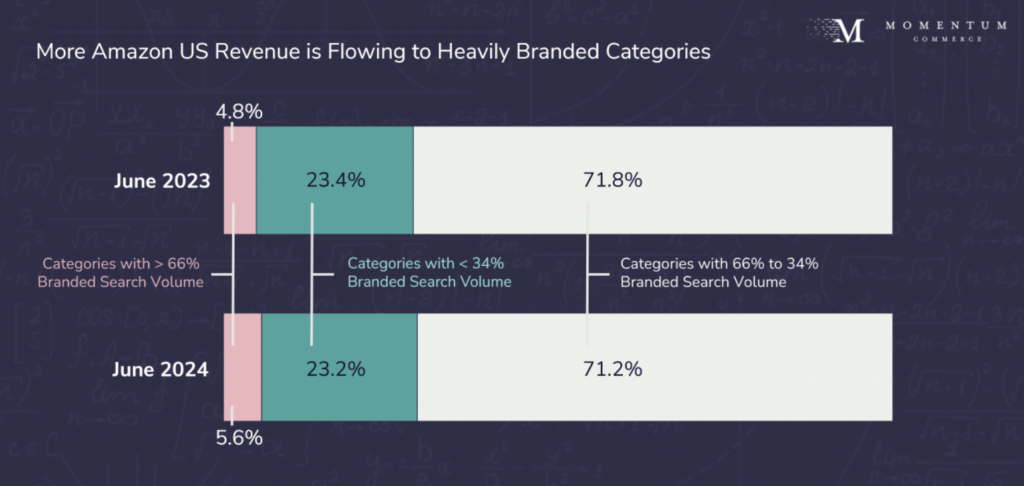

77% of Amazon US Searches are Unbranded, But Branded Search is Rising

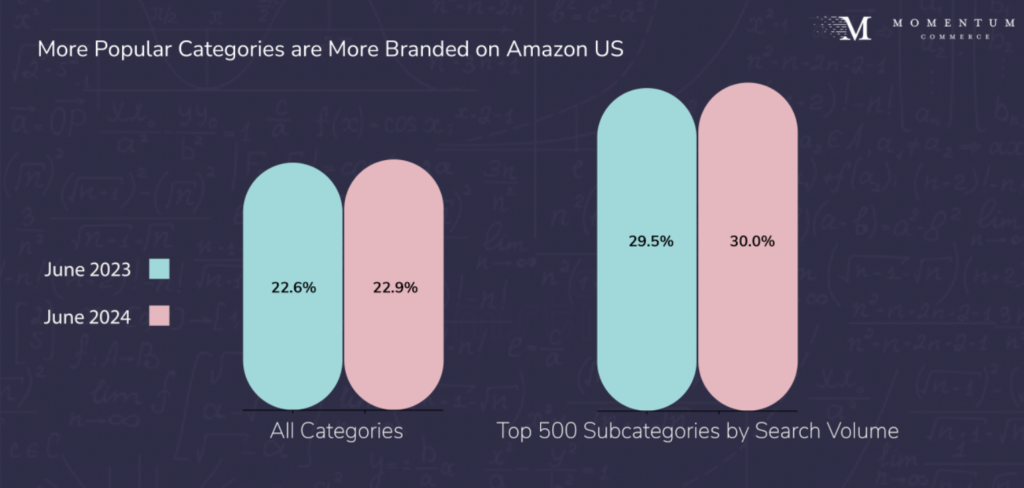

In June 2024, 22.9% of Amazon US searches included a brand name, up from 22.6% in June 2023, with the increase more dramatic across more popular categories. Additionally, categories with 67% or more search volume going to branded terms accounted for 5.6% of total Amazon US revenue – up from just 4.8% in June 2023. This emphasizes that Amazon US is growing more branded as a whole, particularly across the most valuable sections of the marketplace.

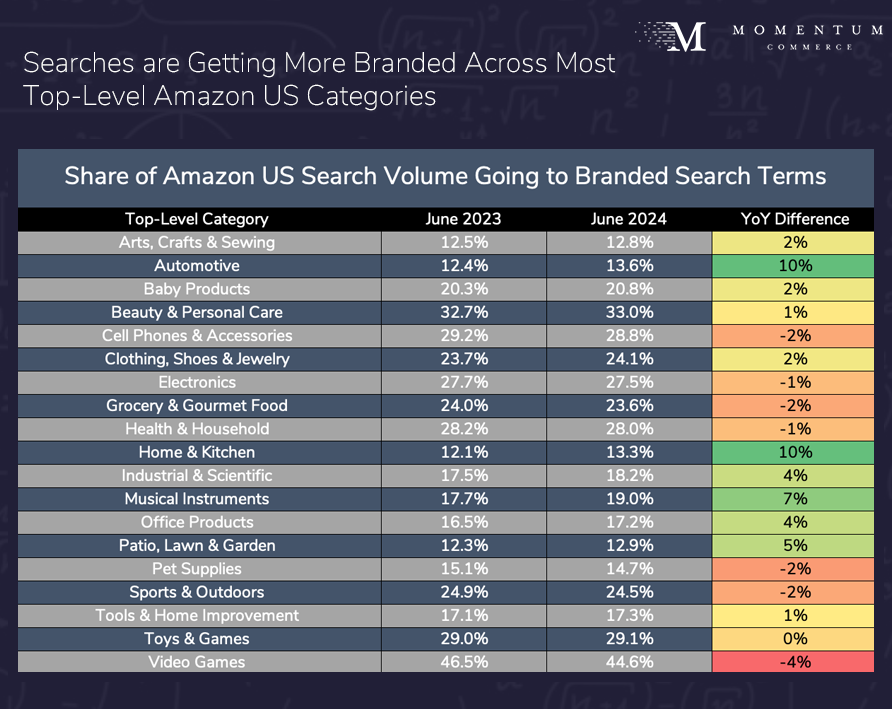

At a high level, the share of search volume going to branded terms grew across 12 of the 19 top-level physical goods categories. Of particular note is the Home & Kitchen category, a traditionally more brand-agnostic market, but one that saw a 10% increase in branded search share. One extreme example is the ‘Thermoses’ subcategory, with branded search volume rising from 56% to 73% of total category searches year-over-year (YoY), thanks in part to the rapid ascent of Owala.

Digging a bit deeper, across the top 500 sub-categories by search volume, 29.5% of searches included a brand name in June 2023 vs. 30.0% in June 2024. This growth outpaced the overall Amazon US average.

Biggest Takeaways for Brands

- Learn the ‘brandedness’ of your product categories and set a corresponding advertising strategy

- Higher and growing values here necessitate an emphasis on driving top-of-funnel interest through DSP and similar programs

- Lower or shrinking values increase the importance of securing top-of-search placements on popular generic terms, and/or using product attribute targeting (PAT) campaigns to capture in-market consumers

- Prioritize and track the branded search volume of your brand and competitors on Amazon

- This should include monitoring competitor placements on your branded terms

- If you pull back on branded term ad spend, you need to balance the efficiency gains against opening terms up to competitor conquesting

- This is especially true if your branded search volume is growing, making you a more ripe conquesting target

- A given competitor outpacing your own brand’s gains in branded search volume should be treated as a meaningful warning sign

- Digging deeper into where that gap is coming from (e.g. new products, advertising mix, social trends) can help inform strategic shifts

- Once you reach a dominant position in terms of branded search, be aware of over-investment, as it’s clear that branded search holds diminishing utility as it rises for a given brand on Amazon

- This can be an opportunity to slowly taper down branded search advertising to achieve a better total advertising cost of sale (TACOS), but keeping the caveats mentioned above top of mind

- This should include monitoring competitor placements on your branded terms

- Expect shifts in branded search activity from social trends – and be able to adjust

- A number of Chinese brands are now driving significant amounts of branded search on Amazon – almost entirely due to social media activity

- Keep an eye on trends across TikTok and other platforms related to your product category to identify new challengers sooner

- As these terms grow in popularity, it may be worth conquesting with paid search advertising as long as you can effectively emphasize the quality or value of your product (e.g. via Sponsored Brands or Sponsored Brands Video)

- A number of Chinese brands are now driving significant amounts of branded search on Amazon – almost entirely due to social media activity