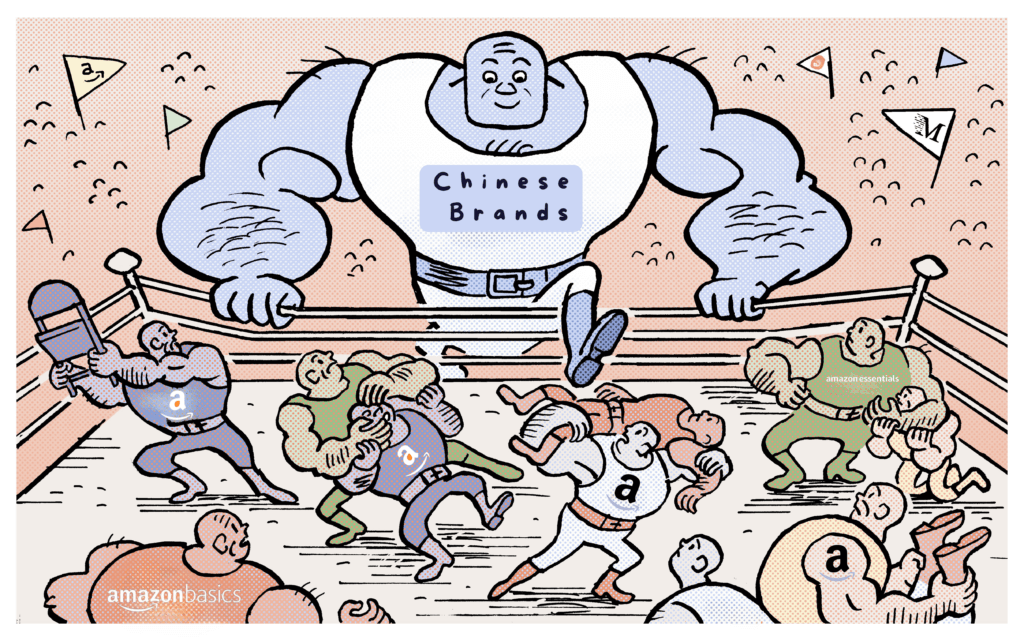

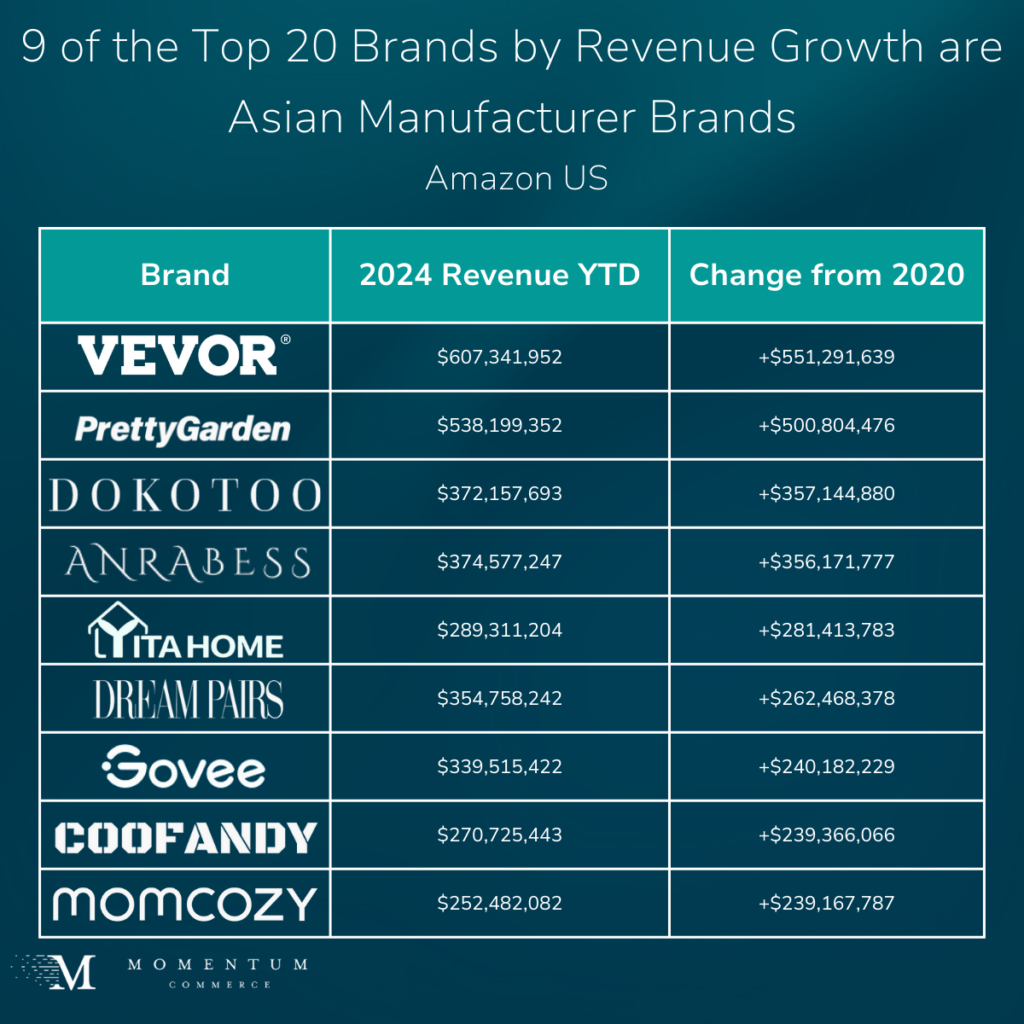

45% of 2024’s Fastest Growing Brands on Amazon US are Asian Manufacturer Brands

Asian manufacturer brands represent 9 of the top 20 fastest-growing brands from a raw dollar perspective across all of Amazon US since 2020. This emphasizes how these brands, despite little to no name recall by an average consumer, have become figurative behemoths on Amazon, but also highlights the level of potential disruption as new and potential tariff changes come into play.

From a category perspective, this figure inflates to 10 of 20 across Home & Kitchen and Clothing, Shoes & Jewelry specifically.

These brands aren’t just dominating lower-cost subcategories either. For example, Chinese manufacturer brands YITAHOME, ANRABESS and EF ECOFLOW respectively operate in the higher consideration furniture, women’s clothing and portable power generator categories.

Biggest Takeaways for Brands

- Take a page from the foreign brand manufacturer’s playbook

- These Asian manufacturer brands have zeroed in on product types that they have expertise in producing and know are in demand by US consumers

- Competitive intelligence tools like Momentum Commerce’s own Velocity platform along with others, can help level the playing field here

- This includes identifying categories with large growth opportunities, and vulnerable incumbents, and how to launch products with the right features, merchandising, pricing, and advertising support to win

- Baby Products and Grocery categories are likely the most safe from overseas competition

- More stringent regulations around these products both nationally and within Amazon itself create a natural buffer

- Outside of those two categories, expect Asian brand manufacturer competitors to continue to make inroads

- This emphasizes the need to maintain a clear view of the exact competitors showing up alongside your products on Amazon’s search

- Because these competitors are likely to win on price, the need to invest in product page optimization, branding initiatives, and delivering meaningful value propositions becomes that much more important

- The potential future impact of tariff changes looms on the horizon

- Recent and potential upcoming shifts in the trade environment may threaten the viability of these sellers on Amazon

- However, any corresponding impact on supply chains for domestic brands injects another element of uncertainty