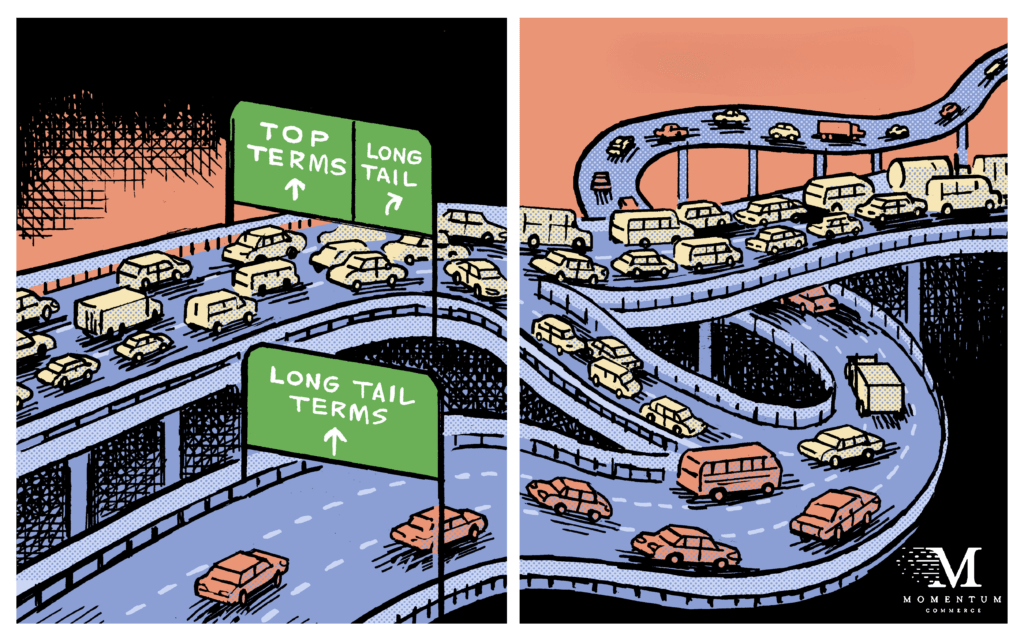

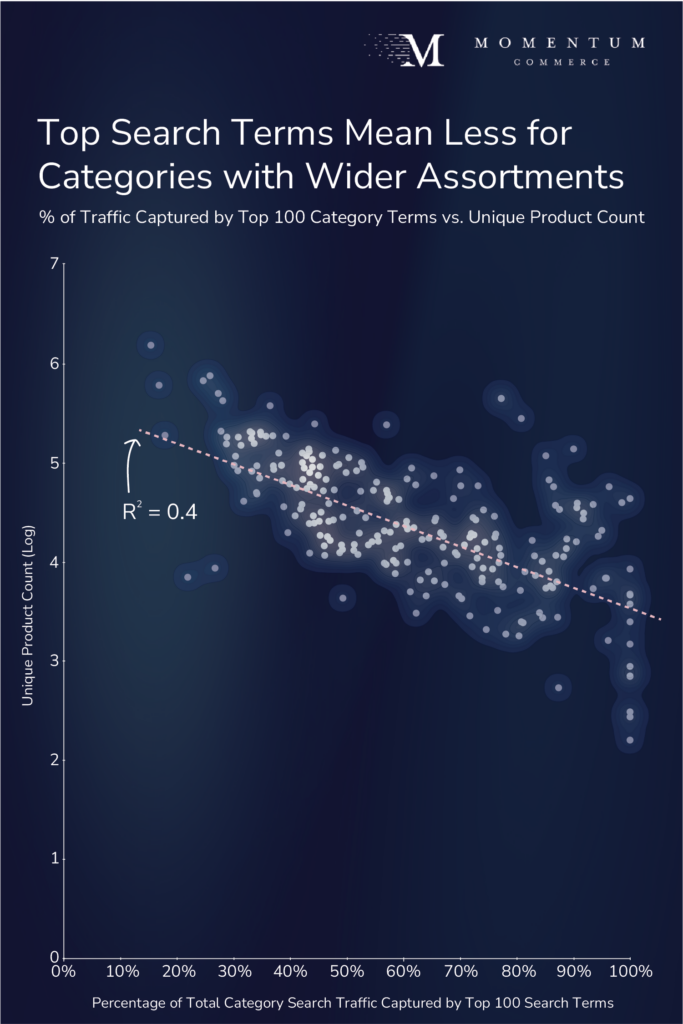

For Long-Tail Categories, The Long Tail of Search Matters More

The share of consumer search activity captured by top terms on Amazon US varies significantly between categories. Assortment breadth within a category is a meaningful factor, with a reasonable correlation between the number of distinct products offered in a category and the share of total search volume captured by the top 100 terms for that subcategory.

This search behavior variation becomes particularly significant when considering Amazon’s most successful product categories. High-volume categories like Beauty & Personal Care, Home & Kitchen, and Clothing consistently drive substantial traffic, but their search patterns differ markedly. While everyday essentials tend to concentrate searches around common terms, fashion and home categories often see more dispersed search patterns. Electronics and specialized categories like Sports & Outdoors typically fall somewhere in between, with moderate concentration around top search terms while still maintaining a substantial long tail.

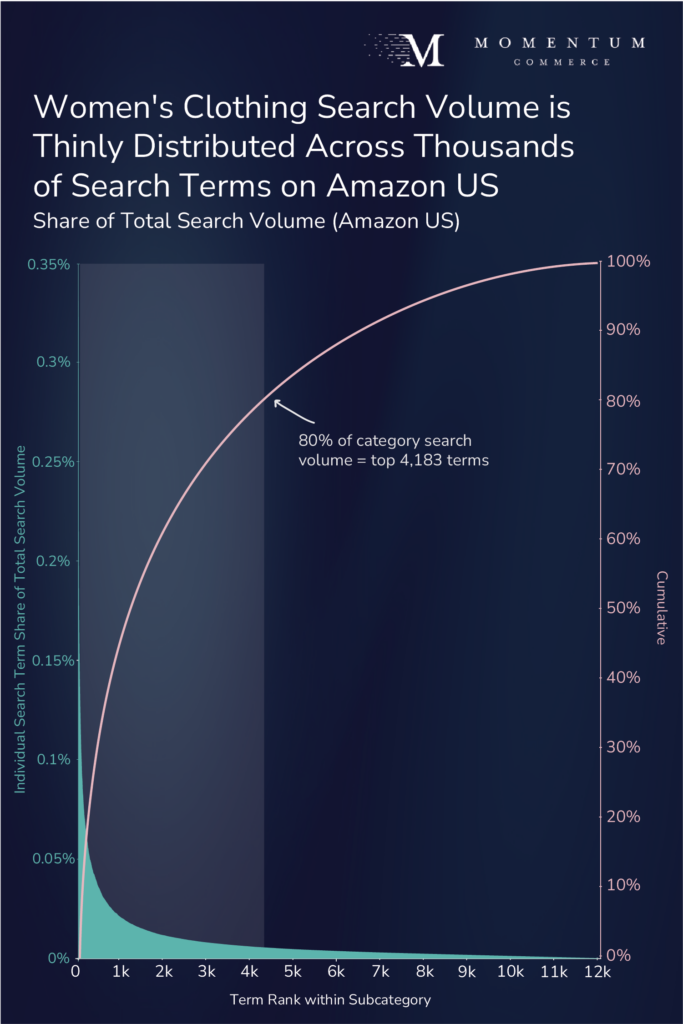

One extreme example is the largest subcategory by product count, Women’s Clothing, where the top 100 search terms account for just 15.4% of overall search volume. In fact, to account for 80% of the total category search volume in Women’s Clothing you’d have to add up the top 4,183 search terms.

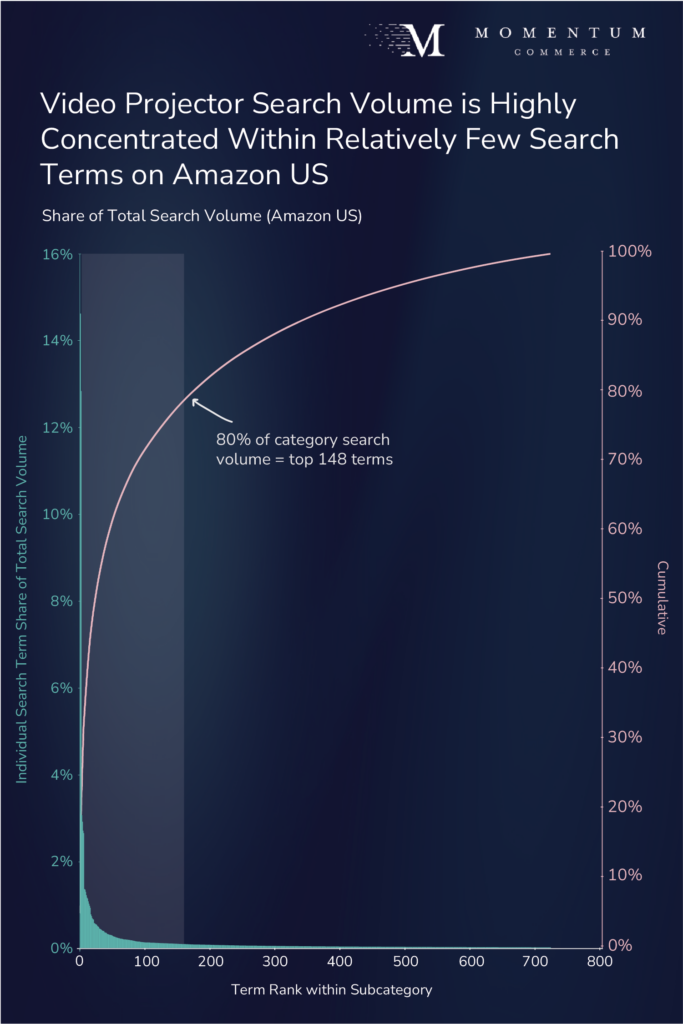

Contrast this with the Video Projector subcategory in Electronics. With just 2,000 distinct products, the top 100 search terms capture 74.6% of category search volume.

This search pattern diversity extends across Amazon’s most active categories. Electronics and Office Supplies typically follow concentrated search patterns similar to Video Projectors, while categories like Sports & Outdoors and Pet Supplies show more distributed search behavior. Health, Household & Baby Care products often demonstrate hybrid patterns, with some subcategories heavily concentrated around essential terms and others displaying longer-tail search distributions. Understanding these category-specific patterns is crucial for brands entering or expanding within these markets, as they directly impact advertising strategy and potential return on ad spend.

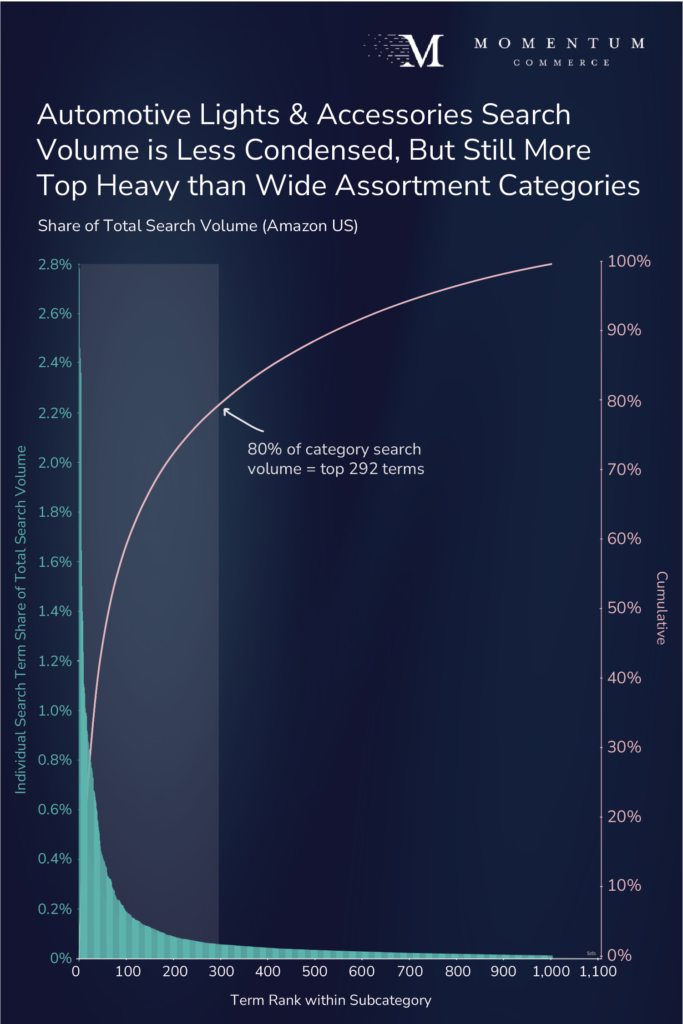

An example of a more ‘middle of the road’ category is Automotive Lights & Accessories. The category sports over 25,000 unique products, and 53.8% of category search volume is concentrated across the top 100 search terms.

The dynamics of achieving “#1 Best Seller” status on Amazon further illustrates the importance of understanding category-specific search patterns. This coveted badge, which indicates top sales performance within a specific category, is heavily influenced by search visibility and conversion. Products must not only capture relevant search traffic but also convert effectively to maintain their ranking. The path to achieving this status varies significantly between concentrated categories like Video Projectors, where dominating a few key terms can drive substantial sales volume, versus dispersed categories like Women’s Clothing, where success often requires capturing traffic across thousands of search terms.

Biggest Takeaways for Brands

- For newer or less populated categories on Amazon, focus on top terms

- This likely will result in higher ACOS, but it’s going to be the best path to driving meaningful sales volumes

- Ensure any share of voice (SOV) metrics are volume-weighted so you are getting the most actionable metric

- Build a competitive edge that matches the shape of the category you play in

- For categories with a higher share of traffic going to top terms, brands need to maintain a tight focus on budget allocation, campaign structure, product quality, pricing, and branding

- Being competitively priced with a meaningful value proposition, while capturing paid slots on select, top terms is going to be a solid foundational strategy

- For categories with a lower share of traffic going to top terms, brands need to be more agile and willing to invest to break past stagnating growth

- Following trends and niches with supporting keyword research, paid search, and SEO can help you win

- One simple method that can help in ensuring that auto campaigns are feeding into manual campaigns based on predefined conversion criteria

- Following trends and niches with supporting keyword research, paid search, and SEO can help you win

- For categories with a higher share of traffic going to top terms, brands need to maintain a tight focus on budget allocation, campaign structure, product quality, pricing, and branding

Methodology

Momentum Commerce examined the estimated search volume associated with the top 1 million search terms on Amazon US over the month of September 2024. Search terms were categorized based on the subcategory associated with the majority of products appearing on the corresponding search results pages. For the purposes of having a meaningful number of search terms associated with each subcategory, only level-two subcategories were analyzed (e.g. Toys & Games/Building Toys).