Amazon Pushes Cheaper Goods in Generic Holiday Search Results

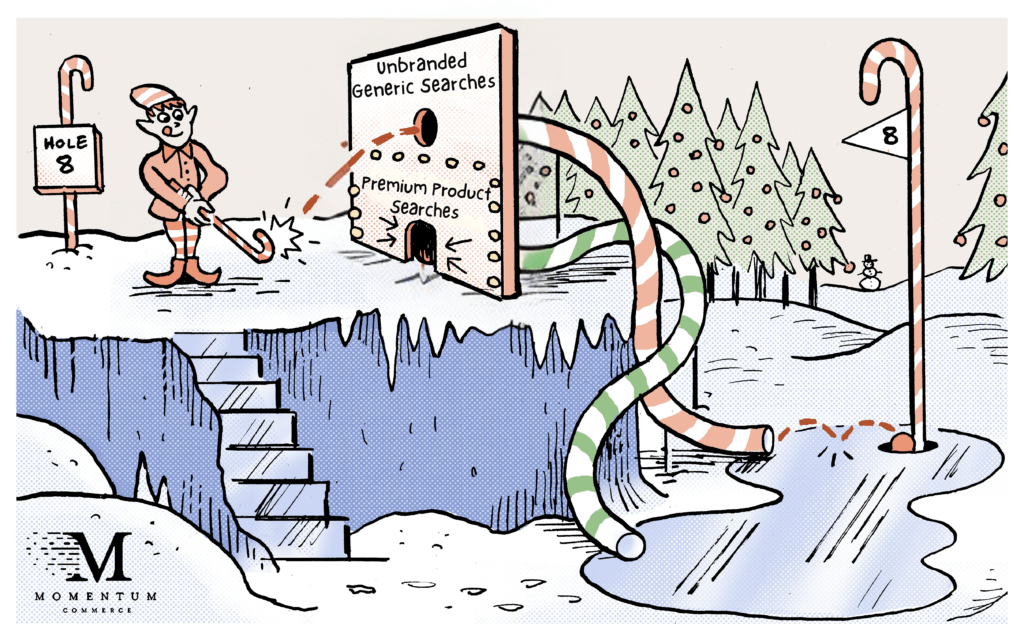

During the peak holiday shopping season, some of the most popular search terms on Amazon are unbranded generic searches like ‘gifts for men’ or ‘stocking stuffers for adults’ — respectively the 16th and 35th most popular search terms on Amazon US in December 2023.

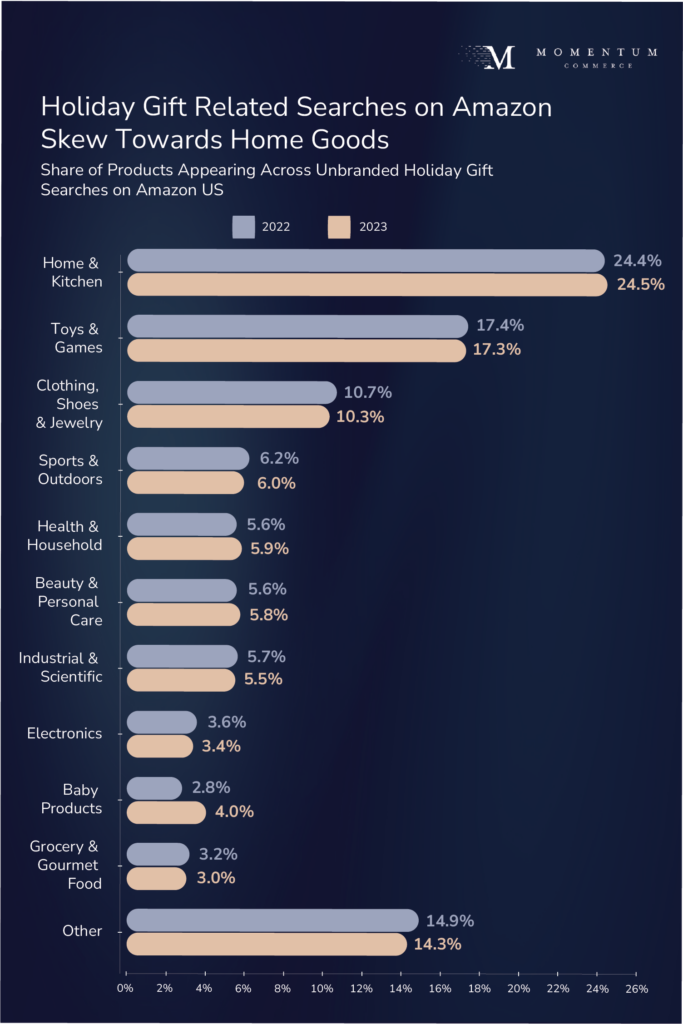

This regular surge in popularity makes ranking for these terms very attractive for brands, though achieving this organically without paid placement can be a challenging goal. After looking at two years’ worth of organic search results on these generic, holiday search terms during November and December it’s clear that Amazon prioritizes products that skew more towards Home Goods and are, on average, cheaper than the site as a whole.

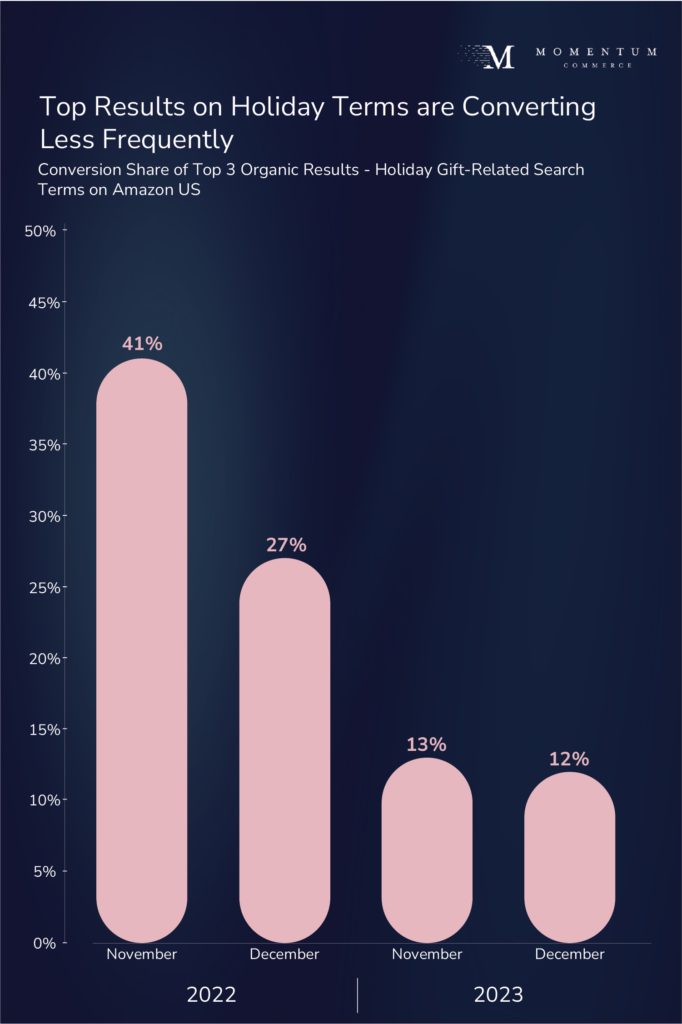

However, Amazon data shows that conversions on these searches have grown progressively less concentrated across the first few results — expected given the open-ended nature of the query — but this minimizes the potential dollar value of ranking highly.

In terms of what types of products appear for these search terms, across both years studied, these were the top five subcategories by organic product appearances across unbranded holiday gift search terms. Only two subcategories out of this top group are not under the Home & Kitchen umbrella:

- Glassware & Drinkware

- Beauty Sets & Kits

- Throw Blankets

- Night Lights

- Portable Bluetooth Speakers

The heavy weight towards Home & Kitchen is even more stark when looking across the top-level categories represented on the results pages:

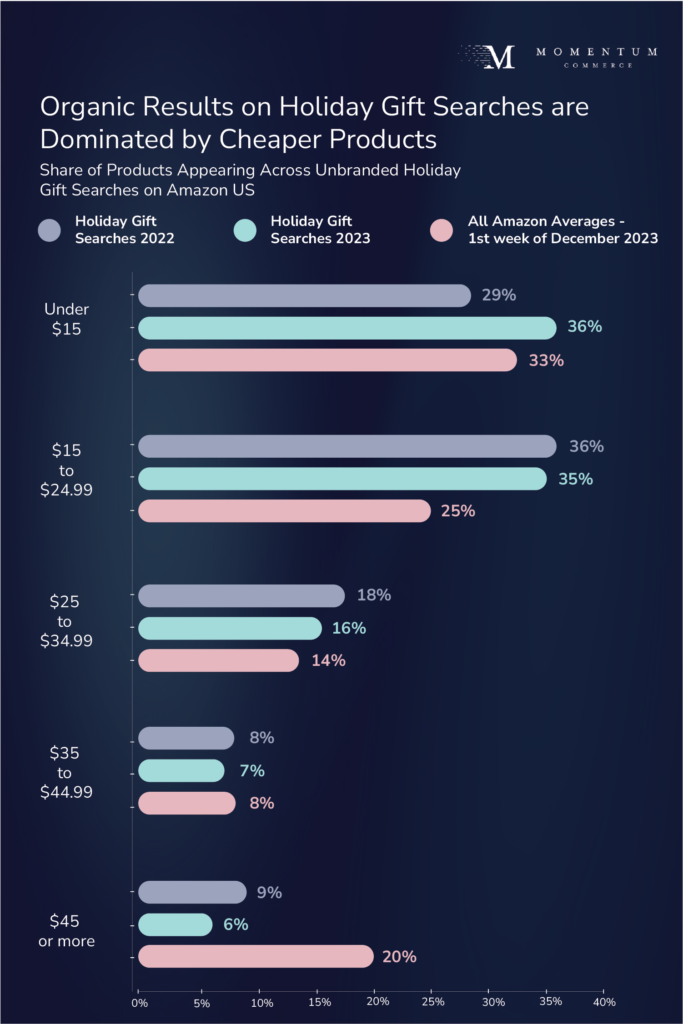

Products that show up organically for these terms also skew significantly lower in price than the site as a whole. In 2023, just 6% of products that appeared on these terms were priced $45 or higher. Across Amazon, 20% of products are priced in that same band.

You can see this reflected in the five products that showed up most frequently in the past two holiday seasons across these terms for at least one of the first three organic search results:

- DIY Collage Kit for Teen Girls by Hapinest (https://www.amazon.com/dp/B09BP35P1Y)

- Burt’s Bees Gift Set by Burt’s Bees (https://www.amazon.com/dp/B004EDWMBO)

- Klutz Lego Gear Bots Kit by Klutz & Lego (https://www.amazon.com/dp/1338603450)

- Date Night Game Box by All Natural Shop (https://www.amazon.com/dp/B08YWP5QRF)

- Fidget Cube by Shashibo (https://www.amazon.com/dp/B08FPGR7V7)

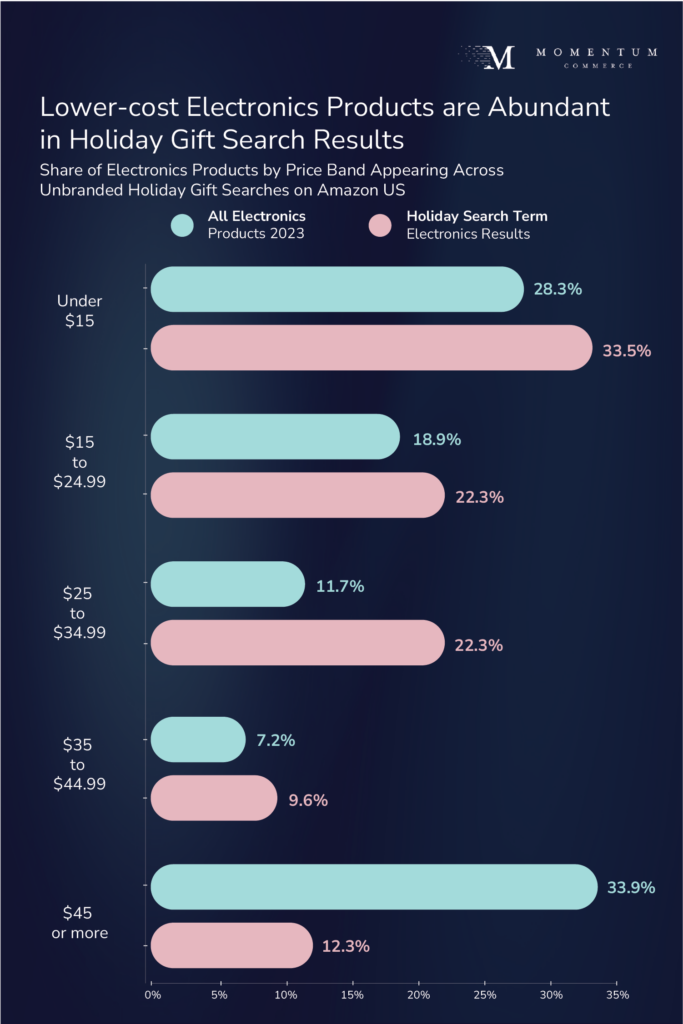

This trend towards lower-cost goods even extends to Electronics products that appear on these gift search terms. Despite being a popular higher-ticket category during the holiday season, just 22% of the Electronics products that appeared organically across this search term set were priced above $35. Across Amazon as a whole, that number is 41%.

Biggest Takeaways for Brands

- Conversion rates on popular gift-related terms are declining for top-of-search

- Despite being super popular, changes to consumer shopping behavior make ranking on these terms less valuable than it used to be

- That being said, if you’re a brand selling lower-cost items, you’re better positioned to rank organically on gift-related terms

- Amazon clearly prioritizes these low-priced items, likely because they tend to convert well for these types of searches

- Ensuring your content is optimized for the holidays and sales velocity is high leading into the peak period (potentially through ads and/or discounts) are the best methods for positioning your product to rank organically on these terms

- For premium products, it’s almost assuredly a ‘pay to play’ on these top gift search terms during the holiday season

- Proceed with extreme caution here – conversion rates are declining for top-of-search placements, and brands should also anticipate high CPCs and likely lower conversion rates regardless given the lower-priced options that will be ranked organically on the same SERP

- Optimize your product listings for the holidays, but don’t expect these unbranded placements

- Consumers respond to product titles, descriptions, and imagery that reflect the season and related use cases

- This is something all brands should be doing in advance of the holiday peak and is a function well suited for Amazon’s new AI tools

- However, brands should focus on setting directly controllable goals related to improving overall search visibility, conversion rate, and overall sales growth

- Consumers respond to product titles, descriptions, and imagery that reflect the season and related use cases

Methodology

Momentum Commerce identified more than 2,700 search terms that were within the top one million search terms on Amazon during the month of November 2023 or November 2022 that contained “gift”, “gifts”, “present”, “presents”, “stocking stuffer”, “stocking stuffer”, or “toys for”, and also included no brand name. Additionally, search terms specifically referencing other events (e.g. birthday, easter, anniversary) were excluded from the analysis. Momentum Commerce then examined all products that appeared organically across the top 10 results on these searches between the dates of November 1 through December 22, 2022 and November 1 through December 22, 2023, including category, brand name and pricing information, for year-over-year comparisons.