Does Brand Equity Matter on Amazon? Well, It Depends…

For brands selling on Amazon, or those looking to start, understanding the popular search terms in categories relevant to their product catalog is critical. Amazon users go straight to the search bar when browsing the platform, making understanding the search terms they use highly valuable to brands. Search terms can be branded, such as “Purina dog food”, or generic, like “dog food”. Each are very different ways of searching that can help brands understand consumer behavior in their category. Each day at Momentum Commerce, we analyze the 1 million most frequently searched terms and determine whether those terms contain a brand name, providing brands with insights into consumer behavior by category.

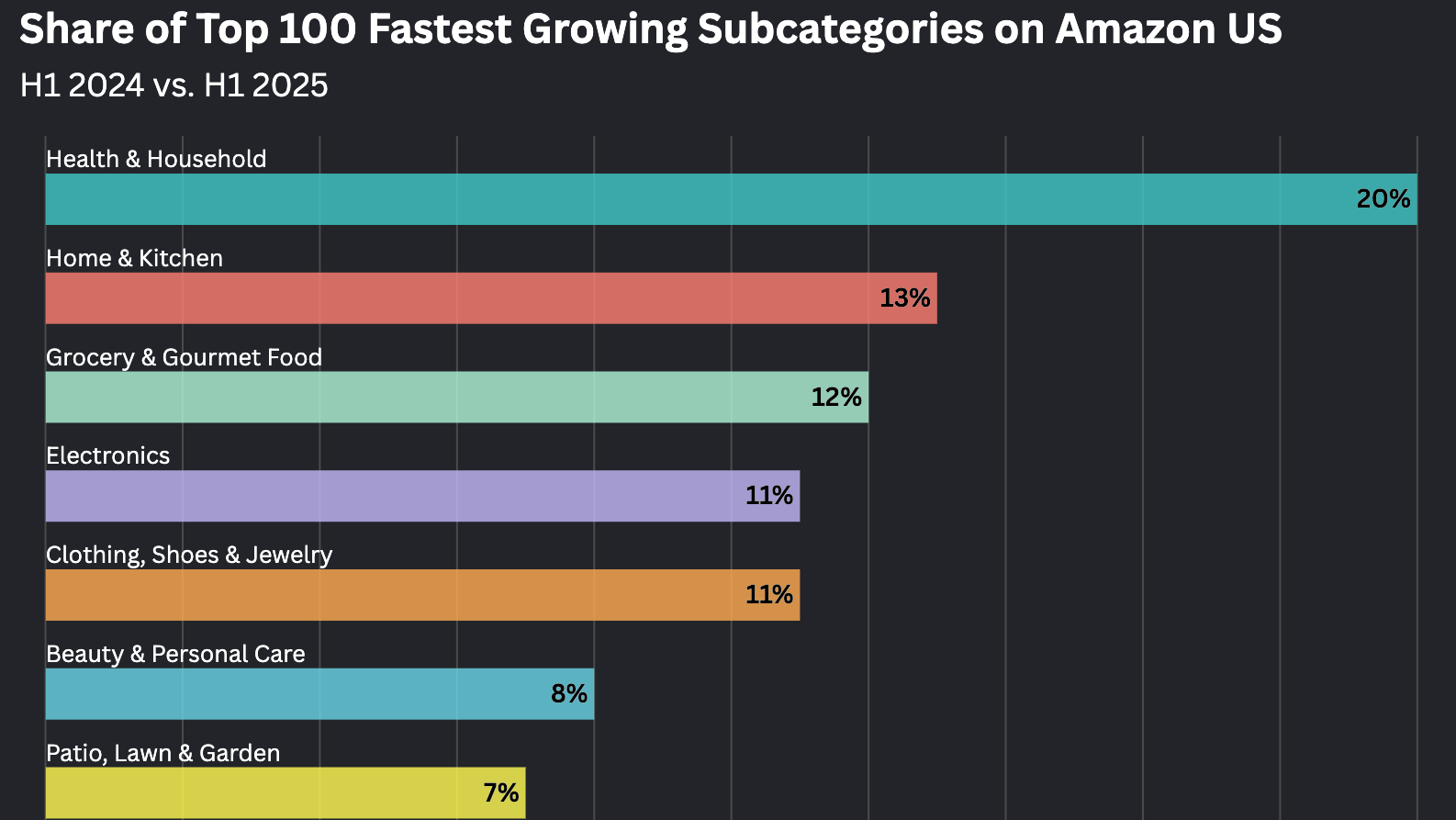

To illustrate the types of insights our data can provide, let’s take the example of a seller looking to sell dog supplies on Amazon. Being familiar with the branded percentage of other categories allows our seller to understand how even the playing field is across the platform. Let’s start at the top level categories.

The visual above shows the Amazon marketplace by category. The x-axis shows how many top-1M-search-terms fall into a category and its associated subcategories; it’s a good proxy for category size. The y-axis is the percentage of terms that are branded. Looking at the pet supplies category, we can see that its 11% branded percentage is one of the lowest on the Amazon marketplace. This means that most users don’t know or have strong preferences about which brand’s product they’re looking for. As a result, a customer may be more enticed by review counts, price differences, or results placements when comparing products. The lower the branded percentage makes the pet supplies category a more even playing field than a category like video games, where almost half of the keywords were branded. This is good news for our seller!

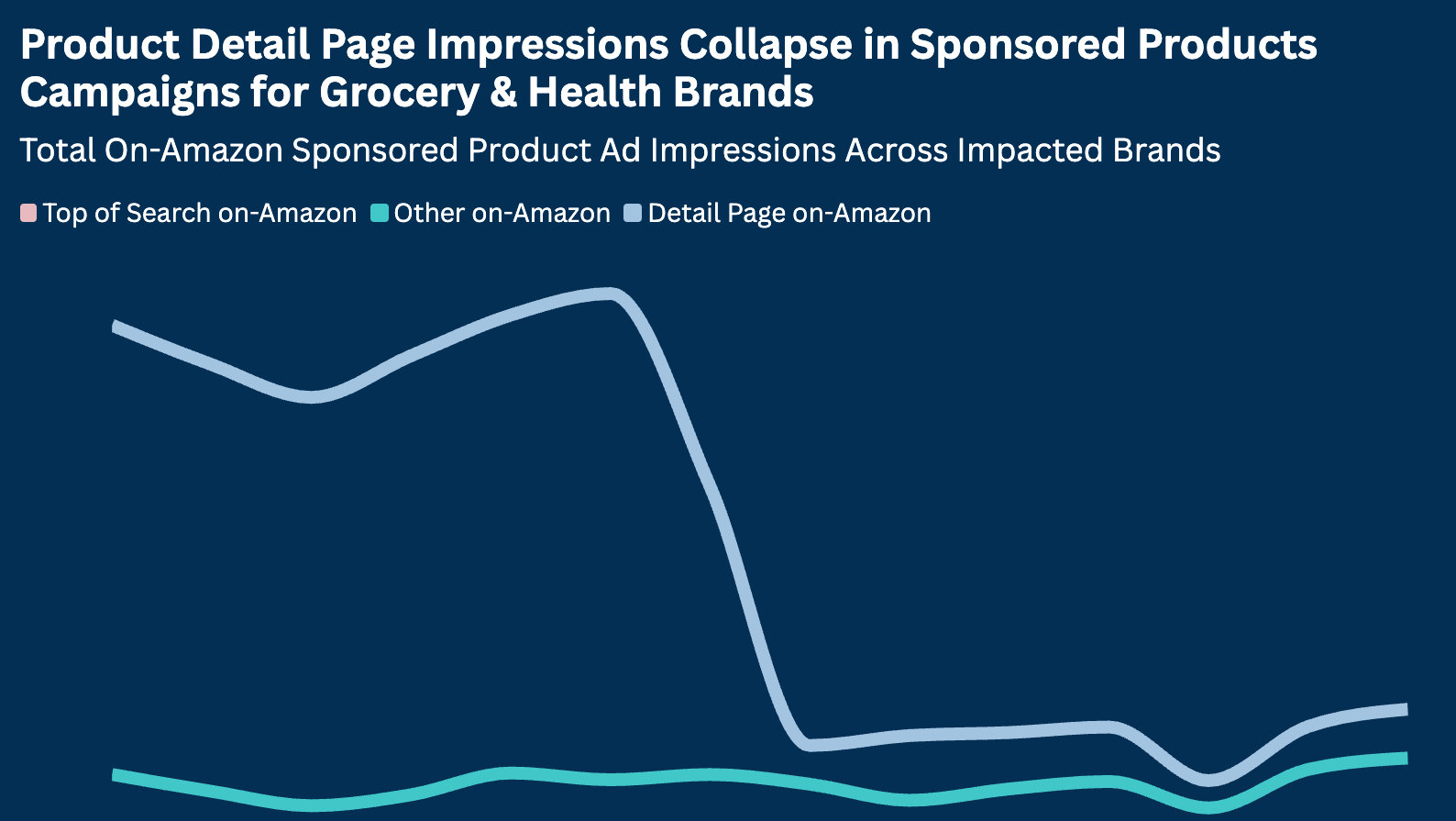

Drilling down to the subcategories within pet supplies provides us with even more insights.

Here, we can see the number of top-1M-search-terms per subcategory and their branded percentage. Our seller is interested in selling dog products and there are two highlights in this visual to support this interest. First, the dog subcategory has volume by our “share of top search terms” metric — 3x more than all other subcategories. Additionally, our seller sees that Dogs has about the same average branded percentage as all the other pet supplies subcategories. From these insights, our seller now knows that there is a strong demand for dog supplies, and that selling them won’t be any more competitive than selling pet supplies in general.

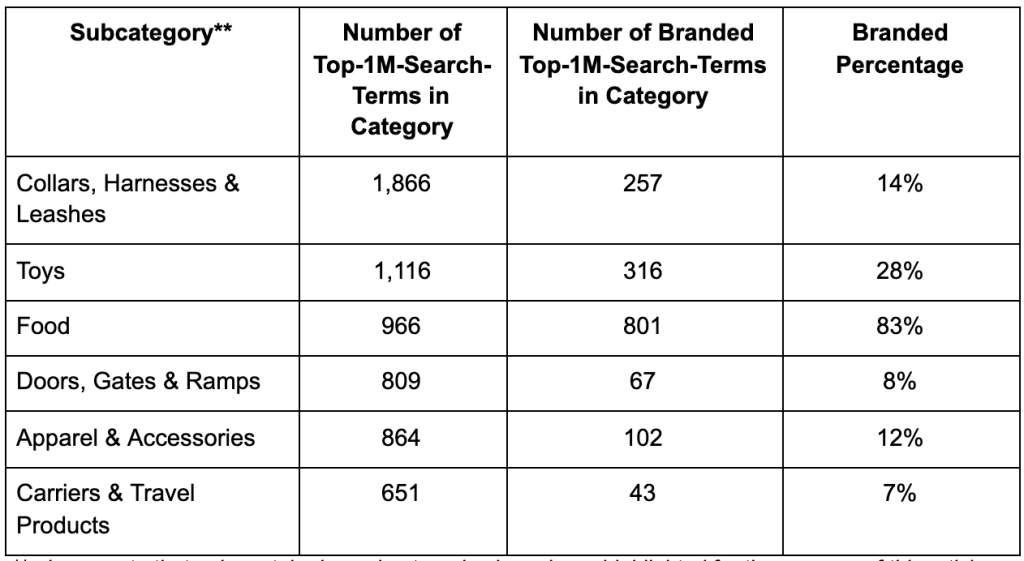

Within the Dog Supplies subcategory, there are even more insights to be uncovered, helping our seller narrow down on what type of dog supplies they want to sell.

One thing sticks out immediately from the visuals above. Dog Food search queries contain more branded terms than searches for all other dog supplies. This is useful information for our seller who is still deciding what dog supplies to sell. Due to the highly branded nature of Dog Food search queries, this will likely be a more challenging area to sell in as customers likely have a strong brand preference in mind. Now, this doesn’t mean that our vendor should rule out entering the Dog Food subcategory entirely, but rather that their Amazon advertising strategy would have to differ greatly from the strategy they’d implement on other dog subcategories. When the percentage of branded search terms in a category is heavily skewed, users have a strong brand preference and will be less likely to engage in product discovery.

Now let’s look at Collars, Harnesses, & Leashes for comparison. This subcategory is 69% less branded than Dog Food and has about 2x as many top-1M-search-terms. This suggests that this subcategory would be much easier to enter than Dog Food due to the higher demand and more even playing field. When a significant portion of search terms in a category are generic, users are more likely to participate in product discovery as they do not have brand preference. With users more likely to click their advertisement while shopping around, this would make collars, harnesses, & leashes a great category for our seller to consider.

While our seller is still debating which dog product to sell, our branded keyword analysis taught them that:

1. Pet Supplies is one of the easier markets to enter as a seller on Amazon

2. 67% of the top-1M-search-terms in the pet supplies category fall in the dogs subcategory

3. Dog food is heavily branded, making the barrier to entry higher for this subcategory

4. Collars, harnesses, and leashes are a better option with 69% less branded top-1M-search-terms and 2x more top-1M-search-terms overall

Our seller now has great insights that will help guide them in making their decision on which dog products to sell on Amazon.