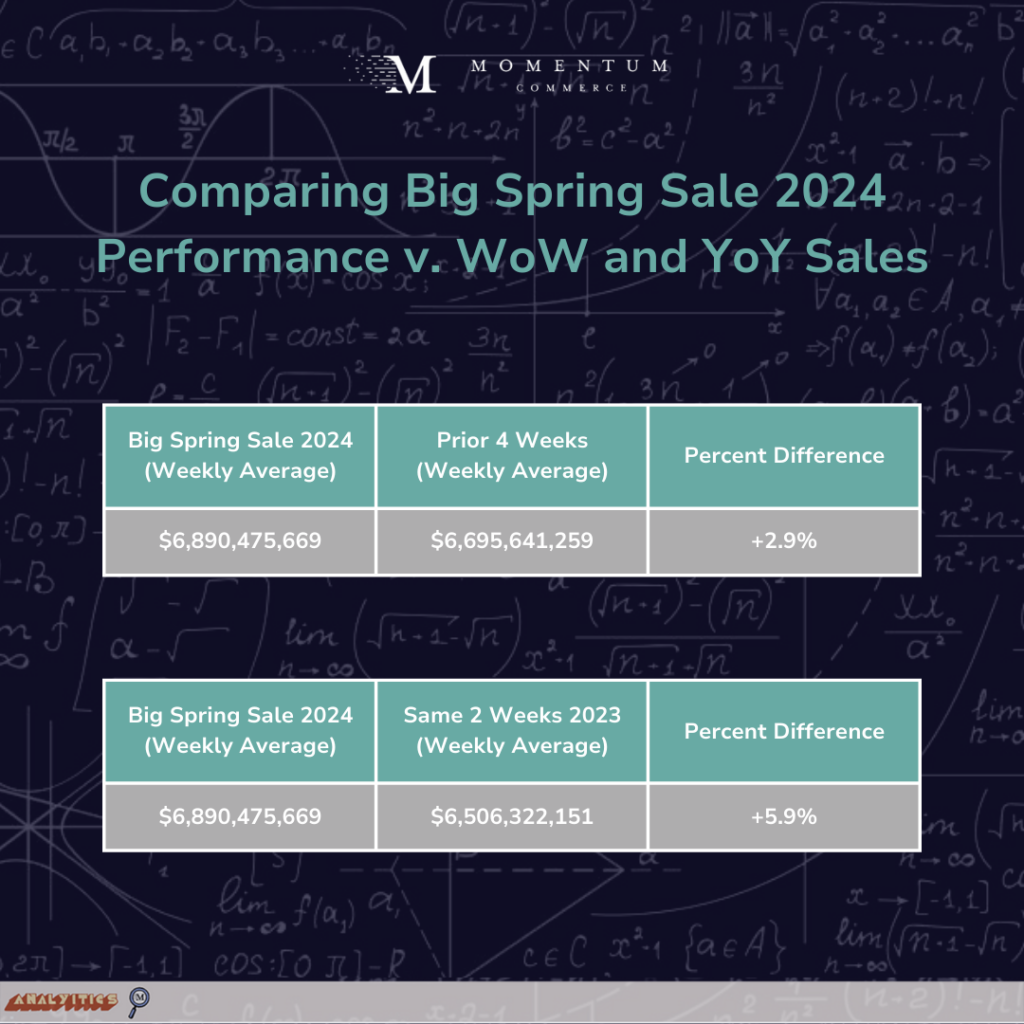

Amazon US Sales Rise 5.9% YoY During 2024 Big Spring Sale

March’s Big Spring Sale represented Amazon’s newest sale event, and its first that was open to all users – not just Prime members. While the number of deals rose significantly across the site, it wasn’t anywhere near the level of July’s Prime Day or October’s Big Deal Days. Meanwhile, seasonal categories like Patio, Lawn & Garden saw the biggest sales increases from prior weeks. Overall, Amazon US sales rose 5.9% compared to the same period in 2023, but that rate was roughly double the 2.9% year-over-year (YoY) revenue growth from the prior month.

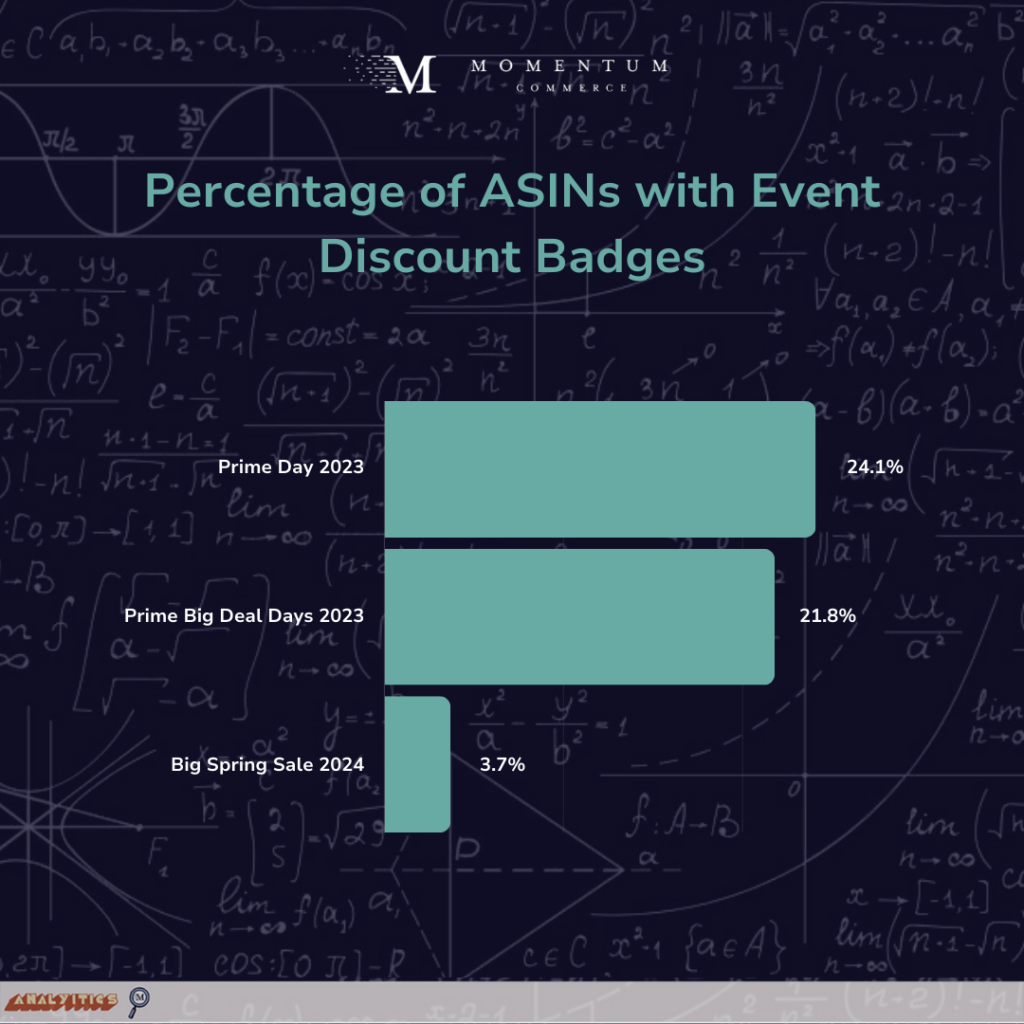

While there were no event-specific tags during the Big Spring Sale, users saw the evergreen “Limited Time Discount” tags on participating products, with those tags roughly doubling in frequency during the sales event.

During the Big Spring Sale, an average of 3.7% of all products on Amazon US had the Limited Time Deal tag. Compare that with last Summer’s Prime Day(s) and Fall’s Prime Big Deal Days, when roughly 22% and 24%, respectively, of products had event-specific discount badges.

There was a good degree of variation in the depth of discounts on a category-by-category basis. At the top, Patio, Lawn & Garden, Beauty & Personal Care, and Health & Household all sported average Limited Time Discounts beyond 34%.

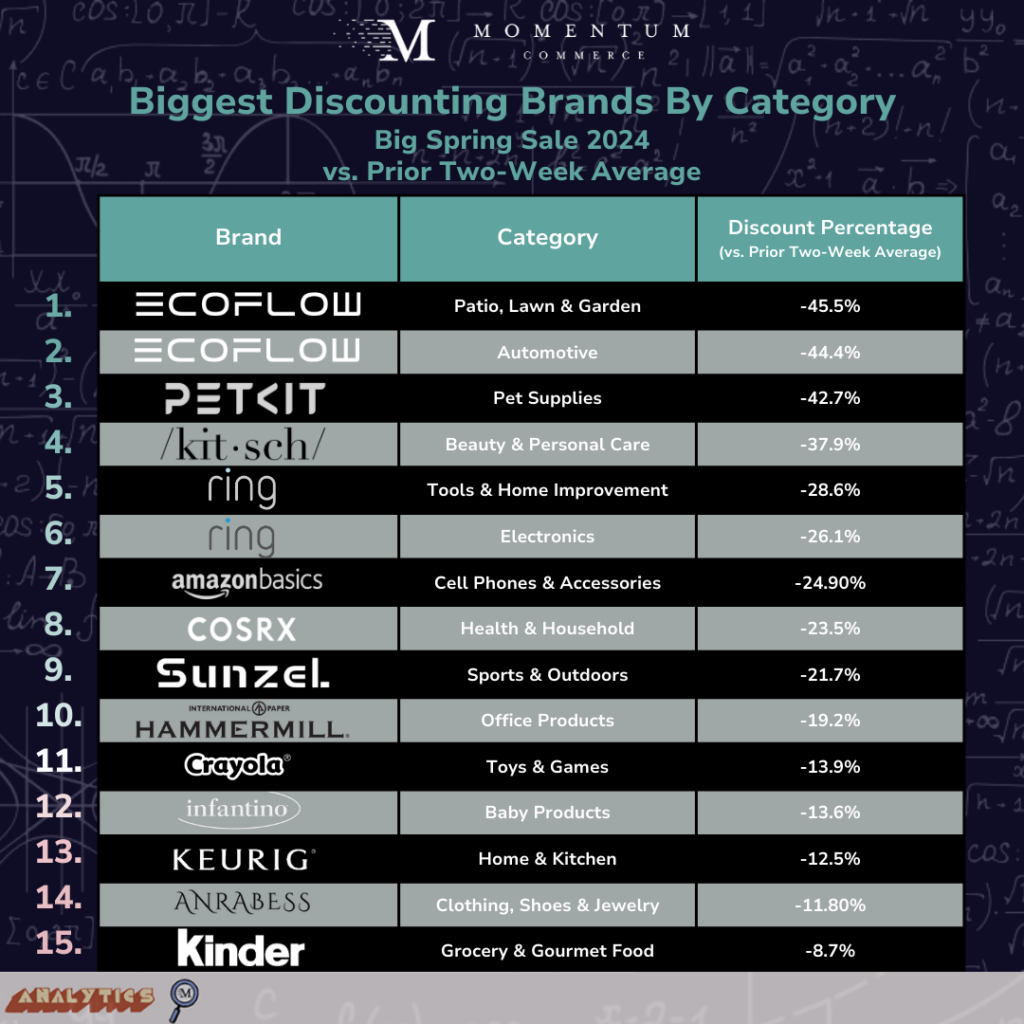

These larger trends are reflected to some degree across top-20 brands in the respective categories. While there was a range of discounting activity, both Beauty & Personal Care and Patio, Lawn, & Garden had one top-20 brand discounting by more than 40% from their prior two-week average.

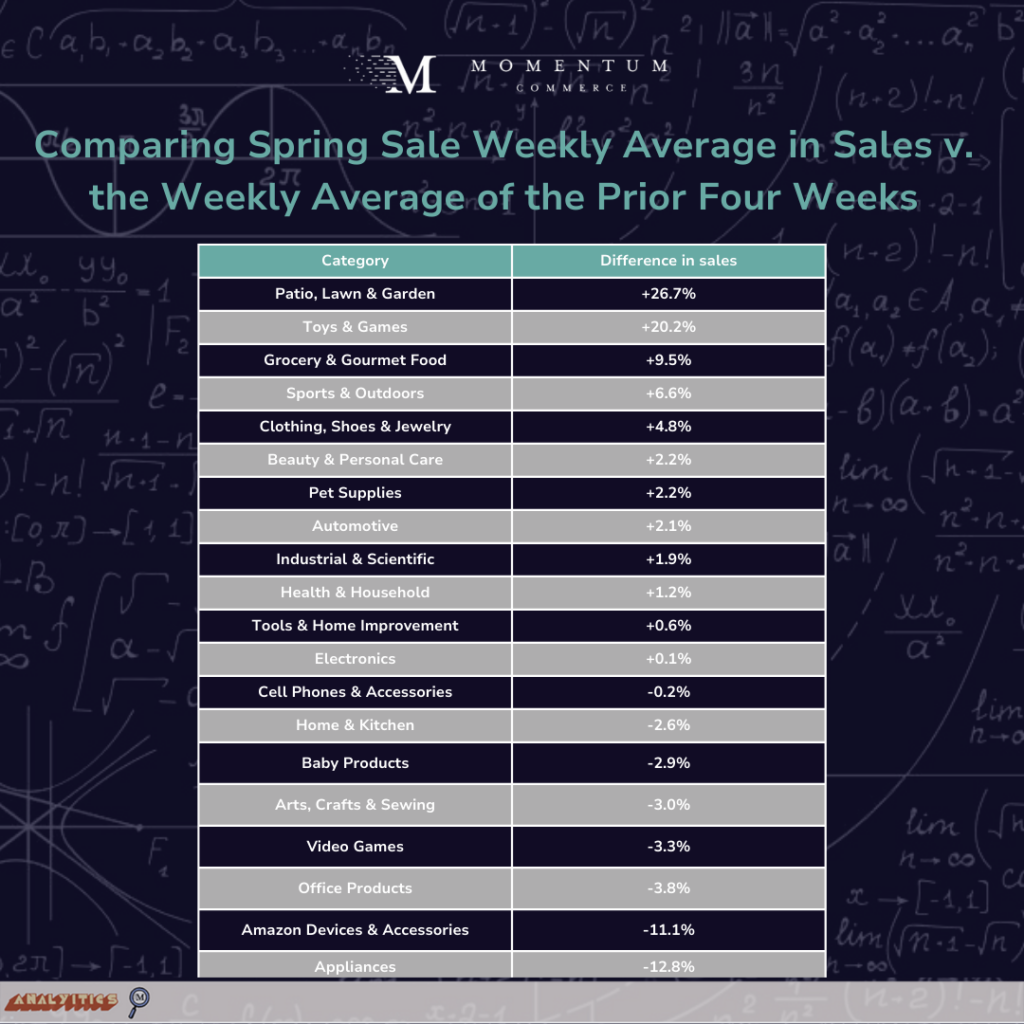

Actual sales activity during the event illustrates how more seasonal categories saw the biggest boost. Only Patio, Lawn & Garden, and Toys & Games saw sales figures rise by double-digit percentage points from the prior four-week average, with the former seeing increased activity given the coming warmer weather, and Easter-related sales helping drive sales in the latter.

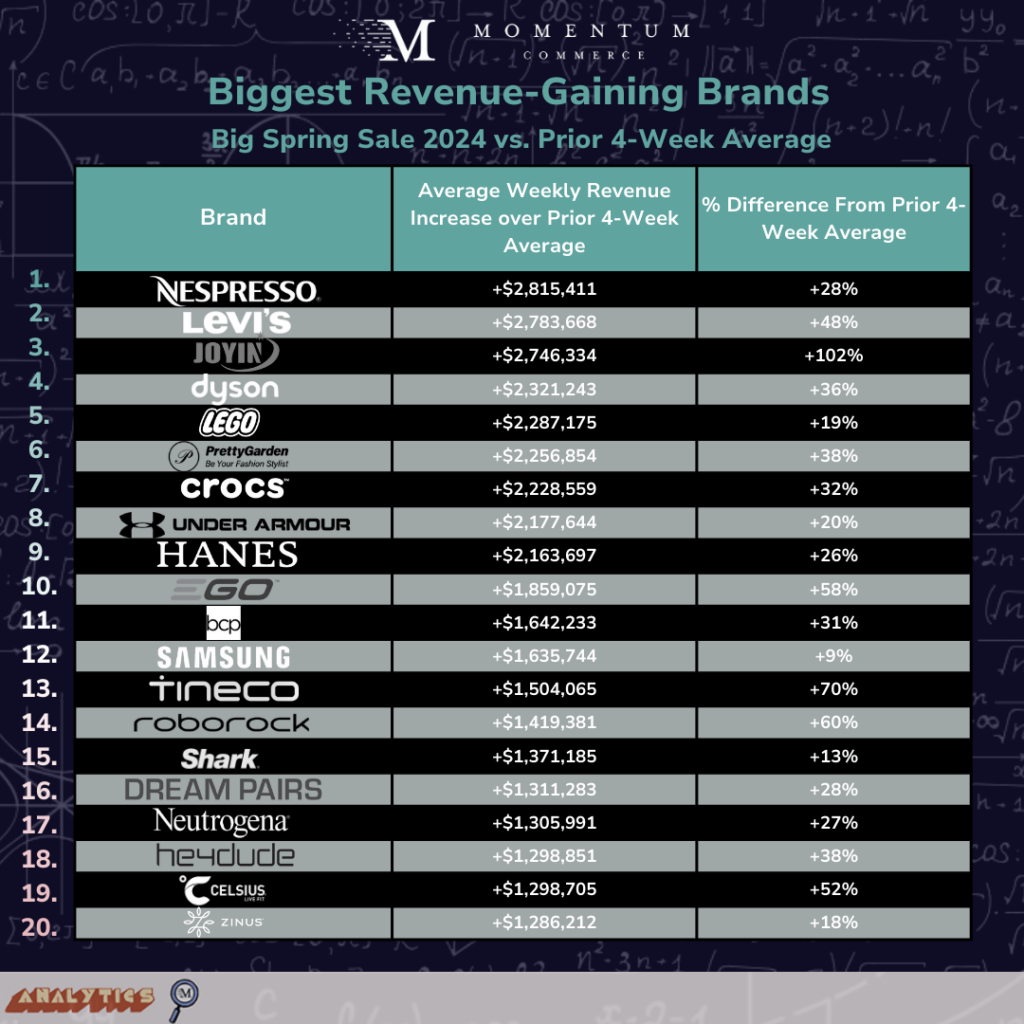

But these more muted results within individual categories don’t tell the full story. Zooming in on individual brands, many were still able to drive substantial revenue increases during the event, including a variety of brands outside of more seasonal categories.

Biggest Takeaways for Brands

- Amazon ‘seasonal sale events’ are here to stay – but with perhaps diminishing returns

- Amazon’s first ‘Fall Prime Day’ in 2021 has now spawned multiple seasonal events with the Big Spring Sale and Fall’s Prime Big Deal Days (the event known in 2022 as the Prime Early Access Sale)

- While it may be due to less promotion or less consumer interest, the diminished widespread revenue impact should temper brands’ expectations for one of these sale events to develop into a kind of ‘second Prime Day’

- During these ‘tier 2’ sale events, heavy, prominent discounting may not be “table stakes” in order to succeed

- While Hanes, Levi’s, and Roborock discounted relatively steeply during the Big Spring Sale, that wasn’t the case across the vast majority of brands that grew period-over-period revenue the most during the event

- Instead, Nespresso, Shark, Joyin, Hey Dude, and others ramped up their paid share of voice (SOV) during the sale period, with minimal to no discounting

Methodology

Momentum Commerce analyzed product sales, pricing, discount rates, and the presence of ‘Limited Time Discount’ badges on individual ASINs appearing at least once across the top one million search terms on Amazon between February 18 and March 25, 2024. The ‘Big Spring Sale’ period was defined as March 20 through 25, 2024, with sales figures expressed as a weekly average of the March 17 through 30, 2024 period. For YoY comparisons, the same data was drawn across the date range of March 19 through April 1, 2023, again expressed as a weekly average. Comparisons to prior sale events, including event-specific badge data were captured across the top one million search term sets during both Prime Day 2023 (July 11-12, 2023) and Big Deal Days 2023 (October 10-11, 2023).