2025 Amazon Big Spring Sale Preview & Strategy Guide

Executive Summary

Amazon’s Big Spring Sale acts as the first major sale event of the year on Amazon US. However, sales data shows that unlike Prime Day, Cyber Week, and Prime Big Deal Days, the jump in purchases tends to be restricted mostly to seasonal categories rather than across the entire site.

The more category-specific nature of the Big Spring Sale means that brands should take a carefully tailored approach to the sale event. Products sold within seasonal categories like Spring Fashion are going to see the most benefit out of increased discounts and search advertising activity. Conversely, for products in more evergreen categories, a top priority should be leveraging AMC to effectively reach in-market buyers, allowing for more flexibility and precision.

Regardless of the approach, the Big Spring Sale can be a good, lower-stakes stress test around your brand’s readiness for the bigger tentpole events later in the year.

What’s the Strategic Importance of the Amazon Big Spring Sale?

Amazon’s Big Spring Sale is an annual weeklong event promising substantial discounts across various product categories during the spring season. For businesses, this event presents significant opportunities to enhance visibility, increase sales, and clear out seasonal inventory.

- Duration: Historically, the sale has spanned six days. In 2024, it ran from March 20 to March 25, and in 2025 the event is slated to begin March 25 and end March 31

- Accessibility: Unlike Amazon’s Prime Day, which is exclusive to Prime members, the Big Spring Sale is open to all customers. However, Prime members may receive additional benefits, such as early access to certain deals and faster shipping options

- Focus: While not exhaustive, Amazon generally places a focus on seasonal categories during the Big Spring Sale, including Spring Beauty, Spring Fashion and Apparel, Patio Lawn & Garden, and Spring Sports & Outdoors

What is the Big Spring Sale’s Impact?

Because the Big Spring Sale is generally centered around a few key categories versus the entire site like Prime Day, both the sales impact and discounting activity is concentrated in certain categories, despite being more muted across the site as a whole.

- Sales: In 2024, Patio, Lawn & Garden sales jumped the most versus the prior four-week average at +26.7%. Toys & Games was close behind at +20.2%, but this was likely driven primarily by Easter coming just one week after the 2024 Big Spring Sale event. In 2025, Easter isn’t until mid-April. Notably, not every category saw sales increases – a sharp contrast with Prime Day where sales historically rise across the entire marketplace.

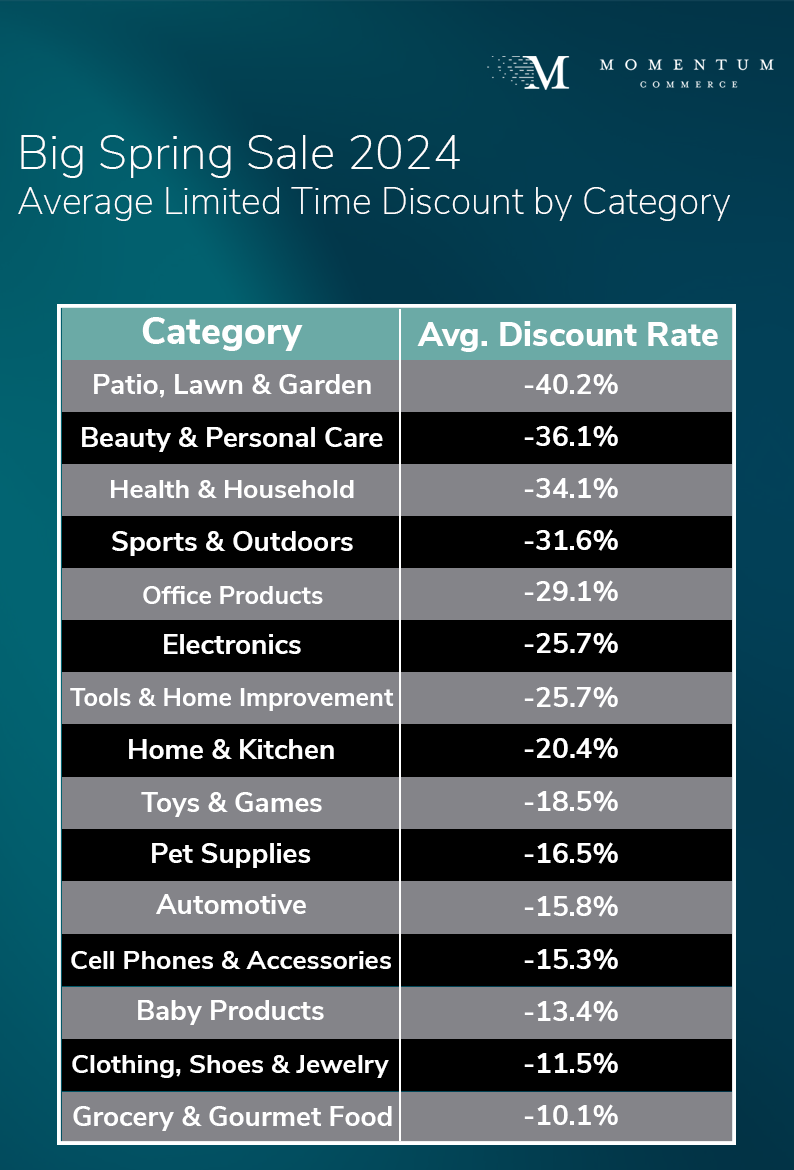

- Discounting: The steepest discounts in 2024 were in the Patio Lawn & Garden and Beauty & Personal Care categories. However, even at the low end, Limited Time Discounts were running at more than 10% off on average. However, these discounts weren’t particularly pervasive – just 3.7% of products had a discount badge over the 2024 Big Spring Sale event compared to more than 20% during the prior Prime Day and October Big Deal Days events.

How Critical is the Big Spring Sale in Terms of Performance?

While purchase activity does rise across a number of categories during the Big Spring Sale, it’s not to such a degree that it makes the event ‘make or break’ for brands in the same way as Prime Day or Cyber Week.

Even for seasonal categories like Patio Lawn and Garden, the share of 2024 units sold during the Big Spring Sale period was only slightly above the share captured during non-tentpole weeks.

That being said, the Big Spring Sale acts as a kind of ‘kick off’ to the warmer weather months, so increased sales velocity during the event can have positive knock-on effects as the season rolls along.

Three Critical Mistakes Leading Brands Made in 2024

- Over-focusing on discounting vs. strategic positioning

- Discounts are a great lever to pull in order to boost conversion rates and sales volume, but brands need to take a longer-term focus to drive meaningful results. The Big Spring Sale isn’t likely to drive the dramatic increase in purchase activity seen during Prime Day or Cyber Week. As such, beyond the short-term goal of driving sales during the event, brands should be taking this opportunity to better leverage technologies like AMC to identify, reach, and convert in-market consumers both before and well after the event.

- Missing the pre-event demand build window

- While getting the top spot on a popular search result can be a big win during a tentpole event, it needs to be part of a broader strategy. Consumers are discovering products and brands across a wide range of channels before coming to Amazon and converting. Brands need to use top-of-funnel tactics to get themselves in front of relevant customers in advance of the sale event in order to maximize sales.

- Misaligning advertising strategy with seasonal shopping behaviors

- The data is pretty clear that more evergreen categories simply don’t see a significant rise in purchase activity during the Big Spring Sale. Brands in these categories should be much more thoughtful about raising bids and committing more budget during the sale event, staying flexible based on sales and conversion rate performance.

Data-Backed Strategies and Momentum Perspective for 2025 Success

Big Spring Sale Deal Strategy

If you are planning to offer a deal during the Big Spring Sale, it should be carefully planned and coordinated to maximize any sales bump.

Big Spring Sale Advertising Strategy

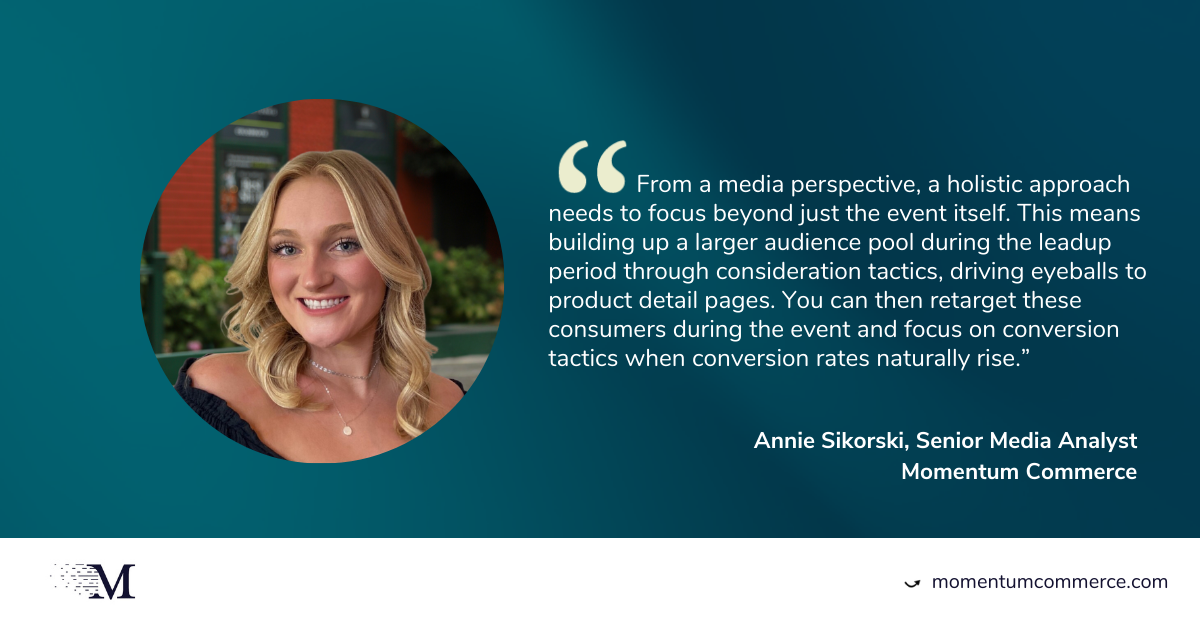

While the Big Spring Sale itself is a six-day event, it’s important to craft a longer-term advertising strategy that also incorporates pre- and post-event activities. The overarching goal is to ‘prime the pump’ with top-of-funnel interest in advance of the event, and better capture in-market shoppers both during and after the event ends.

Big Spring Sale Merchandizing Strategy

If your inventory or product content is improperly managed, even a terrific, well-thought-out discounting and advertising strategy won’t deliver the results you expect. For tentpole events like the Big Spring sale, there are a few tactics that can help better position you for success.

Leveraging Amazon Marketing Cloud for Big Spring Sale Execution

Amazon Marketing Cloud (AMC) is a critical part of ensuring that you’re reaching in-market buyers before, during, and after the sale event. This means leveraging the targeting options available in AMC in a kind of sequential manner, driving consumers through the funnel.

What if I’m Not Sure About What to Do for the Big Spring Sale?

Be sure to take advantage of Momentum Commerce’s range of free resources to better research your category, competitors, and market dynamics so you can make informed decisions:

- Amazon Brand Leaderboard

- Week-by-week, category-specific information around search visibility, advertising activity and discounting.

- Amazon Brand Index

- Week-by-week, category-specific comparisons around search visibility, advertising activity, and top search terms.

- Amazon Search Trends

- Historical, monthly data around search term popularity, brand visibility in relevant searches, and the biggest untapped opportunities

If you have more questions and want to speak in detail about how Momentum Commerce may be able to help guide your sale event strategy, send us an email at hello@momentumcommerce.com

Stay Tuned for the 2025 Amazon Big Spring Sale Recap

Once the Big Spring Sale 2025 gets underway, Momentum Commerce will publish data detailing performance across Amazon US including:

- Year-over-year sales trends

- Category-specific breakdowns

- Advertising trends

- Discounting trends

Want to be among the first to get the insights once they are live?