Momentum Commerce Category Deep Dive: Volatility of Kitchen Utensils & Gadgets Category Highlights a Fragmented Market

Market leadership changes hands four times in 12 months as brands compete for category, with holiday strategy proving decisive

The Kitchen Utensils & Gadgets category on Amazon US presents an intriguing competitive landscape. While overall revenue held steady at -0.1% YoY, significant shifts occurred over the past 12 months, with four different brands holding the top market share position, and 22 brands entering the top 10 for at least one month over the same period. This analysis examines how ThermoPro successfully navigated this environment, particularly during the critical holiday season when category revenue jumped more than 90% above average monthly levels.

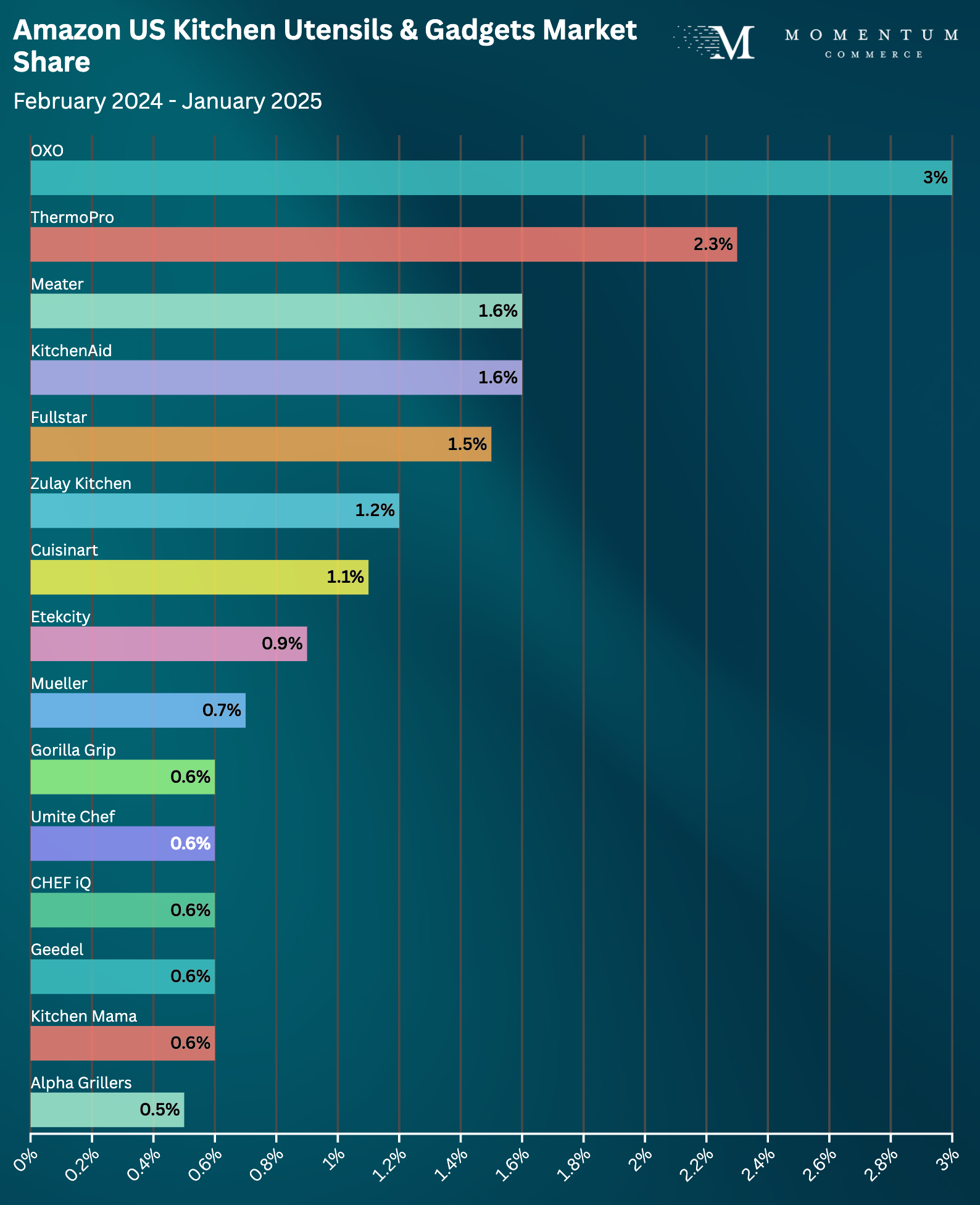

The data reveals a notably tight competitive landscape in Kitchen Utensils & Gadgets. Market leader OXO maintains only a slim advantage, with six brands falling within 2 percentage points of their market share. This compressed competitive environment creates specific opportunities during peak selling periods:

- Category revenue in November and December 2024 increased +49.3% and +93.6% respectively versus the prior nine-month average

- During these critical months, ThermoPro and Meater successfully displaced OXO from the top position

- The revenue concentration during these periods (approximately 25% of annual sales) amplifies the impact of successful holiday strategies

Market share dynamics show tightly contested category

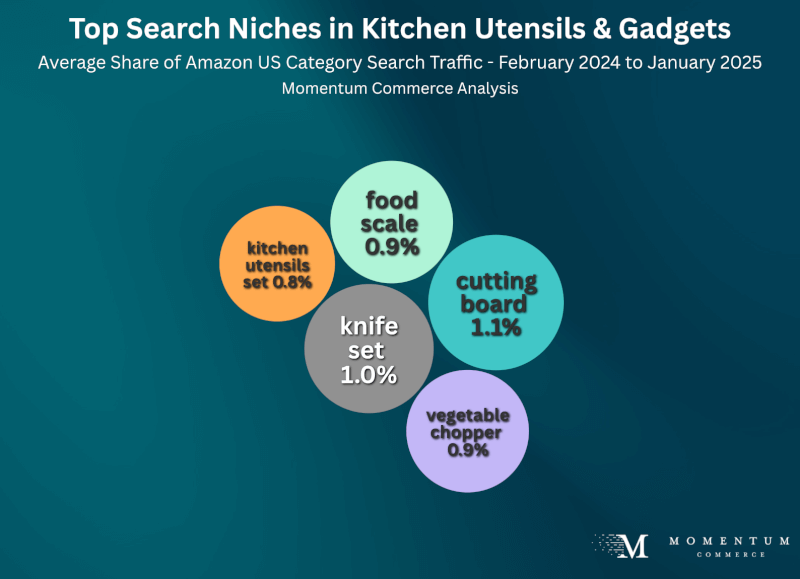

Search Analysis: Product Function Dominates Category Search Terms

Search data reveals a clear pattern: consumers overwhelmingly search by product function rather than brand name. The top 10 search terms are all non-branded, function-specific queries like “can opener” and “measuring cups.” This search behavior has direct implications for brand strategy:

- Organic and paid visibility on function-based terms drives more traffic than brand terms

- Category leadership requires strong performance across multiple product-specific searches

- Success depends more on product utility and visibility than brand recognition

Search volume analysis shows consumer searches revolve around specific functions, not brands

ThermoPro’s path to market leadership in November and December 2024 offers specific insights into effective peak-period strategy in the Kitchen Utensils & Gadgets category. The brand combined three key tactical elements, each supported by measurable results.

Data-Driven Holiday Strategy: Three Key Components

Analysis of ThermoPro’s holiday performance reveals the following tactical approaches:

- Strategic Discount Implementation

ThermoPro’s November-December discount strategy showed clear prioritization:

- Cross-platform promotion through social media and retail channels

- Discounts launched simultaneously across its Amazon and D2C channels

- Emphasis on gift sets and premium products rather than entry-level items

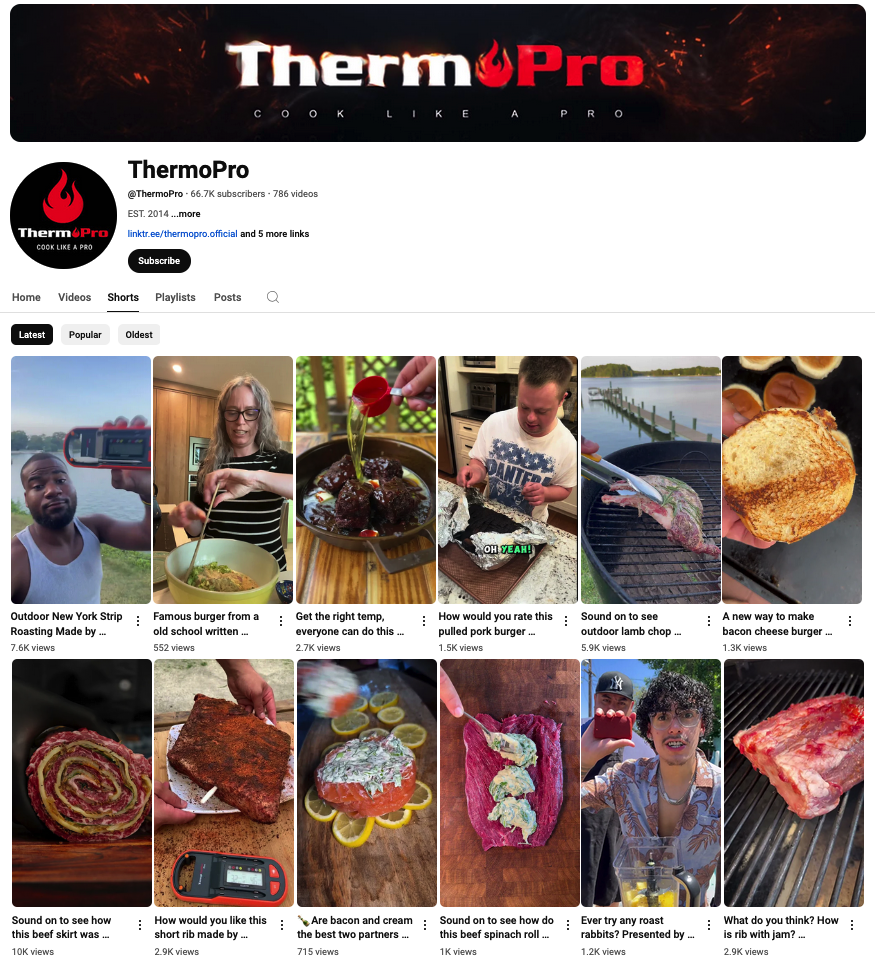

- Promotional content focused on gift-giving use cases on Youtube, Instagram, and TikTok

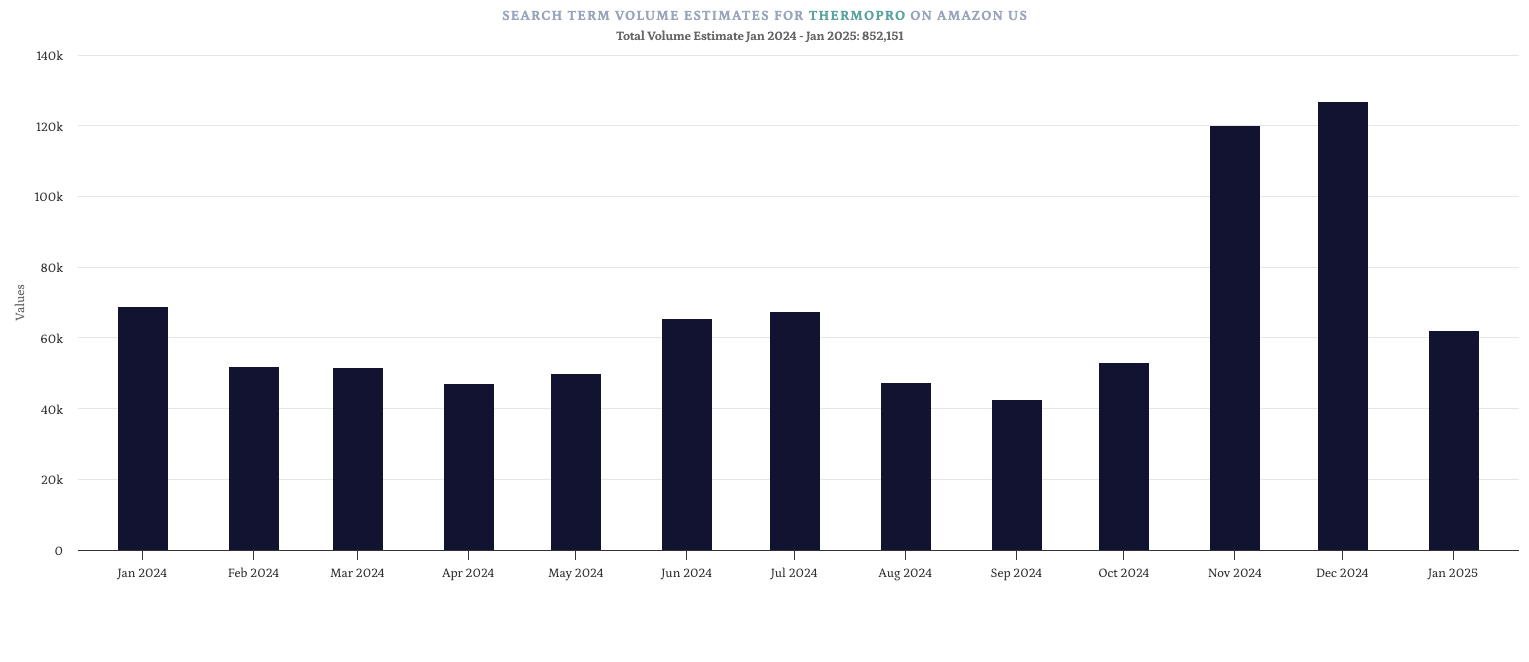

- Early-Start Marketing Strategy

ThermoPro began holiday initiatives in early November, generating measurable momentum:

- Branded search volume progression: 52.8K (October) → 119.8K (November) → 126.7K (December)

- Media coverage secured across multiple news outlets doing deal roundups in advance of Cyber Week

- The brand leveraged their social media content for advertising throughout the holiday season and partnered with relevant influencers, building brand awareness

Jump in monthly branded search volume illustrates the impact of wider marketing push

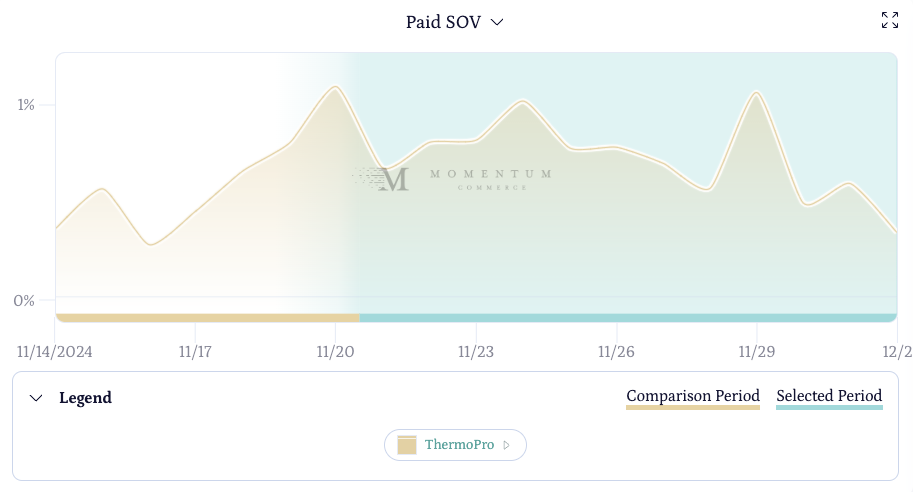

- Targeted Advertising Investment

ThermoPro’s advertising data shows precise resource allocation:

- Paid share of voice doubled during peak leading up to Cyber Week

- The brand then pulled back moderately as the peak period came to a close

- This approach helps concentrate resources when buying activity spikes most sharply, but with the flexibility to pull back as volume dictates

Increased paid search activity helps get in front of in-market buyers during the most active period of the year

Key Lessons for Brands

- Treat the Lead-in Period as Vital to Peak Period Success

- Amazon is actively trying to stretch holiday shopping deeper into the calendar – brands should leverage this to their advantage by getting deals live and promoted early

- Investing in pre-event marketing tactics drives brand awareness during the key consideration period as gift giving gets under way in force

- Keep the Discounting Strategy Broad but the Promotion Strategy Focused

- Consumers are searching for gift-related terms – prioritize the promotion of these kinds of items (e.g. gift sets, higher-end tools) and ensure product and promotion content accentuates this use case

- Having entry-level items discounted is important to capture budget-minded or last minute shoppers, and generally seem more attractive to sites or media outlets producing gift guides

- Search advertising should scale up and down alongside activity volume to maximize impact

Looking Forward: Data-Driven Strategy Requirements

The increasing complexity of Amazon’s marketplace requires sophisticated analysis and rapid tactical adjustment.

Our analysis identifies two essential components for maintaining or gaining market share:

Real-Time Market Intelligence Systems

- Automated trend detection and competitive monitoring

- Multi-dimensional tracking across organic rank, paid share of voice, and pricing

- Category-specific seasonal pattern analysis with promotional impact measurement

- Daily share tracking during peak events when market dynamics shift rapidly

Rapid Strategic Response Capabilities

- Cross-functional expertise spanning advertising, pricing, and content optimization

- Advanced analytics infrastructure for real-time decision support

- Category-specific playbooks built from historical performance data

- Dedicated peak event execution teams

Brands that pair their internal capabilities with the right agency partner are best positioned to win in this new environment. At Momentum Commerce we offer both sophisticated data insights and experienced marketplace execution, positioning our brand partners to capitalize on opportunities as they emerge.

Next Steps: Applying These Insights

This analysis reveals clear opportunities for brands to capture market share through strategic timing of investments and resources. To understand your brand’s specific opportunities within these patterns:

- Request a custom analysis of your category’s seasonal dynamics

- Get a detailed competitive positioning report

- Review your peak period execution strategy

Contact Momentum Commerce for a data-driven consultation focused on your specific market position and growth opportunities.

This is the third in an ongoing series of monthly reports across key Amazon US subcategories. To view all reports as they are published, click here.