Amazon Searches with No Reviews Displayed Jump 3X; Little Impact to BSR

|

Data Science

Retail Media

Retail Strategy

December 8, 2022 · 2 min

Last month, we noticed some anecdotal evidence of searches on Amazon showing no reviews for all results outside of Sponsored Brands listings. To help quantify this issue, Momentum Commerce dove into our massive repository of Amazon search data.

The Research:

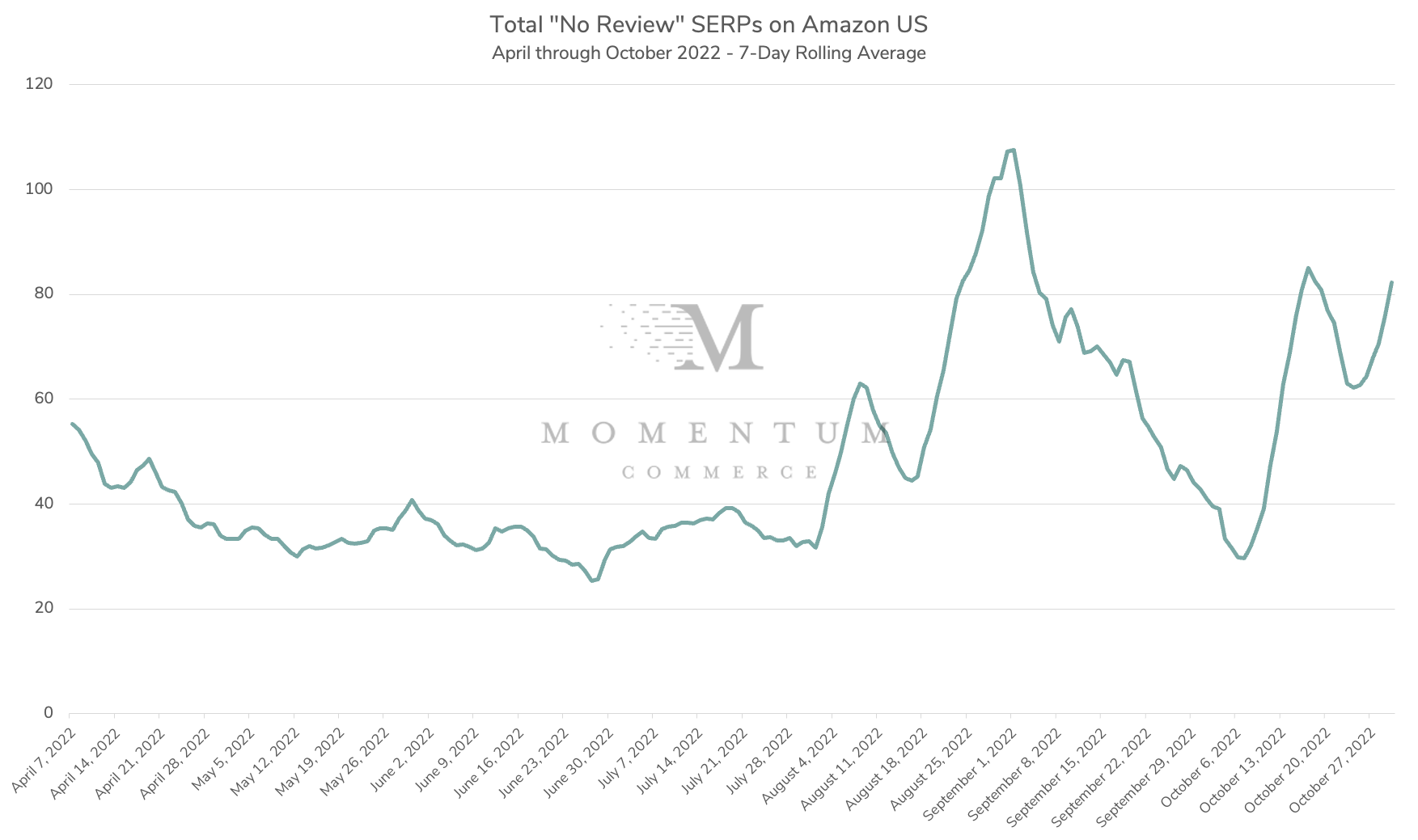

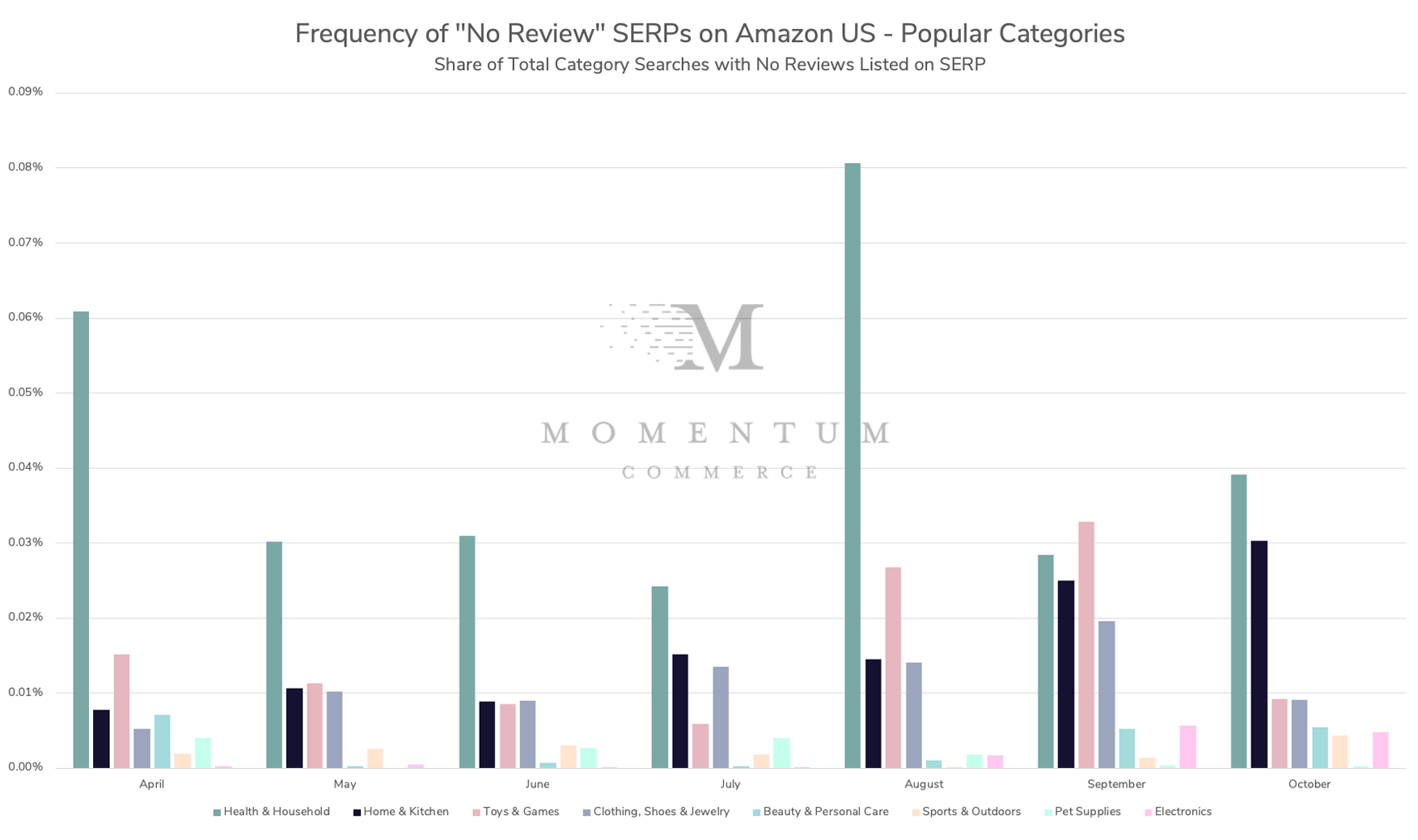

Momentum Commerce analyzed the presence of review information listed on Amazon search results pages (SERPs) from April 1 through October 31, 2022. Searches were categorized based on what products appeared on the SERP. To maintain a consistent set of terms, all portions of the analysis were against the top 500,000 search terms on Amazon over the course of October 2022.

The Story:

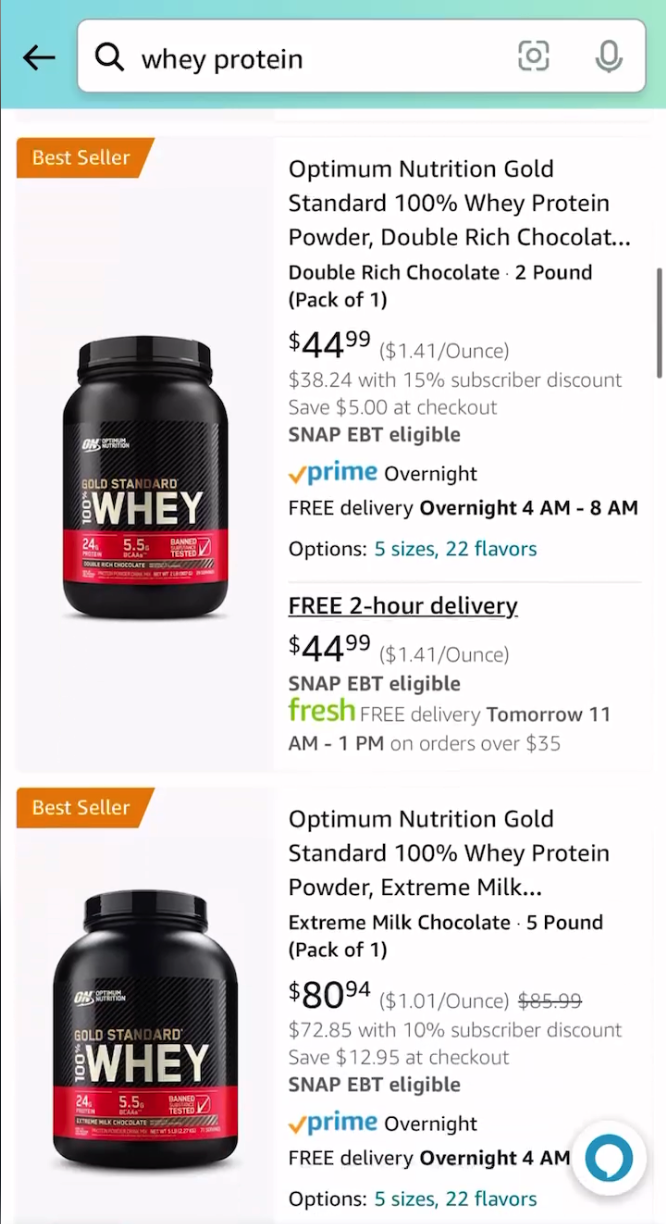

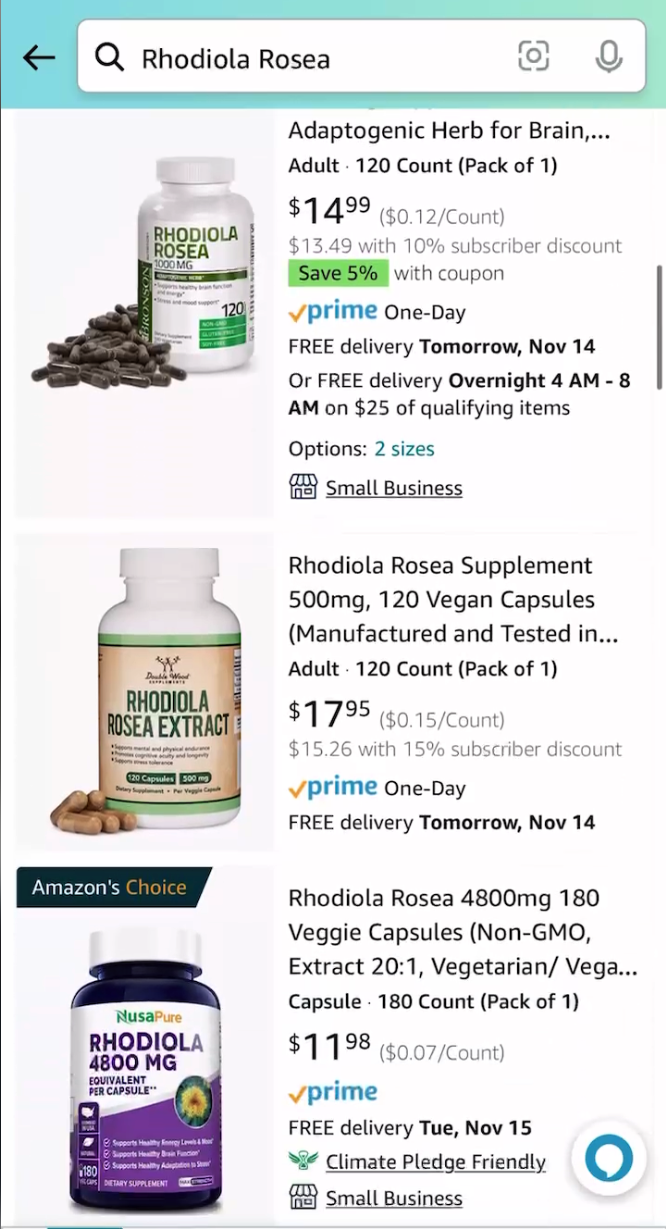

- In both August and October 2022, the number of search results pages (SERPs) across Amazon displaying no reviews jumped by 3X from prior levels

- However, the share of searches this represents on Amazon remains relatively low – between 0.01 and 0.02% on any given day within the analysis. This does vary significantly by category, with Health & Household searches leading the way.

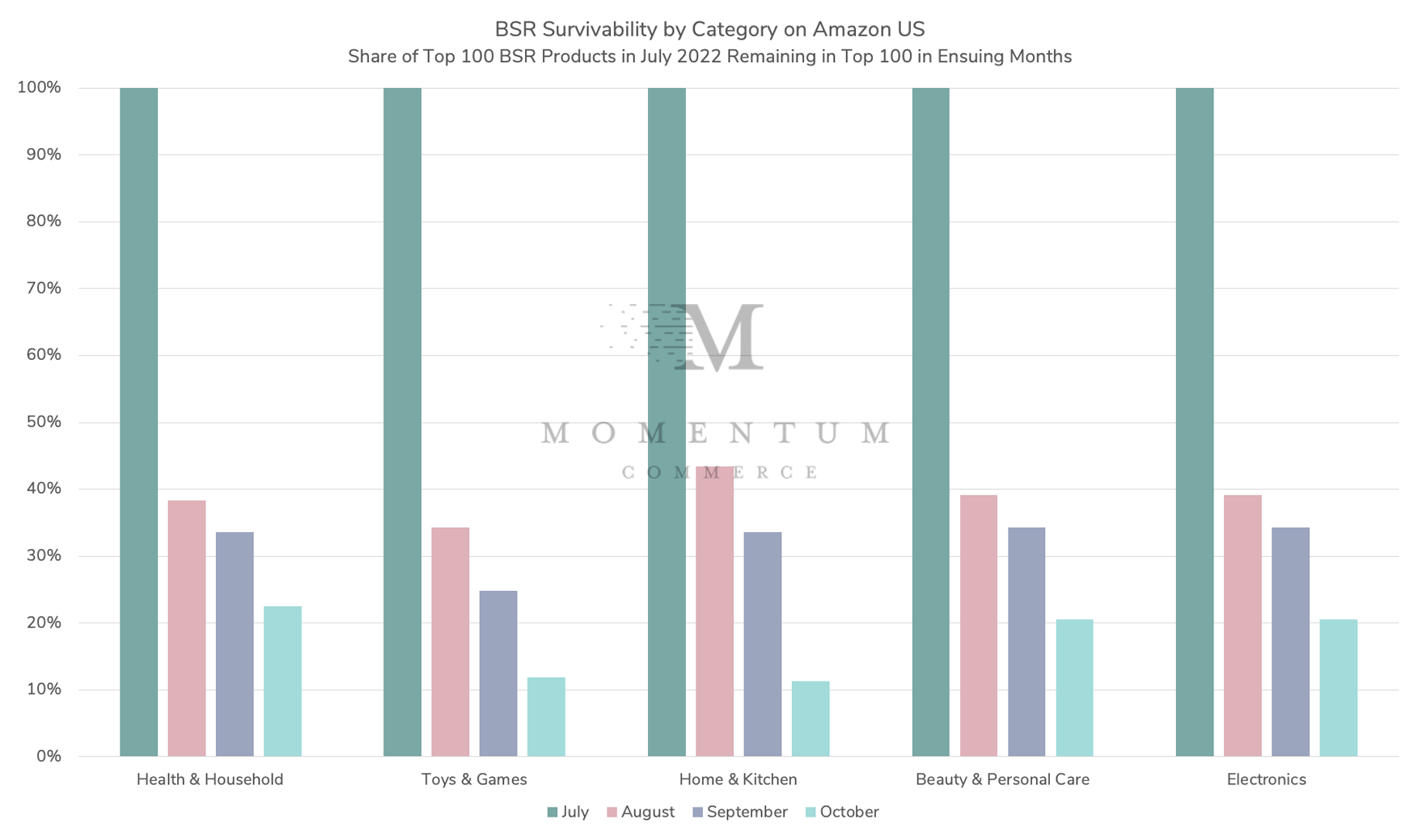

- There’s little evidence suggesting the increasing frequency of “reviewless searches” are having broader impacts in terms of best-seller rank (BSR) durability. Higher ‘no review’ rate categories like Health & Household saw similar month-over-month BSR degradation rates as categories like Electronics, which demonstrated comparatively low rates over the same timeframe.

Biggest Takeaways for Brands:

- The growing incidence of review-less searches demonstrates the need to look beyond ‘review moats’ as the sole means of differentiation. While review counts and ratings will remain important, brands should seek to improve their relative price and share of voice wherever possible in order to remain dominant.

- Amazon will continue to test and deploy relatively major changes to the search experience. The more you can track these changes as they occur through data tools or partnerships, the better you’ll be able to gauge potential implications and tactical countermeasures.