31,000+ retail locations via In-Store Marketplace. For retailers prioritizing AI innovation, performance, and scalable demand, Koddi offers a clear alternative to rigid or bundled solutions.

Instacart

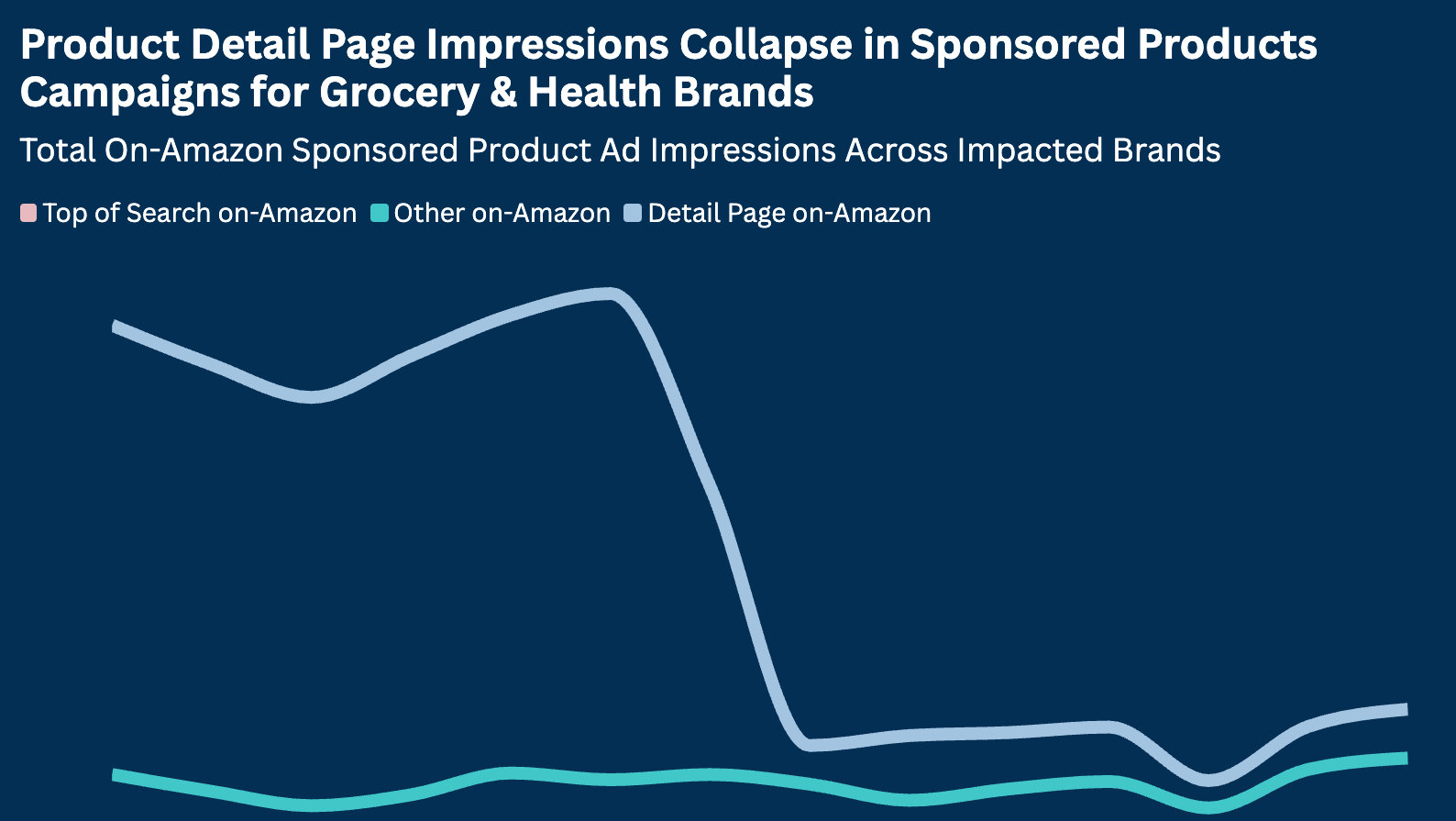

If you’re a brand operating in the grocery space, Instacart needs to be on your radar. Some estimates expect online grocery to grow 15x faster than brick and mortar over the next 5 years. Grocery itself represents a $1.1T revenue opportunity in the US, so expect Instacart to continue to make strides in securing a larger piece of this pie given their narrow focus (compared to players with a more broad focus on retail). Instacart has the ability to deliver to the front door of over 85% of online grocery shoppers in the US so they are well-positioned in the space. Advertisers can leverage the Instacart Customer Intelligence Platform (ICIP) to understand their performance across 600+ (and growing) retail partners. Instacart is heavily investing in it’s platform as well as the monetization of its traffic. They expanded their team by over 50% in 2021, including corporate hires from Facebook, Goldman Sachs, LinkedIn, Amazon, Airbnb, and Google. In March of this year, Instacart’s valuation grew to over $39B compared to $17.7B in October of 2020.

Criteo

Criteo is most well known for their display targeting capabilities but has built an extensive retail media network, beginning with it’s acquisition of HookLogic in 2016. Criteo’s leadership expects to power over $700M in media spend via retail media in 2021, up from $400M in 2020 (Source: Criteo). Their technology allows them to seamlessly integrate sponsored placements on retail media platforms that haven’t developed their own ad stack. This benefits retailers in allowing them to monetize their traffic while focusing on their core competencies rather than ad management and corresponding software development. For brands selling on these platforms, they can not only focus on an “always on” advertising approach but seamlessly manage their advertising across many platforms (abbreviated list below) out of one ads platform. Additionally, Criteo offers several attribution windows to allow brands a flexible understanding of their advertising effectiveness (this is unique compared to a platform like Amazon that does not offer varying attribution models). Criteo’s acquisition of Mabaya in May of 2021 is aimed at allowing more retail media platforms to monetize their site traffic without needing to develop in-house advertising solutions.

Notable North American Platforms Integrated*: Target, Best Buy, Ulta Beauty, CVS, Walgreens, Staples, Costco, Meijer, Macy’s

* Criteo has done a nice job developing it’s offering in Europe as well, highlighted by a recent agreement with Carrefour on the supply side.

CitrusAd

CitrusAd is an early-stage venture-backed software company out of Australia that is seemingly vying for the same retail partners as Criteo and PromoteIQ. They appear to have done a good job convincing retailers that they are best off working with multiple ad tech partners (versus an exclusive agreement) in order to maximize yield and demand for retail media solutions. CitrusAd has used this strategy to secure partnerships with Target, Lowe’s, Shipt, Macy’s, ShopRite, GoPuff, and others. Their advertising capabilities include sponsored products, banner ads, branded landing pages, and email placement. The platform remains very early in its development but is definitely one to keep an eye on.

Other Emerging Players

Quotient

Founded in 1998, Quotient rebranded from Coupons.com in 2015. They offer omni-channel digital marketing capabilities mainly around on-site promotion as well as a variety of digital marketing capabilities that drive sales through compelling consumer experiences. Their network of retail platforms includes Walmart, CVS, Dollar General, Albertson’s and others.

Kevel

Kevel began as Adzerk in 2010. They focus on server-side API ads and have built not just an API ad server but tools for companies to build their own ad products. They aim to help retail platforms drive revenue and to enable brands to be less reliant on some of the larger platforms mentioned previously (i.e. Amazon).

Making Strategic Decisions in Today’s Retail Media Landscape

The retail media ecosystem of 2025 offers more sophisticated capabilities and diverse opportunities than ever before. Brands should evaluate potential partners based on both their current positioning in the landscape and their trajectory for future innovation. Consider these key factors when developing your retail media strategy:

- Technical sophistication and AI capabilities

- Scale and market reach

- Integration flexibility and partner ecosystem

- Proven performance metrics

- Innovation roadmap and investment in new capabilities

The right mix of platforms and partners will depend on your specific business objectives, category dynamics, and resource capabilities. Whether you’re just beginning your retail media journey or looking to optimize an existing program, understanding this evolving landscape is crucial for success in today’s digital commerce environment.