Momentum Commerce 360: Amazon Baby Products Category

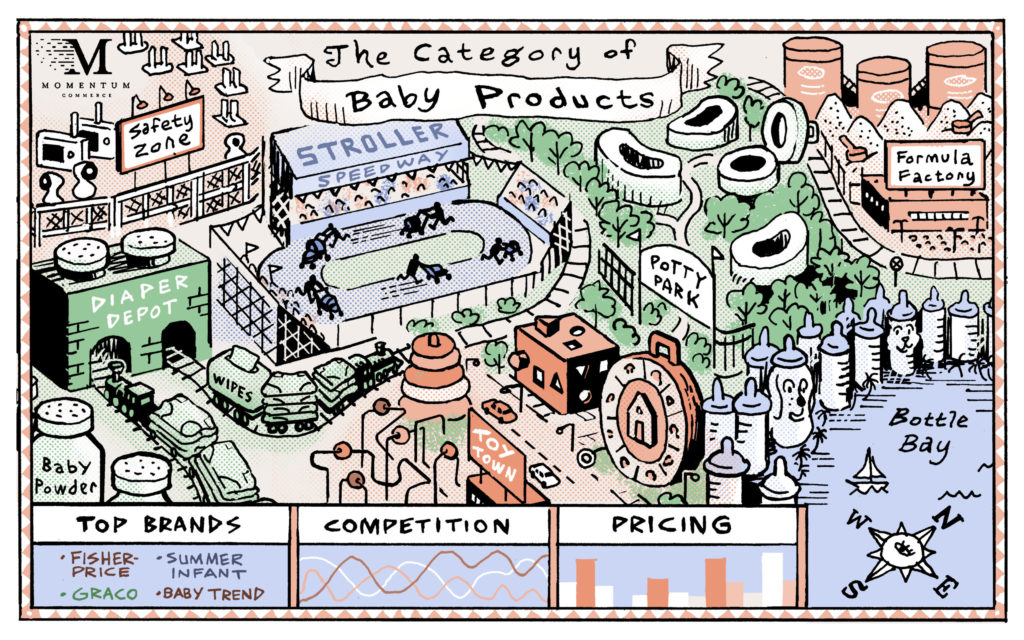

In this Momentum Commerce 360 report, Momentum Commerce provides detailed paid and organic share of voice (SOV) data across seven different Baby Products subcategories on Amazon. The data not only emphasizes the dramatically differing market dynamics between these subcategories, but Best Seller Rank (BSR) survivorship data makes it clear that staying on top is a particularly tenuous exercise in the Baby Products category.

At a high level, the Baby Products category on Amazon is strong and growing. Third-party revenue estimates for the category reached $900M-$1B per month in late 2021 and early 2022, up from the $500-600M range a year earlier. With parents and family members migrating more of their baby product budgets to Amazon, the stakes are even higher for brands selling on the retail site to successfully grow and capture market share.

To meet this challenge, brands must closely monitor and adapt to market dynamics within their specific Baby Products subcategory. As an example, despite all being under the Baby Products umbrella, Car Seats, Diapering, and Baby & Toddler Toy categories exhibit vastly different price ranges, consumer shopping behavior, and competitive landscapes.

From a strategic perspective, emerging brands need to gain a deep understanding of what niches from a subcategory and search term perspective offer the biggest opportunity while being eminently addressable by their products, content, and advertising budget. Larger brands must do all of the above, while also developing a clear view of the time, processes, and resources necessary to capture significant market share in a given subcategory and maintain those levels over time.

To this last point, BSR survivorship data emphasizes the difficulty around maintaining market share. There is more volatility across top BSR Baby Products than categories like Beauty & Personal Care and Grocery & Gourmet Food. This may be good news for newer, emerging brands in their ability to ‘break through’ on Amazon, but larger brands will need to be vigilant in order to stay ahead.

Fill out the form below to download the full report, and check out our Amazon Brand Index tool for even more SOV data.

What’s in the Amazon Baby Products Report:

- Paid and organic SOV data across 7 different Baby Products subcategories

- April 2022 vs. October 2021 comparisons

- Top organic, paid, and fastest-rising brands by sub-category

- 3, 6, and 12 month BSR survivability rates in the Baby Products category

- Key strategic and tactical takeaways from this data for Baby Products brands