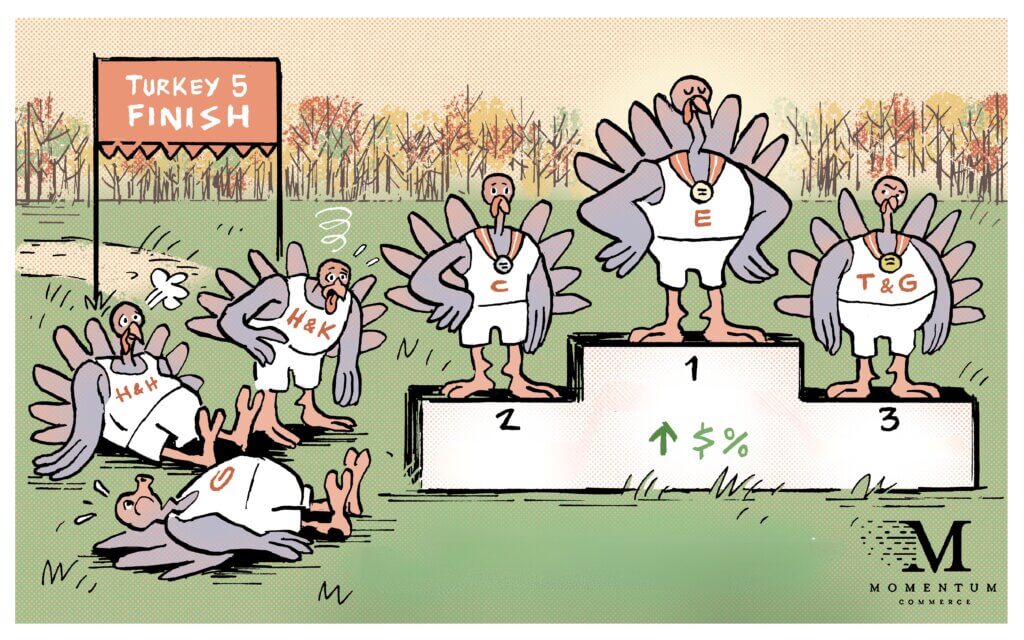

Cyber Week 2023 Movers and Shakers

Black Friday sales were up 7.5% year-over-year, and Cyber Monday sales are also slated to top analysts’ estimates of $12 billion! We saw some brands push the gas throughout Cyber Week, while others opted to pull back at various points over the weekend. Yesterday we shared some brands who were aggressive in terms of Price and Paid Share of Voice (SOV) during the Black Friday sale on Amazon. Let’s use our Amazon Brand Leaderboard tool to see how brands in various categories made adjustments during Cyber Weekend itself.

For this analysis, we compared the Cyber Monday period (Sunday 11/26, and Monday 11/27) to the preceding Black Friday period (Sunday 11/19 through Saturday 11/25) of Cyber Week.

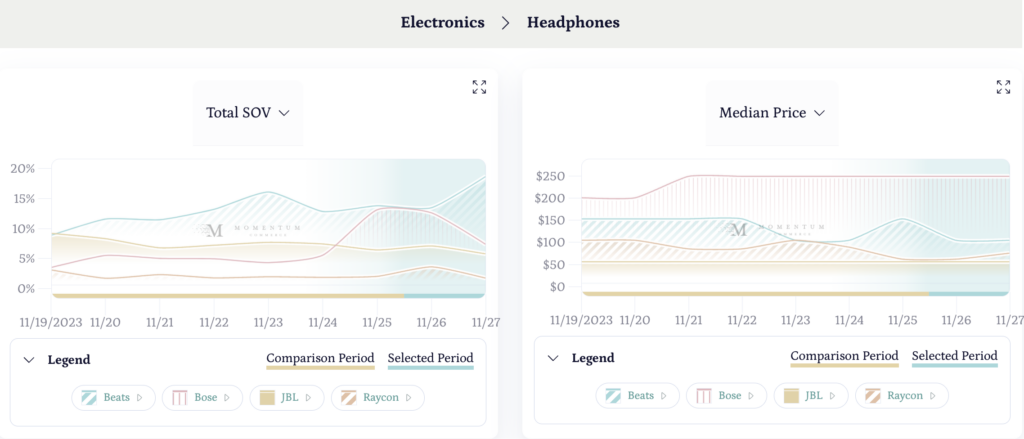

Electronics > Headphones

- Raycon increased Toal SOV by 0.59% during the Cyber Monday period (4th largest increase in the category)

- Among many others in the category to do so, JBL actually pulled back on Paid SOV by -2.04%.

- Raycon decreased prices by -30.81% (2nd biggest discount in the category)

While big names Bose, Apple, and Beats seemed to take an aggressive approach early on in Cyber Week, these brands began to taper off their Paid Ad spend and reduce discounts, allowing smaller brands like Raycon to creep in.

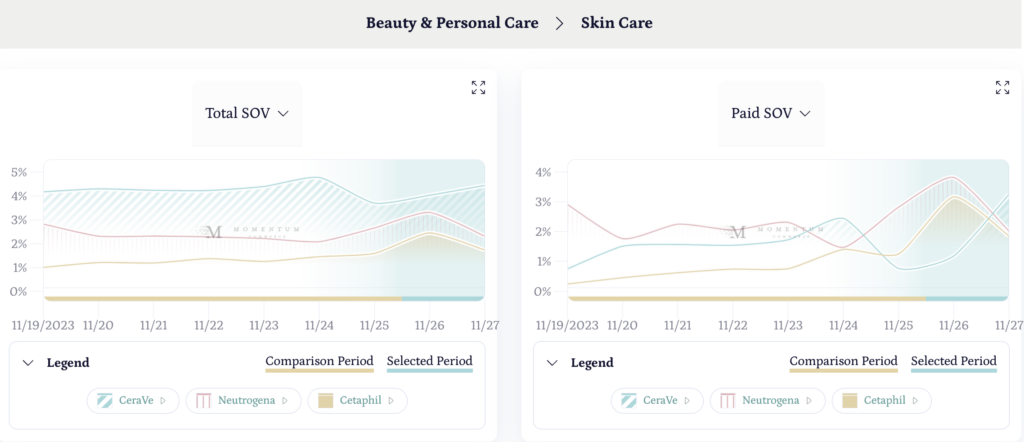

Beauty & Personal Care > Skincare

- Cetaphil increased Total SOV by 0.82% during the Cyber Monday period (the largest increase in the category for this time frame)

- Cetaphil increased Paid SOV by 1.79% (the largest increase in the category for this time frame)

- Cetaphil decreased prices by -11.84% (the steepest discount in the category for the time frame)

Cetaphil continued to increase ad spend and simultaneously reduce prices when other beauty brands had already begun to taper off.

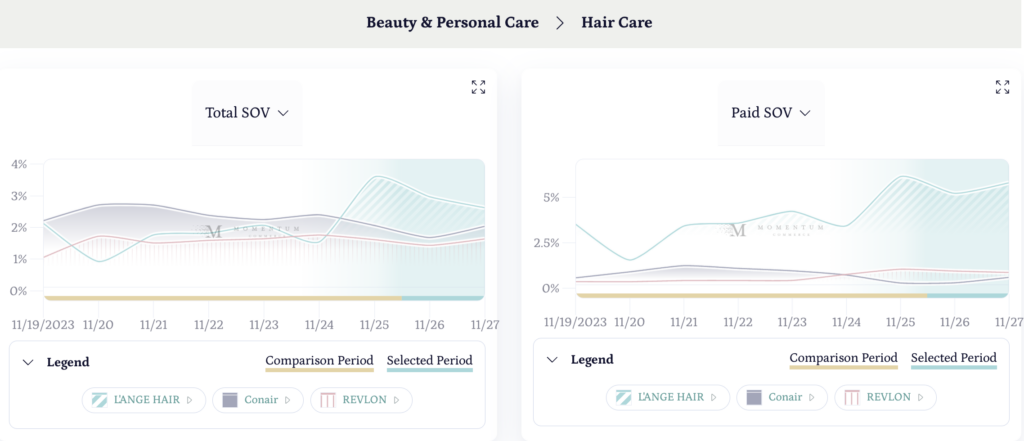

Beauty & Personal Care > Hair Care

- L’ANGE HAIR won the category in terms of Total SOV with 2.77%.

- L’ANGE HAIR increased their Paid SOV by 1.86% during the Cyber Monday period (the largest increase in the category for this time frame)

- L’ANGE HAIR increased prices by 0.93% in the Cyber Monday time period, while Conair and Revlon increased prices by 7.32% and 6.03% respectively.

L’ANGE HAIR continued to increase ad spend by the most in the category, followed by HOT TOOLS at only a 0.42% increase. Slow to gain momentum in the preceding period, the increase in ad spend allowed L’ANGE HAIR to dominate the Hair Care category as Cyber Week rounded out.

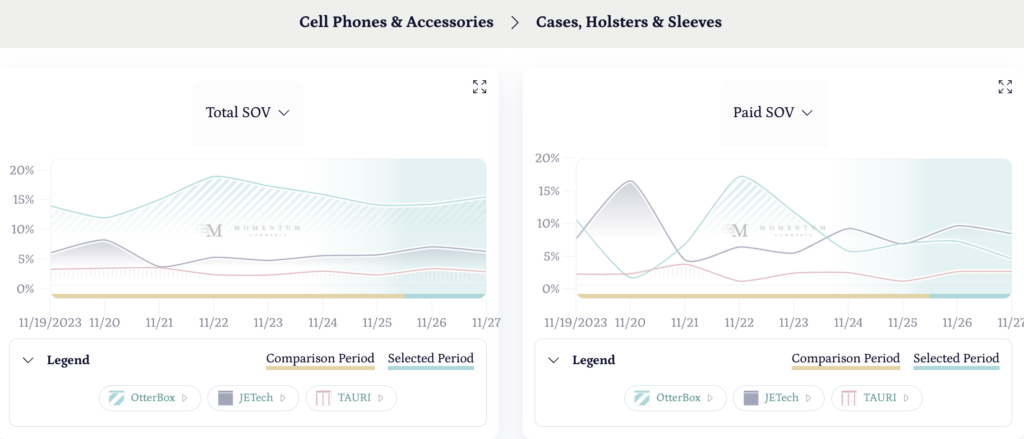

Cell Phones & Accessories > Cases, Holsters, & Sleeves

- OtterBox dominated the category by claiming 14.72% Total SOV for the given time period.

- However, their Paid SOV decreased by -2.83% in the time period, the largest decrease in the category.

- OtterBox only decreased prices by -3.09%.

OtterBox entered Cyber Week already on top in terms of Total SOV, and a strong brand presence allowed for the brand to remain on top. OtterBox’s Organic SOV change for the given period was 2.04%, the most out of any brand in the category.

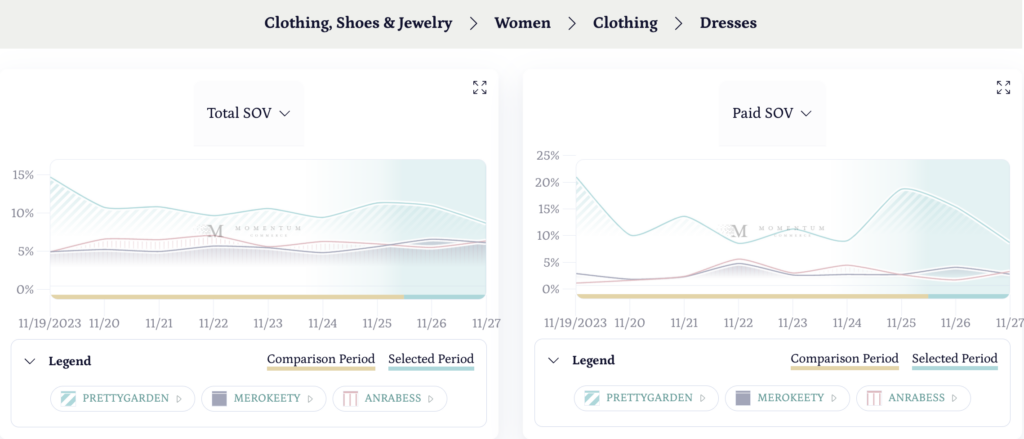

Clothing, Shoes & Jewelry > Women > Clothing > Dresses

- PRETTYGARDEN won the category earning 9.67% of Total SOV for the Cyber Monday time period.

- However, the brand’s Paid SOV went down by -1.18%, the biggest decrease in the category.

- MEROKEETY decreased prices by -9.03% (the second steepest discount in the category for the given time frame)

PRETTYGARDEN entered Cyber Week on top, an impressive feat in a category that has experienced a 23.6% lift in revenues year-over-year. An early aggressive approach to paid advertising coupled with discounting allowed this brand to emerge dominant after the sales week, despite tapering off late.

While Turkey 5 may be over, there is still plenty of holiday spending left in the year! If you want to stay up to date on more Turkey 5 analyses and other holiday shopping content, subscribe to our newsletter here, or follow Momentum Commerce on LinkedIn.