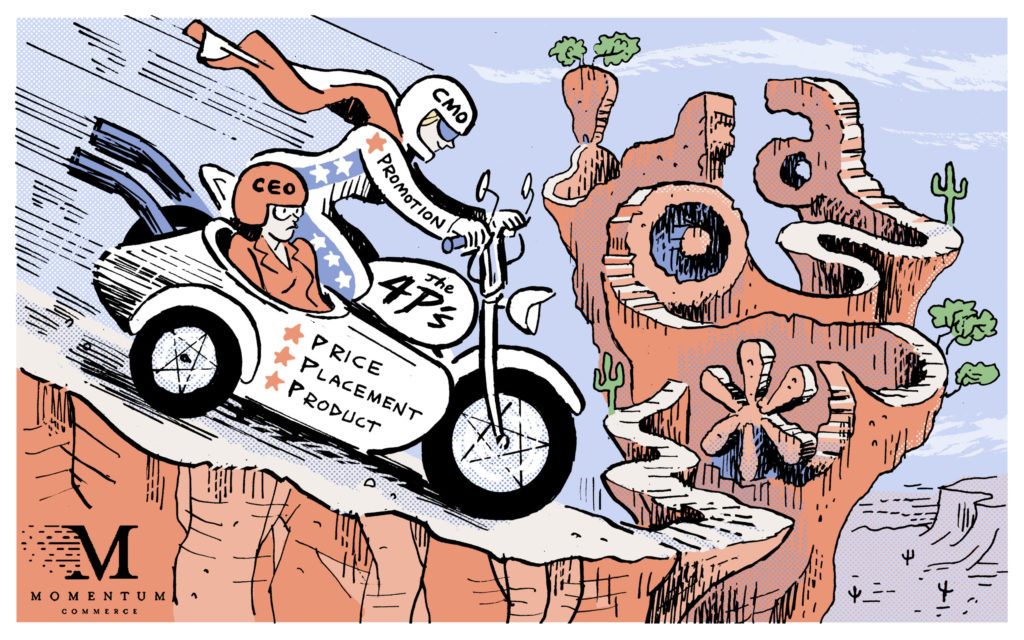

How Digital Retail Is Returning Control of The 4P’s to the CMO

Imagine you have a product sitting on a digital shelf at Amazon, Walmart.com or Target.com and it’s not selling at the rate you planned. What can you do? You could lower your price. You could increase your advertising. You could bundle that product with another one and create a new “virtual bundle”. You could reallocate the product to another store or channel, or you could do some combination of these things. In other words, you could run through the 4Ps of Marketing:

- Product: What you are selling: what is its function, its benefits, its packaging, etc.

- Placement: Where you are selling and how you are getting it there: distribution, stores, channels, and the enabling logistics.

- Price: At what price are you selling, wholesale, MSRP, discounts, shipping costs.

- Promotion: How you are making the world aware of the product and convincing them to buy, advertising, PR, creative, sales, CRM, etc.

In the last couple of decades, we have seen the responsibilities of the Chief Marketing Officer and the teams that report to this role become focused primarily on Promotion. Many people have – rightfully – argued that this reduction in responsibility is the primary reason the average tenure of a CMO has become less than three years. CMOs are expected to drive business growth but are often not given the influence, controls or authority needed to actually do so. However, the rise of Digital Retail signals a shift back to an empowered CMO who is tasked with driving strategic company growth and not just leading tactical execution across PR, media buying and creative messaging.

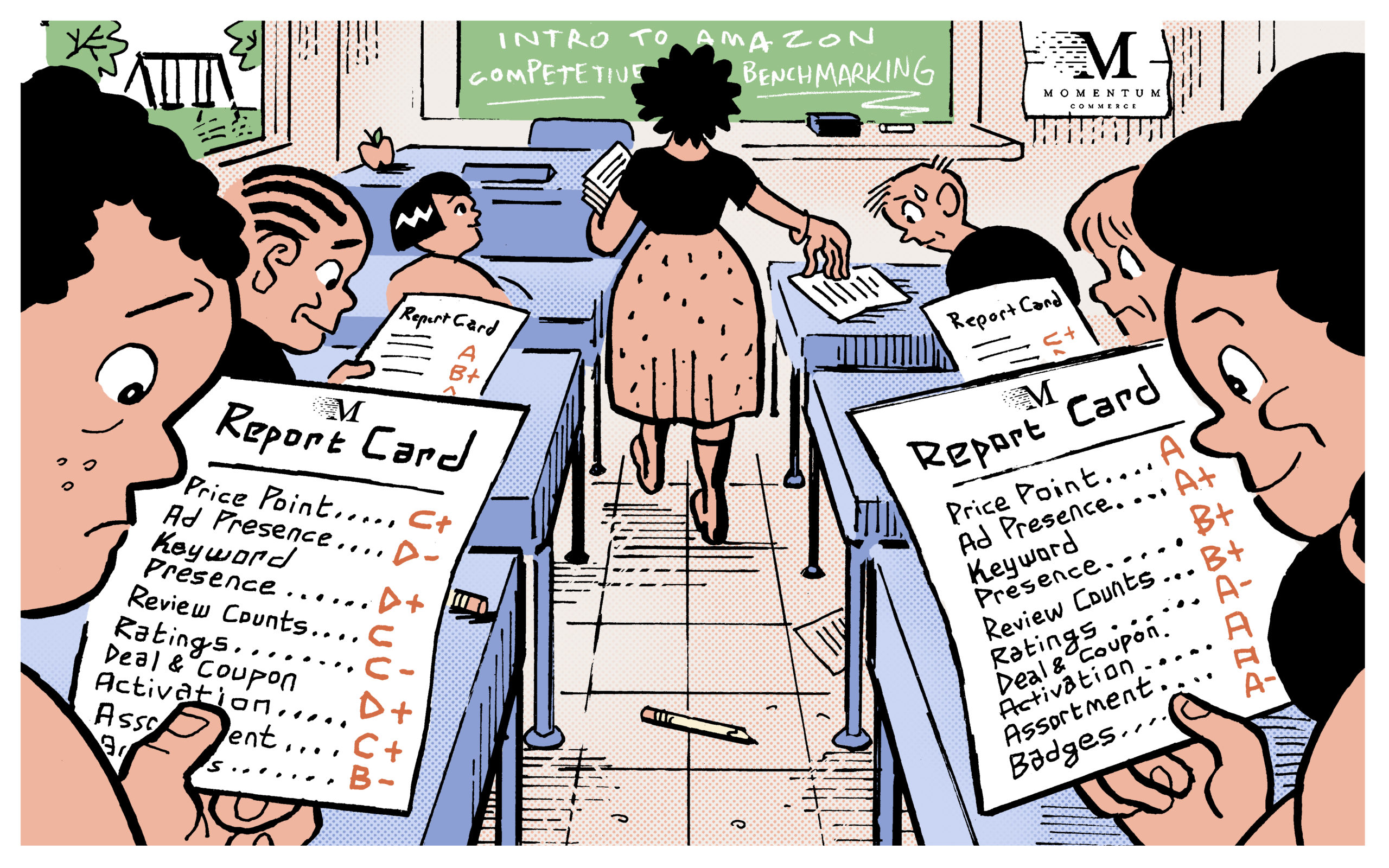

At Momentum Commerce, we are frequently hired to help assess organizational capability and capacity to drive growth on Digital Retail – primarily with a focus on Amazon. The most common obstacle we see is growth that is stifled by three recurring silos:

- Data is siloed into retail, marketing, brand and consumer insights data tables that all need to be joined together to inform decision-making. How can you devise an advertising strategy without knowing your inventory levels, margins or total sales figures?

- Knowledge of best practices across the 4Ps at Digital Retail is siloed in different departments which restricts strategic development.

- Decision-making is siloed in functional departments resulting in poor coordination across the 4Ps.

As Digital Retail and its influence over physical retail continues to accelerate, the brands winning are the ones that break down these silos and centralize ownership of decision-making across all 4Ps. Here are a few marketing plays we see the most digitally savvy CMOs orchestrating:

To market or to markdown: CMOs who control price drive more growth.

Digital Retail is more price-driven than Physical Retail. The lion’s share of searches on retailer websites are brand-agnostic, creating a much higher price elasticity of demand for many categories on digital shelves (where price comparison is trivial for the consumer) relative to physical shelves (where consumers often need to examine labels to even see price). As a result, the “to market or markdown” debate is more nuanced on Digital.

At Momentum Commerce, we work with many of our clients to understand price-distribution at the search-term level on Digital Retailers (e.g. what is the median price of the first 20 products that return on Amazon.com for the search “men’s underwear”? What about “men’s boxer briefs”?). One application of this data is that we help our clients to “pick the right spots” to run a more surgical strike with Retail Media (search term bidding) and Product Content SEO (alignment of product title and description content to search terms). The goal of these efforts is to select the search terms that align best with the client’s current pricing strategy.

Anyone who is trying to run promotional efforts without this flavor of analysis is leaving opportunity on the table. However, this approach is limited because it is largely reactive; we can only drive so much impact when we are forced to only find the search-terms we can play on at our current pricing. It gets much more interesting when we can pursue price experimentation to find an efficient frontier to maximize total profit volume. If we can lower our price by 10%, we could discover a wider universe of search terms that we can compete on, and maybe the increase in volume that comes from that is enough to offset the loss in per-unit margin.

The smartest brands understand that one of Digital’s primary advantages is the speed of learning. They are comfortable experimenting with price in order to learn how to accelerate growth and they understand that pricing strategy has huge implications on media performance, inventory forecasting, cross-channel issues, and ultimately financial performance. They test price changes frequently and they collect data to learn.

Digital Retail Data Fuels Product Innovation: CMOs who use digital retail data to inform product development drive more growth.

The amount, speed and quality of consumer behavior data on Digital Retail is several orders of magnitude greater than physical retail. Smart brands understand that they should not only think “digital retail first” in product development planning because of its sales growth, but because it’s actually a lot easier to do so in a truly data-driven way.

At Momentum Commerce, we work with our clients to extract data from the consumer ratings and questions and answer pages across Digital Retail in their categories to understand what customers actually care about. For example, if customers in the “curtain” category are constantly asking if curtains fully “blackout” sunshine and leave poor reviews for curtains that do not, perhaps there is an opportunity to develop a better product here and to emphasize this with product content. We also analyze the general volatility of markets to look at how often brands enter and exit top selling spots on Digital to understand how difficult it may be to crack into a new market. For example, if the top 10 best seller products in the “blue-tooth shower speaker” have gone unchanged for 6 months, this may be a tough nut to crack. But, if we have seen 50 different brands in the top 10 best sellers for the “cooler with built in bluetooth speakers” over the last six months, perhaps that signals an easier market to enter.

The smartest brands understand that bespoke data-mining of Digital Retail is the best way to drive product innovation.

You can’t sell what you don’t have: CMOs that control placement are not restricted by product availability and drive more growth.

When a brand goes out of stock at a physical store, they will miss some revenue while they are out of stock, but as soon as the brand is back in stock they return to the same rate of sales—or, perhaps, a slightly higher rate. Digital Retail penalizes stock-outs much more harshly. Brands that go out of stock on Digital Retail not only miss sales while they are out of stock, but they also miss sales when they replenish because the search algorithms of the digital retailers rightfully punish products with a higher risk of going out of stock. Availability is a key input to product ranking at Digital Retail. There needs to be tight alignment between your supply-chain and promotional efforts.

On the other side of the coin, if your product doesn’t sell fast enough you are met with long-term storage fees or significantly reduced reordering. As a result, there are opportunities to use promotional programs to maintain the rate of sales for products with high inventory.

At Momentum Commerce we are constantly working with clients to understand inventory position and feed that back into Retail Media Decisions.

The smartest brands routinely run stale inventory retail media campaigns to avoid long-term storage fees if they operate in the marketplace (3P selling) and coordinate retail media bidding based on inventory availability to ensure they do not advertise SKUs that are at risk of going out of stock.

As Retail Media heats up, I predict we will see a much more empowered CMO. Exciting times to be a digitally-savvy CMO driving growth on Digital Retail.