How Traditional Manufacturer Brands Must Adapt to the Forces of Digital Retail

Long before COVID-19, there was a massive digital transformation afoot. There is no shortage of data to suggest that online marketplaces have overtaken all traditional physical retail models. Even before COVID-19, online marketplaces (like Amazon) generated well over half of all global online sales. The benefit for the consumer is fairly straightforward with a few clicks you can access the widest assortment of products at the lowest prices. It’s never been easier for consumers to quickly seek impartial reviews and understand what product will best serve their need. On top of that, marketplace fulfillment models allow consumers to receive their products faster. In order to win in digital retail, brands must meet the increasing expectations of today’s consumer.

There are three main forces that traditional brands face today as they adapt to digital retail.

- The proliferation of e-commerce

- Competition from Chinese sellers and digitally-native brands

- The collision of physical and digital retail

The Proliferation of E-commerce

It’s been well documented that COVID-19 has accelerated the growth of e-commerce by up to a decade. This is evident in Amazon posting a 37% growth in revenue during 2020 (Source: Amazon) and their revenue generated from advertising ballooning to over $20B in 2020, up from $10B in 2018 (Source: Amazon). Particularly jarring for traditional retailers and brands has been the broken habits of consumers that may have preferred shopping in-store prior to the past year. These consumers favoring traditional retail were (and still are to some degree) forced to adopt online shopping. Some of these consumers may eventually return to shopping in grocery stores, department stores, etc. However, most predict that the majority of first time online shoppers will embrace a world where wider assortment, lower prices and on-demand delivery is the rule and not the exception. Perhaps Jorge Paolo Lemann (Co-Founder of 3G Capital, which owns brands like Anheuser Busch and Kraft Heinz), said it best….

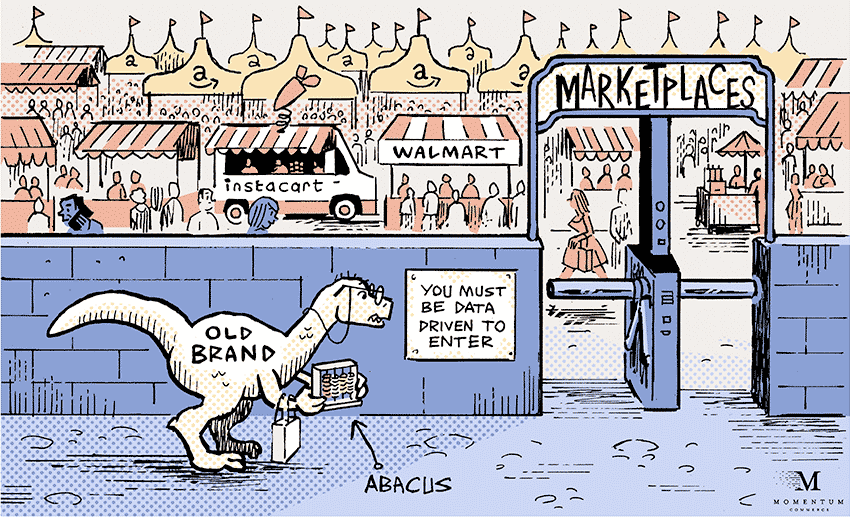

“I’m a terrified dinosaur….

I’ve been living in this cozy world of old brands, big volumes, nothing changing very much, and you could just focus on being very efficient and you’d be okay, and all of a sudden we are being disrupted in all ways.”

Competition from Chinese Sellers and Digitally Native Brands

With the proliferation of e-commerce comes competition that traditional brands have rarely had to consider before. Prior to the explosion of online marketplaces, access to consumers in traditional retail models had been handled by brick and mortar retailers. There was a human-led relationship between brands and retailers and the introduction of new brands or change in general, was glacially slow mainly due to physical limitations of the space within a store. Enter overseas sellers, who in many cases would have been boxed out in traditional brick and mortar retail models. According to Marketplace Pulse, 30-40% of Amazon’s GMV comes from sellers based in China. Further, China based sellers constituted 75% of all new sellers on Amazon in January of 2021 (up from 47% in January of 2020). With Chinese sellers comes competition, specifically on price, that introduces a new dynamic for traditional brands.

If that wasn’t enough, traditional brands also have digitally native brands to contend with. Digitally native brands (think Warby Parker, Brooklinen, Away, Casper, Allbirds, etc) were born on reaching consumers on the internet and on social media and driving them to their .com site, rather than to a brick and mortar retailer. By moving away from the traditional retail model, they’re able to hold higher margins and stay closer to the needs and wants of the end consumer buying their product. Their model provides them greater agility to adapt to online marketplaces and their margin provides a greater buffer to absorb the costs (commissions, fulfillment costs, etc) associated with doing business on Amazon and other marketplaces while still remaining cost competitive.

The Collision of Physical and Digital Retail

We’ve seen new methods to connect physical and digital retail, like BOPIS (buy online, pick up in store) and Instacart, as ways to help traditional retailers and brands bridge the gap between how business was done, how it’s done today and will be done in the future. Instacart is a phenomenal example of the recent acceleration of ecommerce and how traditional retailers and brands are trying to adapt. Just over a year ago, “81% of shoppers said they never turned to the internet for groceries”(source: Gallup/NY Times).

Consider that Instacart’s current valuation is $39 billion (three times higher than it was in June 2020) and it’s transaction volume in December of 2020 was three times higher year over year. Additionally, 2020 brought 1,300 new vendors (a 500% increase) to the on-demand grocery platform. Grocery shopping is certainly a microcosm for the seismic shift towards digital retail, and it’s not just Instacart that is taking notice. Amazon purchased Whole Foods for $13.7B in 2017 and Walmart announced in 2020 that a new $98 per year subscription would offer same day delivery on close to 200,000 grocery items.

By now I have painted a pretty grim picture for traditional brands. The need to adapt can’t be questioned, so let’s look to the prescription. Now is the time for traditional brands to “bet the house” on digital. There is a lot tied up in this, but the key is investing in technology, top talent, and processes that are purpose-built for digital e-commerce.

Brands can picture a tree as the best way to map out their path forward to success in a world where ecommerce is compressed on the relatively few online marketplaces that can meet consumer demands.

- At the base of the tree are its roots, for brands this represents the data and insights that can be derived from analyzing your own data, consumer insights data and competitive intelligence.

- The trunk of the tree is the strategy you put in place to grow faster, wider and taller than your competition.

- The branches and leaves are advertising and media execution, as well as creative optimization.

These are the main levers, assuming you’ve laid an effective foundation, to help you win and overtake competitors that haven’t embraced the new world of online marketplaces. At Momentum Commerce, we encourage our partners to think about the process of digital transformation in this way. Investing in each aspect of “the tree” will allow brands to break the silos that have historically grown within traditional brands to enable integrated decision-making across consumer insights, marketing, sales, creative and product development teams.