Introducing the Momentum Commerce Amazon Brand Index

“One of the most common questions we are asked by brand and private equity business partners is ‘who within a given category is really good at Amazon?,'” said John T. Shea, Momentum Commerce’s Founder and President. To help brands and private equity firms answer this question, we’ve created the Momentum Commerce Amazon Brand Index.

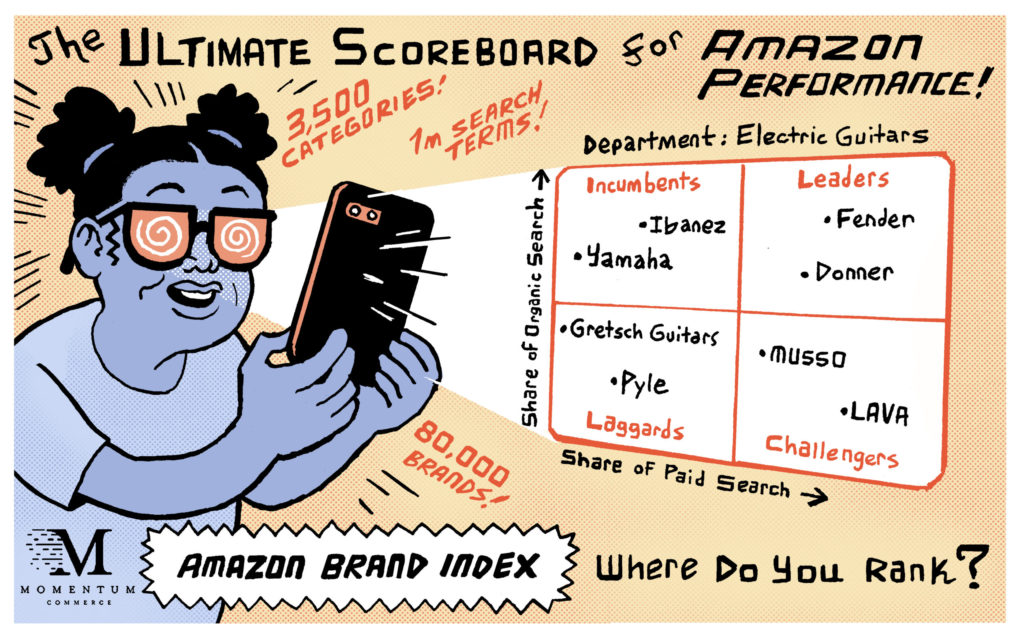

The Index is a free interactive software tool that tracks over 3,500 product categories on Amazon.com, scores how discoverable over 80,000 brands are within the Amazon search results, and reveals to what extent sales for these categories and brands are driven by Sponsored Amazon Advertising placements or organic, free listings. The Index classifies brand participation on Amazon into four different classes: Leaders, Incumbents, Challengers and Laggards.

Wondering how you can use the Amazon Brand Index to inform your ads strategy? Here are 4 use cases:

Review competitive market in new industries/categories

Thinking about Amazon Seller acquisition? You have to start with the ABI. It’s more important than ever to know what you’re getting into before signing the check. The ABI allows you to get a feel for where the brand currently stands from an organic and paid perspective, as well as what the competition looks like in that category.

For example, let’s imagine you manufacture and sell musical instruments for children. You want to expand your product assortment and are considering ways to do so via acquisition. Using the ABI, you can review the Ukelele category (Musical Instruments -> Ukeleles, Mandolins & Banjos). The department ad density, located in the upper right corner of the ABI, shows that it is over 60%, indicating that the market is heavily ad-driven. Here, you can identify that Hola! Music is a Challenger brand that is already investing in advertising and will likely see organic SOV growth as the flywheel effect kicks in.

Track impact of changes in your brand’s ad spend in market competition

Running tests is a great way to determine the impact of advertising on your business, but it’s important to be able to define quantitative results to measure the impact. As an advertiser, you have access to your advertising spend and performance, but rarely do you have access to a competitor’s. With the ABI, you can track the ratio of paid SOV week-over-week, providing supporting data points around the impact of changes to the advertising strategy (such as increasing or decreasing branded spend).

Keep an eye on upcoming Challengers and protect your brand

There are a lot of reasons why you should keep an eye on the competition in your market – perhaps you are a well-known brand with a lot of cheap knockoffs as competitors, or you have a USP that others are starting to mirror. By keeping an eye on the brands that are moving from the Laggards quadrant into the Challengers quadrant, you can quickly determine who is spending the big bucks to make a splash in your category. These insights allow you to ensure your brand protection campaigns are strong enough to combat any competitive conquesting and adjust bids and budgets if you lose SOV on strategic keywords.

Refine targets for competitor conquesting campaigns

If you aren’t already running product attribute targeting (PAT) campaigns, here’s your sign – get them going! PAT campaigns are similar to manual search campaigns in that you should always be looking for new targets to add. By leveraging the ABI, you can pick up on new brands to target and adjust your strategy and appetite for competition based on the changes you see in the competitive landscape week-over-week.

Once you have a brand to target, you can either target at the brand level or find specific ASINs using third-party scraping tools on Amazon SERPs or Storefronts. From there, it’s easy to add those ASINs to your PAT campaigns to target those products specifically.

Cost-per-click (CPC) tends to be higher on search results pages than product detail pages, particularly for conquesting campaigns bidding against a competitor’s brand term, making that strategy prohibitively expensive for most emerging brands. The ABI can help you understand what brands in your category are searched for the most, and from there you can focus your conquesting efforts on more cost-efficient tactics, such as on-site sponsored display ads targeting competitor PDPs.