Momentum Commerce Category Deep Dive: Top Brands Maintain Leadership in Men’s Active Clothing, but Fragmentation Increasing

Category revenue rises 2.3% YoY, with market share growing more widely distributed across smaller brands

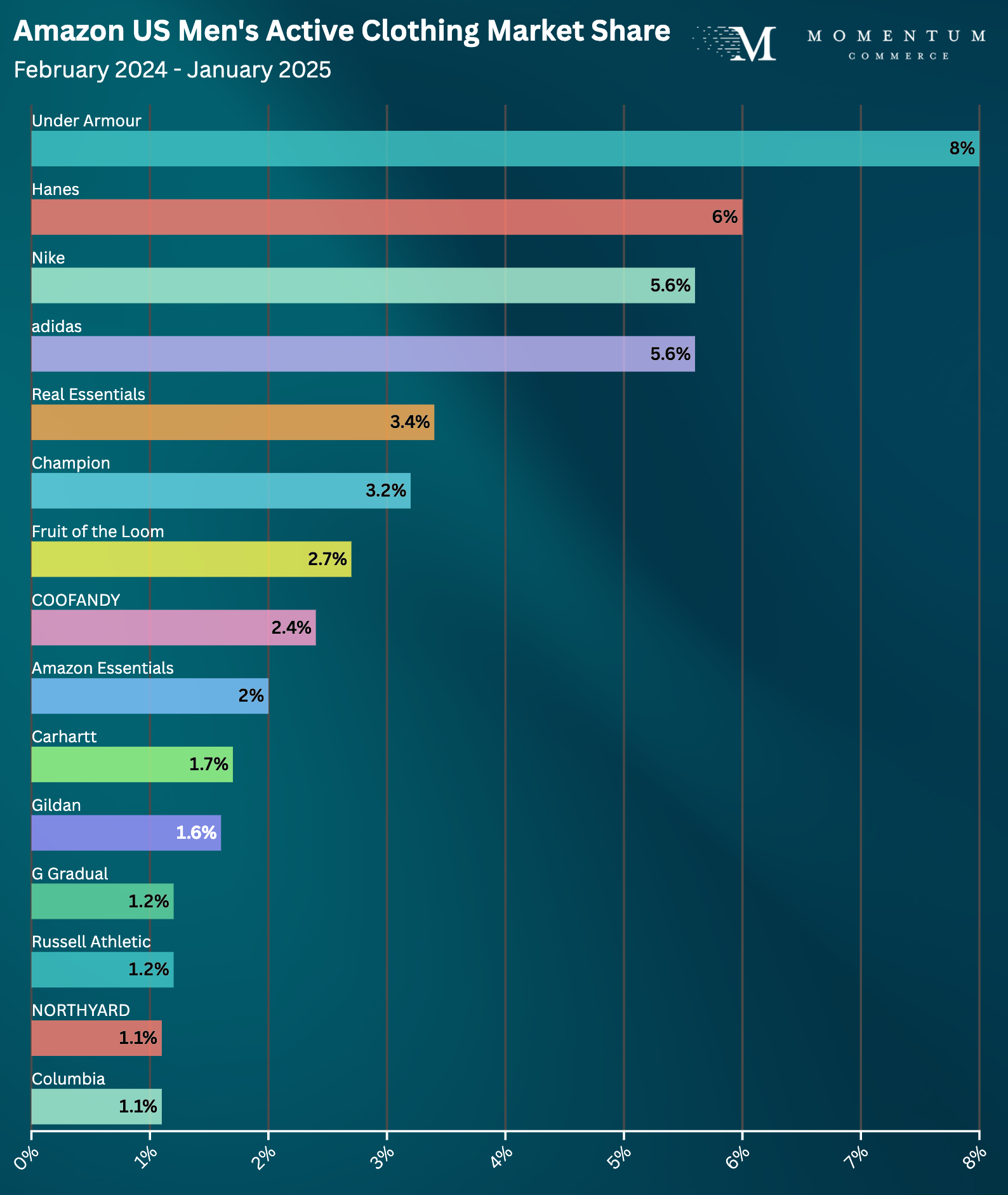

Men’s Active Clothing on Amazon US is a dynamic category, even within the relatively volatile apparel space. Over the last 12 months, revenue has risen a moderate 2.3%, but major subcategories like Active Pants and Active Hoodies have grown by more than 60% over the same period. Meanwhile, despite leading, multinational brands largely maintaining top market share positions, more category revenue is progressively flowing towards smaller players. In this environment, Under Armour’s ability to hold the #1 position for the vast majority of 2024, including the peak month of December, stands out and is the subject of a deeper analysis.

While there was some jockeying between top brands throughout 2024, Under Armour, Hanes, Nike and Adidas collectively captured 25.2% of Men’s Active Clothing category revenue over the last 12 months. But after this group at the top, revenue throughout the category begins to splinter. To account for 75% of category revenue over the same period, you’d have to include the top 135 brands. Notably, this is a category where success during specific time periods can drive outsized results:

- 15.1% of category revenue in 2024 was generated just in December, with sales 102% higher than the January through October average

- December revenue even eclipsed November by a hefty 45.1%, despite the start of holiday shopping – highlighting how brands need to take a careful approach to match consumer demand

- While Under Armour briefly lost its #1 market share position in October and November to Hanes, the brand took a full 2.5 percentage point lead in December when it mattered most

After top players, market share is much more closely contested

Search Analysis: Category Search Activity Revolves Primarily Around Function, But Branded Search is a Force

Top search terms and niches in the Men’s Active Clothing category are unbranded and oriented around product types (e.g. “men’s socks” and “men’s sweatpants”). However, branded search makes up roughly 30% of search traffic, with those rates ticking up to around 34% during the all-important holiday season. That outpaces Men’s Clothing overall, where branded search has never eclipsed 25% of search traffic in a given month. This is significant for setting a winning strategy in the category:

- Visibility on top product type terms – either organically or through paid advertising – is incredibly important for driving sales velocity

- Particularly in advance of the holiday season, investing in top-of-funnel marketing tactics to improve branded search rates is critical

- Budgets around key terms need to flex substantially between peak and off-peak months, ideally based on conversion signals

The most popular consumer search topics are tied to specific product types

Given the unique and competitive market environment, Under Armour’s ability to capture and maintain market leadership in 2024 is especially meaningful. Examining their strategies and tactics demonstrates how premium brands in particular can get creative and win in this category.

Making Seasonality Work: Two-Pronged Strategy

Under Armour grew its market share by 3.8% YoY over the last 12 months. An analysis shows two key strategies the brand employed to beat out competitors:

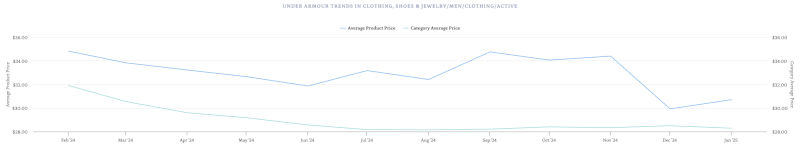

- Deep, Limited Time Discounting Restricted to Peak Periods

Throughout the rest of the year, Under Armour products are priced roughly $4 to $5 above the category average, but they took an aggressive, ramped discount approach beginning in November and running through December:

- Under Armour went live with a slate of early deals on Amazon weeks in advance of Black Friday

- Starting in mid-December, Under Armour launched 50% discounts across a range of products on Amazon specifically

- During Cyber Week, a wide selection of Under Armour products were discounted by 30% or more – both on Amazon and the brand’s D2C site

- Overall, the average Under Armour Men’s Active Clothing product was discounted to within a $1.50 of the category average in December 2024

- Slow Scaling of Paid Presence, Top-of-Funnel Marketing as November Approached

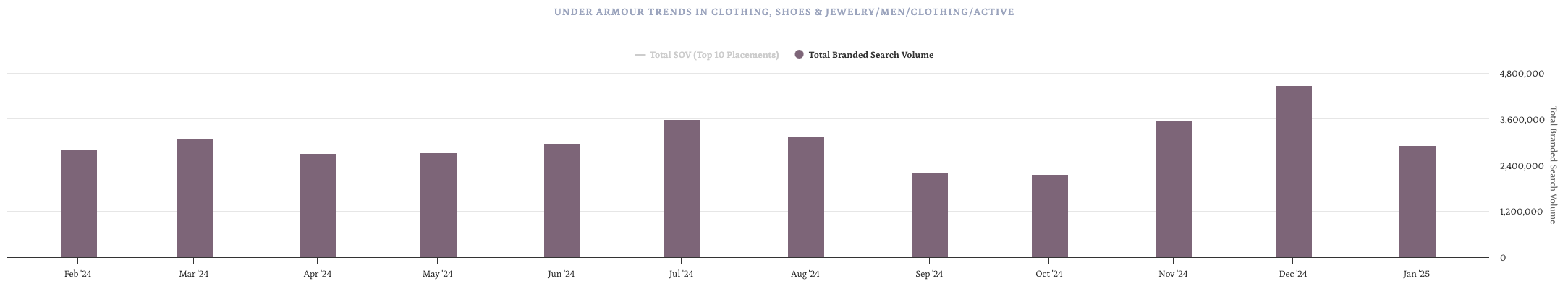

Under Armour increased their share of paid placements on relevant search terms steadily starting in October, alongside other promotional activity:

- Under Armour’s paid share of voice (SOV) in the category tripled in three months – from 0.4% in September to 1.2% in December

- The brand worked with a wide range of influencers on TikTok and Instagram to promote the brand in a holiday gift-giving context throughout the holiday season

- Over this period, branded search volume rose steadily on Amazon US: 2.15M (October) → 3.5M (November) → 4.5M (December)

Steady increase in both monthly branded search volume and paid SOV underscores a multifaceted promotional strategy

Key Lessons for Brands

- Deploy Discounts Strategically to Boost Sales While Not Impacting Brand Perception

- Consumers clearly are motivated by discounts in this category, so time those price reductions for when sales volume is gaining momentum

- Increased sales velocity here has natural knock-on effects in terms of search visibility

- By making discounts deeper but more infrequent, a brand is better able to maintain its premium positioning while reaping the most benefit out of price cuts

- Implementing limited-time discounts across a broad range of products – if not the entire product catalog – helps simplify the messaging from a promotional standpoint

- Begin Top-of-Funnel Advertising and Marketing Activity Months in Advance

- Driving increased branded search activity as overall consumer buying activity rises is critical to maximizing the holiday period, but this requires time and a multifaceted approach

- Outside of influencer programs, brands should also examine DSP and utilize AMC to effectively target relevant, in-market consumers from well in advance of the holiday period all the way through the shipping cutoff

- Ensure that budgets are flexible based on performance, with the ability to analyze key metrics like conversion rate and conversion volume as they develop to justify and effectively deploy additional spending

Looking Forward: Data-Driven Strategy Requirements

The increasing complexity of Amazon’s marketplace requires sophisticated analysis and rapid tactical adjustment.

Our analysis identifies two essential components for maintaining or gaining market share:

Real-Time Market Intelligence Systems

- Automated trend detection and competitive monitoring

- Multi-dimensional tracking across organic rank, paid share of voice, and pricing

- Category-specific seasonal pattern analysis with promotional impact measurement

- Daily share tracking during peak events when market dynamics shift rapidly

Rapid Strategic Response Capabilities

- Cross-functional expertise spanning advertising, pricing, and content optimization

- Advanced analytics infrastructure for real-time decision support

- Category-specific playbooks built from historical performance data

- Dedicated peak event execution teams

Brands that pair their internal capabilities with the right agency partner are best positioned to win in this new environment. At Momentum Commerce we offer both sophisticated data insights and experienced marketplace execution, positioning our brand partners to capitalize on opportunities as they emerge.

Next Steps: Applying These Insights

This analysis reveals clear opportunities for brands to capture market share through strategic timing of investments and resources. To understand your brand’s specific opportunities within these patterns:

- Request a custom analysis of your category’s seasonal dynamics

- Get a detailed competitive positioning report

- Review your peak period execution strategy

Contact Momentum Commerce for a data-driven consultation focused on your specific market position and growth opportunities.

This is the latest in an ongoing series of monthly reports across key Amazon US subcategories. To view all reports as they are published, click here.