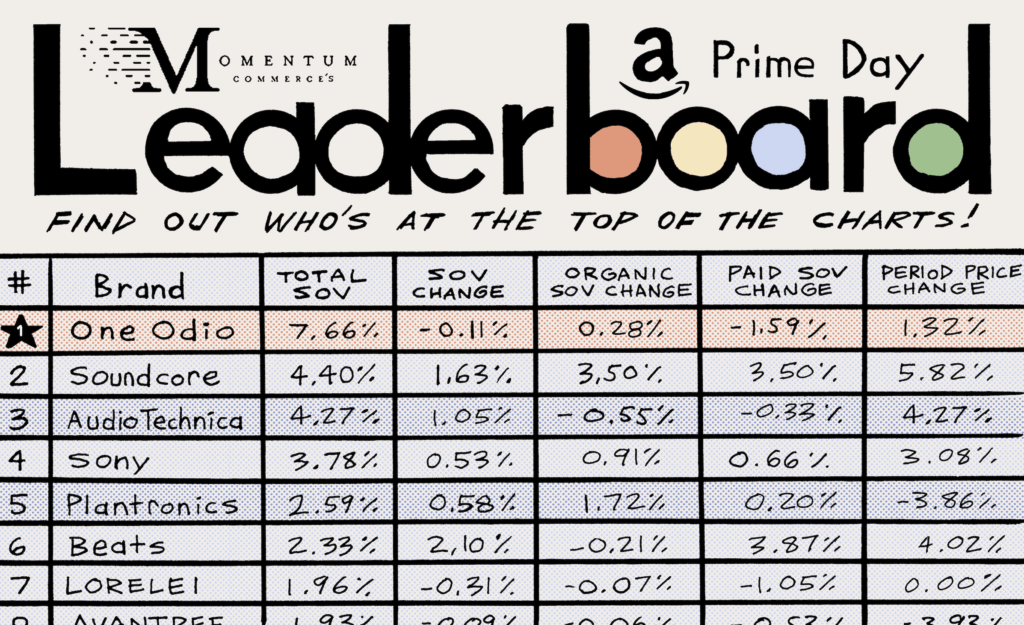

The Discounters and Advertisers that Made the $14B Prime Day 2024

The 2024 Prime Day sale event was Amazon’s largest Prime Day ever, offering significant deals across all categories. Brands have been meticulously preparing their strategies for months, with some strategies even starting weeks ahead of the event. Despite the ‘Prime Day frenzy’ and the Amazon Ads Console crashing at the end of Day 1, many brands achieved remarkable success throughout the event. Let’s explore some top advertisers and discounters using our Amazon Brand Leaderboard.

Notable Paid SOV Increases

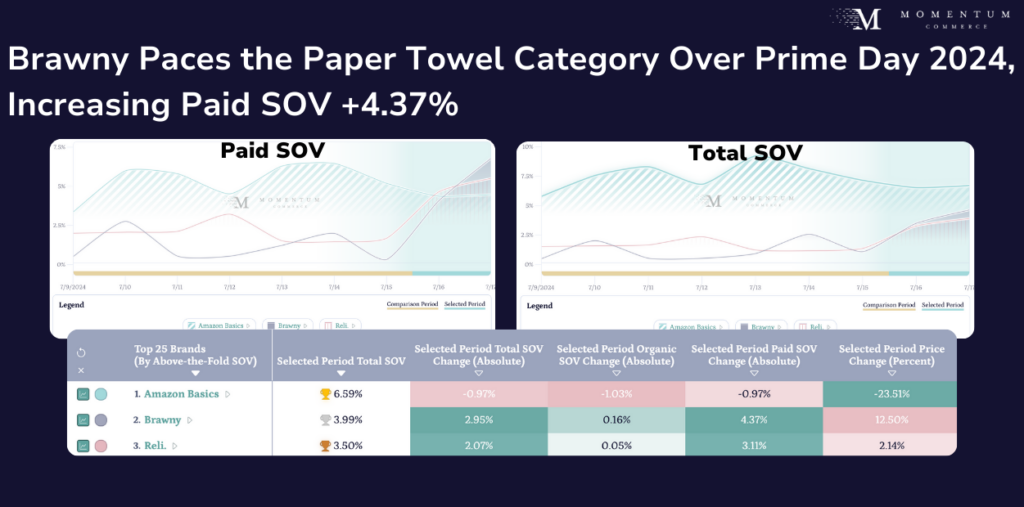

- Brawny saw the largest increase in paid ad placements within the Paper Towel subcategory, rising by +4.37%

- Although they reduced ad spend before Prime Day, they ramped up efforts during the event, surpassing Amazon Basics.

- Notably, 60% of purchases occur on the first day of Prime Day. Brawny’s strategy to boost visibility on this crucial first day contrasted with Amazon Basics, which focused on seeding demand prior to the event.

- Reli had the second-largest increase in Paid Share of Voice (SOV) in the subcategory, slightly behind Brawny

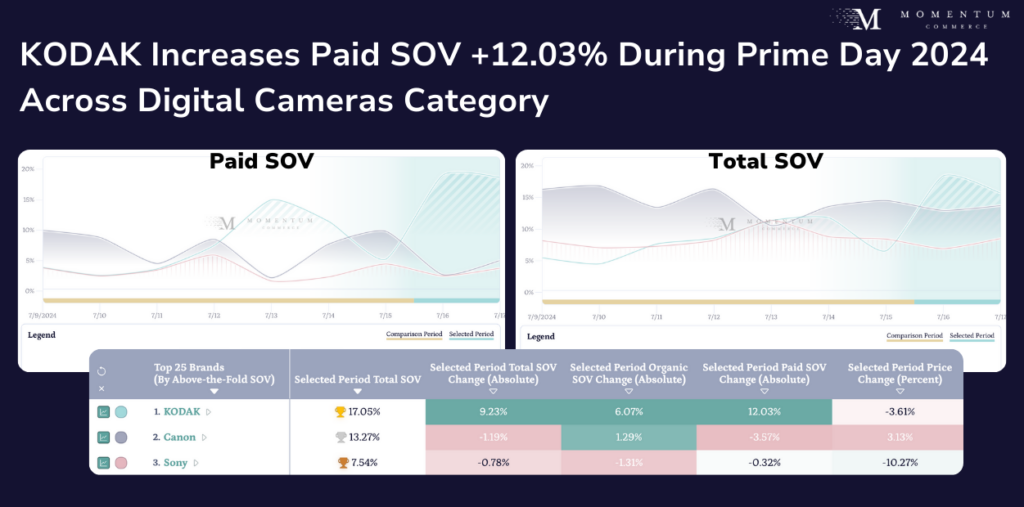

- KODAK increased paid ad placements by +12.03% during Prime Day, the largest of any brand in the subcategory

- KODAK deviated from the subcategory trend by increasing ad spend in the days leading up to Prime Day, significantly pulling back the day before, and then continuing to increase through the end of the event

- In contrast, other competitors in the subcategory were more reserved the week prior, targeting ‘window shoppers’ browsing before the sale event, but ultimately reducing their ad spend during Prime Day itself

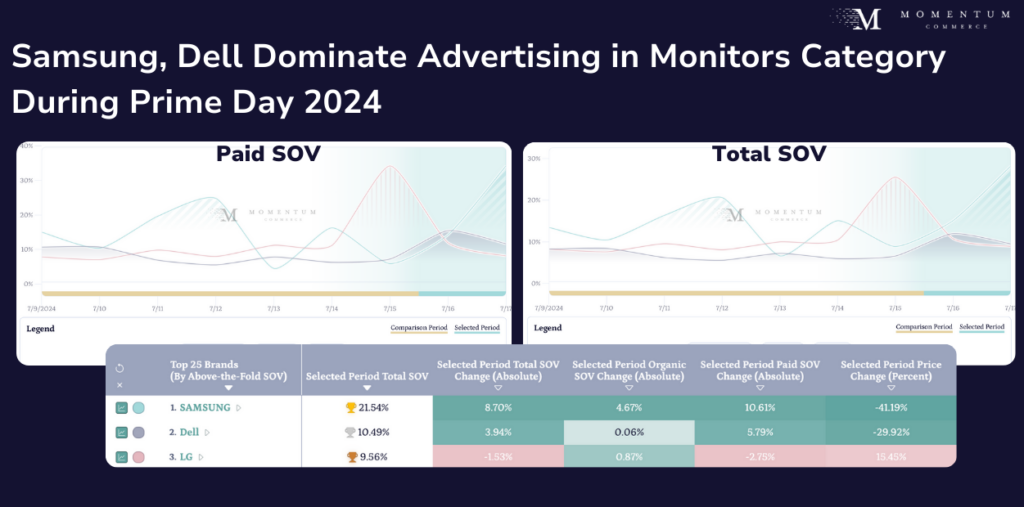

- In the Computer Monitors subcategory, Samsung increased paid placements by +10.61% during Prime Day, the largest of any brand

- Interestingly, Samsung was less aggressive on Day 1, which allowed Dell to compete, but then significantly increased ad visibility on Day 2

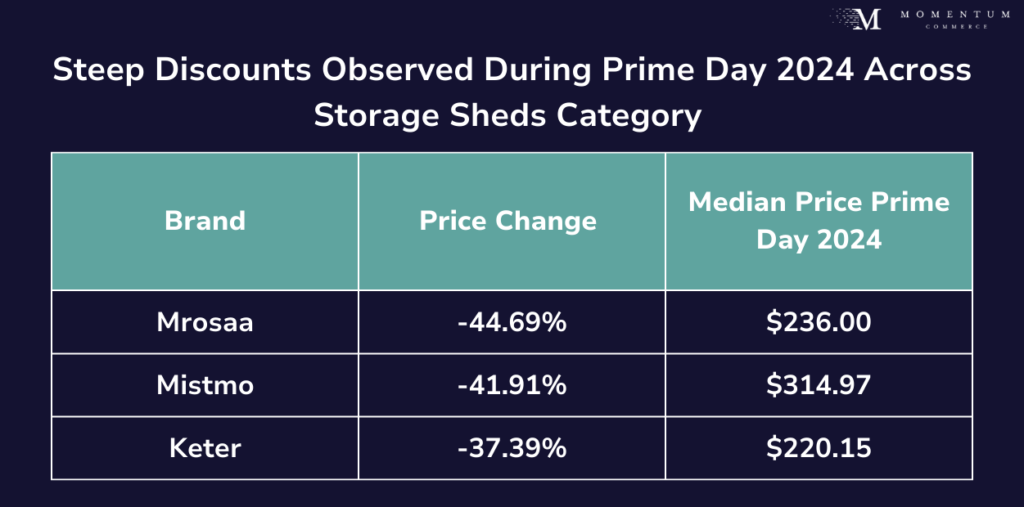

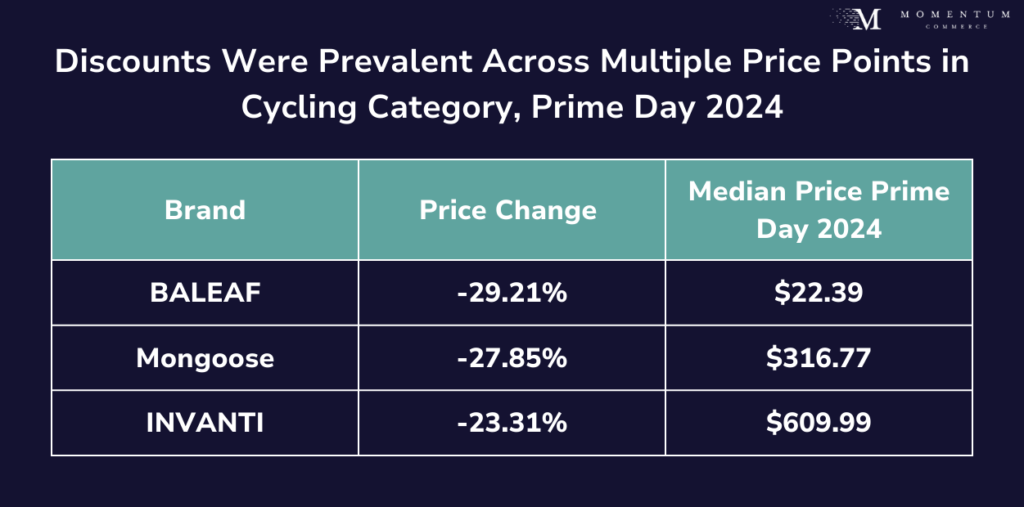

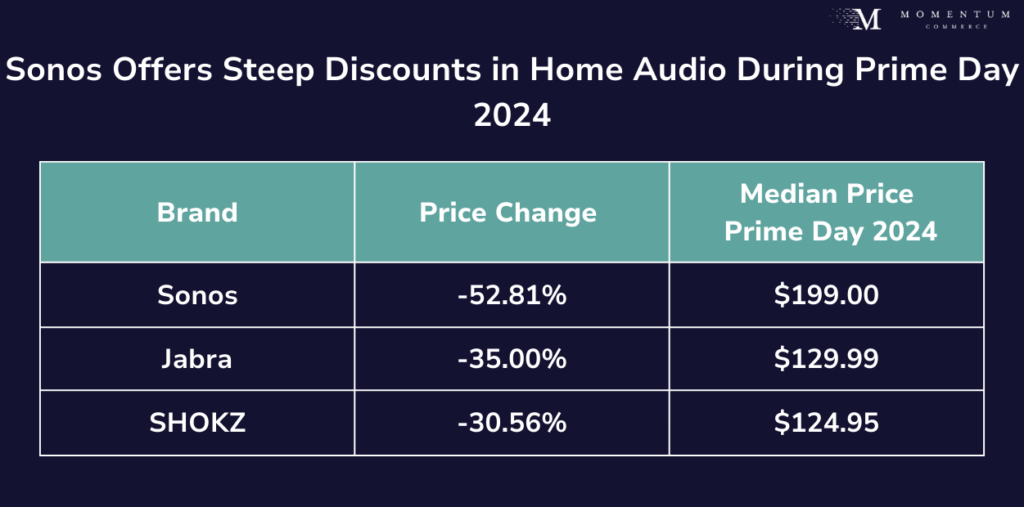

Notable Discounters

Biggest Takeaways for Brands

- Each brand has unique needs and therefore requires a unique strategy for tentpole events like Prime Day

- Earlier on, we saw 3 different strategies at play in terms of ad spend:

- Amazon Basics investing ad dollars the week leading up to Prime Day, then pulling back during the event

- KODAK increased spending in the days leading up to Prime Day, then continued to ramp up advertising during the event

- Samsung took a more reserved approach, jumping on ad placements on Day 2 when other brands had likely depleted ad budgets

- Each of these brands placed ‘#1’ on our Amazon Brand Leaderboard, yet took a different approach to getting there in their respective categories

- Earlier on, we saw 3 different strategies at play in terms of ad spend:

- In the past, we’ve noted that a combination of discounting and advertising is the strategy associated with better Prime Day outcomes

- KODAK, Samsung, and Dell stuck to this approach, while brands mentioned above like INVANTI and Mongoose seemed to focus mainly on discounting over advertising

- Seasonal categories like Patio, Lawn & Garden, and Tools & Home Improvement came to play in this year’s Prime Day event

- We noticed that categories that usually perform well during major events, such as Electronics and Beauty & Personal Care, remained active this year. However, the Electronics category experienced fewer discounts, with the average discount rates also being lower than usual

Want to check out another category’s Prime Day performance? Visit our Amazon Brand Leaderboard!

Methodology

All price figures in the daily price graph are calculated as daily averages of a brand’s category-specific products based on their appearances within the top 10 overall (paid and organic) results on page one across the top one million search terms on Amazon between July 9th and 17th, 2024. All Total share of voice (SOV) figures are drawn from a brand’s average share of organic, Sponsored Products, Sponsored Brands, Sponsored Brands Video, and Editorial Recommendations placements within the top 10 overall (paid and organic) results on page one across category-specific, top one million search terms on Amazon. All paid SOV figures utilize the same formula, but only across Sponsored Products, Sponsored Brands, Sponsored Brands Video, and Editorial Recommendations placements in the top 10 results on page one. In the accompanying tables, the ‘Prior’ period is defined as July 9th through 16th, 2024, while the ‘Selected’ period is defined as July 16th and 17th, 2024.