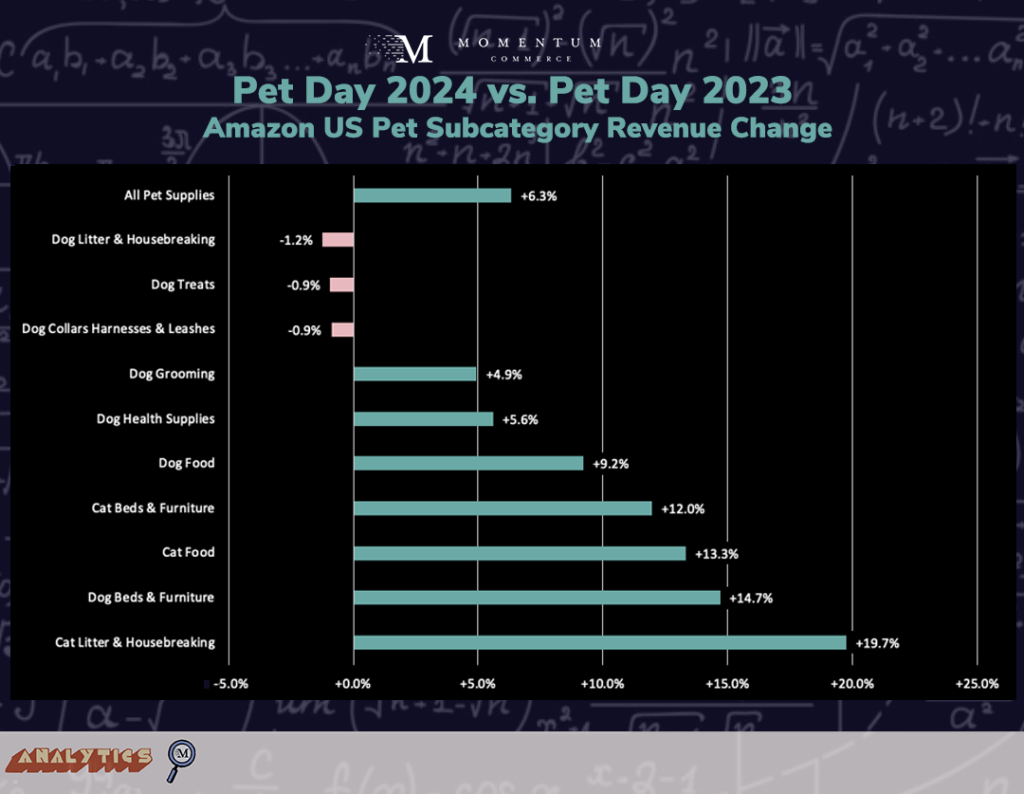

Amazon Pet Day Sales Rise 6.3% Year-over-Year in 2024

From May 7 through 8, 2024, Amazon’s Pet Day sales event entered its third year as part of Amazon’s overarching bid to compete with specialty pet retailers like Chewy. Overall, broader Pet Supplies category sales on Amazon grew 6.3% the week of the 2024 Pet Day sales event compared to the week of Pet Day 2023. However, these gains were centralized across just a few subcategories, and the fortunes of individual brands varied considerably on a year-over-year (YoY) basis.

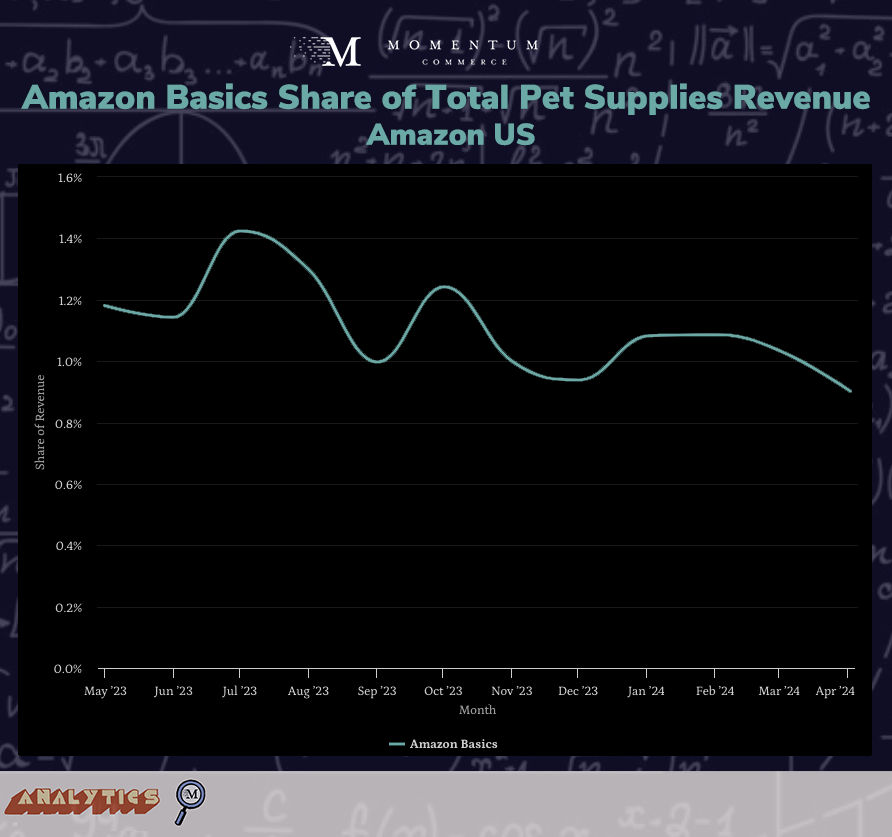

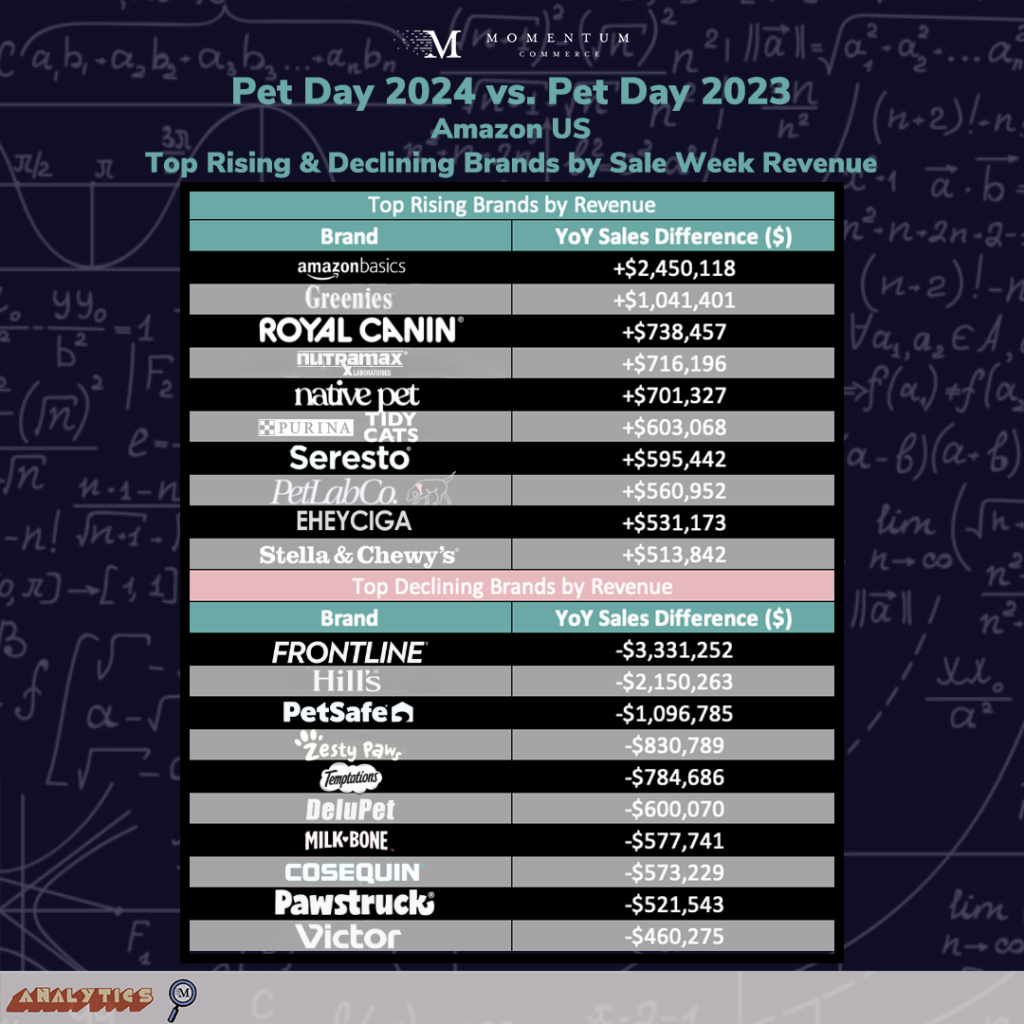

At a brand-by-brand level, Amazon Basics pet supplies had the largest revenue increase compared to Pet Day 2023 by a significant margin. This is despite the brand’s share of Pet Supplies category revenue ticking steadily downwards over the past year.

Beyond Amazon Basics, a number of brands posted YoY revenue increases of more than $500K during the week of Pet Day. Conversely, other brands saw marked declines in weekly revenue YoY, demonstrating how Pet Day overall revenue growth was anything but universal across the Pet Supplies space on Amazon.

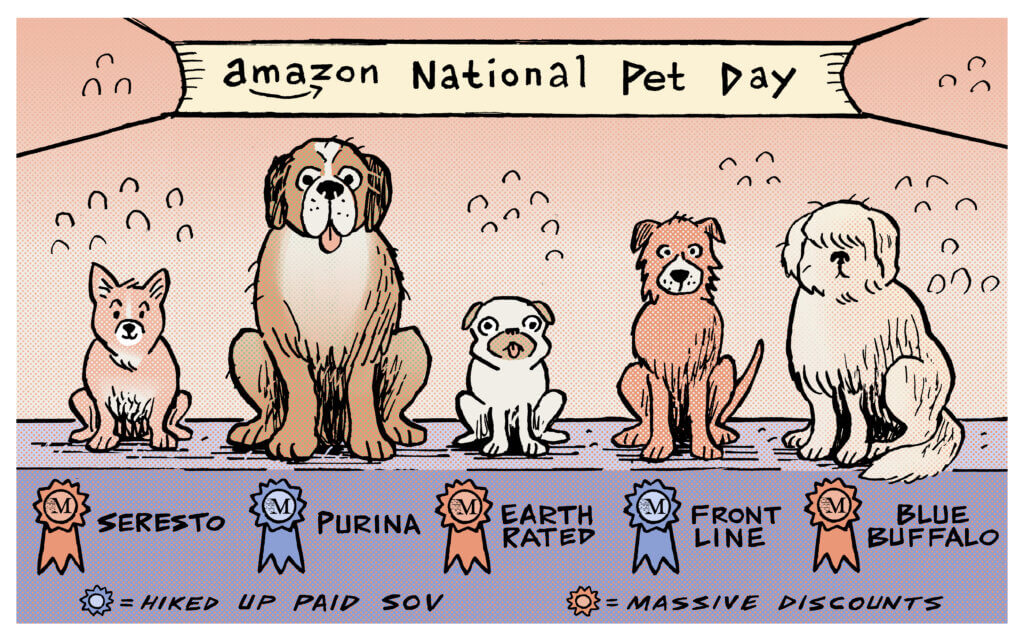

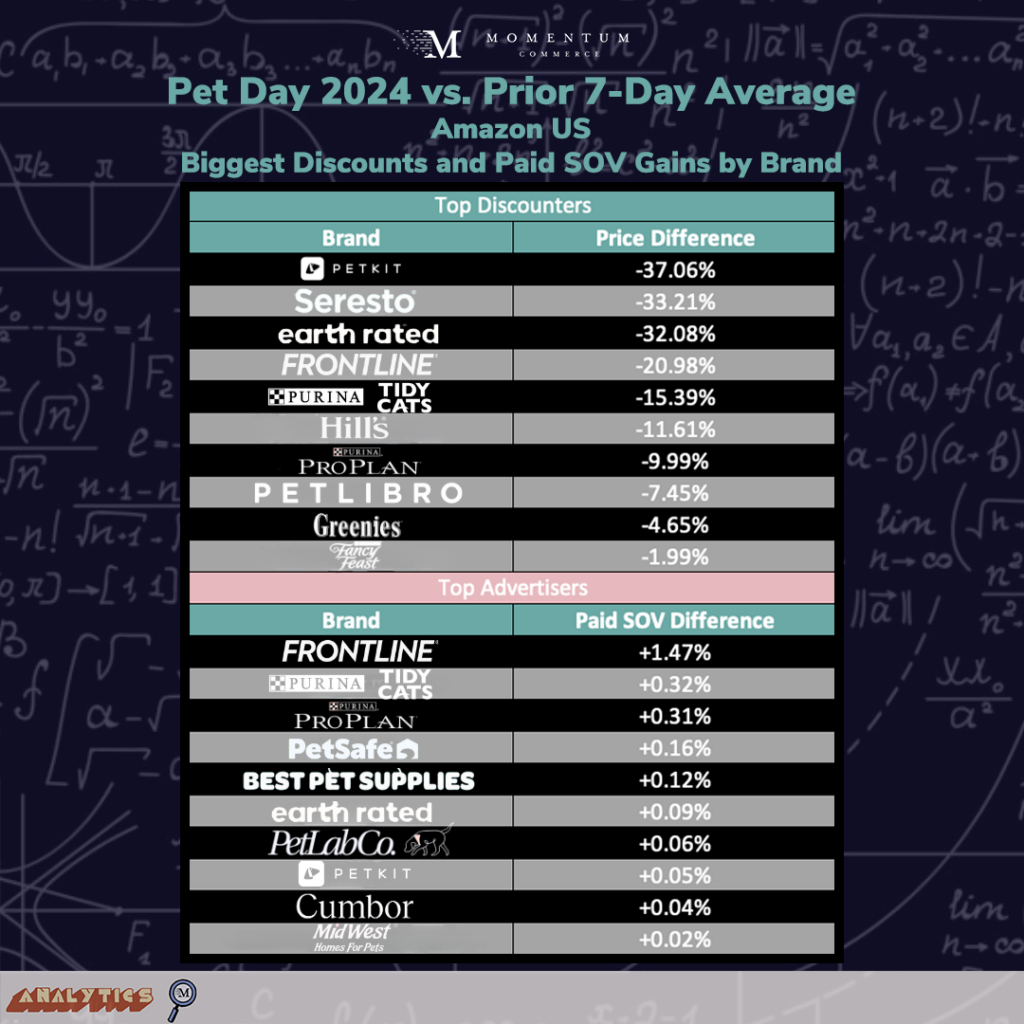

From a tactical perspective, across the top 25 Pet Supplies brands there were examples of brands conducting both extensive discounting paired with driving substantial increases in category Paid SOV.

Most strikingly, despite the largest Paid SOV increase during the two-day Pet Day period compared to the prior week’s average, Frontline had the largest YoY revenue decline of any brand studied. The brand’s revenue in the Flea & Tick Control subcategory has declined 64% over the past year, underscoring how advertising alone isn’t a cure-all on Amazon, particularly in higher consideration categories like pet health.

Biggest Takeaways for Brands

- Events like Pet Day show that Amazon hasn’t fully eaten Chewy’s lunch (yet)

- Pet Supplies sales on Amazon during Prime Day, Big Deal Days, and Turkey 5 2023 all significantly outpaced Pet Day

- While Amazon is estimated to have a larger share of the eCommerce Pet Supplies market, the persistent single-digit YoY growth rates aren’t very far off from Chewy’s figures

- Driving success during category-specific sale events requires a great deal of care – don’t rely on simple strategies

- Pet supply shopping during Pet Day was clearly weighted towards specific classes of products, and this contributed to the fact that brands that took similar discounting or advertising strategies often saw vastly different outcomes

- It’s critical for brands prior to these events to have a clear line of sight on the price elasticity of demand for key products so discounting is employed where it will do the best, search volume trends so budget is allocated effectively, and an overall ads strategy that emphasizes driving new-to-brand sales

- In higher consideration categories, the marginal utility of increased ad investment may be minimal for existing top brands

- If click and conversion rates across key terms indicate consumers are doing extensive filtering and scrolling before purchasing, it’s worth closely evaluating search advertising campaign architecture and likely placing a higher priority on top-of-funnel efforts

- Prior to dramatic increases in ad investment both during events and throughout the year, brands in higher consideration categories should examine historical trends for their brand in terms of how increasing Paid SOV relates to any changes in revenue and market share

Methodology

For sales metrics, Momentum Commerce analyzed and compared weekly Amazon US sales figures across products sold within the Pet Supplies category and associated subcategories during the periods of May 5 to May 11, 2024 (Pet Day 2024) and April 30 to May 6, 2024 (Pet Day 2023). Subcategory breakdowns were restricted to those at depth-level three (e.g. Pet Supplies > Dogs > Dog Food).

Average discount and Paid SOV metrics reflect the period of May 7 and 8, 2024 compared to the prior one-week average (April 30 through May 6, 2024) across the top 25 brands by Total SOV over that same period.