Momentum Commerce Category Deep Dive: Market Share Shifts Reveal Winning Strategies in Amazon’s Vacuum Category

Analysis of 2024’s -2% category decline exposes the specific tactics still driving market share gains in the competitive Vacuums & Floor Care space

The Amazon US Vacuums and Floor Care category saw significant market share redistribution in 2024, even as overall revenue contracted by 2%. Our analysis reveals how strategic timing of advertising spend and promotional activity during key shopping periods directly influenced these shifts. Using Shark’s +11.9% revenue growth as a case study, we’ll examine the specific tactics that drove market share gains, providing actionable insights for brands competing in this space.

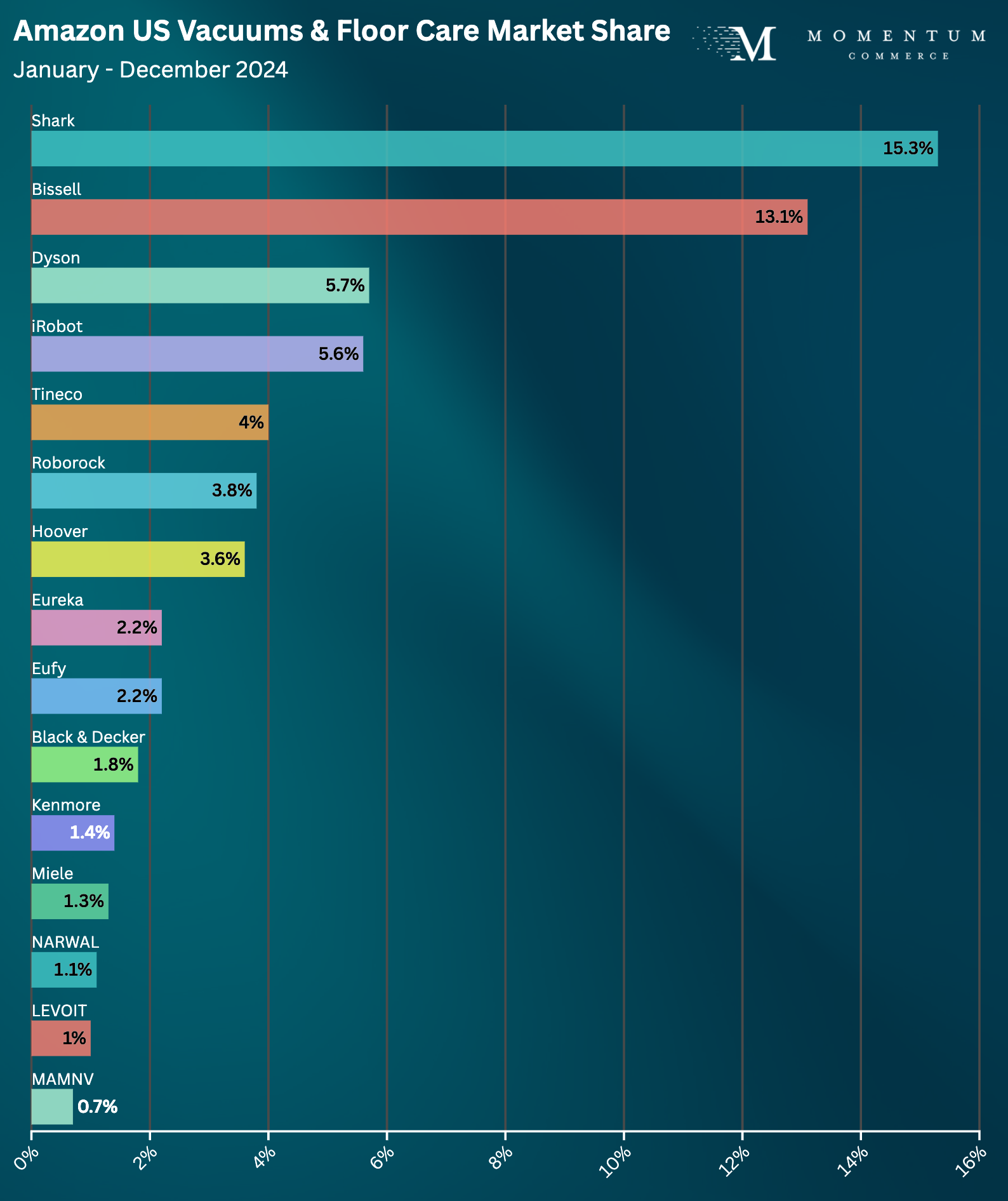

The data shows clear consolidation at the top of the category, with established players adapting their strategies to maintain their market position. While several Chinese manufacturers (LEVOID, MAMNV and NARWAL) made inroads at the lower end, and iRobot experienced challenges following their failed acquisition (-2.6% market share decline), the most notable shift was Shark’s +1.9% market share gain. By examining the tactics behind these market movements, we can identify specific opportunities for brands to optimize their Amazon presence.

Market share dynamics show high levels of consolidation among leading brands

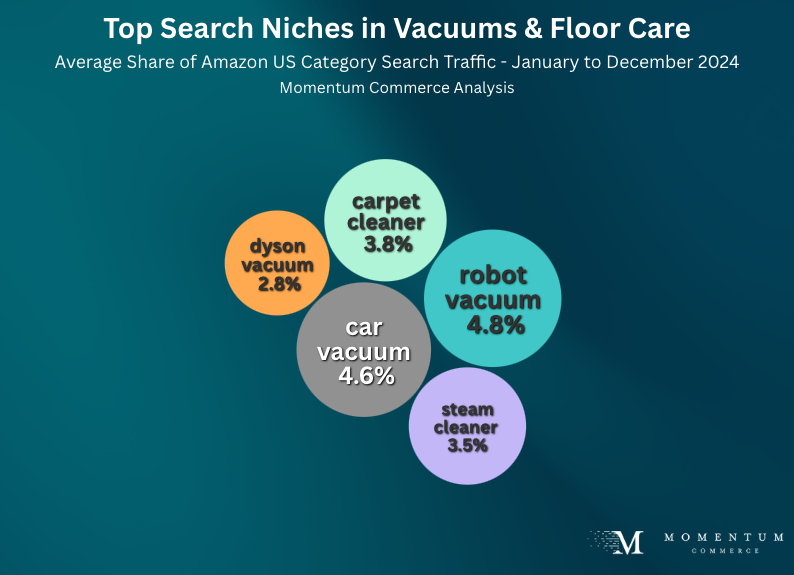

Search Behavior Reveals Category Purchase Drivers

An analysis of 2024 search patterns reveals two distinct ways consumers are looking for products in this category. While most high-volume searches focused on specific features and functionality, established brands like Dyson also generated significant branded search volume. This dual dynamic presents both challenges and opportunities for brands looking to capture market share.

Analysis of search volume reveals feature-driven consumer behavior with some brand-specific searching

Key Search Pattern Insights:

- Feature-driven terms (“robot vacuum,” “cordless vacuum”) dominate non-branded search volume

- Premium features appear frequently in top searches, indicating consumers aren’t scared off by the higher prices of advanced functionality

- Only one brand (Dyson) generates enough branded search volume to collectively reach the fifth-most searched topic in the category

- Seasonal variations in search activity align with promotional periods

These search patterns directly influence successful advertising and promotional strategies, as demonstrated in the tactical analysis below.

Tactical Analysis: Market Share Gains During Category Contraction

Our analysis of successful market share capture during 2024’s category contraction revealed three key tactical approaches. Using Shark’s execution as a case study, we can examine how strategic pricing adjustments (averaging 12% below previous levels) combined with targeted advertising during peak periods influenced market share movements.

Maximizing Seasonal Opportunities: Three Tactical Points of Emphasis

The data reveals three distinct activities associated with brands driving market share gains:

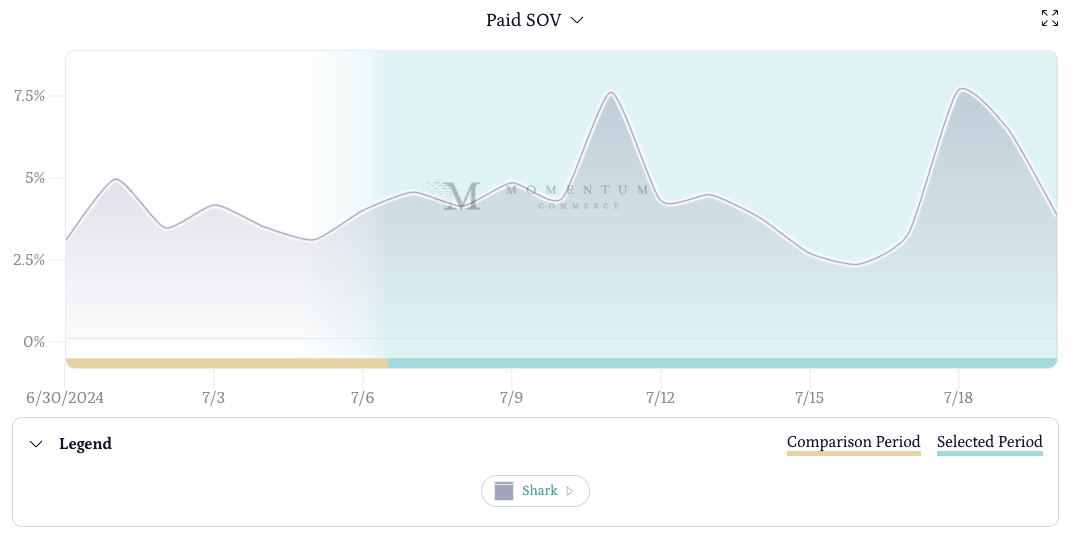

- Strategic Concentration of Advertising During Peak Events

Analysis of paid search patterns during Prime Day reveals how concentrated advertising investment can spur market share gains:

- Early deployment of paid search (7-10 days pre-event) captures intent from early deal researchers

- Focus on premium, higher-margin products during peak discount periods maximizes revenue potential

Advertising visibility shows heavier activity around lead-in and lead-out of major shopping period

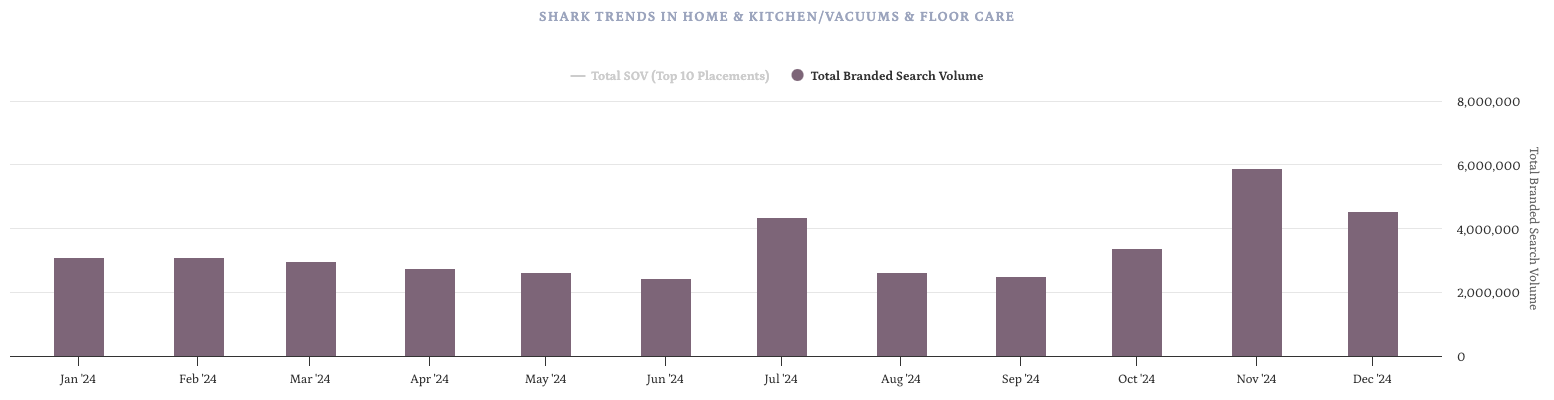

- Upper-Funnel Investment Impact on Branded Search Volume

There’s a clear line-of-sight between multi-channel visibility and increased branded search volume

- Strategic PR, social, and media coverage of deals across multiple platforms leading into the sale events amplified visibility

- Branded search volume increases tracked directly with promotional periods: 327K (June) → 530K (July) → 854K (November)

Monthly branded search volume demonstrates impact of concentrated marketing efforts

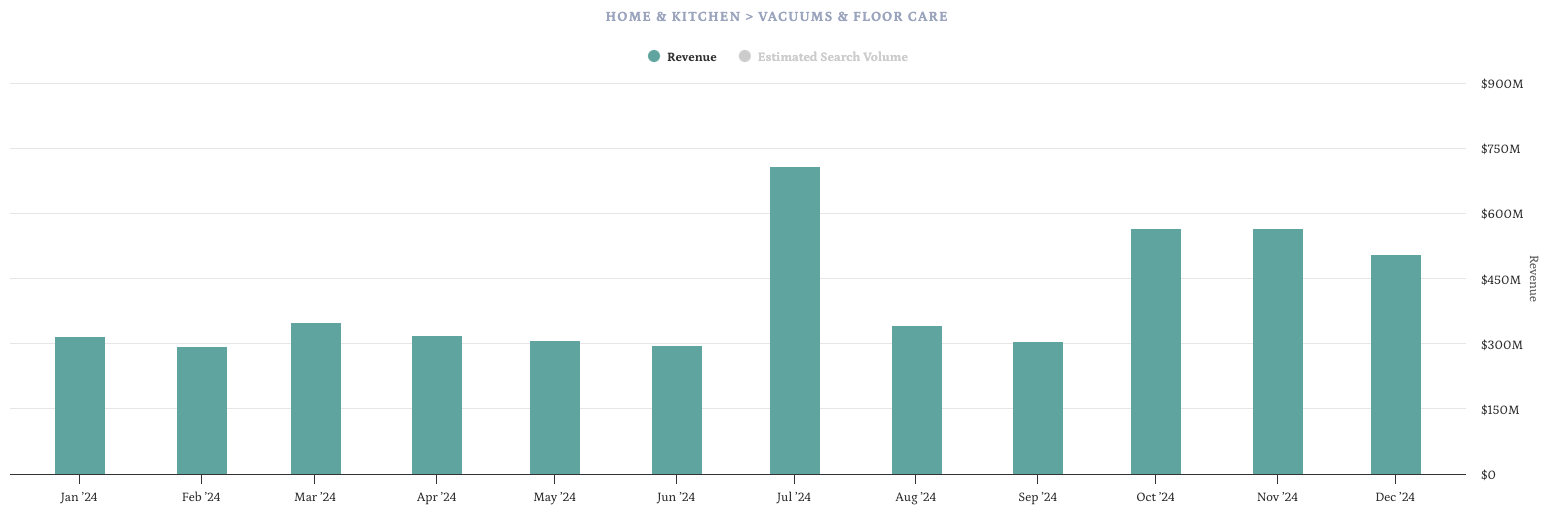

- Strategic Resource Allocation Between Peak and Off-Peak Periods

The data demonstrates how selective investment timing impacts overall performance:

- Concentrated advertising and promotional activity around high-volume shopping periods

- Reduced investment during traditionally slower months allows for more aggressive peak-period tactics

- This approach requires careful margin management, but due to the large disparity between peak and non-peak periods, can yield higher overall returns

Revenue concentration during peak shopping periods highlights importance of seasonal strategy

Key Lessons for Brands

- Peak Period Performance Drives Annual Results

- Category data shows 40-50% of annual revenue is concentrated in key shopping events

- Early preparation and aggressive execution during these periods is crucial

- Investment in pre-event visibility creates compound benefits

- Premium Product Strategy Opportunities

- Emerging brands should focus on surgical precision in their marketplace approach, and be willing to double down when performance indicates additional running room

- Key areas for investment include:

- Strategic paid search campaigns during periods of high social media visibility

- Optimization of product detail pages for both search and conversion

- Careful monitoring and defense of branded search terms once those terms are driving significant search volume

Looking Forward: Data-Driven Strategy Requirements

The increasing complexity of Amazon’s marketplace requires sophisticated analysis and rapid tactical adjustment.

Our analysis identifies two essential components for maintaining or gaining market share:

Real-Time Market Intelligence Systems

- Automated trend detection and competitive monitoring

- Multi-dimensional tracking across organic rank, paid share of voice, and pricing

- Category-specific seasonal pattern analysis with promotional impact measurement

- Daily share tracking during peak events when market dynamics shift rapidly

Rapid Strategic Response Capabilities

- Cross-functional expertise spanning advertising, pricing, and content optimization

- Advanced analytics infrastructure for real-time decision support

- Category-specific playbooks built from historical performance data

- Dedicated peak event execution teams

Brands that pair their internal capabilities with the right agency partner are best positioned to win in this new environment. At Momentum Commerce we offer both sophisticated data insights and experienced marketplace execution, positioning our brand partners to capitalize on opportunities as they emerge.

Next Steps: Applying These Insights

This analysis reveals clear opportunities for brands to capture market share through strategic timing of investments and resources. To understand your brand’s specific opportunities within these patterns:

- Request a custom analysis of your category’s seasonal dynamics

- Get a detailed competitive positioning report

- Review your peak period execution strategy

Contact Momentum Commerce for a data-driven consultation focused on your specific market position and growth opportunities.

This is the second in an ongoing series of monthly reports across key Amazon US subcategories. To view all reports as they are published, click here.