Do Viral Social Media Trends Translate to Amazon?

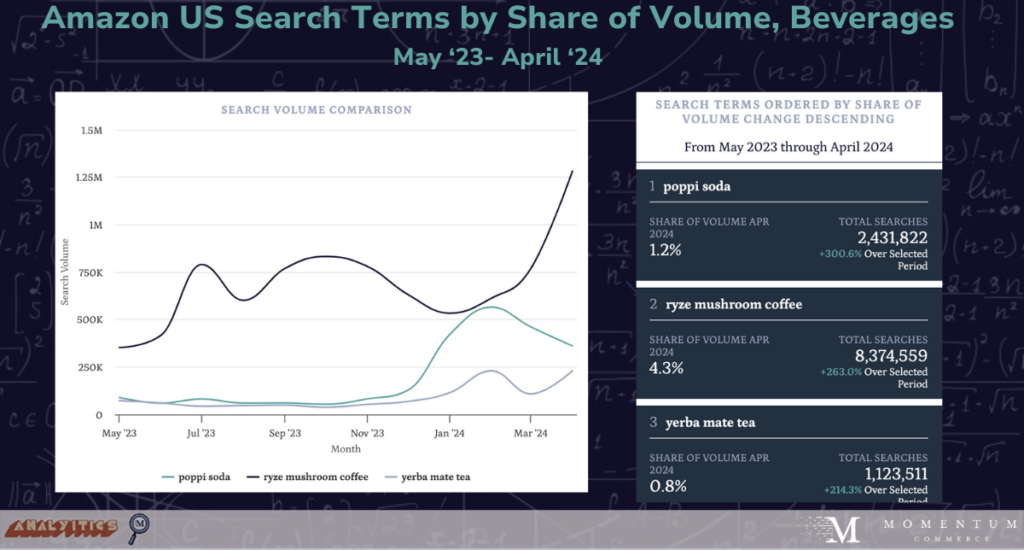

Good-for-you soda brands like Olipop and poppi have taken social media by storm, promoting the plethora of health benefits one can receive by opting for a natural soda over a traditional Coke or Pepsi, (and even among the latest lawsuits, they are still going strong!) So are these viral brands seeing lasting sales effects on Amazon?

Using Velocity by Momentum Commerce’s latest beta module addition, ‘Custom Markets,’ we can customize Amazon categories beyond the existing hierarchy. For a newer market like healthy soda, the subcategory options available within the ‘Beverages’ subcategory don’t quite capture the market. For this analysis, we created a custom market by filtering out terms like ‘coffee, tea, electrolytes, energy drinks,’ etc., from the Bottled Beverages, Water & Drink Mixes subcategory and set the time frame to be a year-over-year comparison.

In the last year for the custom ‘healthy soda’ subcategory, we saw:

- $53.4M in estimated total sales

- 2M estimated units sold

- Roughly 281 brands competing in the space

- Of those brands, poppi holds 40% of the market, earning $21.4M in sales in the last year

- Olipop holds a 10.6% market share, earning $5.7M

- NOKA holds an 8.5% market share, earning $4.5M

- Wildwonder holds 3.4% of the market, earning $1.8M

poppi, which sells just 14 ASINs on Amazon, has seen impressive growth in the last year. In the traditional ‘Beverage’ subcategory, poppi is the largest gainer in terms of year-over-year search volume growth, increasing by +300.6%. With the beverages category forecasted to see +27.3% YoY growth according to our Amazon Sales Forecast Dashboard, holding a dominant stance in terms of branded search is an enviable position.

A recent Momentum Commerce analysis reported that holding a #1 Best Seller Rank on Amazon is worth 41.5% more units sold per week, with varying degrees of success across different categories and price points. Within Grocery & Gourmet Food, this number rises to a 52.5% average change in weekly units sold versus the prior week. poppi is dominating, holding both a #1 BSR and an Overall Pick Badge.

Biggest Takeaways for Brands

- Social media trends absolutely have an impact on Amazon shopping behavior

- This extends to both discrete brands like Olipop and poppi, but also overarching trends like clothing brand ‘dupes’

- It’s important to hone in on your true market and direct competitors

- While Olipop is seemingly ‘low’ in terms of SOV in the Beverage subcategory, it’s a top contender when it comes to the Healthy Soda market

- Segmenting to a more custom market will allow for more accurate and attainable goals

- Utilize keyword tools to identify what consumers are searching for, and continuously optimize your listings to reflect those terms

- In the case of brands like poppi and Olipop, they’re driving incremental growth that suggests a long-term stay on marketplaces like Amazon

Methodology

Momentum Commerce analyzed products on Amazon US in the Beverage subcategory of Grocery & Gourmet Food. Excluding terms ‘coffee, tea, sparkling water, electrolyte, powder, meal replacement, and energy drinks’ and including terms ‘ healthy, probiotic, and prebiotic.’ Aggregates for the selected period, June 2023 through June 2024 were compared against the same period the prior year.