The Long-Tail on Amazon Doesn’t (Really) Matter

What makes Amazon sales of a given product grow the most? It’s showing up in the right Amazon searches, in the right placements.

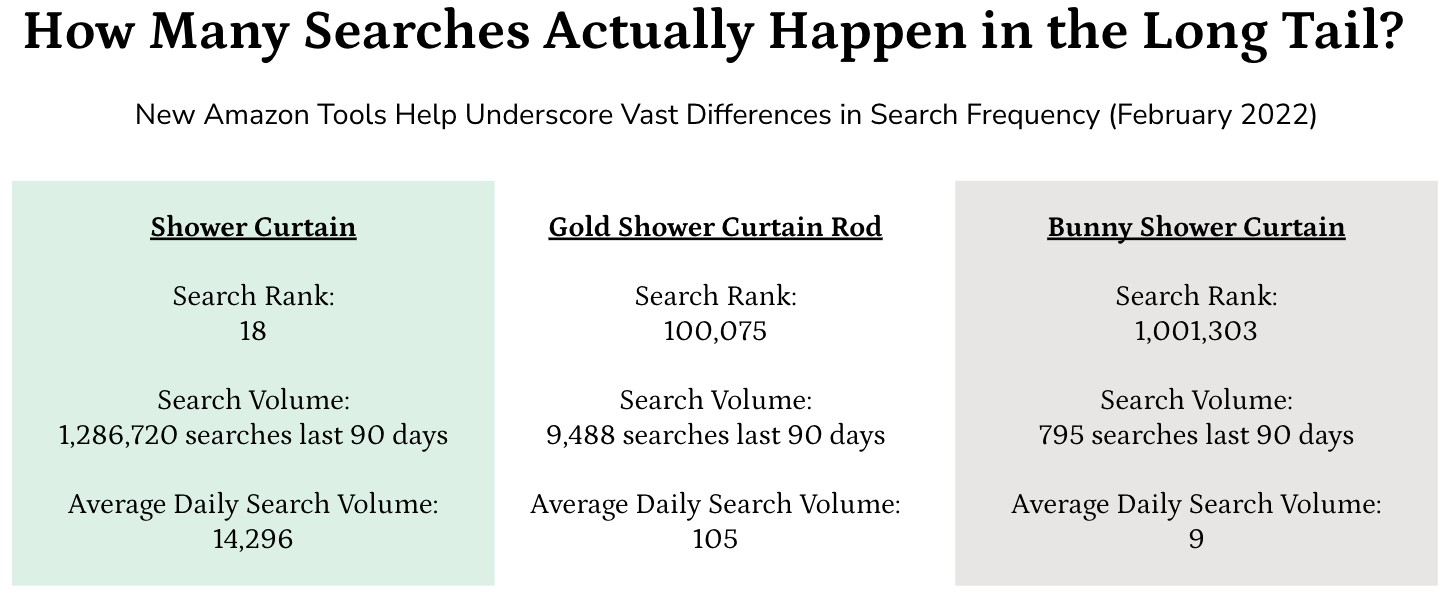

Underscoring this is one of Amazon’s newest tools, Product Opportunity Explorer (presently in beta), which provides the exact 90-day search frequency of individual search terms. This is tremendously valuable in determining the relative value of ranking high on a given search term, and whether you should target it with advertising or product content. More specifically, what the underlying data demonstrates is that what some brands may consider “top” search terms, actually don’t drive much search volume at all.

The example above demonstrates that while Amazon is a massive marketplace, there is a relatively steep drop off in search volume as you move down in popularity rank. The folly marketers can run into is thinking that achieving the first result for a less popular but hyper-focused term is an indicator of success for a given product. In terms of scaling, maximizing revenue and capturing market share, search term popularity needs to be heavily weighted when setting a marketing strategy around penetrating top of search. Long-tail searches for niche or ‘spear-fishing’ type terms just won’t cut the mustard over the long haul.

Key Observations

- Amazon’s new Product Opportunity Explorer tool provides search volume data for a wide range of search terms

- Data demonstrates that search terms in the ‘long tail’ of popularity simply don’t drive significant volume, and likely aren’t worth brands focusing on, regardless of specificity

- To drive knock-on effects for organic ranking on popular terms, brands need to develop a marketing strategy designed to help an ASIN show up within popular search results more often over time, particularly during key periods

- ASINs that show up most often across the most popular search terms share some characteristics

- Comprehensive retail readiness on the product detail page

- Paid support against similarly popular terms

- Increased visibility with paid placements on top terms filtered down into greater organic placements on a wider array of top terms

The ASINs that Dominate Amazon Search

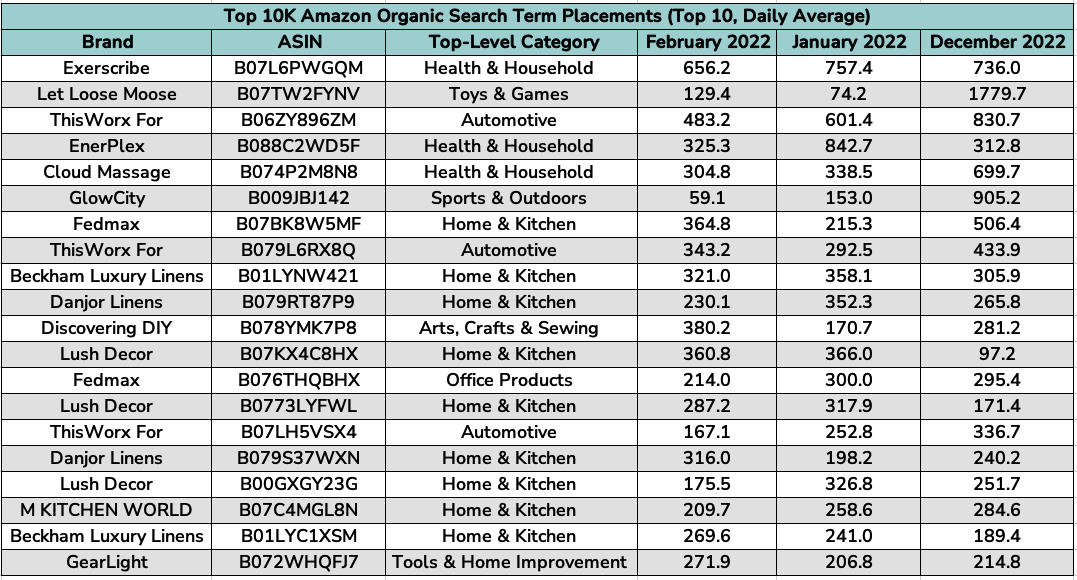

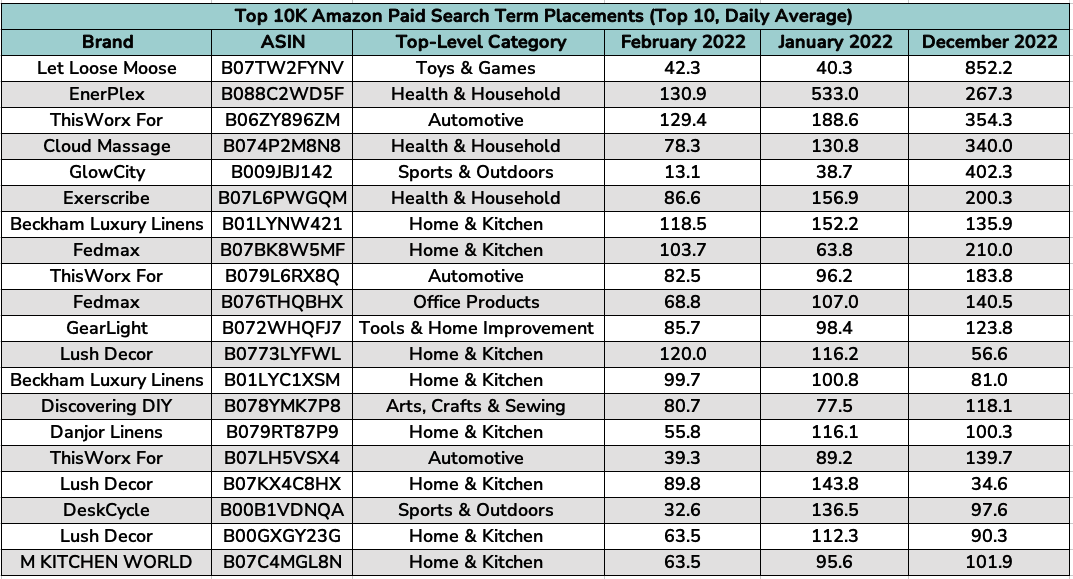

So what are the ASINs that do this the best? Momentum Commerce looked across three months worth of Amazon search data to determine what ASINs are ranking in the top 10 placements most often across the most popular 10,000 terms. For some degree of consistency, we utilized three distinct top 10,000 search term sets from January 1, February 1, and March 1, 2022, and applied the daily search results on those terms retroactively to the prior month. This means for example, results throughout February relate to the same group of top 10,000 search terms from March 1, the results throughout January relate to the same group of top 10,000 search terms from February 1, etc. We ran this analysis both for paid and organic results separately.

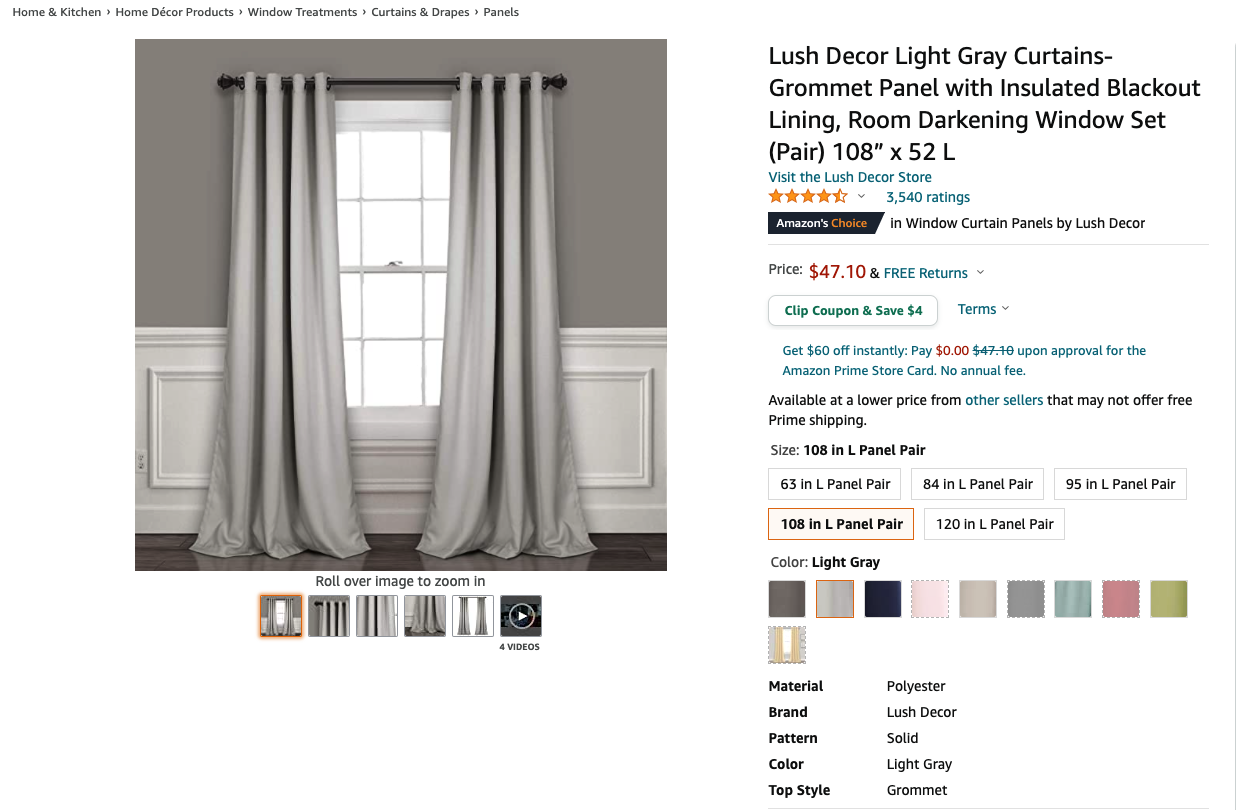

A variety of Home & Kitchen products populate the top of the organic list, likely related to the fact that terms in that category command a plurality of the most popular searches on Amazon most months. Even so, at a qualitative level, these ASINs present a number of characteristics others can emulate. The example below is the 12th most visible product across top search terms from December through February.

Notice the product title hits on use case related terms – ‘blackout’ ‘insulated’ ‘room darkening’ – along with the measurements. Lush Decor, a Momentum Commerce customer, also did not skimp on the product imagery, and certainly, the four-figure review count helps. Outside of these more retail-readiness related items, Lush Decor’s organic velocity was mirrored by its aggressive paid strategy on top terms over the same period.

This pattern is repeated by ASINs in categories like Toys & Games and Sports & Outdoors. Increased visibility with paid placements on top terms filtered down into greater organic placements on a wider array of top terms. Especially during high volume periods like the December shopping season, investing in sponsored top-of-search placements on high volume terms that are most related to your product (e.g. toy soccer ball) can then have downstream effects on placements on even more popular generic terms (e.g. gifts for six year olds).

The big takeaway for brands is that after setting a good foundation with a great product and best practices in retail readiness behind it, it’s imperative you take a wider view of what search terms on Amazon will drive true growth. Along those lines, you also want systems and strategies in place to continually adjust as market conditions and the popularity of terms change. An example of data to back up these shifts are methods like our Amazon Aggregates we discussed in a previous post. This forms the basis for a marketing strategy designed to help an ASIN show up within popular search results more often over time, and particularly during key periods.