Competing Against Factory Brands & Overseas Suppliers on Amazon

I recently tried to buy a carabiner – you know, one of those funny little clip things that mountain climbers reportedly use. I wanted to be able to easily clip my golf towel to my golf bag and the normal S-hooks kept bending – resulting in me buying too many golf towels. So, I started by searching for ‘Carabiner’ on Amazon.

There are a ton of brands competing for this search. Let’s look at the top results:

- Position 0.1-0.3 (Sponsored Brands): Gold Lion

- Position 1-4 (Sponsored Products): CampTek, Ou Peng, Favofit (2x)

- Position 5: Nite (sold by Amazon.com)

- Position 6: (Amazon’s Choice): Unijoy

- Position 7: (Best Seller badge): CampTek

- Position 8: sprookber

- Position 9: (SB Video): Gold Lion

You have 7 different manufacturers, all competing quite aggressively for the most visible positions on the page. If I scroll further down, 8 of the top 20 positions on the page are paid placements, representing an ad density for this search of roughly 40%.

Something that has become important to me is trying to limit how much I buy from 3P sellers based in China. I’m not going to make a moral argument about why you should also do this – it’s just an arbitrary decision I’ve made. Let’s see how successful I will be against that goal in my search for a carabiner:

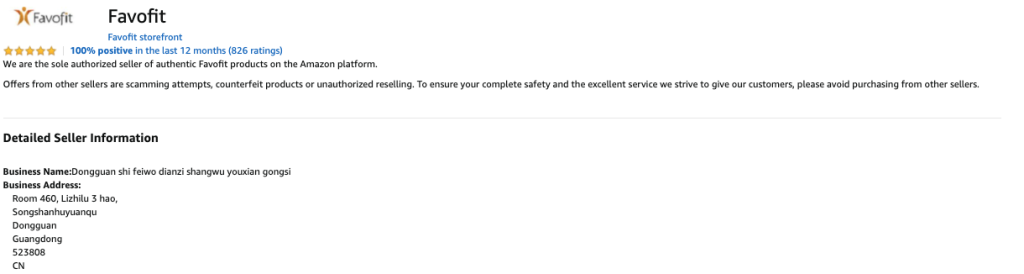

The Gold Lion brand is fortunately sold by a US listed 3P seller under the name Explore First Brands based out of Boston. So, this search is rather easy – they’re visible at the top of the page using a SB Ad, and they’re also in the SB Video Placement. That said, with the exception of the 1P brand Nite, all of the other brands in the top positions are China or Hong Kong based 3Ps, verified by going to each of their ‘Sold By’ pages. As an example, here’s Favofit:

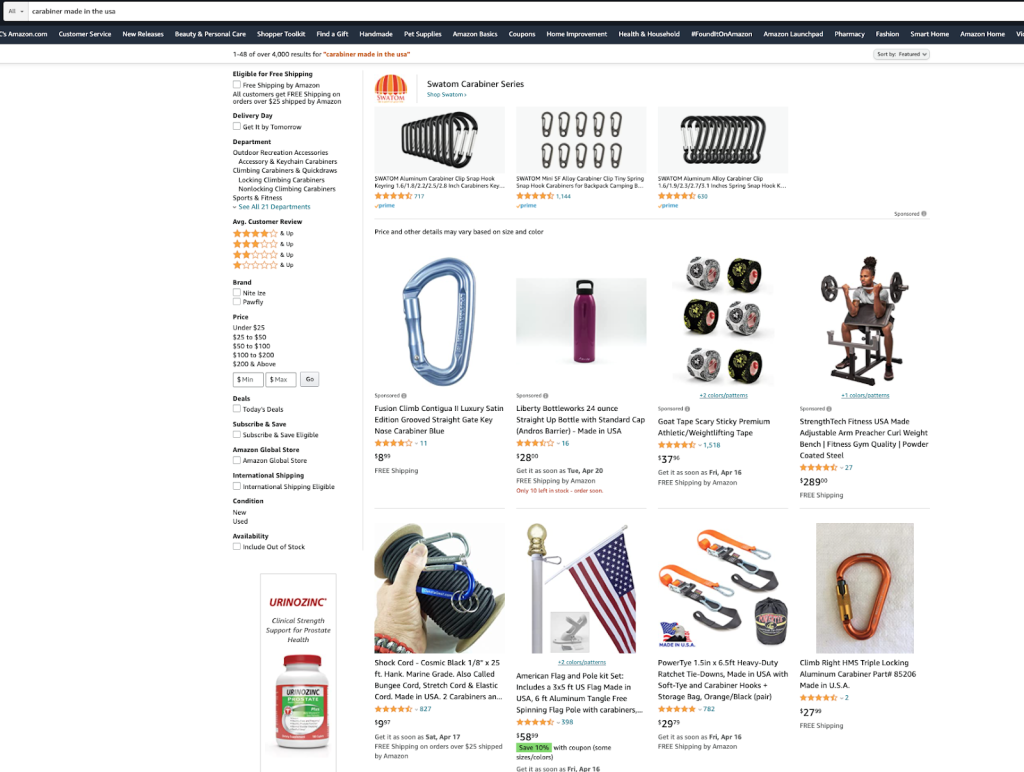

If I searched for something like ‘carabiner made in the usa’ I’m going to have a hard time finding what I’m looking for amidst all of the Chinese 3P product results that are available. Amazon even struggles to return relevant results when I search in this manner – showing me everything from weightlifting tape to american flags alongside the carabiners.

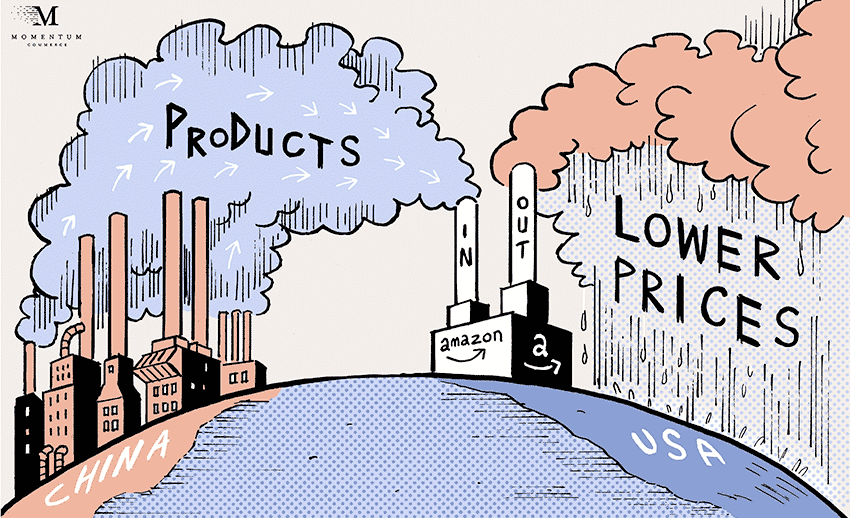

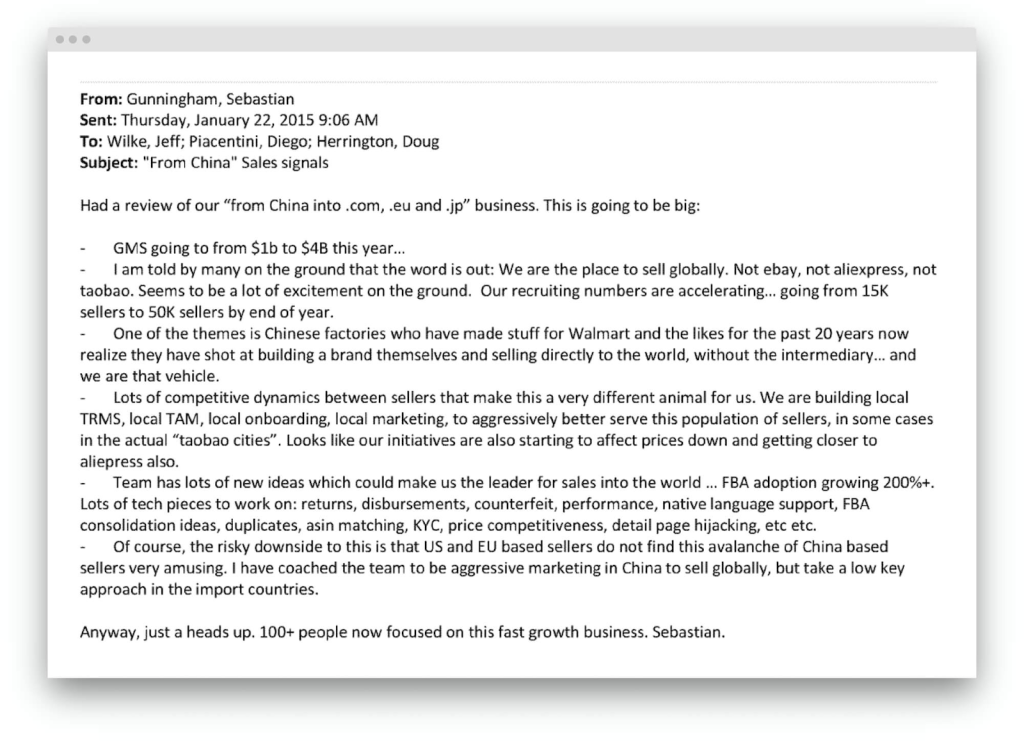

Flipping the perspective to think about this from the point of view of a brand – Amazon is often criticized for its use of marketplace data to prop up it’s private label brands like Amazon Basics. With the exception of a few specific categories this threat is way overblown relative to the bigger threat that enough Consumer Brand executives are paying attention to. Amazon has become the gateway by which overseas factories cut out the intermediaries and go direct to global consumers with lower prices. An internal Amazon note from 2015 released as part of a House Judiciary investigation that describes the beginning of this trend with stunning clarity:

Now consider that more than 40% of Amazon US GMV comes from these Chinese ‘factory brands’ today and that more than 50% of all new seller sign-ups in the Amazon marketplace are Chinese suppliers. Not very amusing at all.

In many categories, the biggest competitive threat on Amazon is not your traditional competitors but instead these factories in China who can make a better margin selling directly on Amazon’s marketplace than to you. So how do you defend against this type of competition to reach consumers that are looking for a good product that meets their needs?

Let’s start with the basics:

- Brand Name – you’re often playing against unrecognizable brand names like ‘sprookber’ or ‘ou peng’. Making sure your brand name is at the start of the product title may be enough to give your product enough credibility to get a click.

- Creative Assets – Make sure you give your potential customer something pretty to look at that accurately portrays your product in real world situations. In other words, make sure your product photography doesn’t look like you photoshopped it on to stock images.

Bad example from Favofit:

This is either the world largest gravity-defying water bottle imaginable that applies zero tension to the strap it’s attached to, or it’s a bad photoshop.

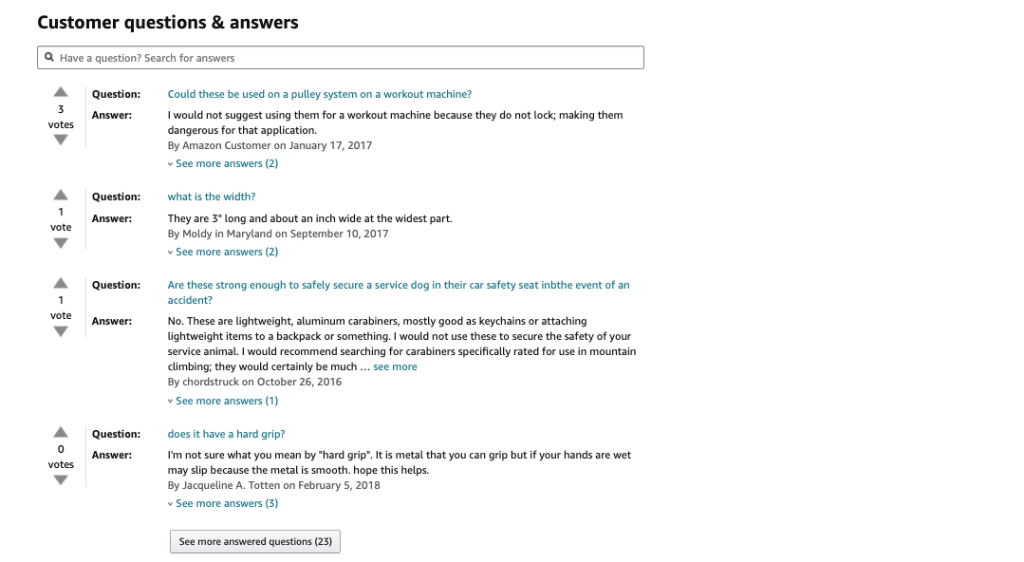

- Customer Support – your customers are going to ask you questions about your products. Make sure you have a plan for how to respond to them. If you don’t respond to these they’re going to assume you don’t care or can’t respond, and you also miss an important opportunity to understand what might be unclear about your product detail information on the page, or how you can improve the product.

- Reviews and Ratings – this is a tough game to play, and there are many grey areas that I prefer to avoid. My advice here is typically to focus on providing a high quality product, and making it clear in the description what customers will be getting if they decide to purchase it from you. Most poor reviews come from mismatched expectations. Stay above a 4.3 average rating.

- Retail Media Execution – Your brand likely demands a higher price point than manufacturers going direct to Amazon shoppers. Use this pricing the margin dollars to attack and defend paid placements where you can make a difference. Gold Lion is doing a great job of this in SB and SB Video. Would love to see more of their products in the SP placements, but there is likely a CPC challenge. Adapt to new ad types if you can’t keep affording the most generic category search terms in SP.

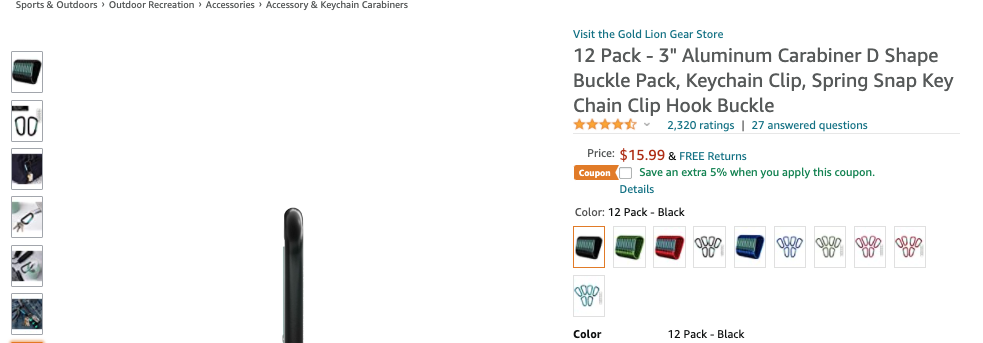

- Amazon Brand Store Design – This is simple. Have a brand store. If I’m on your PDP and I see ‘Brand: sprookber’ that takes me to a search page with all of the sprookber products I’m immediately skeptical. If at the top of your PDP I’m encouraged to ‘Visit the Gold Lion Gear Store’ and it’s well designed, then I know I’m at least shopping from a brand that has put a small amount of effort into creating a meaningful presence on Amazon, and that likely means they have put at least a small amount of effort into creating a quality product.

Good:

Bad:

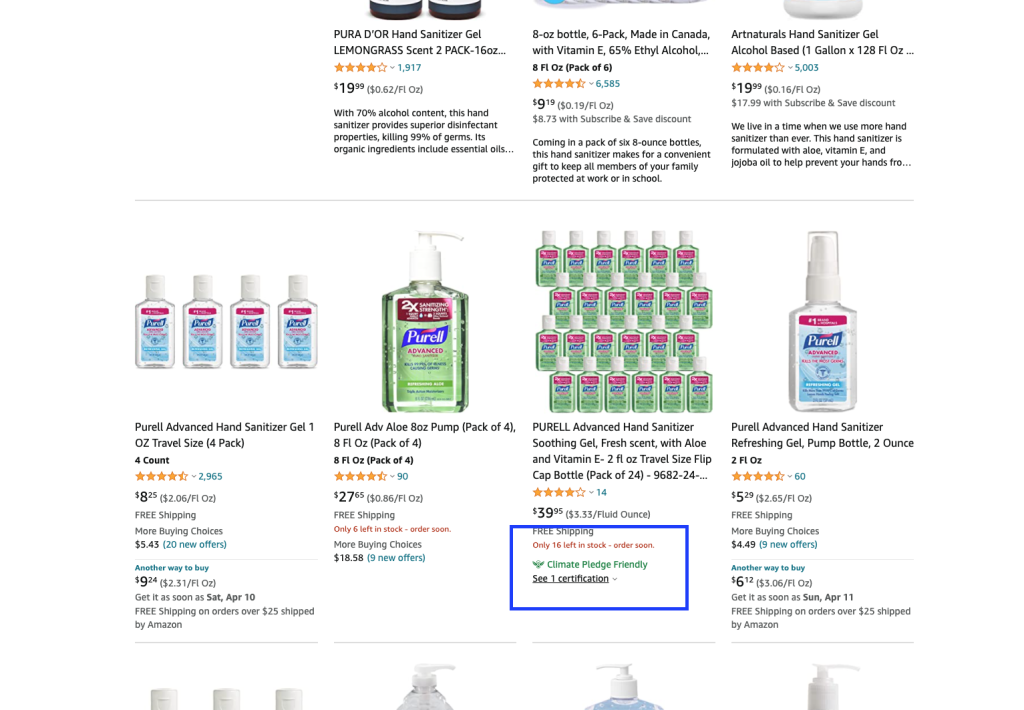

- Badging – I’m not going to talk about Best Seller/Amazon’s Choice badges. Instead – the Climate Pledge badge is something I’m starting to see show up in Search Results pages. It’s not necessarily open strictly to US based manufacturer brands, but I would be willing to bet you’re going to be more willing and capable of navigating the process to qualify for the badge. This will appeal to climate-conscious consumers, and most likely comes with a CTR/CR boost to get shoppers on your PDP and converting.

- DTC.com Presence to Reinforce Brand – This is also simple. Make sure you have a website and that it has your products on it. If I want to check to see if you’re a real brand I’m going to search for you outside of Amazon. If I can’t find it easily I’m going to assume you’re just an overseas factory that has shipped containers into a fulfilment center and the quality of your product is a complete dice roll.

- Retailer diversification – don’t get stuck focusing solely on Amazon. Other retailers – Target.com is front and center of my mind when I say this – do a better job of controlling who can sell products on their site. If you can get listed on Target.com, or really any other major retailer, you’re likely going to see overall ecomm growth and you’re less likely to face the competition from these manufacturers-turned-brands from overseas.

- Know your market – Overseas factory brands going to struggle with the above 9 items – exploit those advantages. But these suggestions are a snapshot in time – the world will change. If your market has this type of competitive force it’s important to understand what these competitors are doing so you can respond as their tactics evolve. These factory brands are likely going to try to compete with you with very low prices and large multipacks. They’re going to try to imitate your features. They will likely try to advertise on the same terms you’re already advertising on. They will adapt. Take the time to ‘walk the store’ – yes, go in and search on amazon the same way your customer might – and regularly observe how products are priced, who is a new player on a new ad type like SB Video, and where the quality of your listings may no longer be sufficiently above your competition. Knowing what’s going on in your market will be the most powerful tool available to you – and will tell you what to do next when these suggestions are no longer enough.