Lululemon, Amazon, and The ‘Dupe’ Wars

What happens when big-name brands choose not to sell on Amazon? In cases like Nike, where brand equity is very high, gray-market resellers take their place. But in most other situations, digitally-native knockoffs step in offering significantly lower prices for almost identical quality. This happens to be the case for the multi-national athletic apparel brand lululemon, whose ‘knock-off’ competitors are making a name for themselves on Amazon. Can big-name brands like lululemon hold their own without selling on the #1 e-commerce platform in the US?

Momentum Commerce analyzed the most common lululemon ‘dupe’ brands that are currently available on Amazon. (The Cambridge Dictionary defines the term dupe as, “a short form of duplicate that refers to a product made to look like a more expensive or high-quality product.”) The hashtag #dupe has over 3.5 million TikTok views with the most recurring brands mentioned being Chinese-based companies CRZ Yoga, OQQ, and BALEAF. So how are these duped brands performing?

The Data

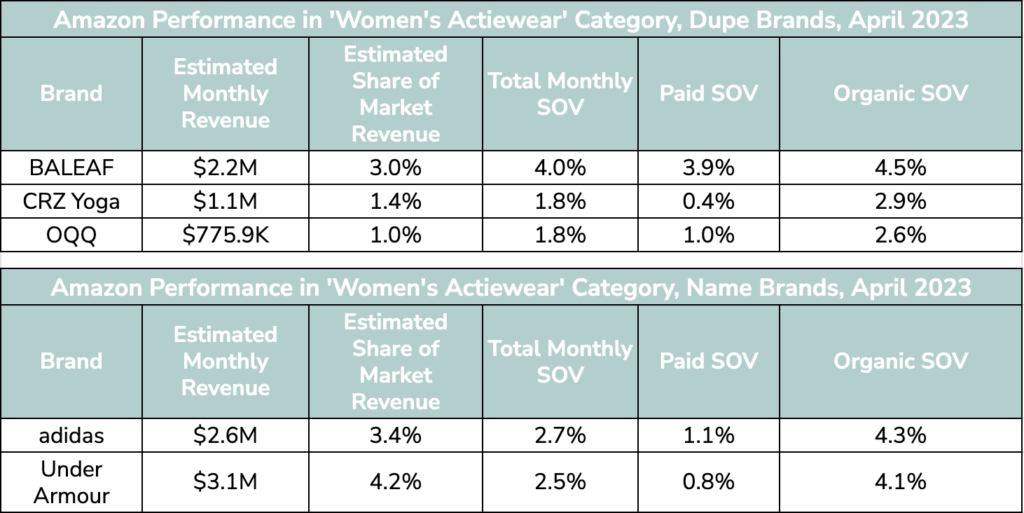

In April of 2023, the three brands mentioned above accounted for just over $4 million in estimated revenue. With Women’s Activewear being an increasingly popular category on Amazon earning $1.8B in sales over the last 12 months, these Chinese sellers are proving themselves to be strong competitors. Even focusing narrowly just on the Women’s Activewear Leggings category, there was a 109% growth in category revenue between January 2022 and January 2023.

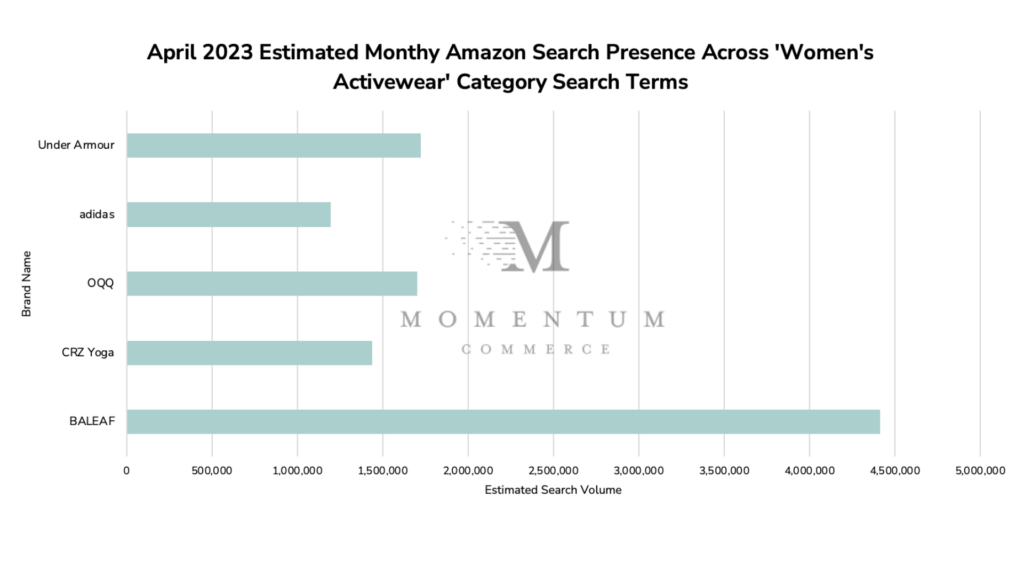

BALEAF is particularly noteworthy with a 3% estimated share of market revenue and a 4% total monthly share of voice (SOV), positioning it very competitively versus the larger US brands. The estimated monthly search presence, or the number of category-relevant search terms where each brand’s products appear within the page one results, has BALEAF in the lead at 4.4M estimated searches. While lululemon’s absence from Amazon may be a strategic decision, its alternatives are successfully capturing shopper demand and staying top-of-mind within the category.

Using Momentum Commerce’s Amazon Search Trends Tool, in the last month the search volume estimate for the term ‘lululemon dupe’ was almost 200,000, with an estimated volume growth of 170% year over year. Searching for ‘lululemon’ itself had just over 97,000 searches, and branded product queries like ‘lululemon belt bag’ surpassed 130,000 searches in the past month. Numbers like these beg the question of why the brand has chosen to remain off of Amazon when the demand is clearly present. During a conversation at eTail West, John Solomon, CMO of Therabody and one of Momentum Commerce’s clients, discussed the internal struggle that many premium brands may face when debating whether to sell on Amazon. Many view it as a ‘low-cost’ marketplace and worry about what connotations selling on the platform may bring for a luxury brand. However in Therabody’s case after looking at the situation from a consumer standpoint, they found that convenience was one of the most important considerations made during a purchase. Amazon automatically becomes the best choice.

The Response & Moving Forward

In response to the latest dupe trends, lululemon made an admirable move to stay one step ahead. The brand held a ‘dupe swap’ at the Century City Mall in Los Angeles for attendees to trade in any knockoff legging for a free pair of the most popular legging, the Align High Rise 25” Pant. Customers received a completely free pair of the original quality legging, while lululemon collected thousands of dupes to research and then recycle. This type of event is a win-win scenario for lululemon- they are embracing the dupe culture while also reminding customers of the brand experience they receive from shopping with the original.

As digitally native disruptors like BALEAF, OQQ, and CRZ Yoga continue to see revenue growth, it’s harder to make the case for lululemon to stay off Amazon. If they don’t change course, continuing with ideas like the dupe swap will become a necessary tool to defend the premium brands’ identity as they attempt to win ‘the dupe war’.

If you are interested in more insights like these, make sure to check out our free tools available on our website!