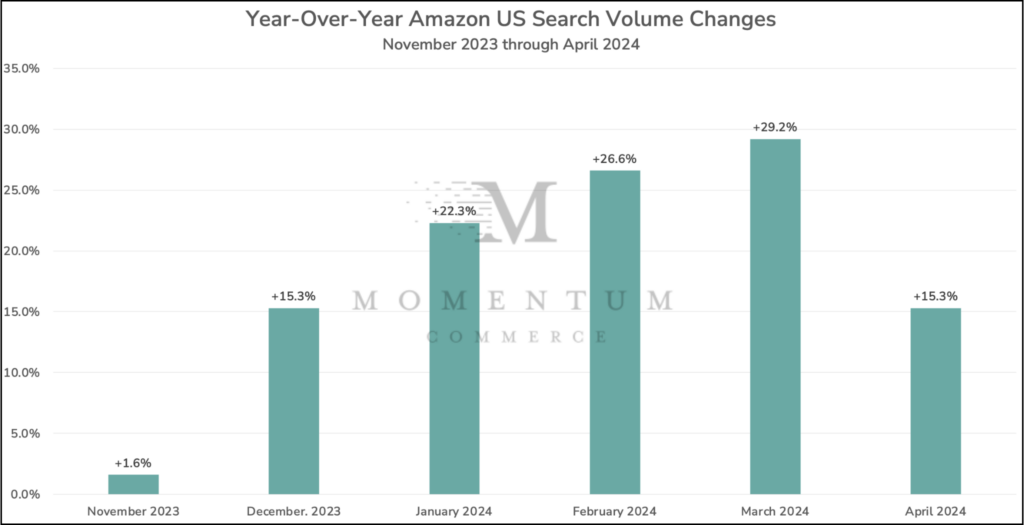

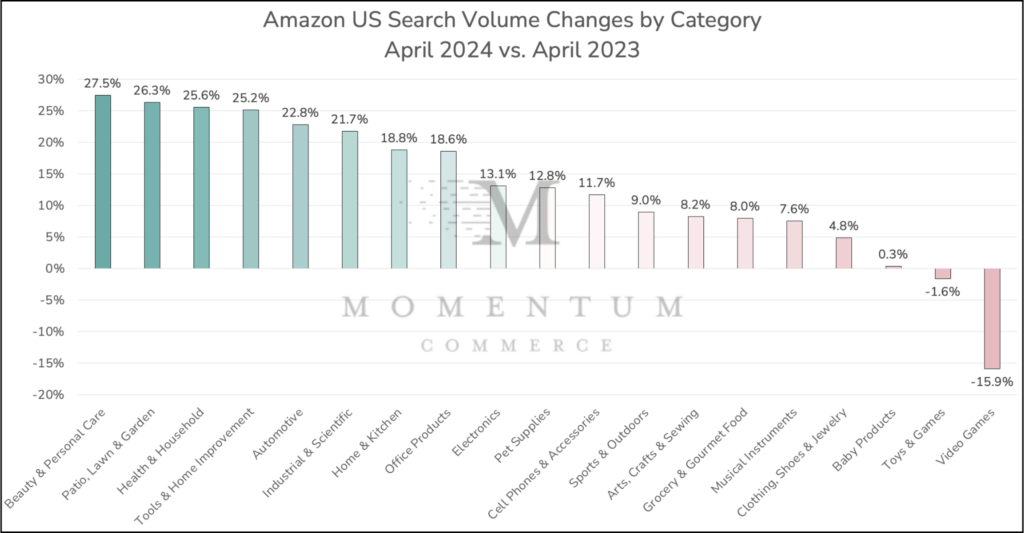

Amazon US Search Volume Climbs 15.3% YoY in April

Amazon US search volume increased by more than 15% year-over-year (YoY) in April 2024. While this was the eighth-consecutive Momentum Commerce analysis demonstrating a YoY increase, the 15.3% rise represents a slowdown from prior growth rates, which had accelerated YoY since November of 2023.

Biggest Takeaways for Brands

- TikTok Shop’s growth in the Beauty category isn’t hampering Amazon’s prospects in the US

- The Chinesellers substack’s latest update shows significant growth for the Beauty category on TikTok Shop, but total estimated sales only reached $6.9M in April 2023 – less than 0.5% of total category sales on Amazon US

- Meanwhile, Beauty & Personal Care has consistently posted YoY search volume gains that significantly outpace the wider Amazon US average, and that has shown no signs of abating

- Clearly, US beauty shoppers are heading towards Amazon frequently to search for products despite platforms like TikTok offering shoppable experiences on top of being a main media source for many consumers

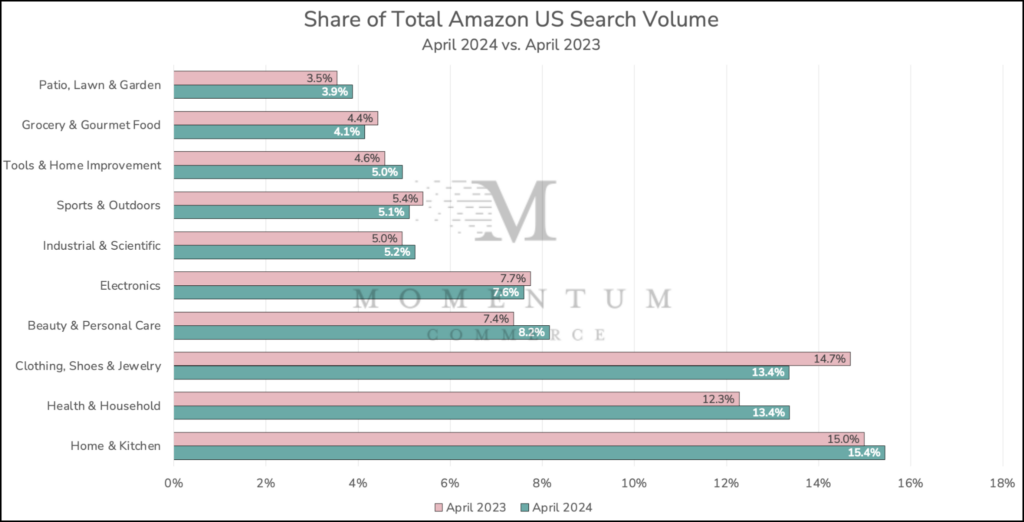

- Seasonal and non-grocery CPG categories continue to climb, pointing to changing shopper behavior

- Similar to Beauty & Personal Care, Health & Household’s strong search volume growth has been consistent over a number of months, to the point where the category could conceivably become the most searched category on Amazon within the next year

- More seasonal categories like Patio, Lawn & Garden, Tools & Home Improvement, and Automotive also demonstrated high YoY search volume increases

- These trends underscore how Amazon is attracting evolving groups of shoppers across higher-consideration categories

- The marked slowdown for Grocery, Baby Products and continued pressure on Toys & Games are warning signs for brands

- This is the second consecutive month where Grocery & Gourmet Food search rates have paced well behind the whole Amazon US average

- The nearly flat YoY growth for Baby Products is stunning in the context of historically high YoY search volume increases for the category

- Alongside Grocery, this slowdown could be influenced by cooling food inflation driving more consumers to shop at physical stores rather than Amazon

- Additionally, birth rates in the US recently hit a record low, which reasonably would lessen the demand for many baby products in aggregate

- With the latest YoY decline, Toys & Games is no longer a top-10 category by search volume on Amazon US

- Brands in each of these categories should focus actively on finding pockets of growth, reorienting budgets to match performance trends, and develop systems to do this continuously

Methodology

Data included in this analysis is based off of search volume estimates across the top 1,000,000 search terms on Amazon during April 2023 and April 2024. Search terms were categorized based on the top-level category associated with the majority of products appearing on the corresponding search results pages.

These models reflect the updates Amazon has made to its search volume methodologies within Search Query Performance metrics. This includes all historical search volume estimations within this analysis.