Amazon’s Commission Change to Battle Temu, Shein is (Mostly) Having the Desired Effect

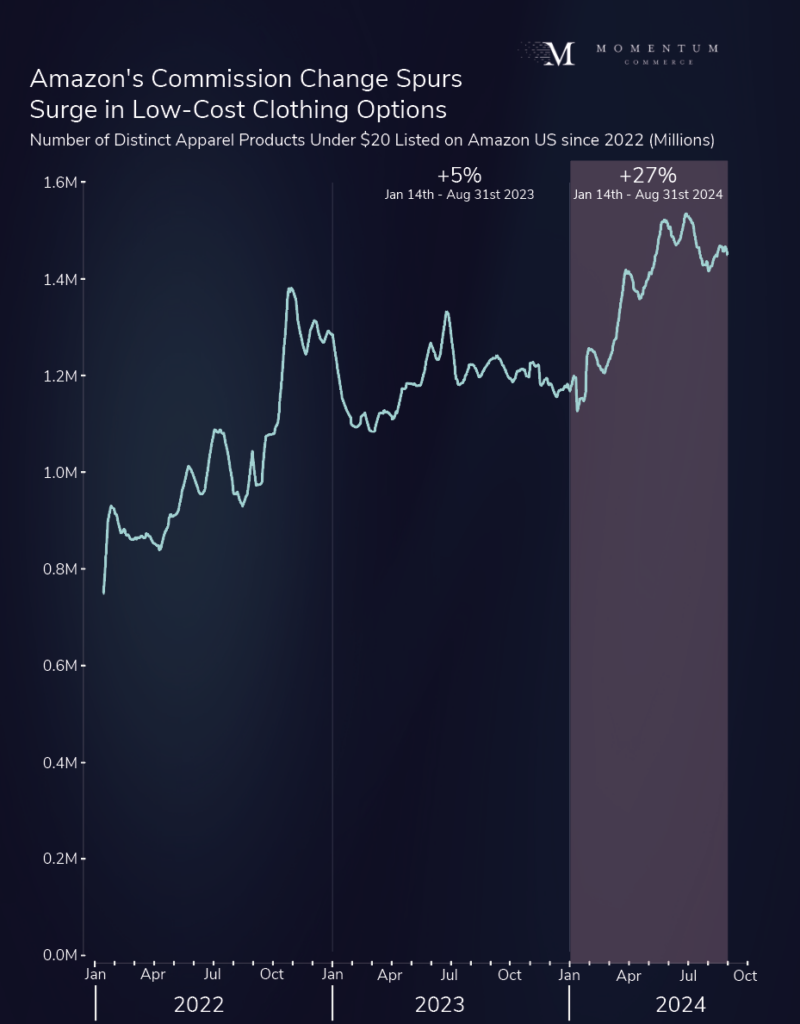

Starting on January 14, 2024, Amazon reduced its commission on lower-cost clothing products. The general consensus is that this move was in response to competitive pressure by Shein and Temu, both of which offer a wide range of low-cost apparel. Roughly eight months following the change, both the selection and sales of under-$20 clothing on Amazon have risen substantially. However, this has come at the expense of legacy brands, with the Buy Box win rates of brands selling impacted products dropping significantly since the change went into effect.

As to selection, the amount of individual, under-$20 clothing products offered on Amazon rose 27% from the time the commission change went into effect through August 31st. Over the same period the prior year, selection in that same group rose only 5%.

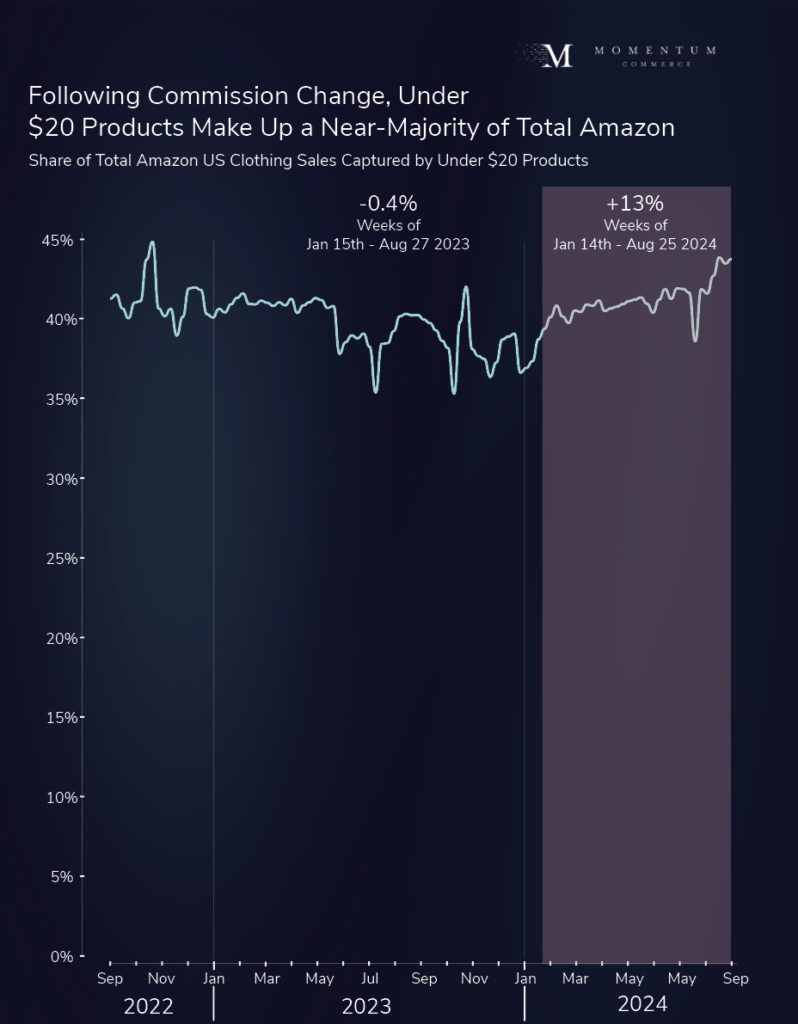

Additionally, in the 32 weeks following the change in commissions, the share of clothing sales across Amazon going to these lower-cost offerings rose by 13%. That’s well above the -0.4% decrease in share observed over the same 32-week period in 2023.

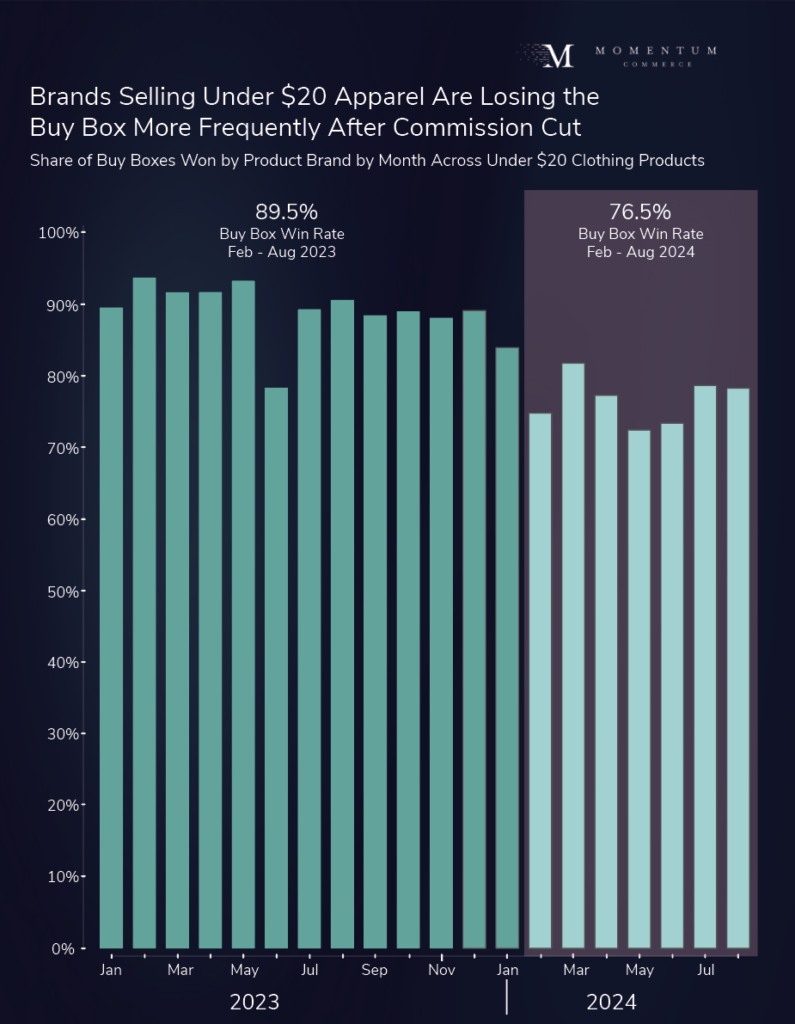

The major downside of the commission change has been the impact on Buy Box win rates. Across clothing products priced under $20, brands were winning their own products’ Buy Box 89.5% of the time from February through August 2023. That number dropped to 76.5% over the same period in 2024 – a decrease of 14.5% YoY.

Biggest Takeaways for Brands

- Brands are already repricing to take advantage of the commission changes

- The share of products in ‘tweener’ price bands of $20 to $21 (1.9% to 1.1%) and $15 to $16 (3.0% to 2.2%) have shrunk significantly since the commission change

- The additional margin available to brands who are able to reprice ‘tweener’ products to meet the decreased commission threshold can be reallocated to support growth via search advertising, which is likely particularly impactful in lower-consideration and brand-agnostic subcategories (e.g. undershirts, socks)

- Impacted brands need to make hard choices around their catalog on Amazon

- Particularly for popular brands and products, resellers now have a greater ability to profitably arbitrage and win the Buy Box

- Brands may need to reconsider how they price and package certain product classes like multipacks, which can potentially be broken up into smaller parcels for resale

- This will extend across sales channels – products offered at bulk retailers like Costco can now more easily leak onto Amazon

- Prepare for deep discounts during peak periods to cause long-term issues

- For impacted brands, significant, limited-time discounts have the potential to cause headaches on the resale market following the promotion period

- Brands may be more successful by more lightly cutting the price of products in promotion periods, but perhaps extending those discounts for a longer period of time

- Alternatively, brands could also focus discounts on products that cannot be split up into smaller pack sizes