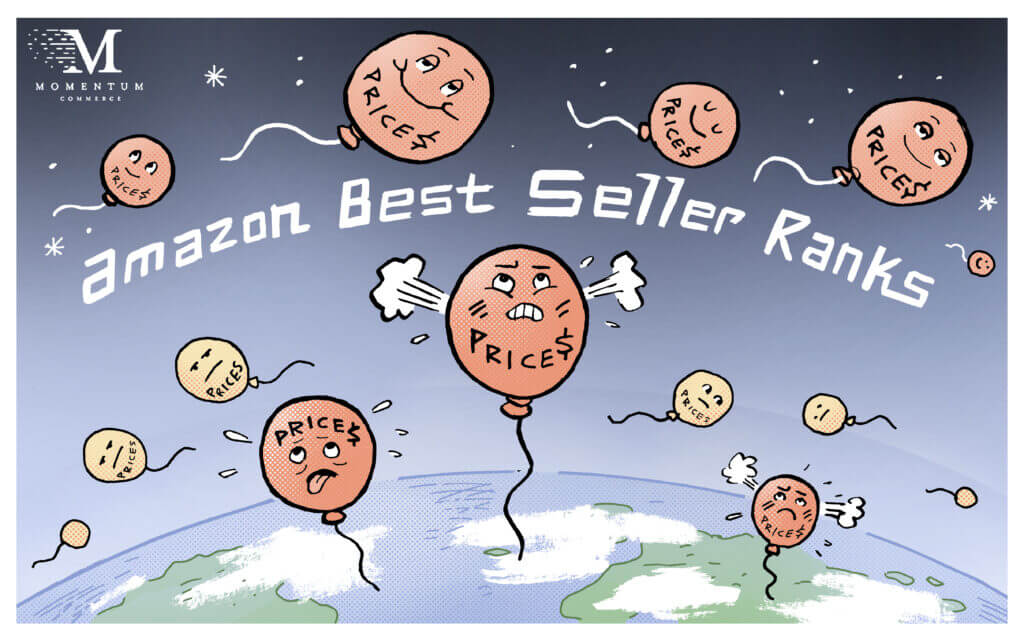

Premium Priced Products that Succeed Have More Staying Power on Amazon

As Amazon continues to capture an increasingly large share of US retail sales as a whole, more consumers are going to the site to shop for a wider variety of goods, including premium priced products. This dynamic goes up against Amazon’s reputation as a price conscious environment, as company resources make no secret of the fact that items listed on its site by brands can’t be undercut on other retail sites, and that reducing price is a major lever to improve sales and conversions.

Yet, new research shows that while it is tough proverbial sledding for premium priced products to capture top best-seller ranks in their respective categories, the upshot is that once those high-priced products actually achieve a top rank, they can be a bit harder to unseat from those positions than their lower-priced competitors. This has meaningful implications when it comes to justifying increased ad budgets for premium brands operating or planning to launch on Amazon.

The Research

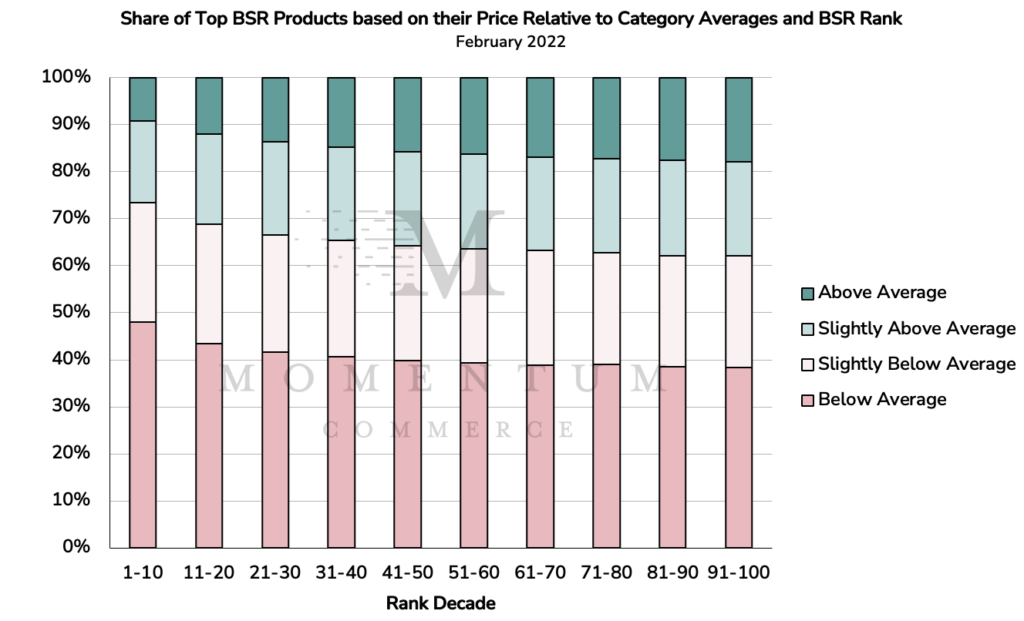

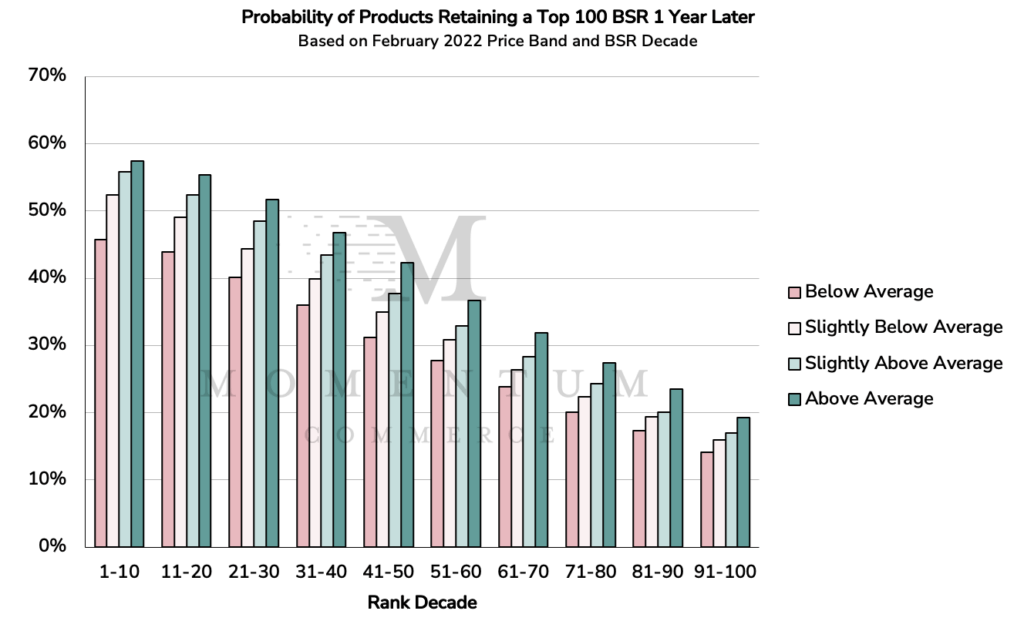

Momentum Commerce analyzed products with top 100 best-seller ranks (BSR) across more than one thousand Amazon categories during the month of February 2022. We then placed products into percentile ‘buckets’ based on their price relative to their respective categories (e.g. a product with a price in the top 25% compared to its competitors is ‘above average’, bottom 25% is ‘below average’, etc.). We then compared the BSRs for these same products in February 2023 and plotted the rate at which these products retained top 100 BSRs over 12 months, and how that was distributed by price band.

The Story

- Amazon is a fickle beast – it’s incredibly difficult to maintain a top BSR over a long period of time

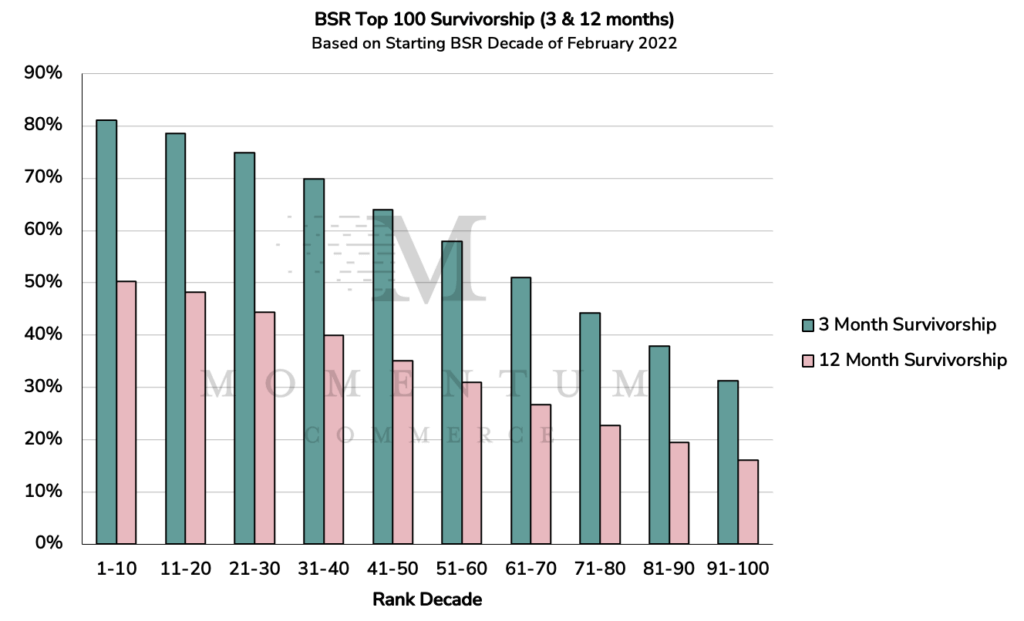

- Across all price bands, only 50% of products with a top 10 BSR still retained a top 100 rank just one year later

- For premium-priced products, this proverbial BSR ‘hill’ is harder to climb in the first place

- Products with prices in the top 25th percentile for their category make up the smallest share, by quartile, of top BSR products on average

- However, premium-priced products that do succeed have a bit more staying power

- ~45% of Below-Average Priced Products in the Top 10 BSR Retain Top 100 Positions One Year Later

- ~55% of Above-Average Priced Products in the Top 10 BSR Retain Top 100 Positions One Year Later

Biggest Takeaways for Brands

- Know what you are up against from a competitive pricing perspective, in a way that is executable

- Having a clear understanding of what products are showing up most often adjacent to your own SKUs in search allows for a better analysis of relative price versus a category-wide view, which may include non-competitive products

- Whether you are truly selling a premium-priced product or one that is closer to the mean should impact your larger strategy

- Provided the ability to invest longer-term is there, the juice is worth the squeeze for premium brands selling on Amazon

- Brands selling at higher price points should commit to higher budgets for longer periods of time to drive long-term success on Amazon

- This will naturally put pressure on margins initially, but higher-priced brands are better positioned than lower-priced competitors to sustain that, and once top BSRs are achieved the brands can begin to ratchet down spend intelligently

- Know how you can optimize outside of price

- Depending on your strategy, you can focus on improving KPIs like paid share of voice or branded search volume that correlate to improved ASIN BSR durability

- A future post will go more into detail on these other signals and how they relate to an ASIN maintaining top BSRs over time